Personal Finance Documents

Tax Forms

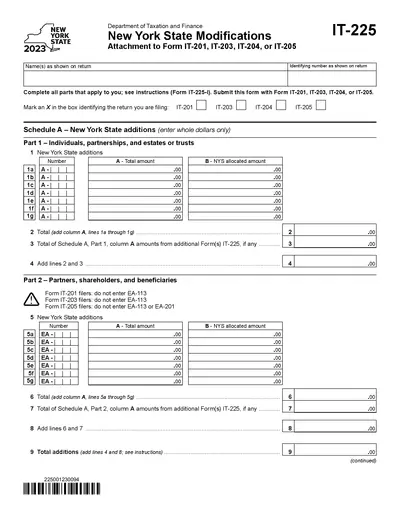

New York State Tax Modifications Form IT-225 2023

The New York State Modifications form IT-225 is essential for filing your tax return accurately. It includes necessary adjustments to ensure proper calculations. Use this form to report additions and subtractions relevant to your tax filings.

Estate Planning

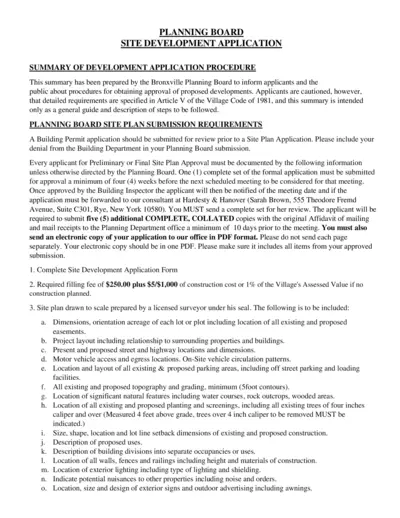

Bronxville Planning Board Site Development Guide

This document provides procedures and requirements for site development applications in Bronxville. It serves as a comprehensive guide for applicants seeking approval for their development proposals. Understanding these guidelines is essential for a smooth application process.

Tax Forms

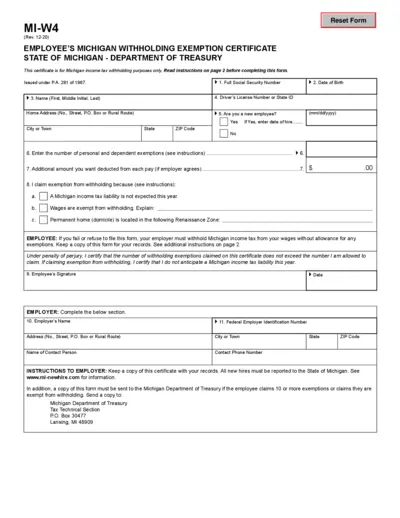

Michigan Withholding Exemption Certificate Form MI-W4

This form is essential for Michigan employees to declare their withholding exemptions. It ensures the correct amount of state income tax is withheld from paychecks. Properly filling out the MI-W4 can prevent over-withholding and ensure compliance with state regulations.

Tax Forms

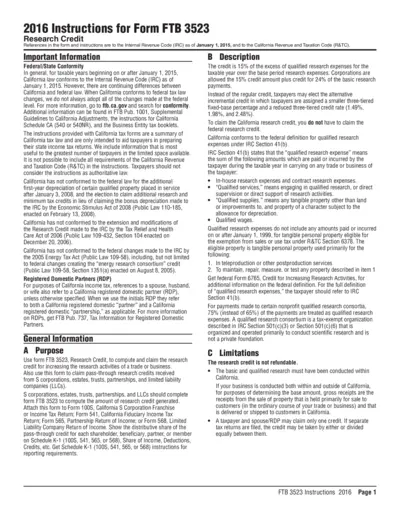

FTB 3523 Research Credit Instructions 2016

This file provides detailed instructions for completing Form FTB 3523 for claiming California research credits. It outlines eligibility, requirements, and step-by-step guidance for taxpayers. Use this essential resource to ensure accurate filing and maximize potential tax benefits.

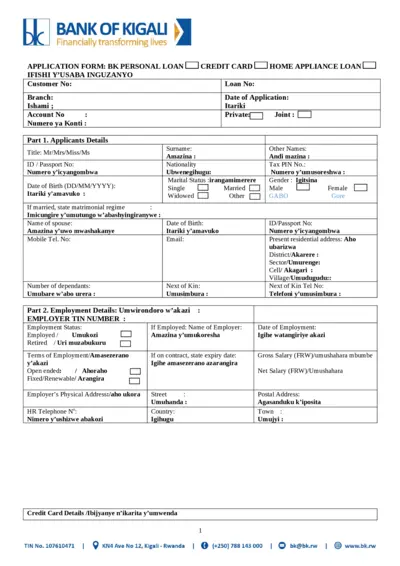

Loans

BK Personal Loan Application Form - Bank of Kigali

This document is the application form for the Bank of Kigali personal loan. It guides users through the information required for submitting a loan request. Filling out this form accurately is crucial for the loan approval process.

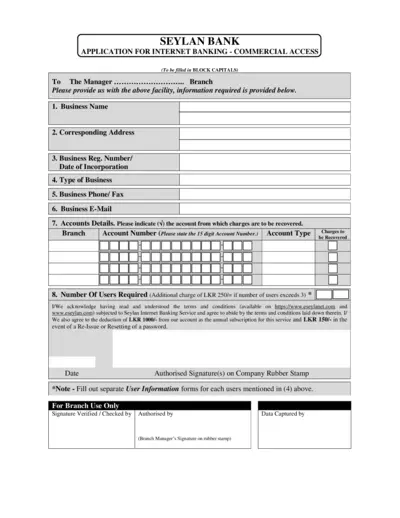

Banking

Seylan Bank Application for Internet Banking

This file contains the application form for Internet Banking services offered by Seylan Bank. Users will find important details on how to fill out the form and what information is required. It is essential for businesses seeking online banking capabilities.

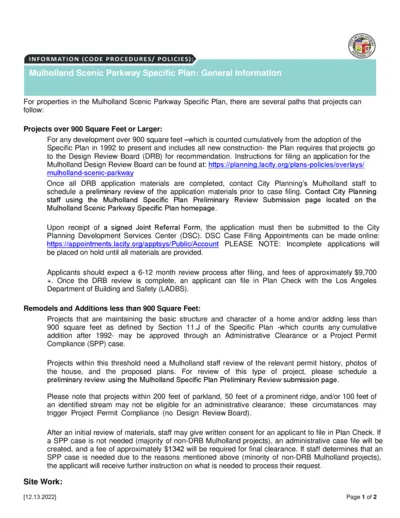

Estate Planning

Mulholland Scenic Parkway Specific Plan Procedures

This file provides detailed procedures and policies for projects related to the Mulholland Scenic Parkway Specific Plan. It outlines the steps for applications, design reviews, and compliance. Ideal for developers, architects, and homeowners involved in projects over 900 square feet.

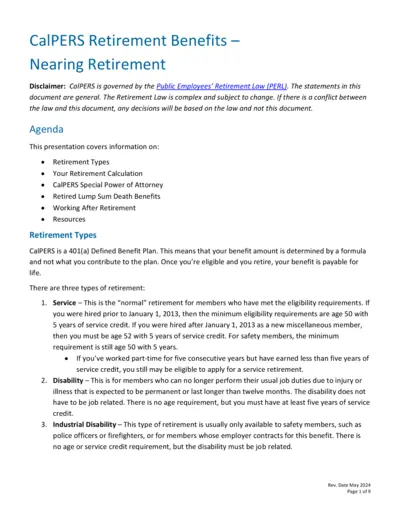

Retirement Plans

CalPERS Retirement Benefits Overview and Instructions

This document provides important information about CalPERS retirement options, calculations, and benefits. It is essential for members nearing retirement or those needing to understand their benefits. Detailed guidelines on retirement types, service credit, and resources are included.

Tax Forms

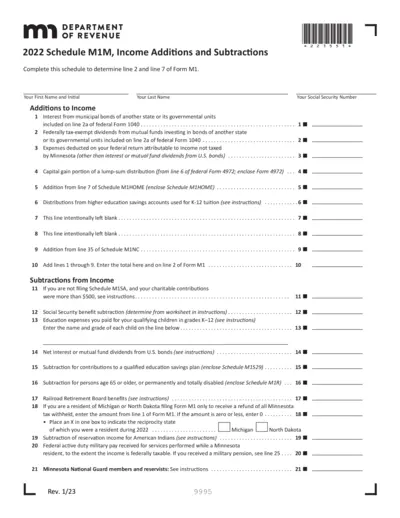

2022 Schedule M1M Income Additions and Subtractions

The 2022 Schedule M1M is a tax form used to report income additions and subtractions for Minnesota residents. This form is essential for accurately calculating your Minnesota taxable income. Follow the provided guidelines to ensure correct reporting.

Tax Forms

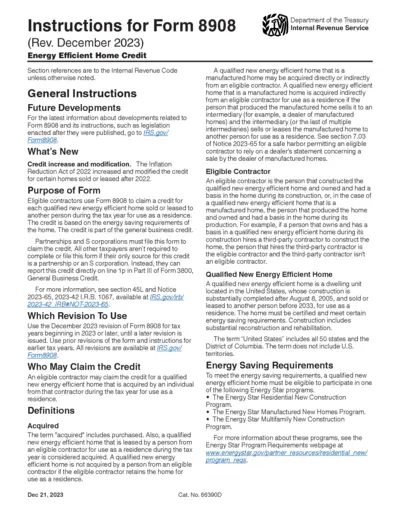

Instructions for Form 8908 Energy Efficient Credit

This document provides instructions for Form 8908, which allows eligible contractors to claim a credit for energy efficient homes. It outlines requirements, who may claim, and specific credits available. Stay informed about the latest updates and program participation details.

Tax Forms

California 540NR Nonresident Tax Filing Instructions 2023

The California 540NR booklet provides essential instructions for nonresidents or part-year residents to file their state income tax. It includes important dates, forms, credits, and common errors to avoid. This guide is crucial for understanding the filing process and ensuring compliance with California tax regulations.

Tax Forms

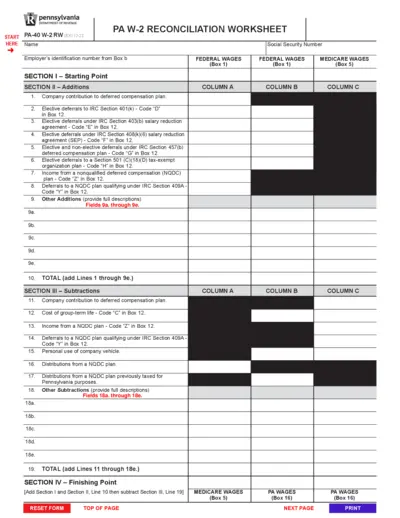

PA W-2 Reconciliation Worksheet Instructions

The PA W-2 Reconciliation Worksheet is essential for reconciling Pennsylvania income tax purposes. It assists taxpayers in detailing information from federal Form W-2. Use this form for reporting income accurately and ensuring compliance with tax regulations.