Insurance Claims Documents

Insurance Claims

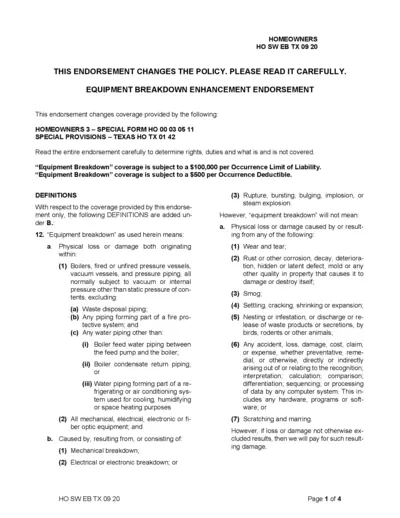

Homeowners Equipment Breakdown Enhancement Endorsement

This document is an Equipment Breakdown Enhancement Endorsement for Homeowners Policies. It outlines the definitions, coverages, and conditions that apply to equipment breakdown events. Please read it carefully to understand your coverage and liabilities.

Insurance Claims

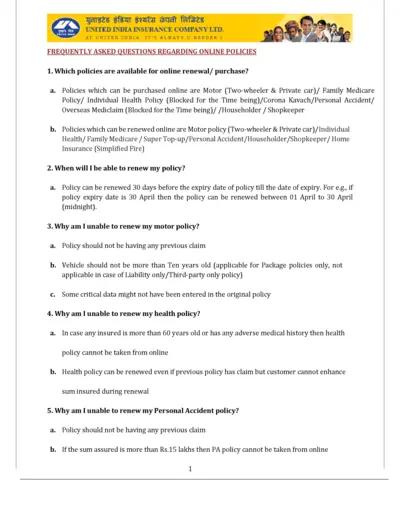

Frequently Asked Questions About Online Policies

This document provides answers to common questions regarding the renewal and purchase of online insurance policies from United India Insurance Company. It covers various types of policies, renewal periods, payment methods, and instructions for handling issues such as unsuccessful payments or duplicate transactions.

Insurance Claims

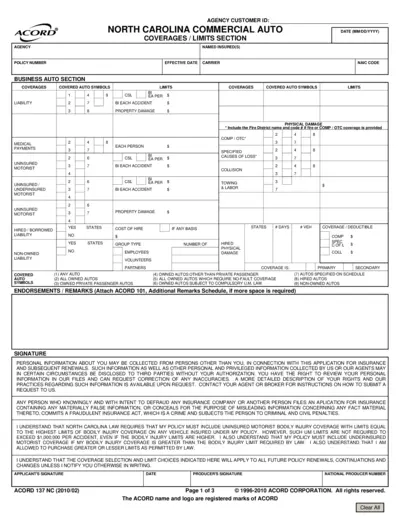

North Carolina Commercial Auto Coverage and Limits Form

This document outlines the coverage and limits for a North Carolina commercial auto insurance policy. It includes sections for liability, medical payments, uninsured motorist, and physical damage coverages. Users can also find instructions for filling out the form and signing the application.

Insurance Claims

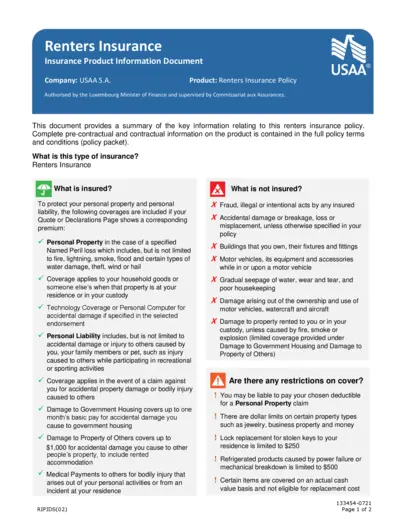

USAA Renters Insurance Policy Information

This document provides key information about the USAA Renters Insurance Policy. It includes details on coverage, exclusions, obligations, and payment terms. Complete pre-contractual and contractual information is contained in the full policy terms and conditions.

Insurance Claims

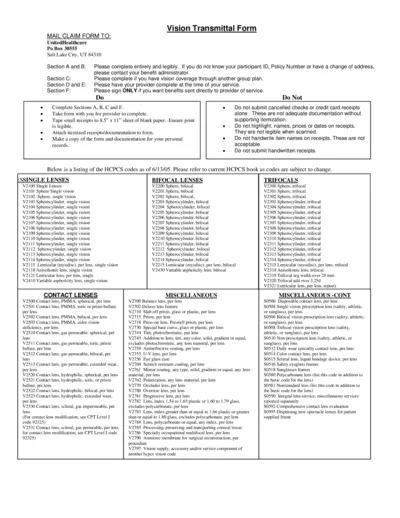

Vision Transmittal Form for UnitedHealthcare Claims

This Vision Transmittal Form is used to submit vision claims to UnitedHealthcare. Complete all required sections and attach itemized receipts. Ensure the provider fills out their corresponding sections.

Insurance Claims

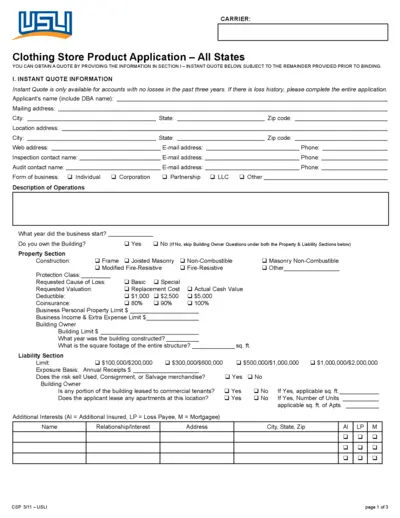

Clothing Store Insurance Application Form

This file is an insurance application form for clothing stores, covering both property and liability information. It includes sections for instant quotes, loss history, and property details. It also provides eligibility criteria and fraud statements for various states.

Insurance Claims

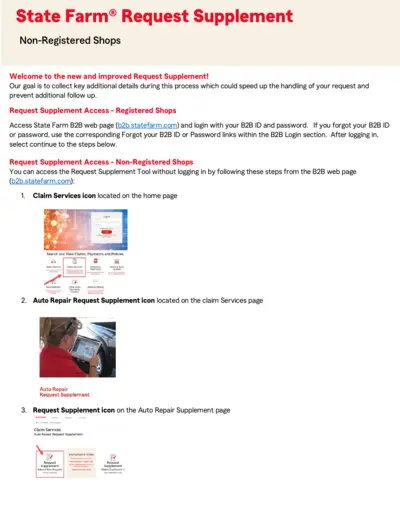

State Farm Request Supplement Guide: Registered and Non-Registered Shops

This file provides instructions for accessing and submitting a request supplement with State Farm. It includes steps for both registered and non-registered shops. It also details the process of validating shop and claim information.

Insurance Claims

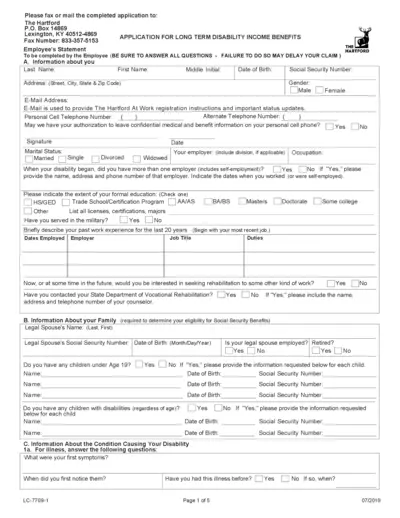

Application for Long Term Disability Income Benefits

This file contains the application for long term disability income benefits. It includes sections for personal information, family details, information about the condition causing disability, and details about healthcare providers and hospitals. It is important to fill out all required fields to avoid delays in processing the claim.

Insurance Claims

Twelfth Amendment to NY Spousal Liability Insurance

This document is the Twelfth Amendment to 11 NYCRR 60-1, addressing Minimum Provisions for Automobile Liability Insurance Policies in New York State. It details changes regarding supplemental spousal liability insurance coverage. If you are a policyholder in New York, this document is essential to understand the updated requirements and provisions.

Insurance Claims

Zurich Builders Risk Reporting Form Policy Guidelines

This document provides guidelines for the Zurich Builders Risk Reporting Form Policy. It explains how to manage Builders Risk coverage and ensure proper reporting. It also includes instructions on premium payment and the responsibilities of agents and brokers.

Insurance Claims

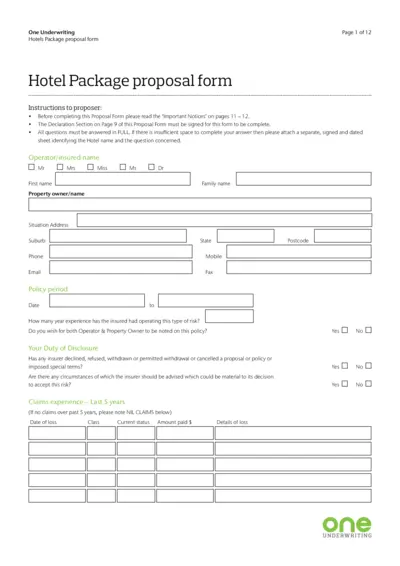

Hotel Package Proposal Form for Insurance

This document is a proposal form for a hotel insurance package. It includes sections on property details, fire protection, security, and more. Complete all fields accurately and submit as instructed.

Insurance Claims

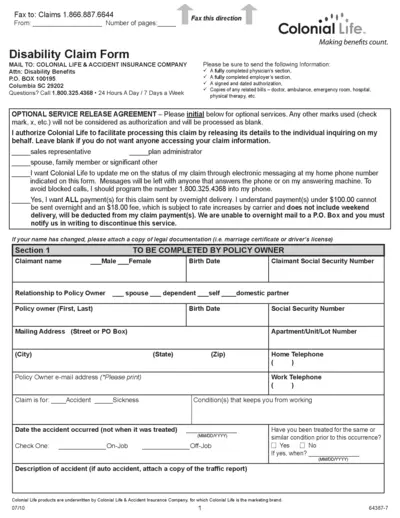

Colonial Life Disability Claim Form

This file contains the Colonial Life Disability Claim Form for filing accident and sickness claims, complete with fraud warnings and certification requirements. Users need to fill out personal and policy information, including accident details and medical history. The form requires signatures from the claimant and policy owner.