Property Law Documents

Real Estate

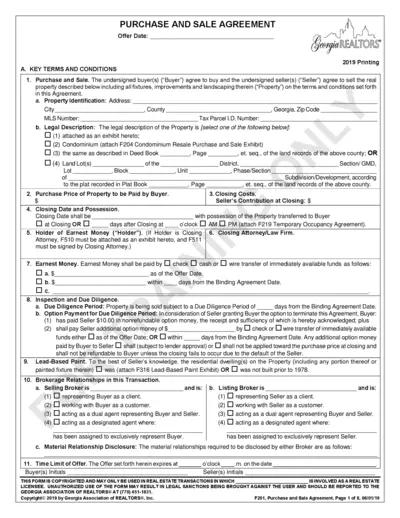

Georgia Purchase and Sale Agreement

This document serves as a legally binding contract between a buyer and seller in real estate transactions in Georgia. It outlines the terms and conditions related to the purchase and sale of property. Users can fill out this form to initiate the buying or selling process efficiently.

Property Taxes

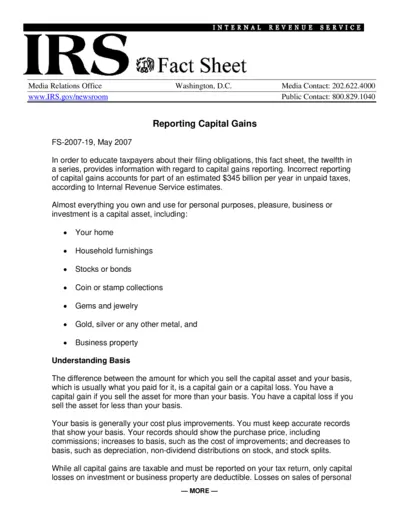

Reporting Capital Gains Instructions for Taxpayers

This IRS fact sheet provides essential guidance on reporting capital gains for taxpayers. It includes definitions, reporting obligations, and important tax considerations. Understanding how to accurately report capital gains can help you avoid penalties and maximize your tax benefits.

Real Estate

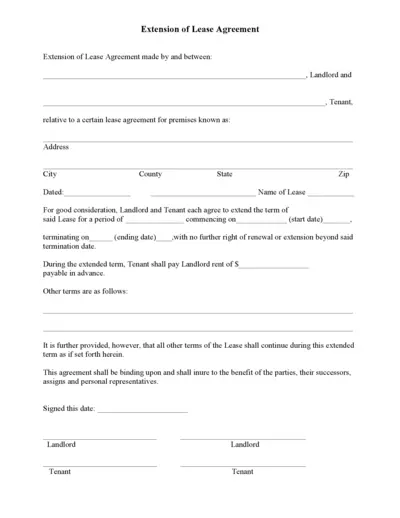

Extension of Lease Agreement Template

This file provides a formal template for extending a lease agreement between a landlord and tenant. It outlines the terms and conditions necessary for an extension, including dates and rent amounts. Use this document to ensure all legal aspects are covered when extending a lease.

Property Taxes

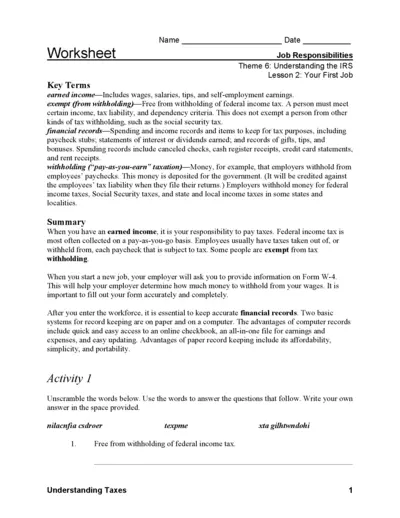

IRS Guidelines on Your First Job and Taxes

This file provides comprehensive instructions for managing taxes related to your first job. It includes key terms, necessary forms, and record-keeping tips. Ideal for new employees and students entering the workforce.

Property Taxes

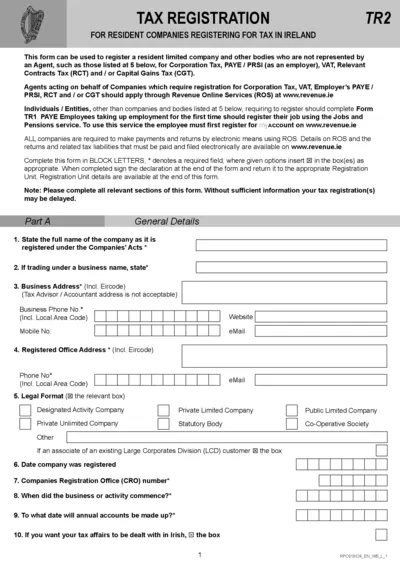

Tax Registration for Companies in Ireland

This file serves as a registration form for resident companies in Ireland for tax purposes. It outlines requirements for Corporation Tax, VAT, PAYE/PRSI, and more. Ensure accurate completion to avoid delays in tax registration.

Real Estate

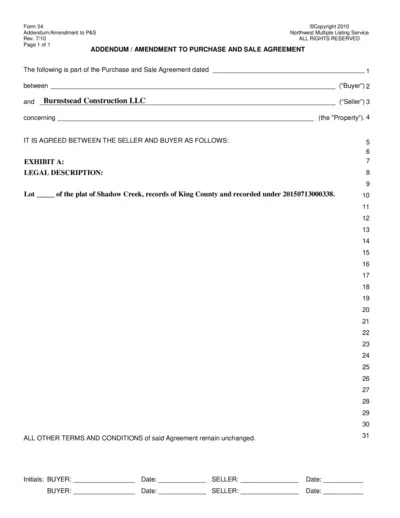

Addendum Amendment to Purchase and Sale Agreement

This document serves as an addendum or amendment to a previously executed Purchase and Sale Agreement. It outlines any changes or additional terms agreed upon by the buyer and seller. Proper completion of this form is crucial for legal clarity between the involved parties.

Property Taxes

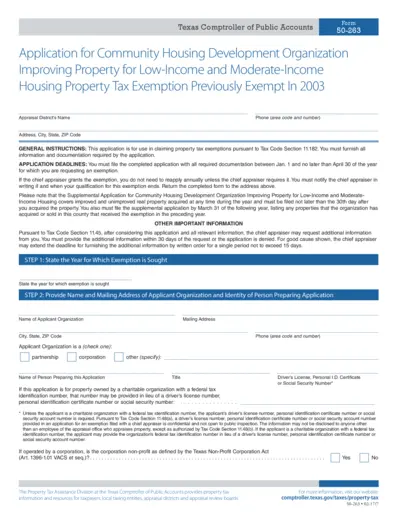

Texas Comptroller 50-263 Community Housing Exemption

This document is an application for property tax exemptions for community housing development organizations. It outlines eligibility criteria for low-income and moderate-income housing. Use this form to apply for tax exemption on properties meeting specified requirements.

Property Taxes

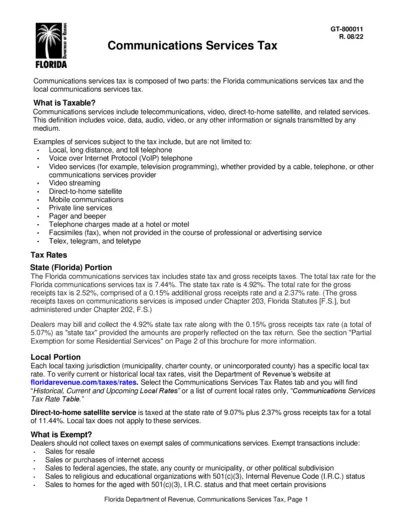

Florida Communications Services Tax Guide

This file provides detailed information on the Florida Communications Services Tax, including its components, tax rates, exemptions, and filing instructions. It serves as a comprehensive resource for individuals and businesses to understand their tax obligations and requirements. Users will find guidelines on how to comply with the Florida Department of Revenue’s regulations regarding communication services.

Property Taxes

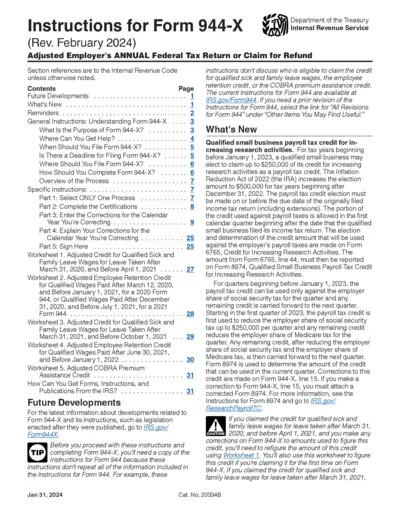

Instructions for Form 944-X Adjusted Tax Return

This file provides comprehensive instructions for completing Form 944-X, including error corrections and submission details. It's essential for employers who need to adjust their annual federal tax return or claim a refund. Stay informed with updates and worksheets included.

Real Estate

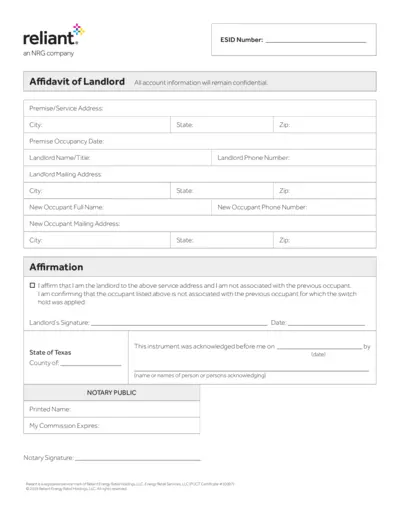

Affidavit of Landlord for Texas Residents

This form is an affidavit for landlords in Texas to affirm their relationship to tenants. It ensures that account information remains confidential. Landlords must provide all necessary details to complete the occupancy change.

Property Taxes

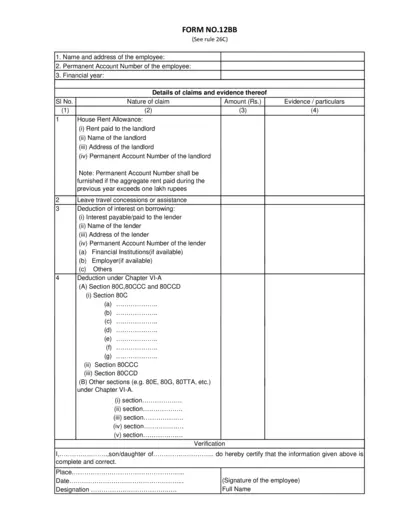

FORM NO. 12BB - Employee Tax Claim Details

FORM NO. 12BB is a crucial document for employees claiming tax deductions. It requires detailed information on various claims, including house rent and travel concessions. Ensure all information is accurately filled to facilitate smooth processing.

Real Estate

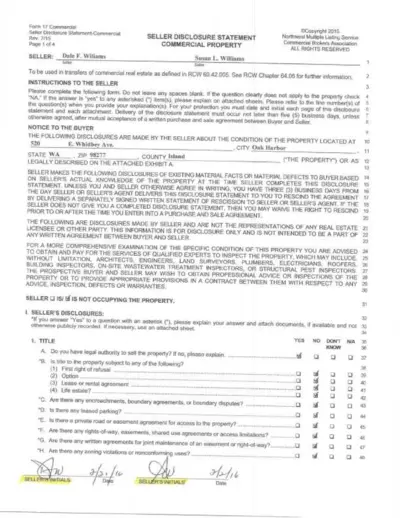

Seller Disclosure Statement for Commercial Property

This file is a Seller Disclosure Statement specifically for commercial properties. It contains essential information about the condition of the property that every prospective buyer should know. Proper completion of this form is crucial for both legal compliance and transparency in real estate transactions.