Retirement Plans Documents

Retirement Plans

CalPERS Nonmember Service Retirement Application

This file is a Nonmember Service Retirement Election Application from CalPERS. It provides necessary information and instructions for retirees in California. Users should carefully fill out all sections to ensure their retirement benefits are calculated correctly.

Retirement Plans

Railroad Retirement Employee Annuity Guide

This booklet provides essential information on your employee annuity under the Railroad Retirement Act. Understand requirements, application processes, and payment details. Read it thoroughly to ensure a smooth application experience.

Retirement Plans

Guide to Completing CalPERS Retirement Application

This guide provides essential instructions for completing the CalPERS Service Retirement Election Application. It will help you through the application process, ensuring you don't miss any important steps. For further assistance, check your myCalPERS account.

Retirement Plans

Thrift Savings Plan Rollover Instructions Fact Sheet

This fact sheet provides vital information about rolling over funds from the Thrift Savings Plan to eligible retirement plans. Learn about the eligibility requirements, contribution methods, and distribution rules. Essential for federal employees and service members considering their retirement options.

Retirement Plans

Retired Pay Application Instructions and Process

This file provides essential information for submitting a retired pay application. It includes necessary forms, instructions for completion, and important deadlines. Ensure timely submission to avoid delays in receiving your retired pay.

Retirement Plans

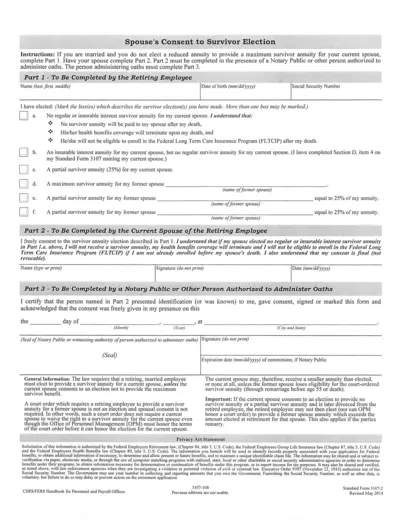

Spouse Consent to Survivor Election Instructions

This file provides detailed instructions for married employees regarding survivor annuity elections. It ensures that both retiring employees and their spouses understand their rights and responsibilities. Follow the instructions carefully to complete the form correctly.

Retirement Plans

IRS Form 5305-SEP Simplified Employee Pension Agreement

Form 5305-SEP allows employers to set up Simplified Employee Pension plans for their eligible employees. These plans provide a way to contribute towards employees’ retirement savings. This form should be kept for records and not submitted to the IRS.

Retirement Plans

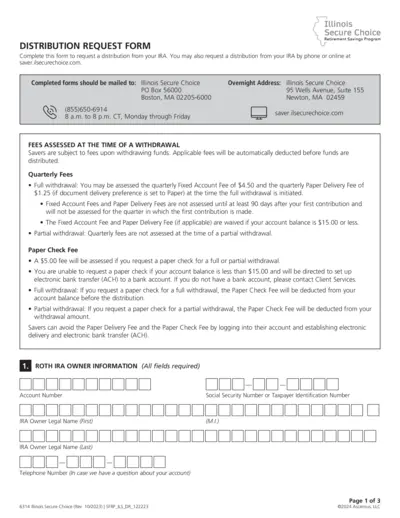

Illinois Secure Choice IRA Distribution Request Form

This form facilitates the distribution request from your IRA. It ensures a smooth process for savers looking to access their retirement funds. Utilize this resource to understand the fees and procedures involved.

Retirement Plans

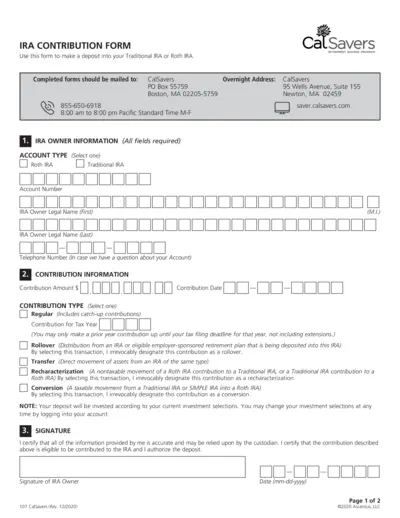

IRA Contribution Form to Deposit in Traditional or Roth IRA

The IRA Contribution Form allows users to make deposits into Traditional or Roth IRAs. This is essential for individuals seeking to manage their retirement savings effectively. Complete the form accurately to ensure your contributions are processed correctly.

Retirement Plans

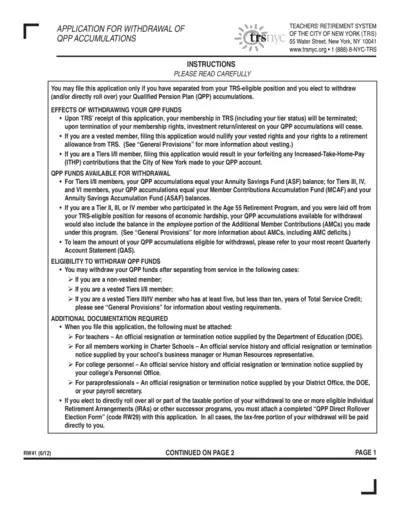

QPP Withdrawal Application - Teachers' Retirement System

This application allows members to withdraw their QPP accumulations from the Teachers' Retirement System. Carefully follow the instructions to avoid losing benefits. Ensure all requirements are met before submission.

Retirement Plans

Sample Annual 403b Notification Letter

This file provides a template for an annual 403(b) notification letter tailored for non-qualified church-controlled organizations. It contains guidelines for notifying eligible employees about their participation in retirement plans. Organizations can customize the letter to meet compliance requirements under the 403(b) regulations.

Retirement Plans

Contribution Election Information and Instructions

This file provides detailed information on electing before-tax, Roth, and after-tax contributions to the Personal Investment Plan (PIP). It outlines eligibility requirements and contribution limits for participants. Useful for both clergy and lay individuals looking to manage their retirement savings.