Personal Finance Documents

Tax Forms

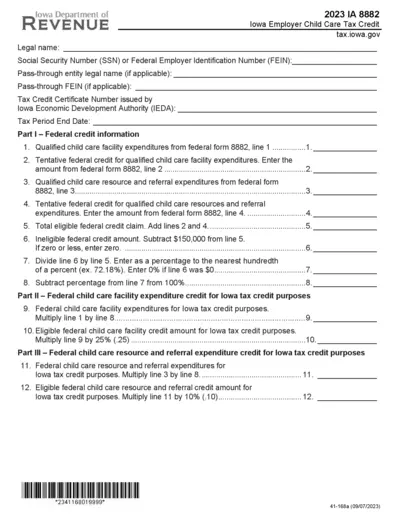

Iowa Employer Child Care Tax Credit Instructions

This file provides detailed instructions for completing the Iowa Employer Child Care Tax Credit (form 8882). It covers eligible expenditures, required information, and calculation procedures. Use this guide to successfully claim your tax credit.

Tax Forms

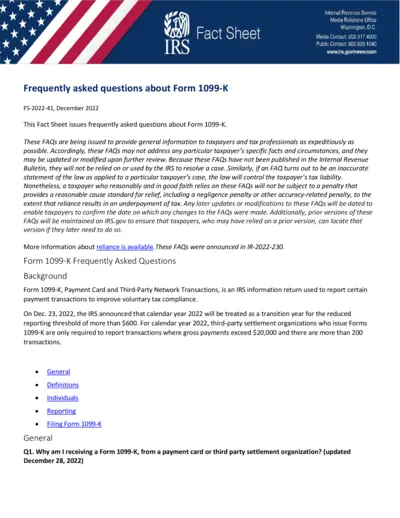

IRS Form 1099-K Frequently Asked Questions

This file provides essential FAQ information about IRS Form 1099-K. It helps taxpayers and tax professionals understand reporting requirements. Users can find detailed instructions and guidance for accurate filing.

Banking

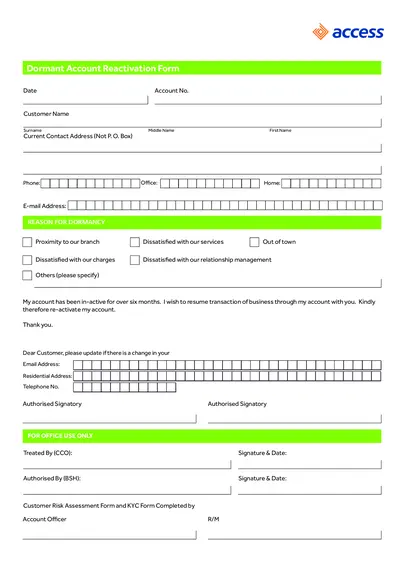

Dormant Account Reactivation Form Instructions

This Dormant Account Reactivation Form is essential for customers seeking to reactivate inactive bank accounts. It includes various fields required for identification and compliance. Ensure to fill in all relevant sections for a smooth reactivation process.

Tax Forms

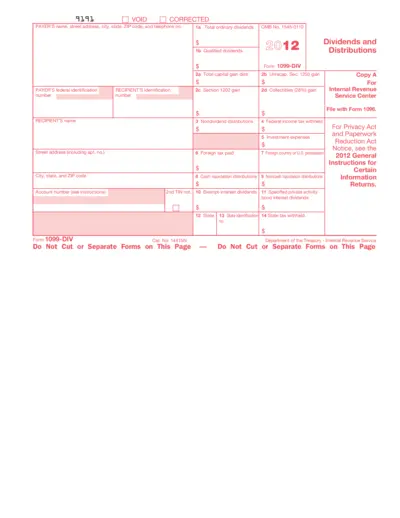

Understanding Form 1099-DIV for Dividends and Gains

This file provides detailed information regarding Form 1099-DIV, which reports dividends and distributions. It is essential for taxpayers to accurately declare their investment income. Use this document to understand how to fill out the form and what to include.

Tax Forms

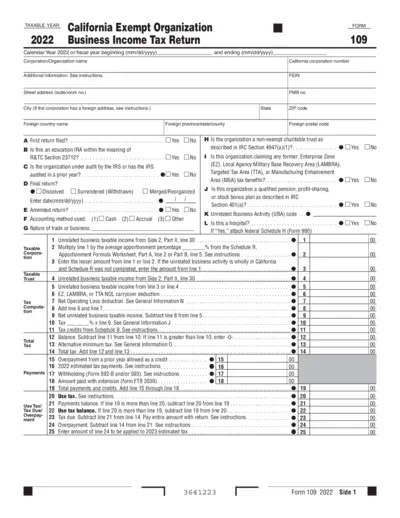

California Business Income Tax Return Form 109 - 2022

The California Business Income Tax Return Form 109 is used by exempt organizations to report their taxable income for the tax year 2022. This form is essential for organizations to accurately report their financial activities and determine their tax obligations. Completing this form ensures compliance with state tax regulations.

Retirement Plans

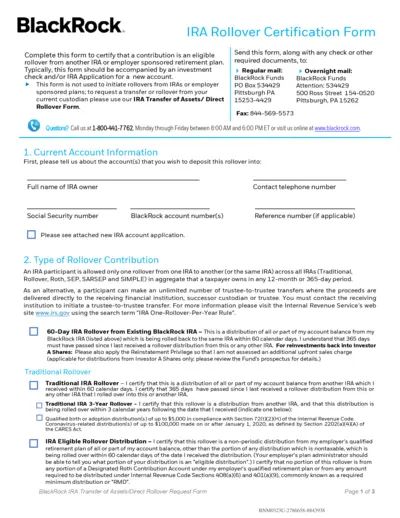

BlackRock IRA Rollover Certification Form Instructions

This document provides essential instructions for completing the BlackRock IRA Rollover Certification Form. It is crucial for participants looking to perform an eligible rollover from another IRA or retirement plan. Ensure that you understand the requirements and processes detailed within this form.

Tax Forms

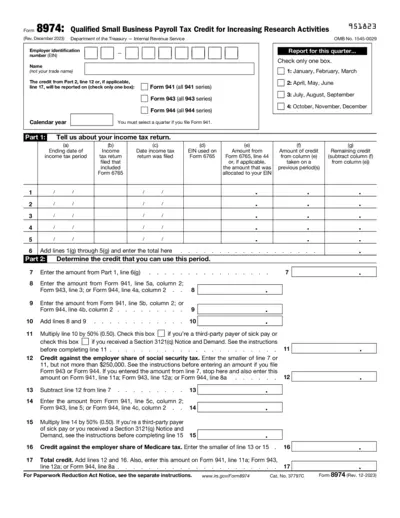

Qualified Small Business Payroll Tax Credit Form

The Qualified Small Business Payroll Tax Credit form helps taxpayers claim credits for increasing research activities. This form must be completed accurately to ensure all eligible credits are claimed. Familiarize yourself with the requirements to effectively utilize the form.

Tax Forms

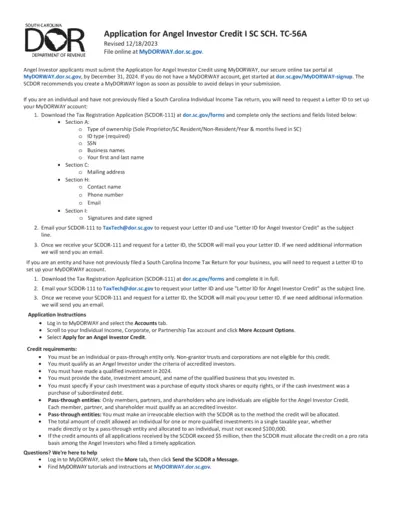

Angel Investor Credit Application - South Carolina

This document provides details on how to apply for the Angel Investor Credit in South Carolina. It includes essential instructions, requirements, and submission deadlines pertinent for applicants. Gain insight into the necessary steps to secure your Angel Investor Credit effectively.

Tax Forms

T1135 Guide Foreign Income Verification Statement

The T1135 file provides essential information for Canadian taxpayers regarding the Foreign Income Verification Statement. It outlines the necessary steps to report specified foreign property accurately. This guide ensures compliance with Canadian tax regulations.

Banking

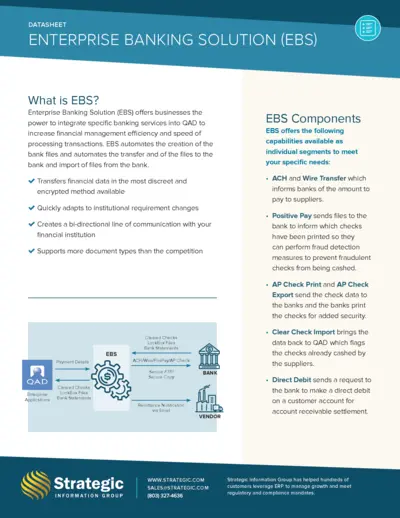

Enterprise Banking Solution Overview and Benefits

The Enterprise Banking Solution (EBS) enhances financial management efficiency by integrating banking services into QAD. It automates processes like file transfers and transaction processing. This datasheet outlines the features and capabilities offered by EBS to streamline banking interactions.

Tax Forms

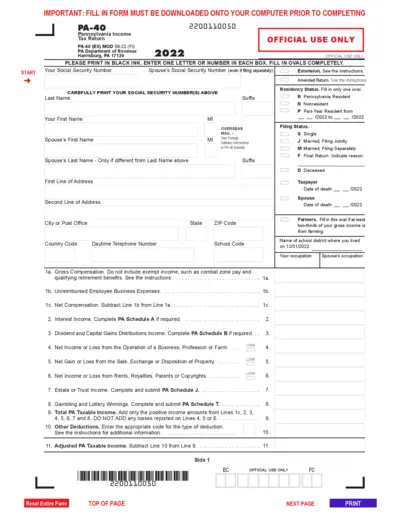

PA-40 Pennsylvania Income Tax Return Instructions

This file contains the PA-40 Pennsylvania Income Tax Return form and its detailed instructions. It is essential for individuals filing their state tax returns in Pennsylvania. Users can fill out this form to comply with state tax requirements.

Tax Forms

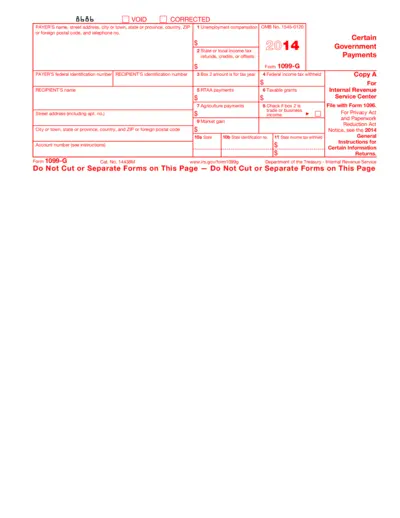

Form 1099-G: Reporting Government Payments

This file contains IRS Form 1099-G, which is used to report certain types of government payments. It outlines necessary fields for unemployment compensation and state income tax. Proper completion is vital to comply with tax regulations.