Property Law Documents

Property Taxes

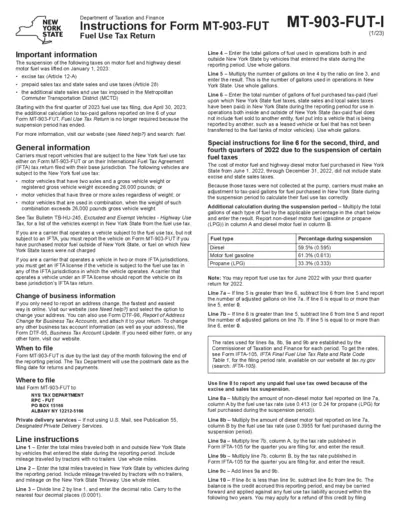

New York State Fuel Use Tax Return Instructions

Instructions for completing the New York State Form MT-903-FUT, including details on fuel use tax, reporting requirements, and filing deadlines.

Property Taxes

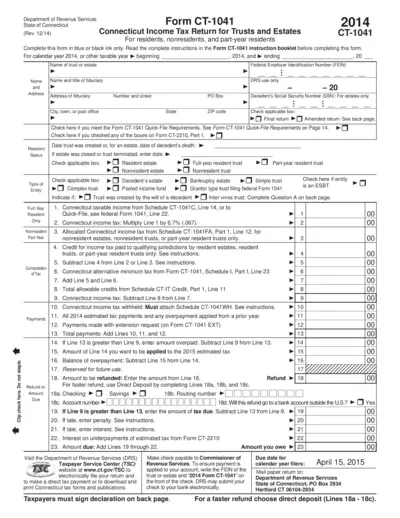

Connecticut Income Tax Return for Trusts and Estates (2014)

Form CT-1041 is used for filing the Connecticut Income Tax Return for trusts and estates for the year 2014. This form should be completed in blue or black ink. Please read the complete instructions before filling out the form.

Zoning Regulations

19A NCAC 03D .0550 Waivers from Emissions Test Requirements

This document outlines the rules and criteria for obtaining a waiver from emissions test requirements in North Carolina. The criteria include passing the safety portion of the inspection, having qualifying repairs completed, and meeting the minimum repair expenditure. The waiver is issued by the Division after verifying all requirements are met.

Property Taxes

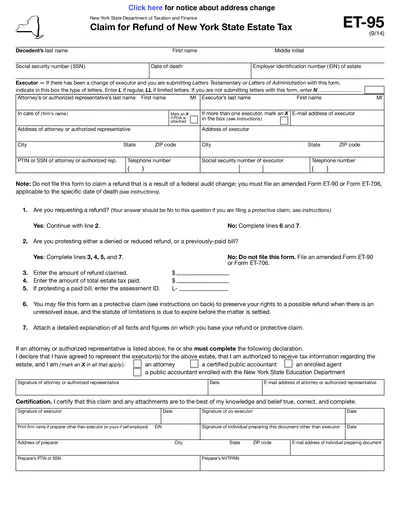

Claim for Refund of New York State Estate Tax - ET-95 Form

The ET-95 form is used to claim a refund of New York State estate tax for protested denied refunds, protective claims, and protested paid bills. This form must be filled accurately to ensure the claim is processed correctly. Learn how to fill, edit, and submit this form using our PDF editor.

Property Taxes

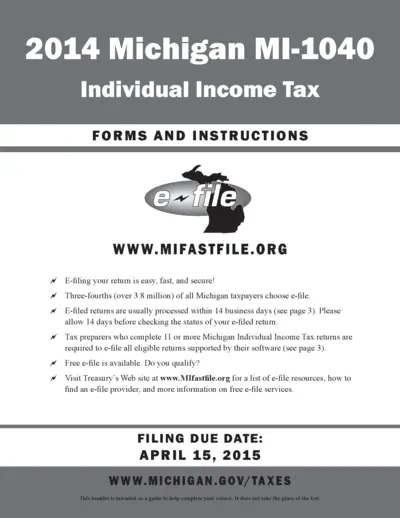

2014 Michigan MI-1040 Individual Income Tax Forms and Instructions

This document contains the forms and instructions for the 2014 Michigan MI-1040 individual income tax. It includes information on e-filing, deductions, and exemptions. It also provides details about payment options and important dates for tax filing.

Real Estate

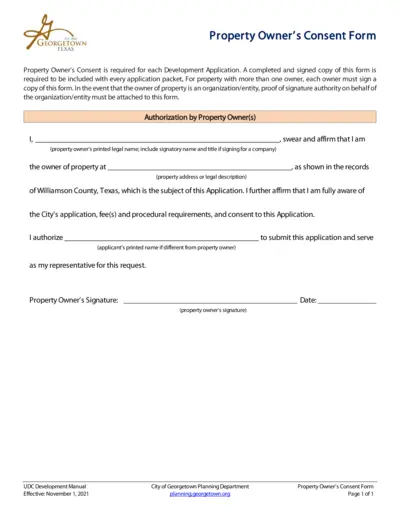

Georgetown Property Owner's Consent Form

This form is required for each Development Application in Georgetown, Texas. A completed and signed copy of this form must be included with every application packet. For properties with multiple owners, each owner must sign a copy of this form.

Real Estate

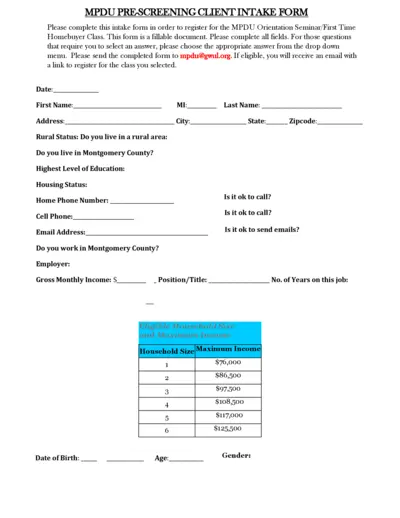

MPDU Pre-Screening Client Intake Form

This form is used to register for the MPDU Orientation Seminar/First Time Homebuyer Class. Complete all fields and select answers from the drop-down menus. Submit the completed form to mpdu@gwul.org to receive a registration link.

Property Taxes

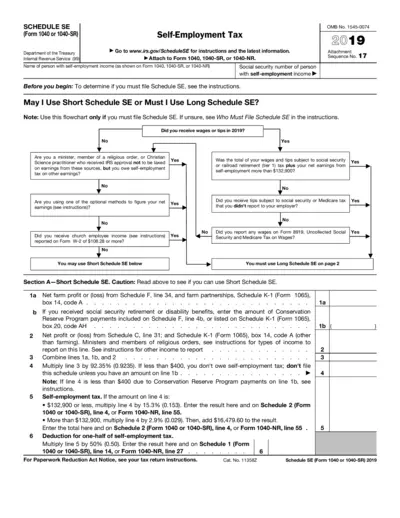

Self-Employment Tax Form for 1040 or 1040-SR 2019

This file includes Schedule SE for calculating self-employment tax for 2019. Attach to Form 1040, 1040-SR, or 1040-NR. Refer to the flowchart to determine if you must file Short or Long Schedule SE.

Real Estate

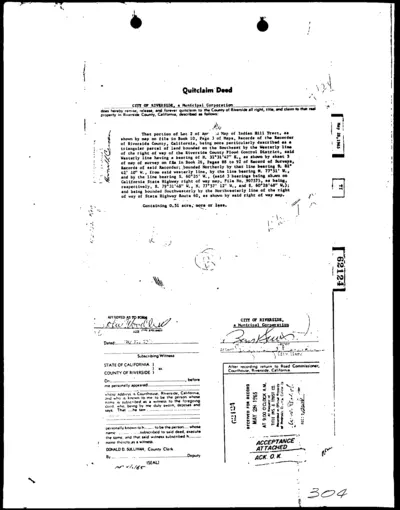

Quitclaim Deed - Riverside County Property

This document is a Quitclaim Deed from the City of Riverside to the County of Riverside. It provides details about the property in Riverside County, California. This file includes legal descriptions and boundaries of the property.

Real Estate

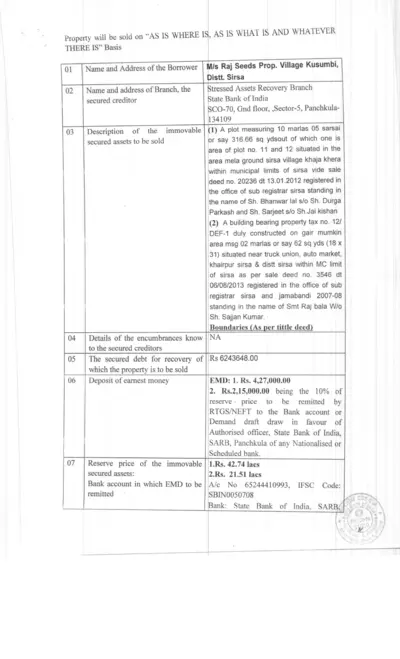

AS IS WHERE IS Sale Property Details

This file contains details about an auction of a property sold on 'AS IS WHERE IS' basis. It includes information about the borrower, property description, and auction details. The document also provides instructions for potential bidders.

Property Taxes

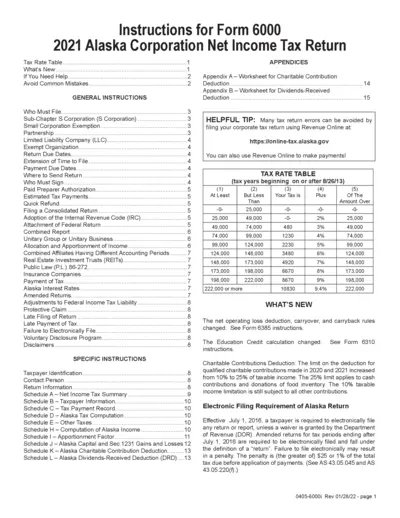

2021 Alaska Corporation Net Income Tax Return Instructions

Instructions for filling out the 2021 Alaska Corporation Net Income Tax Return, including updates, filing requirements, and general instructions.

Property Taxes

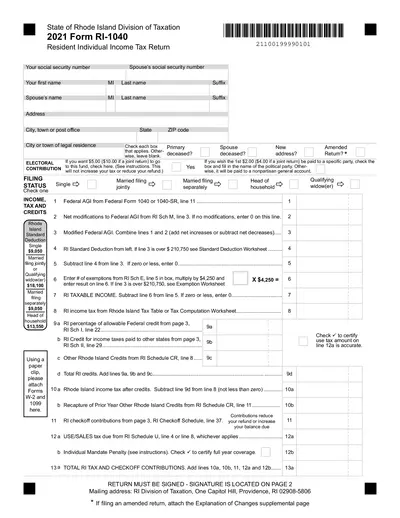

Rhode Island 2021 Form RI-1040 Resident Individual Income Tax Return

This file contains the Form RI-1040, which is the Resident Individual Income Tax Return for the state of Rhode Island for the year 2021. It is used to report and calculate your state income tax. Make sure to follow instructions carefully and attach all required documents.