Veterans Affairs Documents

Veterans Affairs

Form 656 Offer in Compromise Instructions and Details

This form provides essential instructions on how to apply for an Offer in Compromise with the IRS. It outlines eligibility, requirements, and necessary steps. Perfect for taxpayers looking to resolve their tax debts efficiently.

Veterans Affairs

Enterprise Case Management ECM Form 3949-A

This document details the Enterprise Case Management system, a transformative application that modernizes IRS processes. It provides critical information on handling taxpayer interactions and managing cases effectively. Understanding its functionalities will help users leverage its features for improved efficiency.

Veterans Affairs

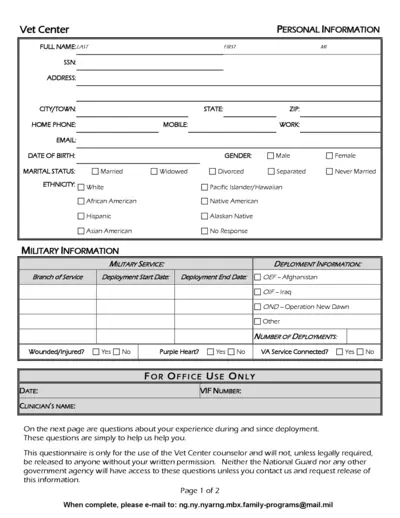

Veteran Center Personal Information Form

This file contains essential personal and military information required for veterans seeking assistance. It includes questions about deployment experiences and post-deployment mental health. Completing this form accurately will help facilitate better support services.

Veterans Affairs

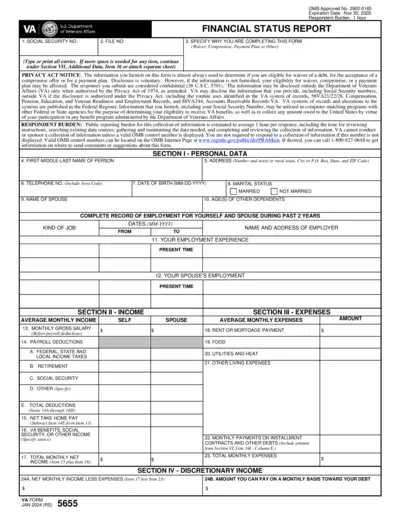

VA Financial Status Report Form - 2024

The VA Financial Status Report helps veterans report their financial conditions. This form is essential for those seeking waivers, compromises, or payment plans. Understanding and completing this form accurately can lead to better eligibility and assistance.

Veterans Affairs

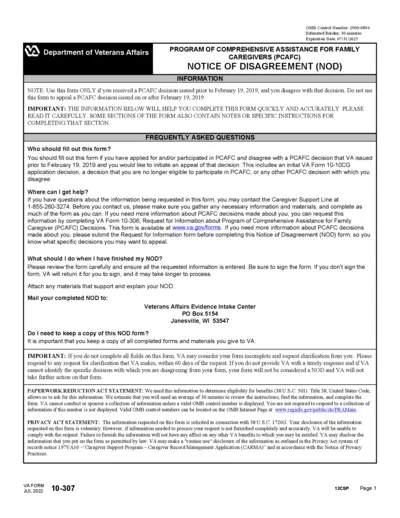

PCAFC Notice of Disagreement Form Instructions

This file contains the instructions to file a Notice of Disagreement for the Program of Comprehensive Assistance for Family Caregivers. It provides essential information on eligibility and how to complete the form accurately. Follow these instructions to ensure the proper processing of your NOD.

Veterans Affairs

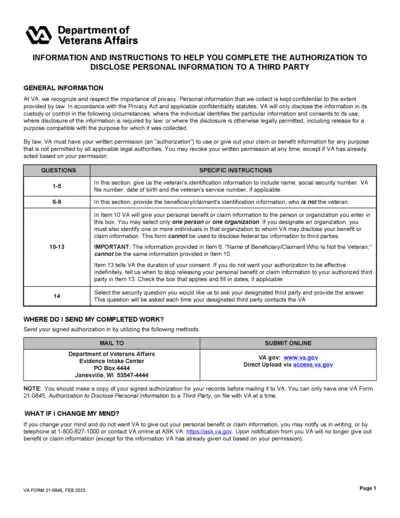

Authorization to Disclose Personal Information

This file provides the necessary authorization form for veterans to disclose their personal information to third parties. It ensures compliance with privacy laws and allows for transparency in information sharing. Use this form to manage your VA benefits efficiently.

Veterans Affairs

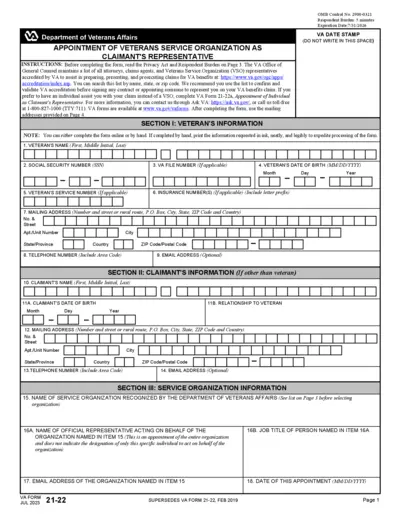

Appointment of Veterans Service Organization as Claimant Representative

This document is used to appoint a veterans service organization as a representative for a claimant's VA benefits. It outlines the necessary instructions to complete the appointment. Ensuring proper completion can streamline the claim process for veterans and their families.

Veterans Affairs

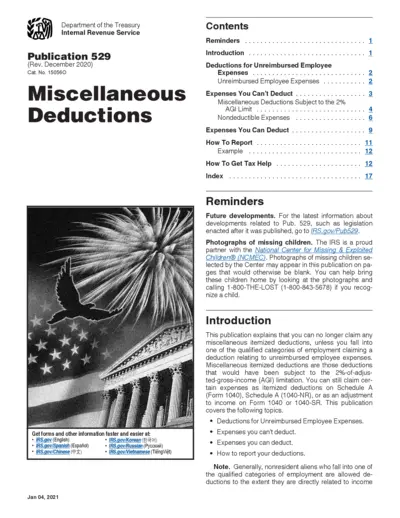

Publication 529 Miscellaneous Deductions January 2021

Publication 529 provides detailed information on miscellaneous deductions. It explains the recent changes regarding unreimbursed employee expenses. Users can understand what deductions are available and how to report them.

Veterans Affairs

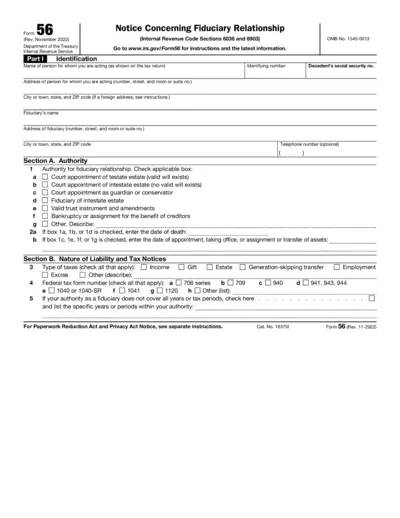

Notice Concerning Fiduciary Relationship - Form 56

Form 56 is used to notify the IRS of your fiduciary responsibilities for a taxpayer. This form is crucial for legal and tax purposes. It outlines your authority and the nature of the fiduciary relationship you hold.

Veterans Affairs

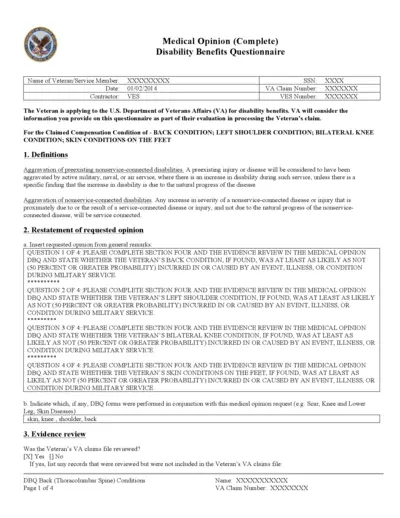

U.S. Department of Veterans Affairs Disability Benefits Questionnaire

This file is a detailed questionnaire for veterans applying for disability benefits from the U.S. Department of Veterans Affairs. It includes sections for medical opinion and history related to claimed conditions. Veterans should accurately complete this form to ensure their claims are processed effectively.

Veterans Affairs

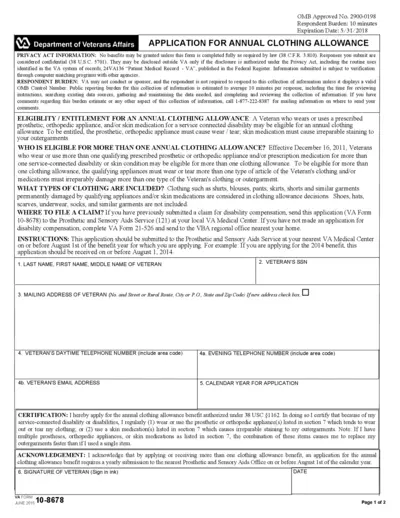

Application for Annual Clothing Allowance

This file provides the application form for veterans to apply for the annual clothing allowance. It includes eligibility criteria, instructions for completing the application, and information about what types of clothing are covered. Useful for veterans looking to receive assistance for clothing expenses due to service-connected disabilities.

Veterans Affairs

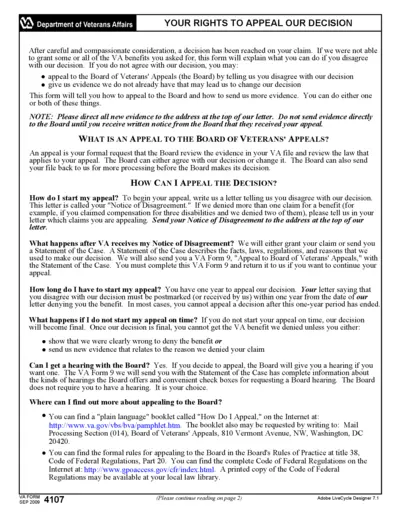

Your Rights to Appeal VA Decision

This file provides essential information on how to appeal a VA decision regarding your benefits. It details the process, your rights, and how to submit additional evidence. Understanding your options is crucial for veterans seeking justice and support.