Finance Documents

Tax Forms

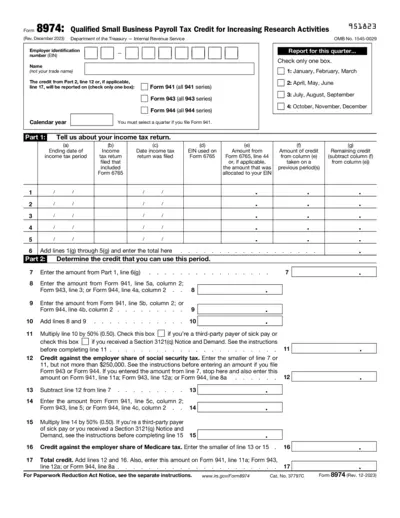

Qualified Small Business Payroll Tax Credit Form

The Qualified Small Business Payroll Tax Credit form helps taxpayers claim credits for increasing research activities. This form must be completed accurately to ensure all eligible credits are claimed. Familiarize yourself with the requirements to effectively utilize the form.

Tax Forms

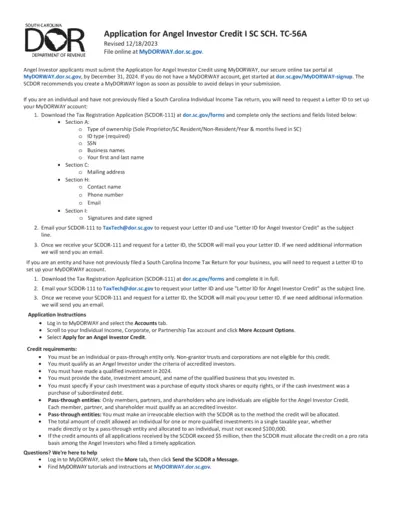

Angel Investor Credit Application - South Carolina

This document provides details on how to apply for the Angel Investor Credit in South Carolina. It includes essential instructions, requirements, and submission deadlines pertinent for applicants. Gain insight into the necessary steps to secure your Angel Investor Credit effectively.

Tax Forms

T1135 Guide Foreign Income Verification Statement

The T1135 file provides essential information for Canadian taxpayers regarding the Foreign Income Verification Statement. It outlines the necessary steps to report specified foreign property accurately. This guide ensures compliance with Canadian tax regulations.

Banking

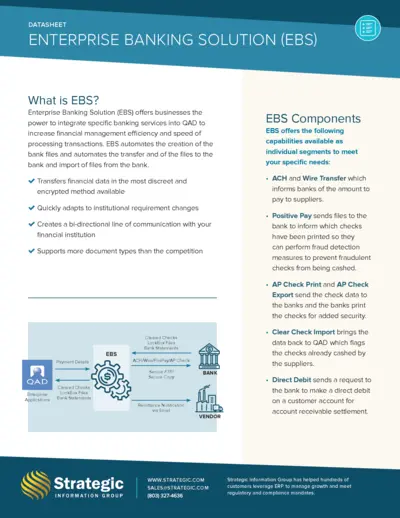

Enterprise Banking Solution Overview and Benefits

The Enterprise Banking Solution (EBS) enhances financial management efficiency by integrating banking services into QAD. It automates processes like file transfers and transaction processing. This datasheet outlines the features and capabilities offered by EBS to streamline banking interactions.

Tax Forms

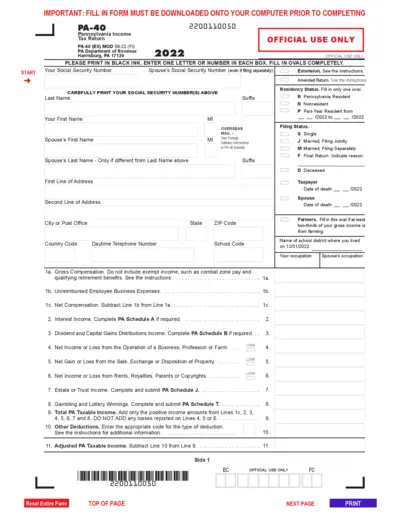

PA-40 Pennsylvania Income Tax Return Instructions

This file contains the PA-40 Pennsylvania Income Tax Return form and its detailed instructions. It is essential for individuals filing their state tax returns in Pennsylvania. Users can fill out this form to comply with state tax requirements.

Tax Forms

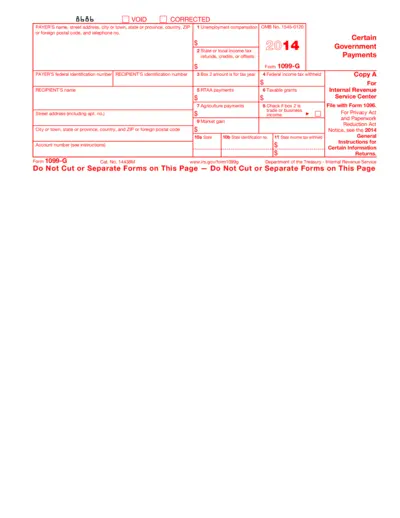

Form 1099-G: Reporting Government Payments

This file contains IRS Form 1099-G, which is used to report certain types of government payments. It outlines necessary fields for unemployment compensation and state income tax. Proper completion is vital to comply with tax regulations.

Tax Forms

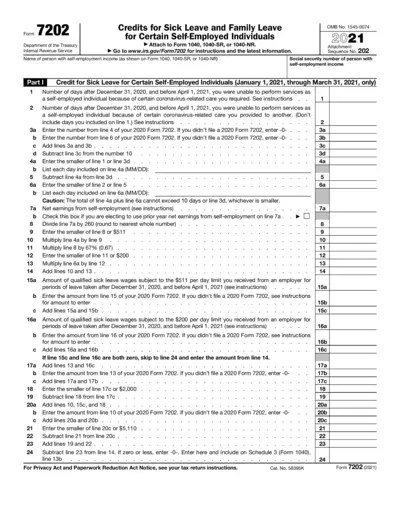

Credits for Sick Leave and Family Leave for Self-Employed

Form 7202 assists self-employed individuals in claiming credits for sick leave and family leave related to COVID-19. This form applies to specific dates in 2021 for those unable to work due to caring for themselves or others. It helps determine eligible days and corresponding tax credits.

Tax Forms

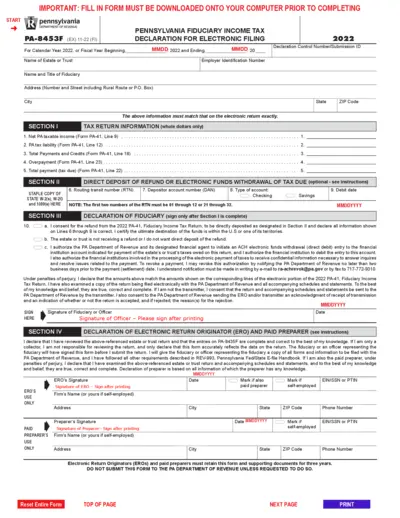

Pennsylvania PA-8453F Electronic Filing Declaration

The PA-8453F form is essential for estate or trust fiduciaries to declare the electronic filing of the Pennsylvania Fiduciary Income Tax for the year 2022. It ensures all relevant information is accurately represented and submitted to the PA Department of Revenue. This form is vital for compliance and to facilitate direct deposit of refund or electronic payment of taxes owed.

Banking

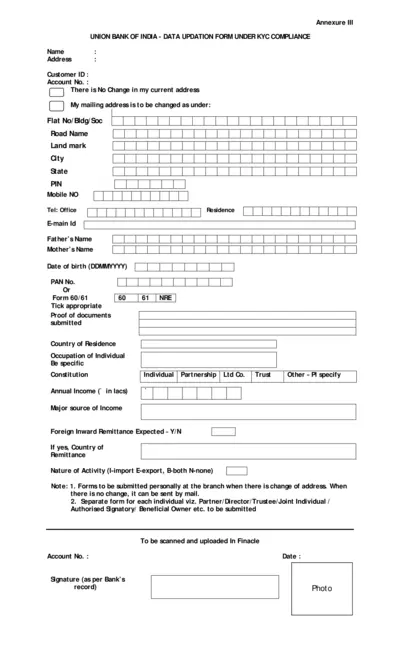

Union Bank of India KYC Data Updation Form

The Union Bank of India KYC Data Updation Form is essential for customers seeking to update their personal information. It ensures compliance with Know Your Customer regulations. Fill this form to maintain accurate records with the bank.

Banking

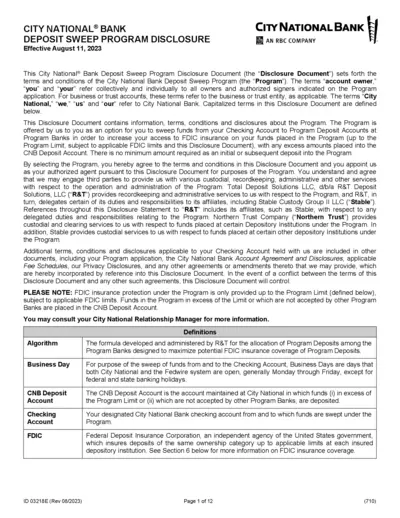

City National Bank Deposit Sweep Program Disclosure

This Disclosure Document outlines the terms and conditions of the City National Bank Deposit Sweep Program. It provides details on how to manage your funds through Program Deposit Accounts. Understand the FDIC insurance coverage applicable to your deposits.

Retirement Plans

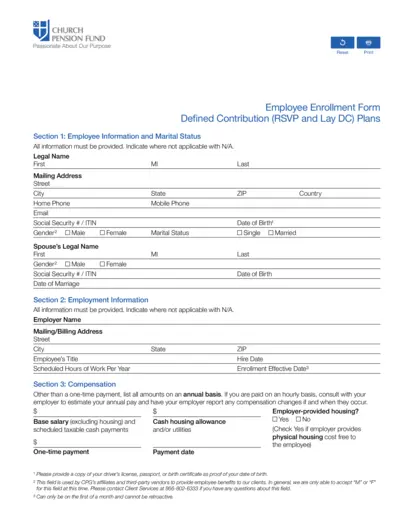

Church Pension Fund Employee Enrollment Form

This form enables employees to enroll in the Church Pension Fund's defined contribution plans. It provides essential details for submitting personal and employment information for retirement savings. Proper completion ensures correct management of retirement funds.

Banking

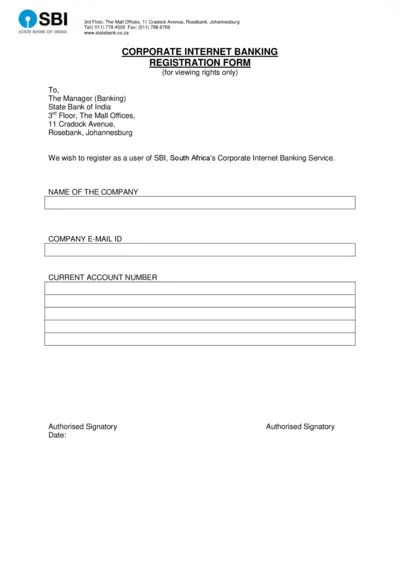

Corporate Internet Banking Registration Form - SBI

This document is the Corporate Internet Banking Registration Form for the State Bank of India. It provides essential details and instructions for businesses to register online for banking services. Perfect for companies seeking to streamline their account management.