Personal Finance Documents

Tax Forms

Instructions for Form 8995-A Qualified Business Income

This file contains detailed instructions for filling out Form 8995-A, which is used to calculate the Qualified Business Income deduction. It provides guidance for individuals and eligible estates or trusts regarding their specific business income. Understanding this form is essential for accurate tax reporting and maximizing potential deductions.

Retirement Plans

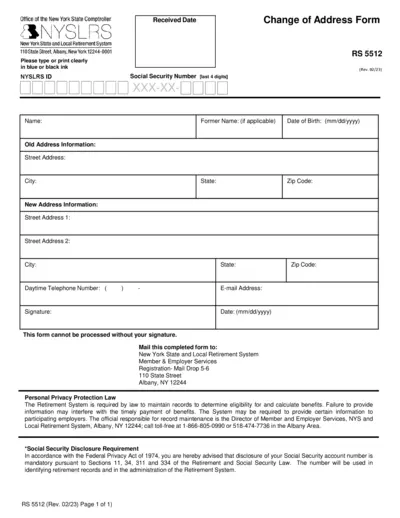

Change of Address Form for NYSLRS Members

This document is a Change of Address Form for the New York State and Local Retirement System. It is essential for members to ensure their address is current for receiving important information. Completing this form accurately helps maintain updated records.

Banking

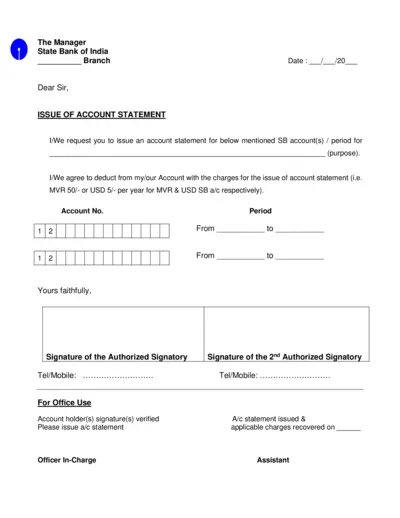

Request for Account Statement Form

This form allows account holders to request their account statement. Fill out the required fields and submit it to your bank branch. Applicable charges will be deducted from your account.

Retirement Plans

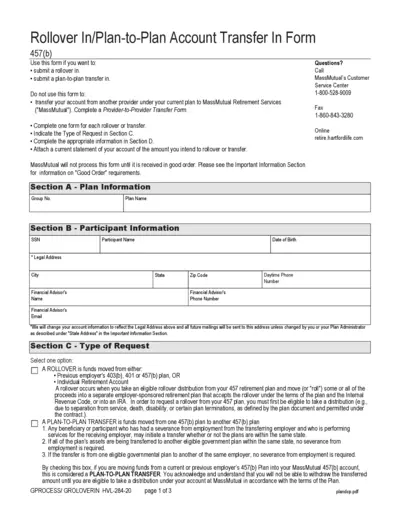

Rollover In/Plan-to-Plan Transfer In Form 457(b)

This form is essential for submitting a rollover or a plan-to-plan transfer in your 457(b) retirement account. Ensure you complete all required sections for a smooth process. Reach out to MassMutual for any questions regarding this form.

Tax Forms

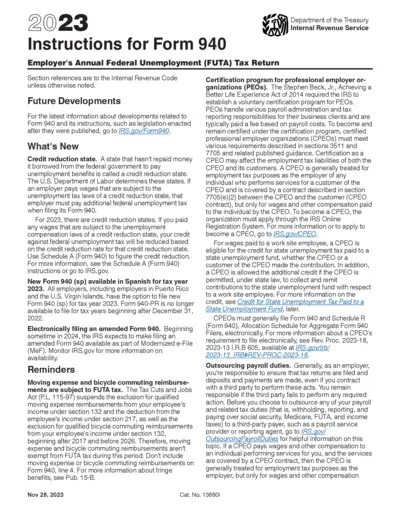

Instructions for Form 940 - Employer's Annual FUTA Tax Return

This file provides comprehensive instructions for the Form 940 filing process, ensuring employers understand their federal unemployment tax obligations. It includes guidance on who must file, key deadlines, and detailed descriptions of various sections of the form. Utilize this resource to ensure compliance with the Internal Revenue Service requirements.

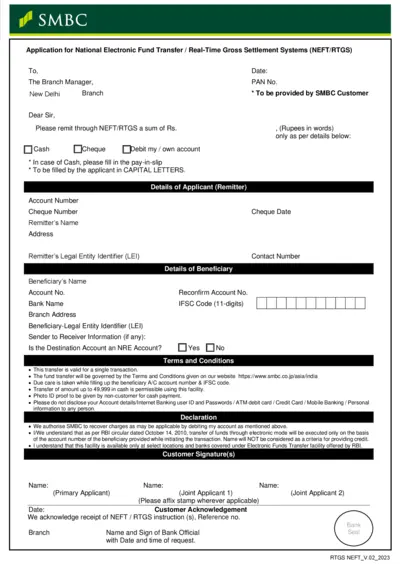

Banking

SMBC Application for NEFT RTGS Funds Transfer

This document is an application form for National Electronic Fund Transfer (NEFT) and Real-Time Gross Settlement (RTGS) services. It provides clear instructions on filling out the form and requirements for fund transfers. Essential for both individual and business users, it facilitates secure and efficient electronic money transfers.

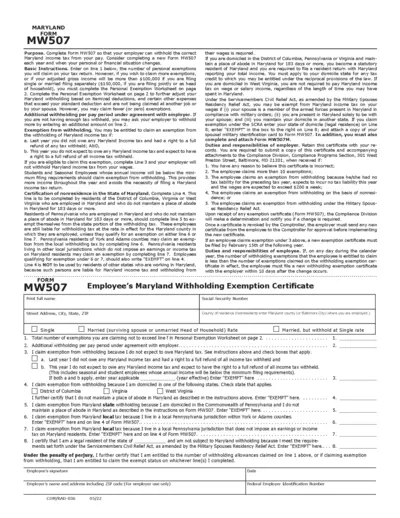

Tax Forms

Maryland Form MW507 Instructions for Tax Withholding

Form MW507 is essential for Maryland residents to ensure accurate income tax withholding. This form allows employees to claim personal exemptions and additional withholding. Completing this form correctly helps in determining your Maryland state tax obligations.

Tax Forms

IRS Form 1099-R Distributions From Pensions and Annuities

The IRS Form 1099-R is necessary for reporting distributions from pensions, annuities, and retirement plans. This file provides essential information on how to fill out the form correctly. Ensure you understand the instructions to avoid penalties when submitting to the IRS.

Banking

Punjab National Bank Form No. 60 Instructions

This document provides essential instructions for filling out the Punjab National Bank Form No. 60, required for individuals without a PAN. It outlines details like personal information, transaction specifics, and supporting documents. Ensure all information is accurate to avoid complications.

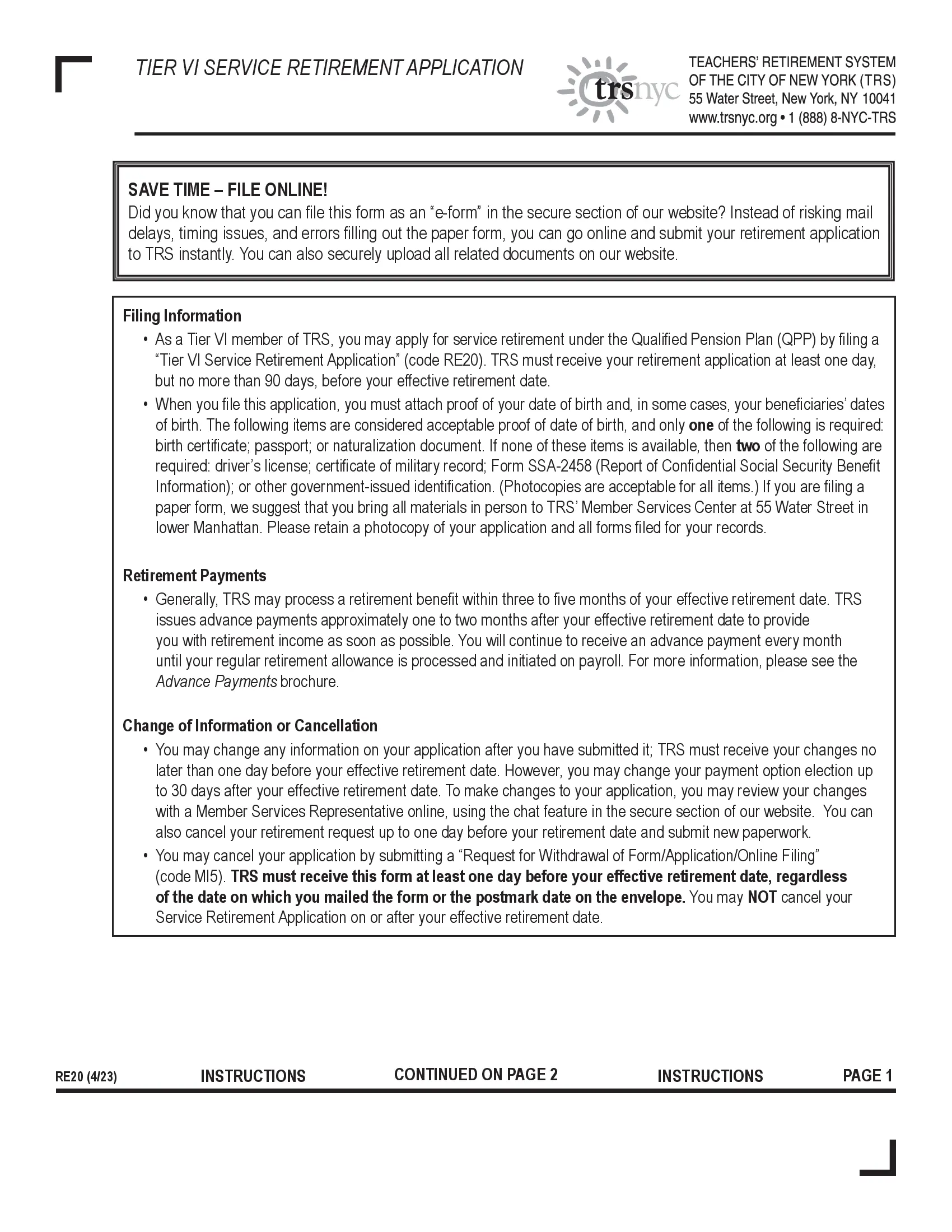

Retirement Plans

Tier VI Service Retirement Application Instructions

This file contains detailed instructions for the Tier VI Service Retirement Application for the Teachers' Retirement System. It outlines eligibility, required documentation, and application procedures for retirement benefits. Access this essential guide to ensure a seamless retirement application process.

Tax Forms

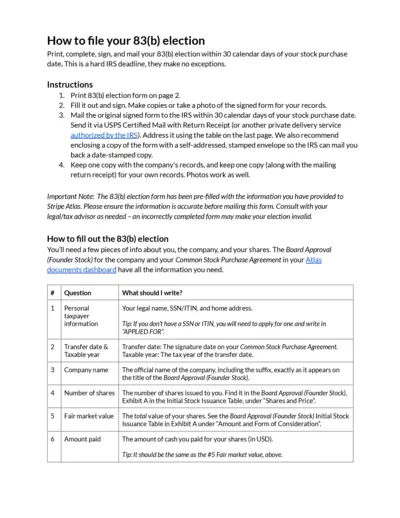

83(b) Election Filing Instructions and Details

This file provides detailed instructions for filing your 83(b) election. Follow the steps to ensure compliance with IRS regulations. Ensure your information is accurate to avoid an invalid election.

Banking

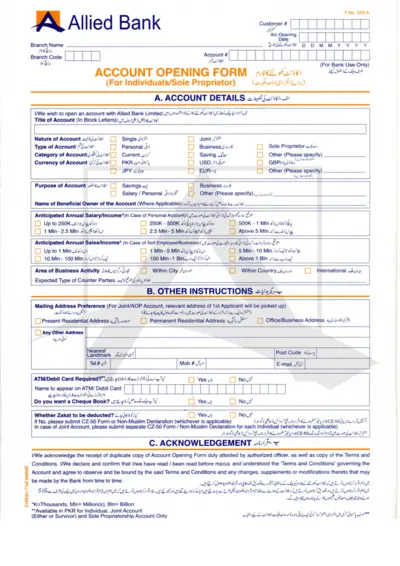

Allied Bank Account Opening Form Instructions

This file contains the Allied Bank Account Opening Form, which needs to be filled out by individuals or sole proprietors. It's crucial for setting up a bank account and ensuring all required information is provided accurately. Follow the instructions carefully to avoid delays in processing your application.