Faith-Based Nonprofits Documents

Faith-Based Nonprofits

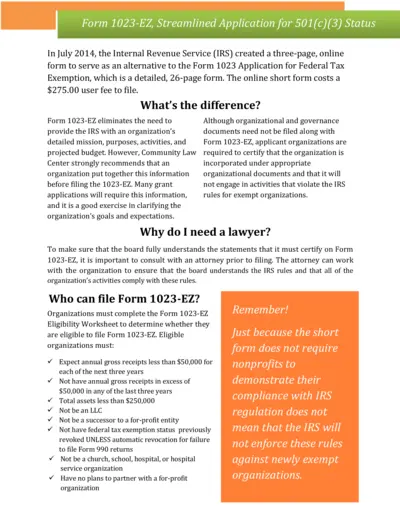

Form 1023-EZ Streamlined Application 501(c)(3) Status

The Form 1023-EZ is a streamlined application for obtaining 501(c)(3) status. It is a simplified, online form that reduces the burden of the previous 26-page application. Organizations can file it with a user fee, making the process more accessible.

Faith-Based Nonprofits

Alabama Department of Archives and History Donation FAQs

This document provides comprehensive information on donating records and artifacts to the Alabama Department of Archives and History. It includes FAQs, donation processes, and guidelines for types of items accepted. Suitable for individuals, families, and organizations interested in preserving Alabama's history.

Faith-Based Nonprofits

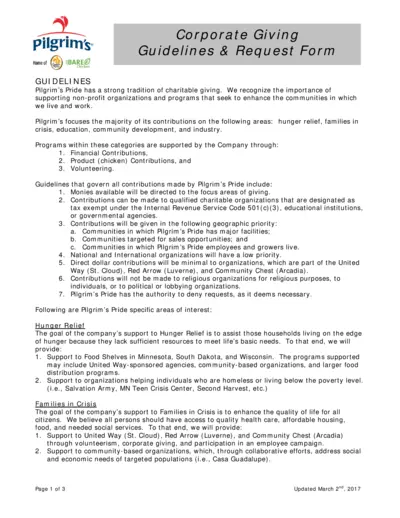

Pilgrim's Pride Corporate Giving Guidelines & Request Form

This document outlines the corporate giving guidelines and request form for Pilgrim's Pride. It provides essential information on supporting charitable organizations and community programs. Ideal for nonprofits seeking donations and support from Pilgrim's Pride.

Faith-Based Nonprofits

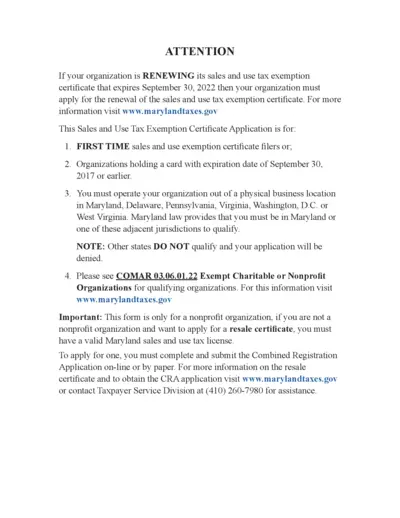

Maryland Sales and Use Tax Exemption Application

This document is crucial for nonprofit organizations seeking to apply for a Maryland sales and use tax exemption certificate. It contains necessary forms and guidelines required for the application process. Ensure all required documentation is submitted to avoid delays in processing.

Faith-Based Nonprofits

Idaho Falls Hawks Baseball Donation Receipt

This file provides a donation receipt for contributions made to Idaho Falls Hawks Baseball, a 501c3 nonprofit organization. It includes details about the donor and the tax-deductible nature of the contribution. Perfect for supporters looking to document their donations for tax purposes.

Faith-Based Nonprofits

Forming A Tax-Exempt California Nonprofit Corporation

This file provides comprehensive guidance on forming a tax-exempt nonprofit corporation in California. It covers essential steps, required documents, and legal considerations for organizations seeking 501(c)(3) status. Ideal for anyone involved in nonprofit management or legal compliance.

Faith-Based Nonprofits

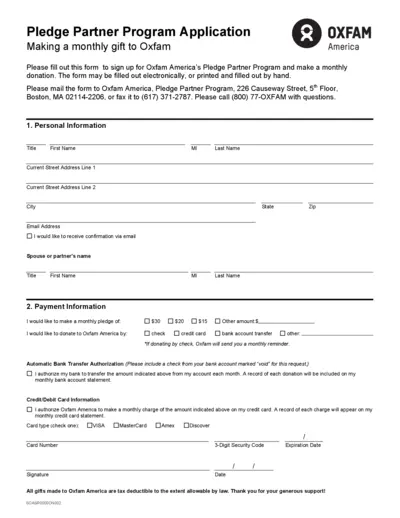

Pledge Partner Program Application for Oxfam America

This file is an application for the Pledge Partner Program by Oxfam America. It allows individuals to make a monthly donation to support Oxfam's mission. Fill out the form to start contributing today!

Faith-Based Nonprofits

Membership Application for Public Charity Submission

This file is a membership application form for public charities. It provides essential information about the submitter and organization. Fill out the required sections to apply for membership and gain access to exclusive benefits.

Faith-Based Nonprofits

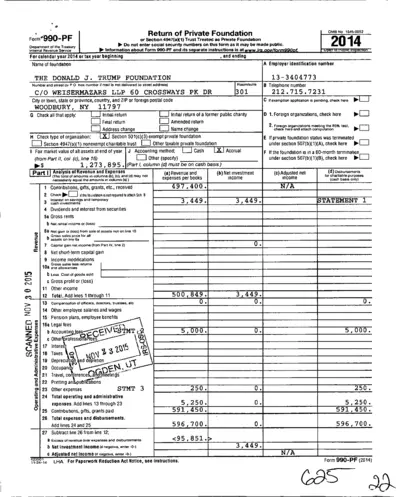

Return of Private Foundation IRS Form 990-PF 2014

This document is the IRS Form 990-PF, which is used for private foundations to report their financial information and comply with tax obligations. It includes details about revenue, expenses, and distributions. Foundations must complete and submit this form annually to maintain their tax-exempt status.

Faith-Based Nonprofits

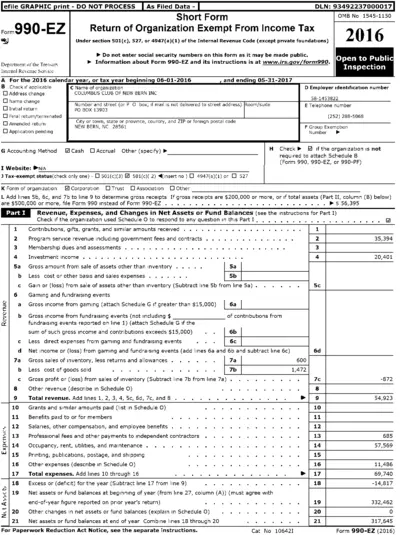

Form 990-EZ Return for Exempt Organization Tax

Form 990-EZ is essential for tax-exempt organizations seeking to report annual income, expenses, and revenue details. It captures crucial financial information, ensuring compliance with IRS regulations. Utilize this form to maintain transparency and uphold your organization’s exempt status.

Faith-Based Nonprofits

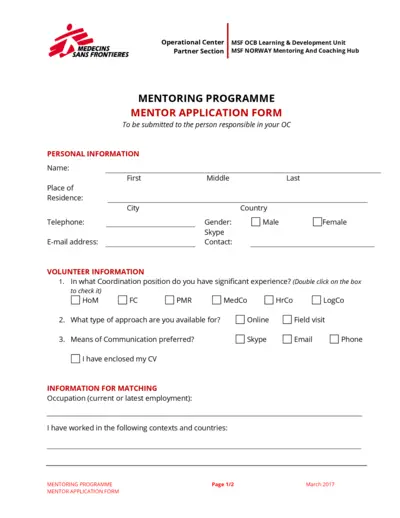

MSF Mentoring Programme Application Form

This document is designed for individuals applying to the MSF Mentoring Programme. It contains essential information about personal and volunteer experiences. Complete this application to connect with a mentor and advance your professional journey.

Faith-Based Nonprofits

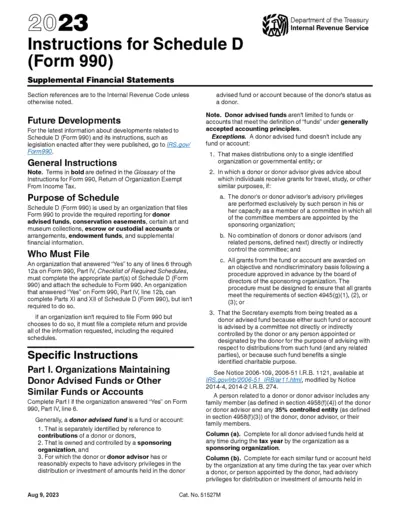

Instructions for Completing Schedule D Form 990

This document provides detailed instructions for Schedule D of Form 990. It covers how organizations must report on donor advised funds, conservation easements, and more. Perfect for nonprofits needing to file accurate financial statements.