Personal Finance Documents

Tax Forms

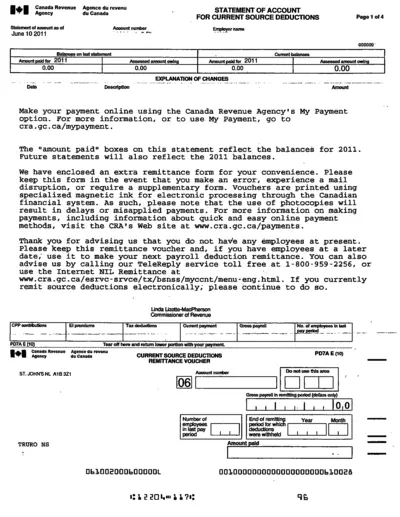

Canada Revenue Agency Statement of Account 2011

This document details the Canada Revenue Agency's Statement of Account as of June 10, 2011. It serves as a formal record of source deductions and balances owed. Employers can use this document for payroll remittance and compliance with tax laws.

Tax Forms

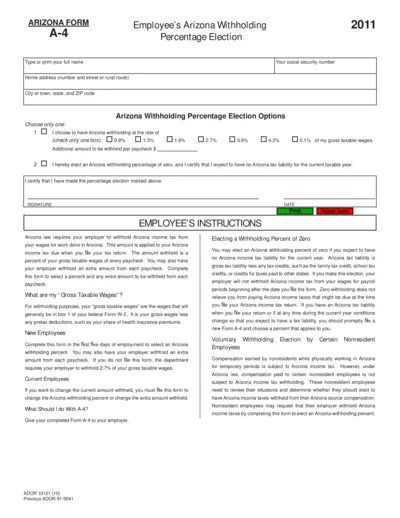

Arizona Form A-4 Employee Withholding Percentage

This document is the Arizona Form A-4, used for employees to elect their withholding percentage for Arizona income tax. It is important for both new and current employees to understand how to fill out this form correctly to ensure appropriate tax withholding from their wages. Make sure to complete this form as soon as possible to avoid incorrect tax withholding.

Tax Forms

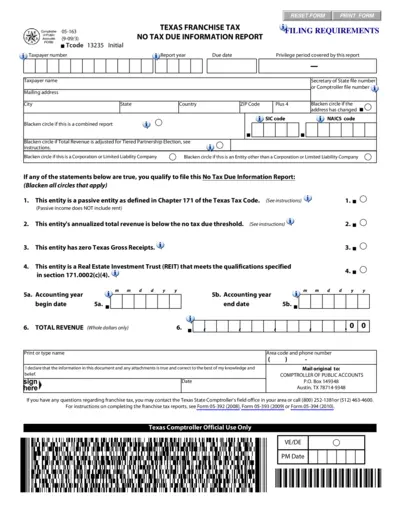

Texas Franchise Tax No Tax Due Information Report

This form is used by Texas entities to report no tax due under the Texas Franchise Tax. It helps determine whether the entity meets specific criteria for tax exemption. Filing this form accurately is essential for compliance with the Texas Tax Code.

Tax Forms

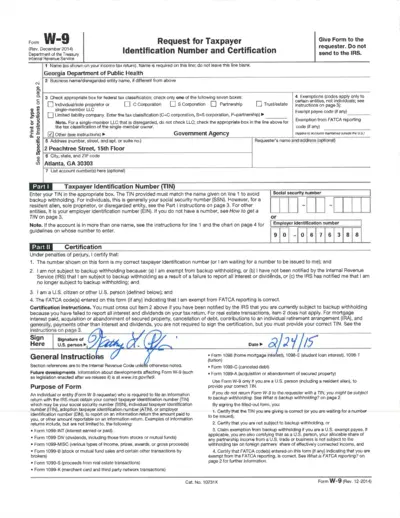

W-9 Taxpayer Identification Number Certification

The W-9 form is used to request your taxpayer identification number, necessary for tax reporting purposes. It is essential for individuals and businesses to accurately fill out this form. Ensure all sections are completed to avoid delays in processing.

Loans

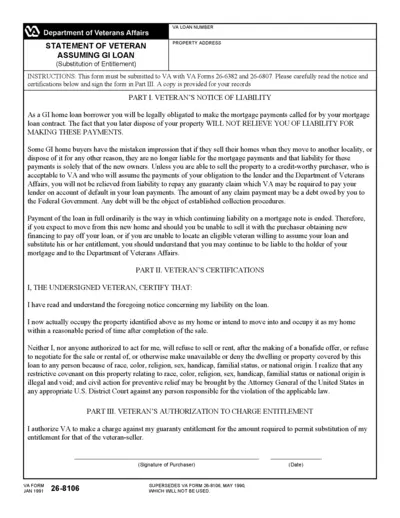

VA Loan Assumption Instructions and Liability Statement

This document outlines the liability for veterans assuming GI loans. It provides essential instructions and certifications necessary for compliance. Understanding these details is crucial for managing your mortgage responsibilities effectively.

Loans

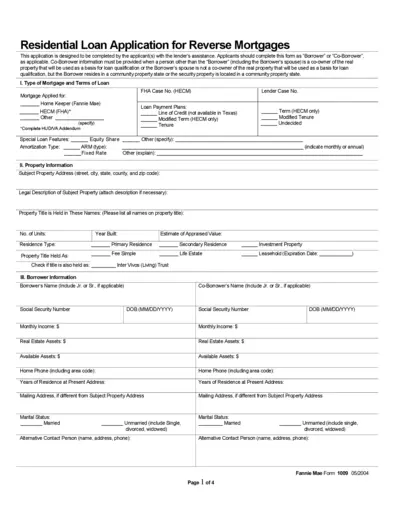

Residential Loan Application Reverse Mortgages

This file contains the Residential Loan Application specifically designed for reverse mortgages. It provides step-by-step instructions to assist borrowers in filling out the necessary details. Essential for individuals or couples seeking to apply for a reverse mortgage loan.

Loans

FHA Streamlined 203(k) Program Loan Overview

This document outlines the FHA Streamlined 203(k) Loan Program designed for home rehabilitation financing. It specifies requirements for renovations and how this program can benefit homeowners. Aimed at mortgage professionals, this file provides essential guidelines for utilizing the streamlined process.

Banking

Himalayan Bank Credit Card Application Form

This document is an application form for obtaining a credit card from Himalayan Bank Limited. It includes personal, employment, and financial details required for processing your application. Ensure to follow the instructions carefully when filling out this form.

Tax Forms

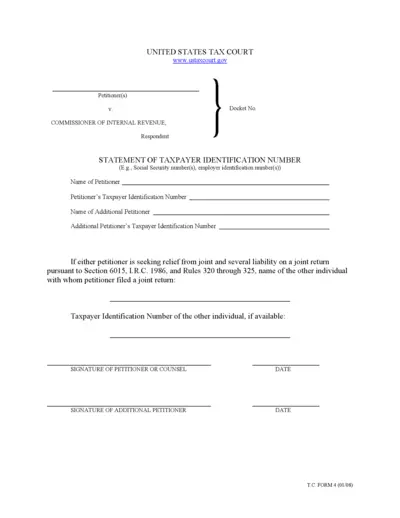

United States Tax Court Taxpayer Identification Form

This form is essential for taxpayers in the U.S. It requires taxpayer identification numbers for individuals and businesses. Use it for accurate tax filing and compliance.

Banking

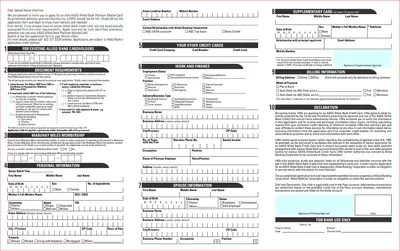

AAXS-Allied Bank Platinum MasterCard Application

This document is the application form for the AAXS-Allied Bank Platinum MasterCard. It provides detailed instructions on eligibility, required documents, and submission procedures. Perfect for Xavier alumni looking to enjoy exclusive banking benefits.

Tax Forms

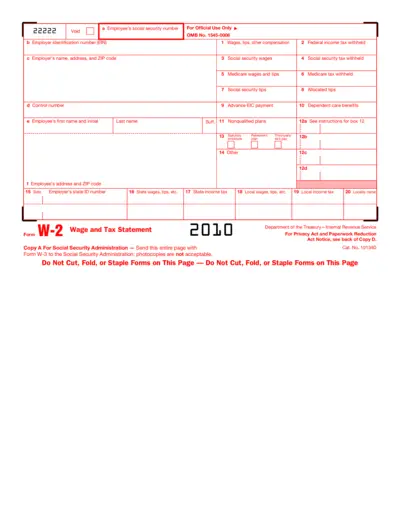

W-2 Wage and Tax Statement Instructions and Details

This file contains instructions for filling out the W-2 Wage and Tax Statement. It is essential for employees and employers alike for accurate wage reporting. Follow the guidelines provided to ensure correct completion and submission of this form.

Tax Forms

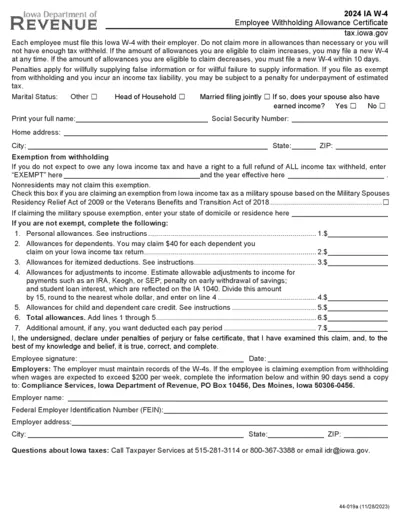

Iowa W-4 Employee Withholding Allowance Certificate

This Iowa W-4 form is essential for employees to declare their withholding allowances. It helps ensure the correct amount of state income tax is withheld from paychecks. Employers use this document to determine tax obligations for their employees.