Personal Finance Documents

Tax Forms

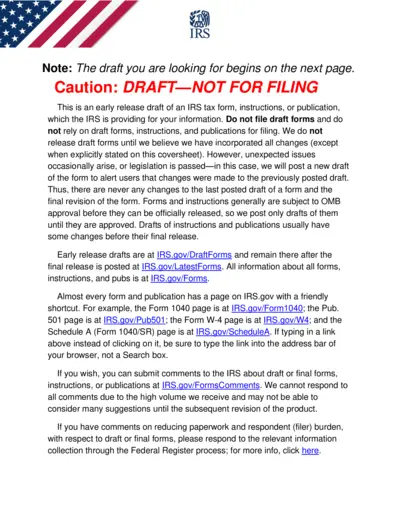

IRS Form 8288-A Instructions for Users

This file provides essential instructions for IRS Form 8288-A, used for withholding on certain dispositions by foreign persons. It includes details about the form's components and filing requirements. Ideal for tax professionals and individuals involved in U.S. property transactions.

Loans

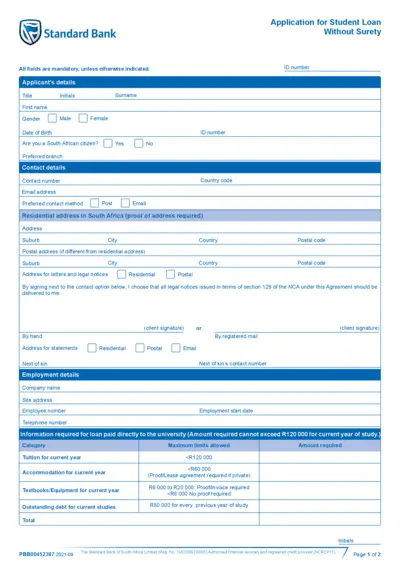

Standard Bank Application for Student Loan Form

This file contains the Standard Bank Application for Student Loan without surety. It includes mandatory fields for personal and financial information. Ideal for South African students seeking financial assistance for their studies.

Tax Forms

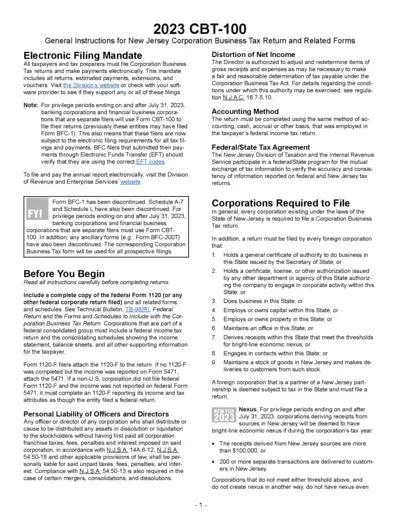

New Jersey Corporation Business Tax Return Guidelines

This document provides comprehensive instructions for filing the New Jersey Corporation Business Tax Return (CBT-100). It outlines electronic filing mandates, eligibility criteria, and details on submissions. Tax preparers and corporations will benefit from following these guidelines.

Tax Forms

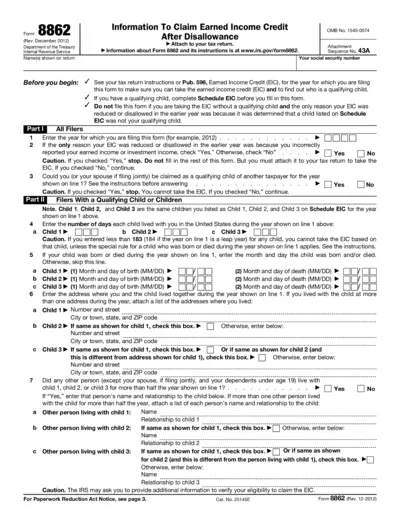

Form 8862 Instructions for Earned Income Credit

Form 8862 is used by taxpayers to claim the Earned Income Credit after it has been disallowed in a previous year. It helps ensure that taxpayers understand their eligibility requirements for the credit. This form must be attached to your tax return if you're claiming the Earned Income Credit.

Banking

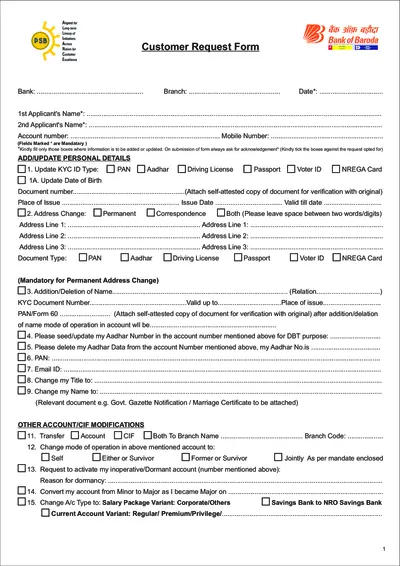

Customer Request Form for Bank Account Modifications

This form allows customers to update their personal details, change account services, and submit requests related to their bank accounts. Users must fill in mandatory fields and provide supporting documents as needed. Ensure to submit the form for prompt processing of your requests.

Tax Forms

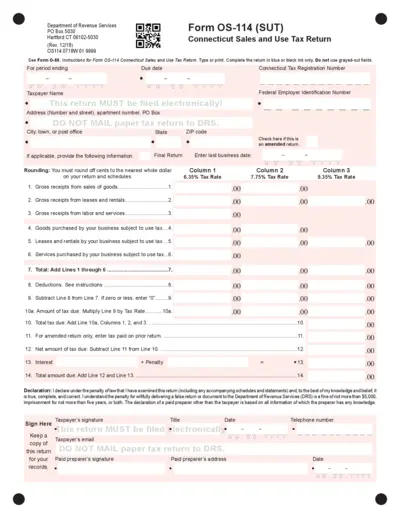

Connecticut Sales and Use Tax Return Form OS-114

Form OS-114 is necessary for reporting sales and use tax in Connecticut. This form must be filed electronically and includes various fields for tax calculations. Proper completion of this return is crucial for compliance with state regulations.

Banking

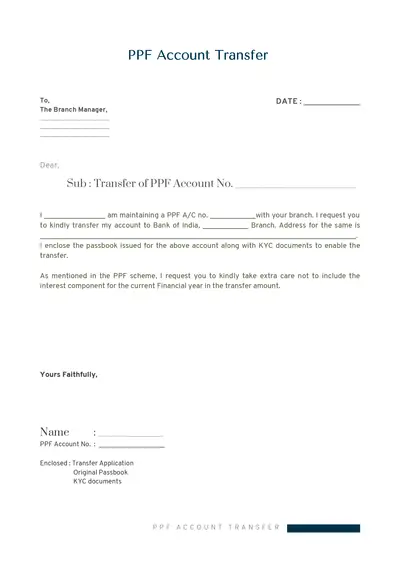

PPF Account Transfer Form Instructions

This document provides a step-by-step guide for transferring a PPF account. It includes necessary components and detailed instructions for completion. Perfect for account holders looking to change their bank branch.

Banking

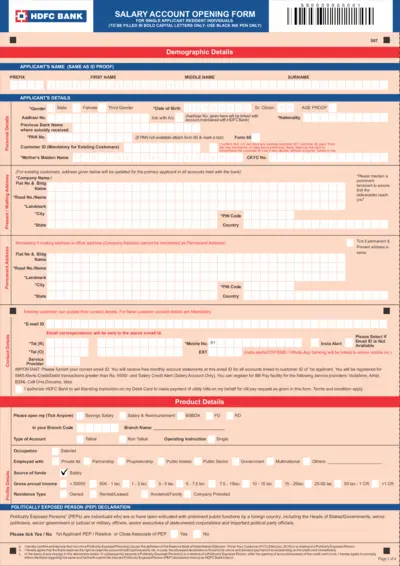

HDFC Bank Salary Account Opening Form for Individuals

This form is designed for single applicants to open a salary account at HDFC Bank. It includes necessary demographic and personal details. Complete this form using bold capital letters and black ink only.

Tax Forms

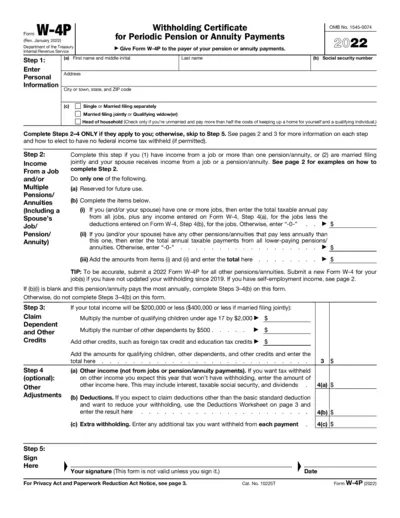

W-4P Withholding Certificate for Pension Payments

The W-4P form is essential for taxpayers receiving pension or annuity payments. It allows individuals to specify how much federal income tax should be withheld from these payments. By accurately filling out this form, taxpayers can ensure they meet their tax obligations and avoid unexpected liabilities.

Tax Forms

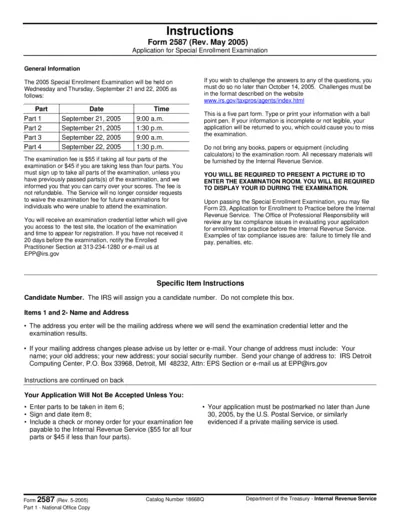

Application for Special Enrollment Examination

This file contains essential information and instructions regarding the Special Enrollment Examination. It provides guidelines on the examination process, including important dates, fees, and submission details. Ideal for candidates seeking to become enrolled agents.

Banking

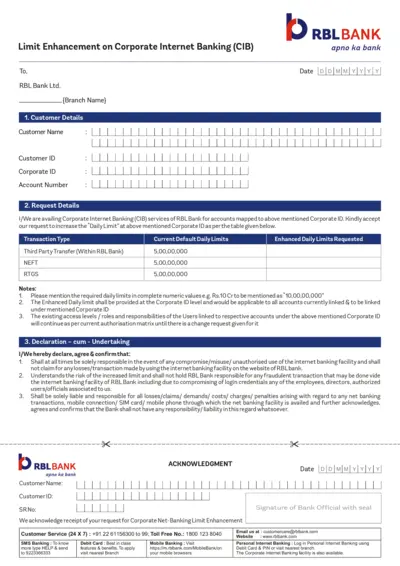

Corporate Internet Banking Limit Enhancement Form

This form requests the enhancement of daily limits for Corporate Internet Banking services at RBL Bank. Customers can fill out their details and submit the request for approval. It is essential for businesses that require increased transaction capabilities.

Tax Forms

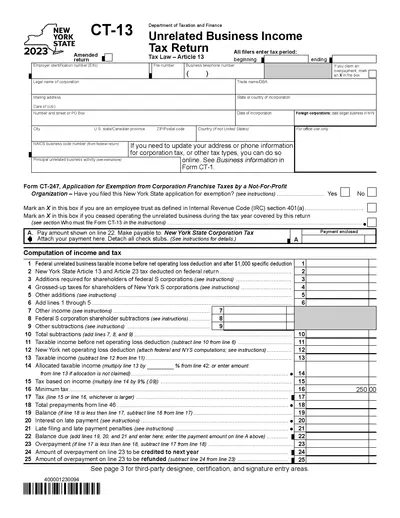

CT-13 Unrelated Business Income Tax Return 2023

The CT-13 form is used for filing Unrelated Business Income tax returns in New York State. It captures pertinent financial data from organizations operating unrelated businesses. Filing this form ensures compliance with state tax laws.