Finance Documents

Retirement Plans

Retirement Planning Simplified with Principal Services

This document provides essential information on managing your retirement savings through rollovers and other options. It guides users on the advantages and drawbacks of various retirement plans. Use this information to make informed decisions about your retirement strategy.

Banking

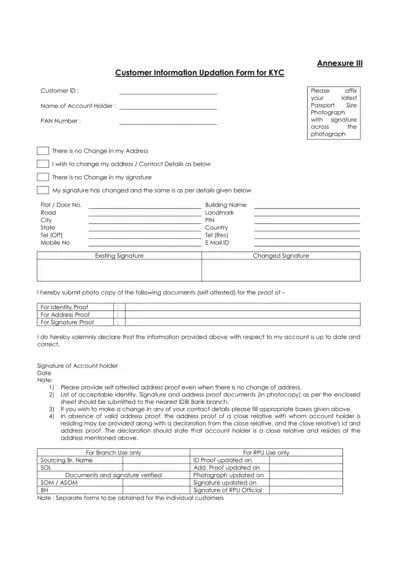

Customer Information Updation Form for KYC

This file provides a comprehensive customer information updation form for KYC purposes. Users can use it to update their personal information including address, contact details, and signatures. It is essential for maintaining accurate records with banking institutions.

Tax Forms

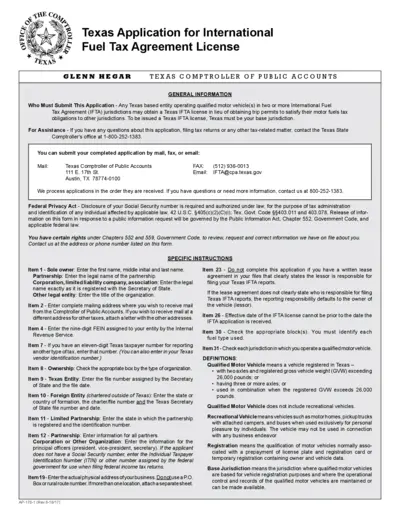

Texas Application for International Fuel Tax License

This application is for Texas entities operating qualified motor vehicles in IFTA jurisdictions. It allows operators to obtain a Texas IFTA license. Completing this form is essential for ensuring compliance with fuel tax obligations.

Tax Forms

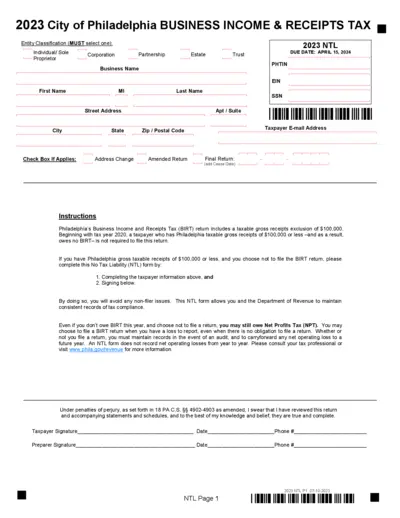

Philadelphia Business Income & Receipts Tax Form 2023

This form is essential for businesses to report their income and receipts for tax purposes in Philadelphia. It includes instructions for filing and details about tax liabilities. Proper completion ensures compliance with local tax regulations.

Tax Forms

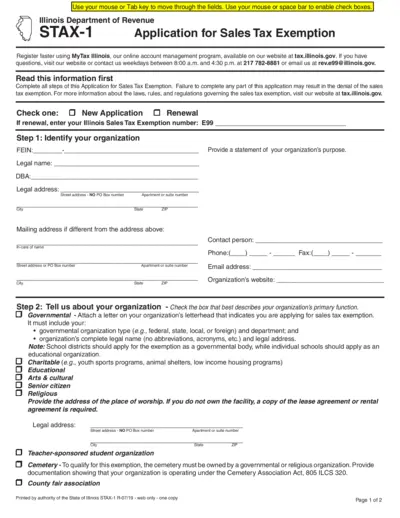

Illinois Sales Tax Exemption Application Form

This file provides the application format for sales tax exemption in Illinois. It includes detailed instructions for organizations seeking tax-exempt status. Access all the necessary information and required documentation here.

Tax Forms

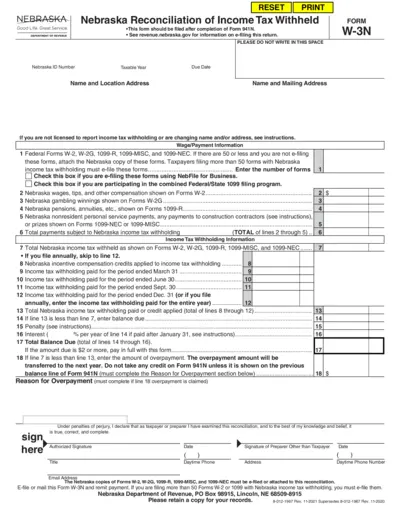

Nebraska Income Tax Withheld Reconciliation Form W-3N

The Nebraska Reconciliation of Income Tax Withheld, Form W-3N, is essential for employers to report income tax withholding details. This form must be filed by every employer or payor withholding Nebraska income taxes and includes necessary instructions for accurate completion. Ensure compliance by filing accurately and on time to avoid penalties.

Banking

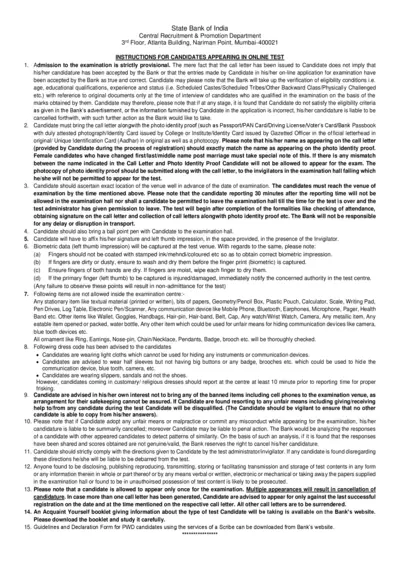

State Bank of India Online Test Instructions

This document provides essential instructions for candidates appearing for the online test conducted by the State Bank of India. It includes guidelines for eligibility, identification requirements, and test day protocols. Adhering to these instructions is critical for a successful examination experience.

Tax Forms

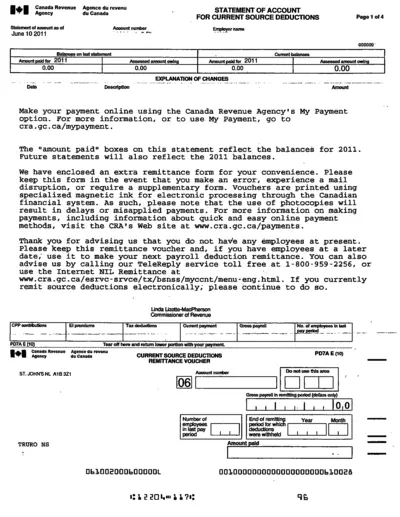

Canada Revenue Agency Statement of Account 2011

This document details the Canada Revenue Agency's Statement of Account as of June 10, 2011. It serves as a formal record of source deductions and balances owed. Employers can use this document for payroll remittance and compliance with tax laws.

Tax Forms

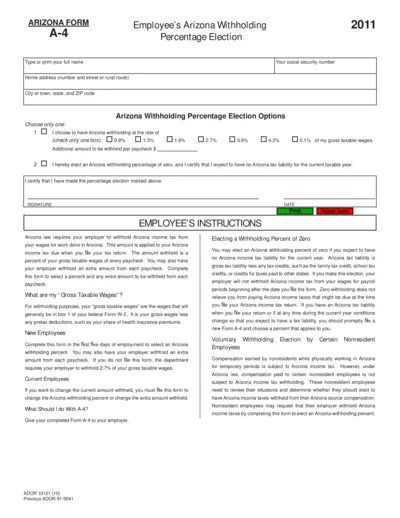

Arizona Form A-4 Employee Withholding Percentage

This document is the Arizona Form A-4, used for employees to elect their withholding percentage for Arizona income tax. It is important for both new and current employees to understand how to fill out this form correctly to ensure appropriate tax withholding from their wages. Make sure to complete this form as soon as possible to avoid incorrect tax withholding.

Tax Forms

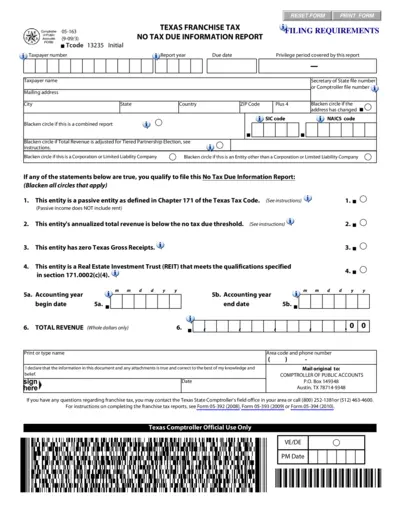

Texas Franchise Tax No Tax Due Information Report

This form is used by Texas entities to report no tax due under the Texas Franchise Tax. It helps determine whether the entity meets specific criteria for tax exemption. Filing this form accurately is essential for compliance with the Texas Tax Code.

Tax Forms

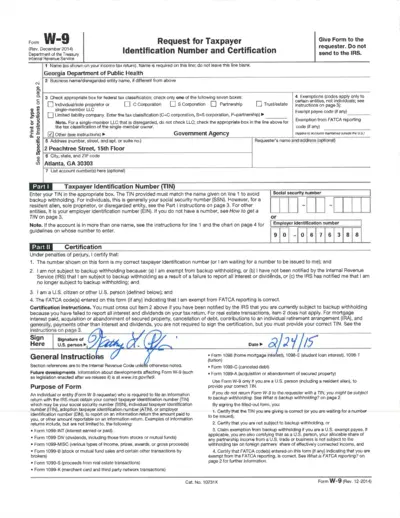

W-9 Taxpayer Identification Number Certification

The W-9 form is used to request your taxpayer identification number, necessary for tax reporting purposes. It is essential for individuals and businesses to accurately fill out this form. Ensure all sections are completed to avoid delays in processing.

Loans

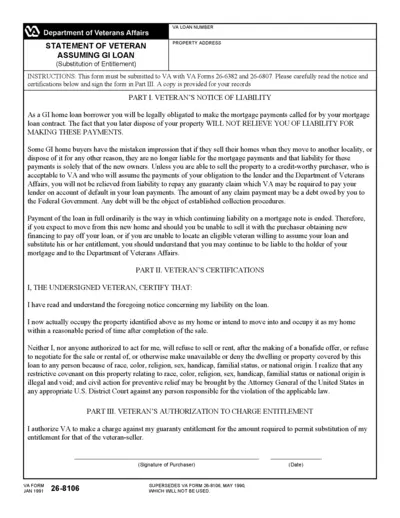

VA Loan Assumption Instructions and Liability Statement

This document outlines the liability for veterans assuming GI loans. It provides essential instructions and certifications necessary for compliance. Understanding these details is crucial for managing your mortgage responsibilities effectively.