Personal Finance Documents

Retirement Plans

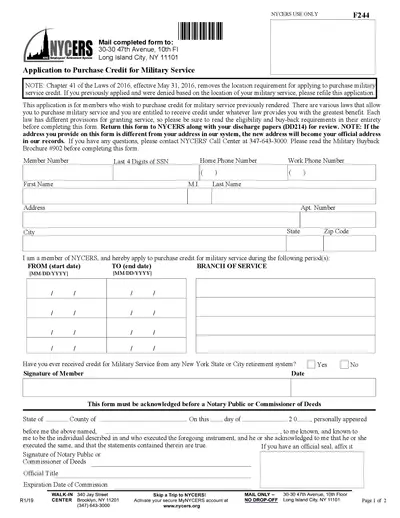

NYCERS Military Service Credit Application Form

This form is for NYCERS members wishing to buy back military service credit. It includes guidelines, eligibility, and submission instructions. Ensure you have all required documentation before applying to maximize benefits.

Tax Forms

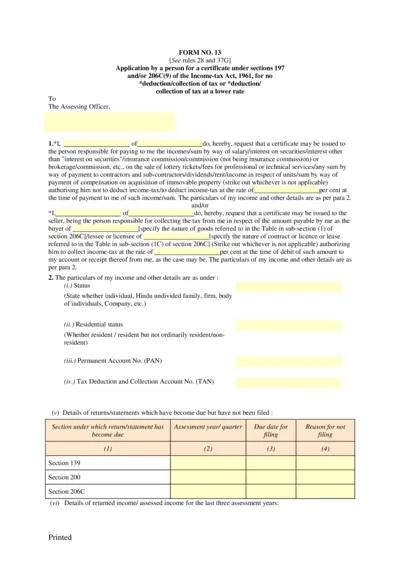

Application for Income-tax Certificate 197 206C

This file is an application form for a certificate under sections 197 and 206C(9) of the Income-tax Act, 1961. It helps individuals and entities to request no deduction of tax or a tax deduction at a lower rate. Users must fill out specific details about their income and tax status.

Loans

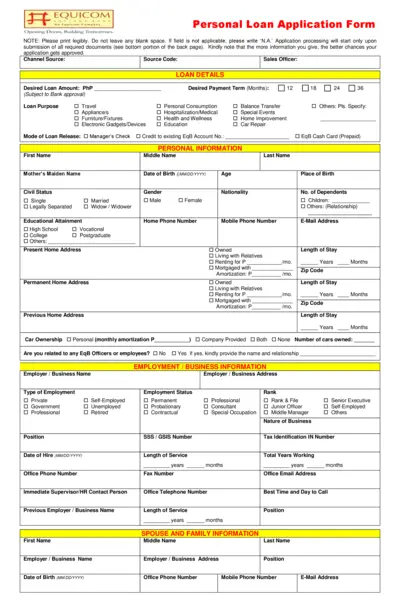

Equicom Savings Bank Personal Loan Application Form

This document is the Personal Loan Application Form from Equicom Savings Bank. It provides essential details required for loan processing. Follow the instructions carefully to ensure your application is complete for approval.

Loans

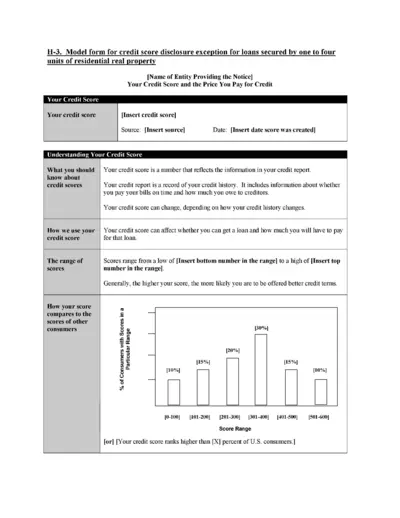

Credit Score Disclosure Form Instructions and Details

This file provides vital information about your credit score and its impact on loans. Learn how to fill out the credit score disclosure form effectively. Access essential details for improving your credit terms.

Tax Forms

Instructions for IRS Form 1040 for 2017 Tax Year

This file contains comprehensive instructions for filling out IRS Form 1040 for the 2017 tax year. It details filing requirements, tax changes, and guidance from the Taxpayer Advocate Service. Essential for taxpayers looking to understand their obligations and benefits when filing taxes.

Tax Forms

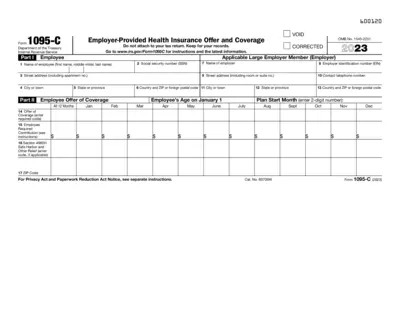

Form 1095-C Employee Health Insurance Coverage

Form 1095-C is an IRS document that provides information on the health insurance coverage offered to employees. It is essential for individuals who wish to claim the premium tax credit or verify health coverage for tax reporting. Employers must provide this form to eligible employees as part of the Affordable Care Act requirements.

Tax Forms

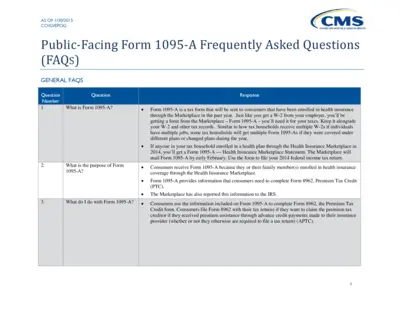

Public-Facing Form 1095-A FAQs and Instructions

This document contains frequently asked questions about Form 1095-A, which is essential for tax filings related to health insurance. It offers detailed guidance for consumers on how to utilize the form effectively. Users will find answers to common queries and instructions for completing the form.

Tax Forms

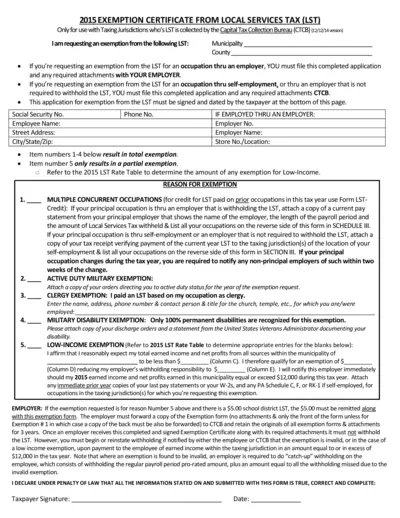

2015 Local Services Tax Exemption Certificate

This form is used to request an exemption from the Local Services Tax (LST) for eligible individuals.

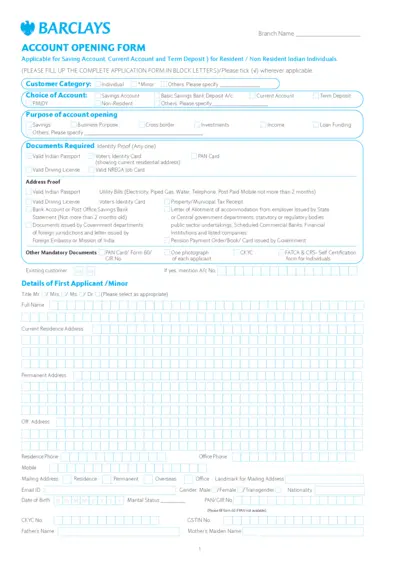

Banking

Account Opening Form - Barclays for Indian Individuals

This form is essential for Indian residents and non-residents to open a savings, current, or term deposit account with Barclays. It details the necessary documentation and personal information required for the application process. Ensure to fill it out carefully to avoid delays in account processing.

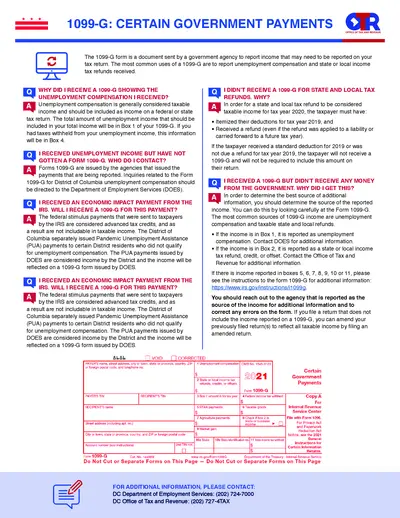

Tax Forms

1099-G Certain Government Payments Form Instructions

This file contains essential information regarding the 1099-G form, detailing government payments and related tax obligations. Users will find guidance on how to fill out the form accurately. It includes FAQs, important dates, and submission instructions for effective compliance.

Tax Forms

IRS Schedule 8812 Child Tax Credit Form 2024

The IRS Schedule 8812 is used for claiming the Child Tax Credit and Credit for Other Dependents. It provides guidance on the credits available to qualifying families. Ensure you understand the eligibility criteria and instructions before filing.

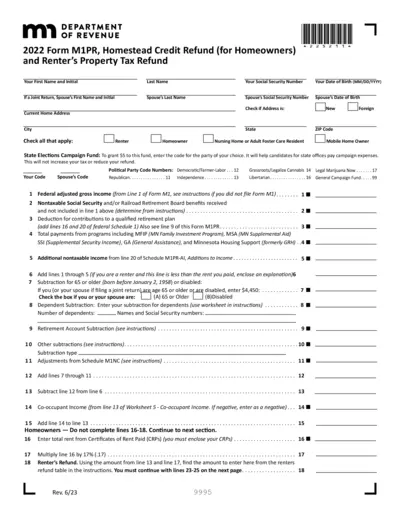

Tax Forms

2022 Form M1PR Homestead Credit Refund Instructions

This file contains details and instructions for the 2022 Form M1PR, used for claiming the Homestead Credit Refund for homeowners and renters. The document guides users through filling out the necessary information for tax refunds. It includes sections for personal information, property details, and refund calculations.