Property Law Documents

Property Taxes

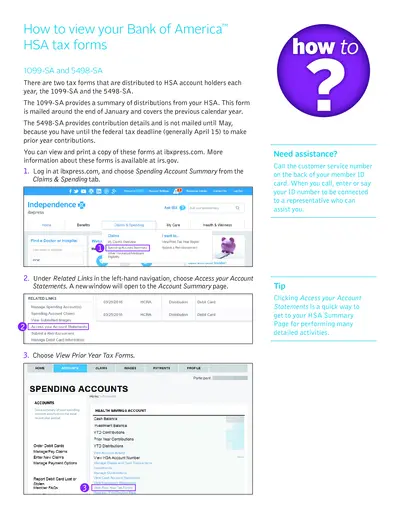

View Your Bank of America HSA Tax Forms Instructions

This file provides important information on viewing and printing your Bank of America HSA tax forms. It includes 1099-SA and 5498-SA forms essential for your tax records. Follow the detailed instructions for assistance with your HSA tax documentation.

Property Taxes

Ohio Individual Income Tax Return Form 2015

The Ohio Individual Income Tax Return Form 2015 is essential for taxpayers to report their income and calculate tax owed. This form must be completed carefully to ensure compliance with Ohio tax laws. Be sure to follow the guidelines provided to avoid any penalties.

Property Taxes

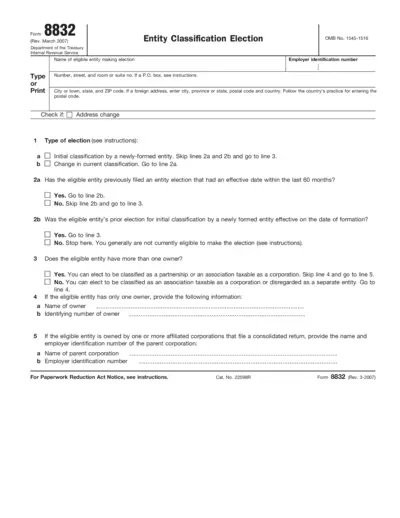

Form 8832 Entity Classification Election Instructions

Form 8832 is used for electing the classification of eligible entities for federal tax purposes. This file provides step-by-step instructions for properly completing the form. It is essential for business entities aiming for the correct classification with the IRS.

Real Estate

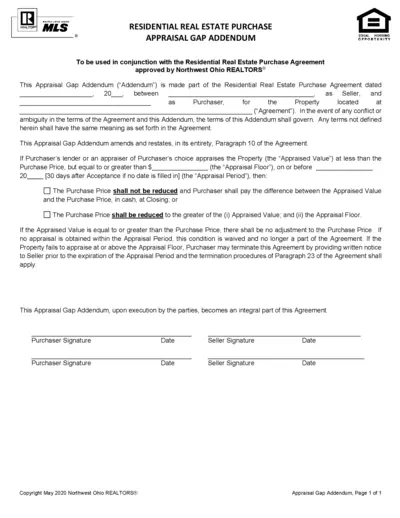

Appraisal Gap Addendum for Residential Real Estate

This document is an Appraisal Gap Addendum that modifies the terms of the Residential Real Estate Purchase Agreement. It provides clarity on how appraised values impact purchase prices. Essential for buyers and sellers in real estate transactions.

Real Estate

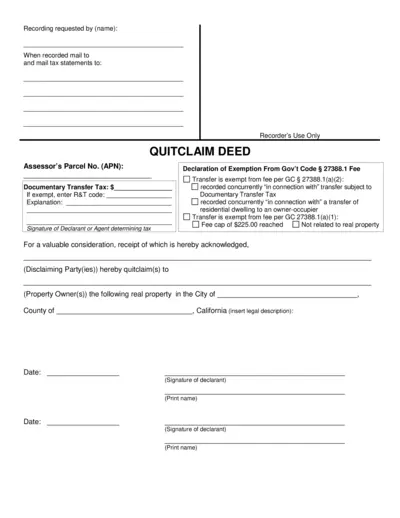

Quitclaim Deed Form Instructions and Details

This Quitclaim Deed form is essential for transferring property rights in California. It provides a legal framework for property owners to relinquish their interests in a property. Whether you're selling or gifting property, this form ensures a clean transfer of ownership.

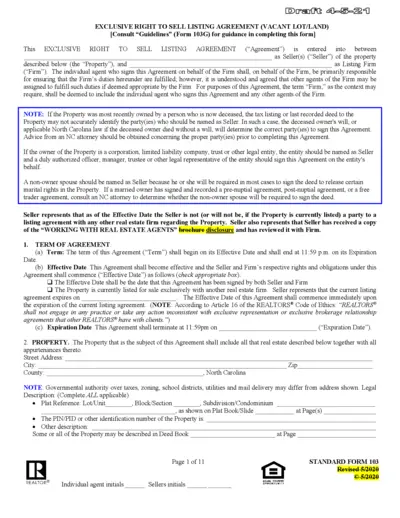

Real Estate

Exclusive Right to Sell Listing Agreement

This document is the Exclusive Right to Sell Listing Agreement for vacant lot or land. It outlines the agreement between the seller and the listing firm for real estate transactions. Use this document to formalize your property listing process effectively.

Property Taxes

Massachusetts Nonresident Part-Year Resident Income Tax

This file provides comprehensive instructions for filing the Massachusetts Form 1-NR/PY for nonresidents and part-year residents. It offers important information about eligibility, filing requirements, and due dates. Utilize this file to ensure accurate and timely submission of your tax return.

Real Estate

Foothill Golf Course Lease Agreement Overview

This document is a comprehensive lease agreement for the Foothill Golf Course between the Sunrise Recreation and Park District and the Cameron Champ Foundation. It outlines the terms and conditions for using the golf course facilities. Ideal for those involved in park management and recreational facility leasing.

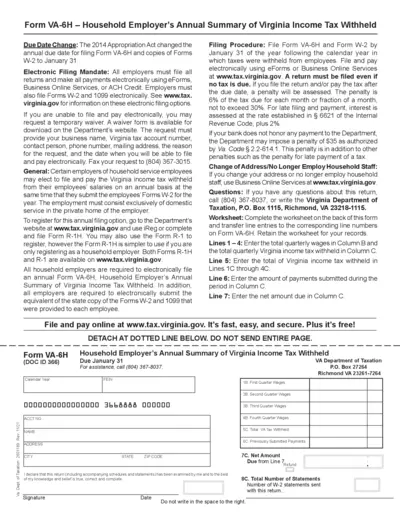

Property Taxes

Virginia Household Employer Annual Tax Summary VA-6H

Form VA-6H is essential for household employers in Virginia to report annual income tax withheld from employee salaries. It must be filed electronically and is due by January 31 of the following year. This summary provides clear guidelines for completion and submission.

Real Estate

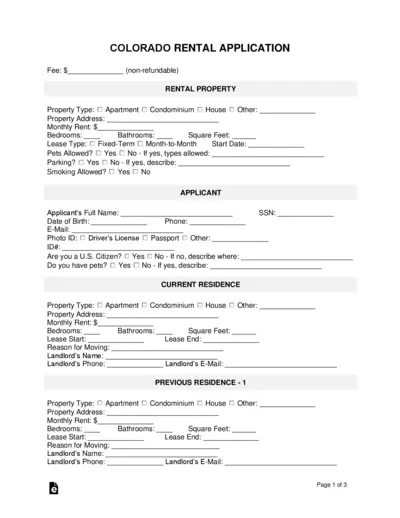

Colorado Rental Application Form Details

This Colorado Rental Application is essential for prospective tenants to apply for apartments or houses. It includes key information fields for personal, employment, and rental history. Ensure all sections are filled out accurately for smoother processing.

Property Taxes

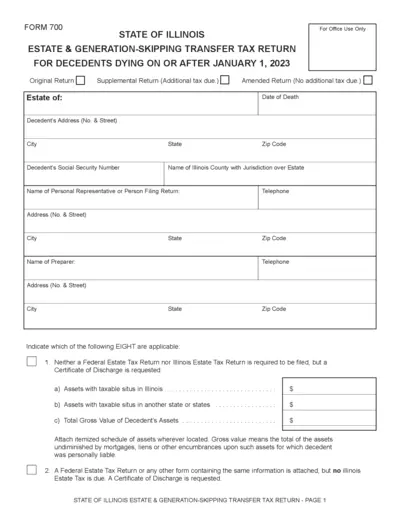

Illinois Estate & Generation-Skipping Tax Return

This file is the Illinois Estate & Generation-Skipping Transfer Tax Return for decedents dying on or after January 1, 2023. It provides detailed instructions and necessary fields to report estate taxes to the state. Useful for personal representatives and tax preparers involved in estate tax filings.

Property Taxes

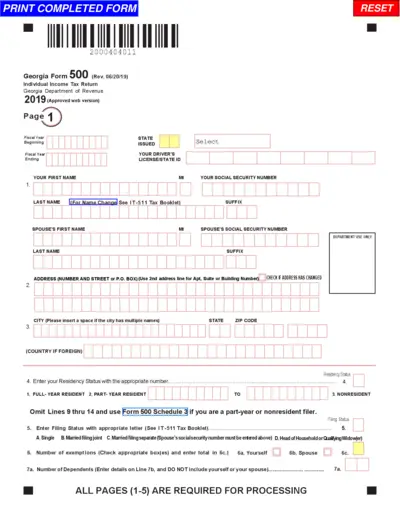

Georgia Form 500 Individual Income Tax Return

Georgia Form 500 is an important document used for filing individual income tax returns in the state of Georgia. This form provides essential details required for accurate tax reporting and ensures compliance with state tax regulations. It is crucial for residents and part-year residents who need to report their income and calculate their tax liabilities.