Income Tax Documents

Tax Returns

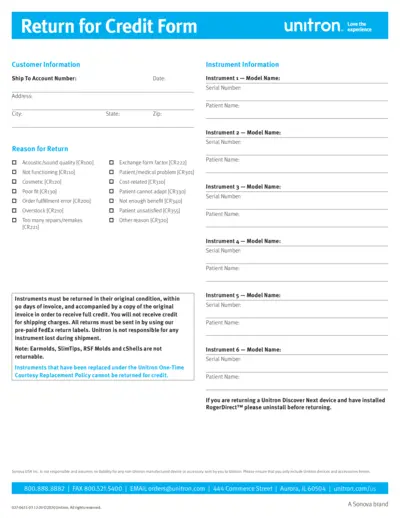

Return for Credit Form - Unitron Product Returns

The Return for Credit Form is used for customers to return Unitron products. It captures customer information, reason for return, and details about the instruments being returned. Follow the instructions to ensure your return is processed smoothly.

Tax Returns

American Airlines Lands' End Returns Procedure

This file provides instructions on how to make returns and exchanges for American Airlines uniforms via Lands' End. It includes detailed steps for completing the return form, packaging the items, and shipping them back. Additionally, it covers return policies and contact information for customer support.

Federal Tax Forms

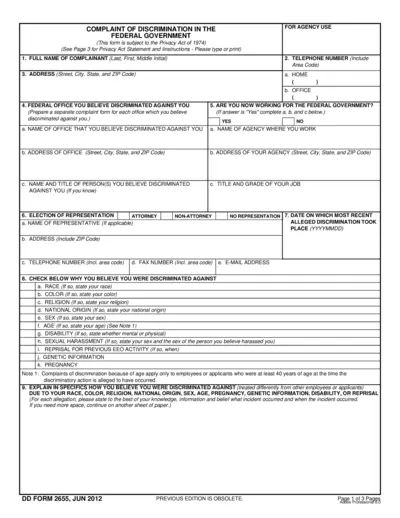

COMPLAINT OF DISCRIMINATION IN THE FEDERAL GOVERNMENT

This file is used for filing complaints of discrimination within the federal government. It includes sections for contact information, details of the complaint, and additional information. It is essential for those who believe they have faced discrimination.

Income Verification

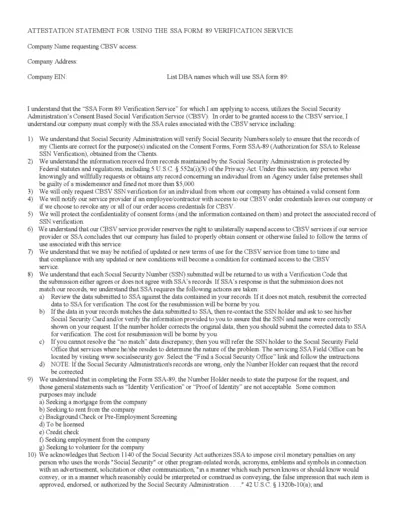

Attestation Statement for SSA Form 89 Verification

This file contains the attestation statement for using the SSA Form 89 Verification Service. It includes the rules and requirements for accessing the CBSV service. Additionally, it outlines the responsibilities for safeguarding Personal Identifiable Information (PII).

Federal Tax Forms

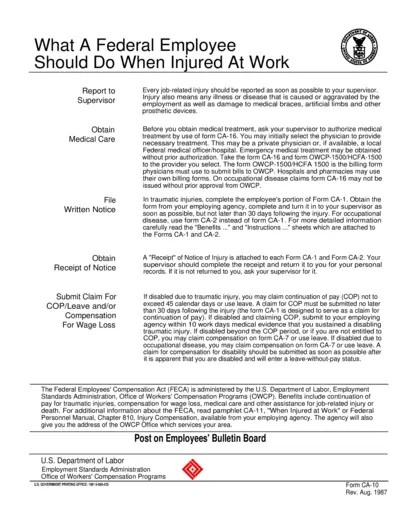

What Federal Employees Should Do When Injured At Work

This file provides guidance for federal employees on the steps to take when they are injured at work. It includes instructions on reporting injuries to supervisors, obtaining medical treatment, and filing various forms. It also outlines the benefits available under the Federal Employees' Compensation Act.

Tax Refunds

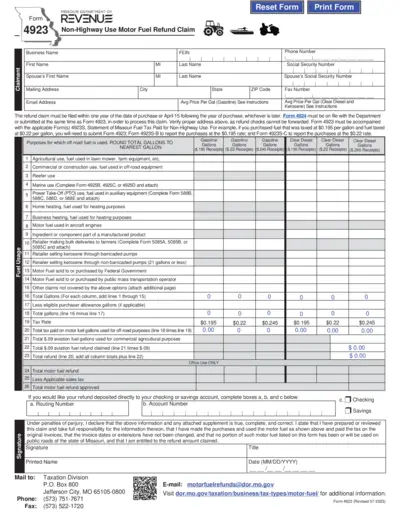

Missouri Non-Highway Use Motor Fuel Refund Form

This form is used by Missouri residents to claim a refund on motor fuel taxes paid for fuel used for exempt non-highway purposes. It must be filed within one year of the date of purchase or April 15 following the year of purchase. Various categories of fuel use and documentation requirements are outlined in the form.

Federal Tax Forms

PII Confidentiality Impact Level Categorization Template

This file provides a template to determine the Personally Identifiable Information (PII) Confidentiality Impact Level (PCIL). It includes step-by-step instructions and impact values for categorizing PII. Use this template to ensure proper handling and protection of PII.

Income Verification

Landlord Verification Form Instructions and Details

The Landlord Verification Form is used to verify your residency and rent/utility expenses. It provides proof of residency for various benefits. Completing this form may help you receive more benefits.

Tax Returns

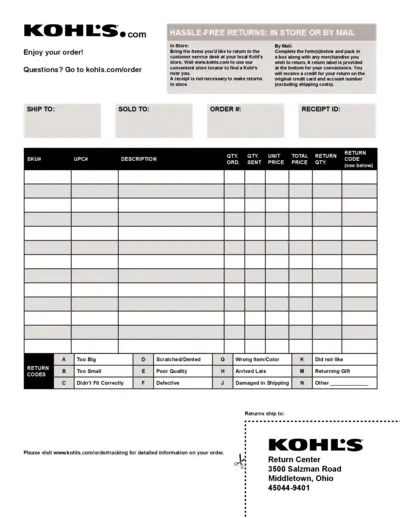

Kohl's Return Instructions and Order Details

This file contains instructions on how to return items to Kohl's, both in-store and by mail. It includes return codes, shipping information, and directions on how to receive a refund. Ensure you follow the steps accurately to process your return.

State Tax Forms

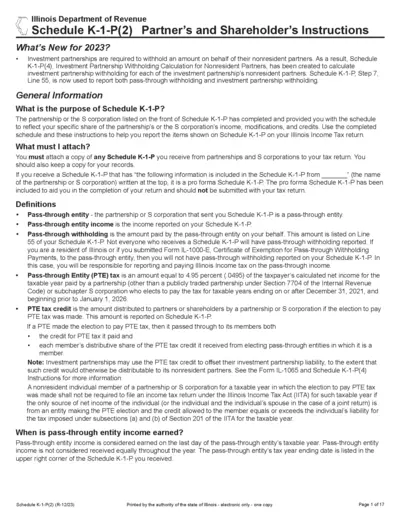

Illinois Schedule K-1-P Instructions for 2023

This document provides comprehensive instructions for Schedule K-1-P, which reflects your share of income, modifications, and credits from partnerships or S corporations. It includes essential information for both residents and non-residents of Illinois. Use this guide to ensure accurate completion of your Illinois income tax return.

Tax Returns

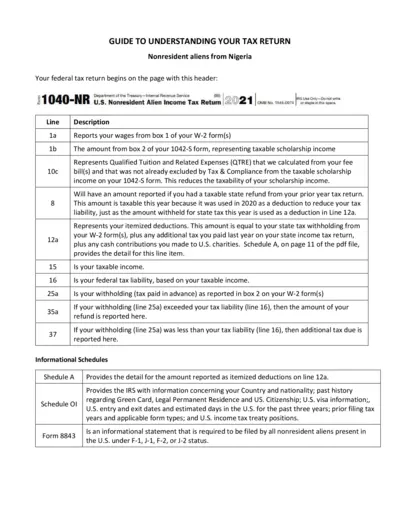

Guide to Understanding Your Tax Return

This file provides detailed explanations of the U.S. nonresident alien income tax return and Connecticut resident tax return. It outlines the requirements and instructions for completing forms 1040-NR and CT-1040. Ideal for nonresident aliens from Nigeria and Connecticut residents.

Tax Returns

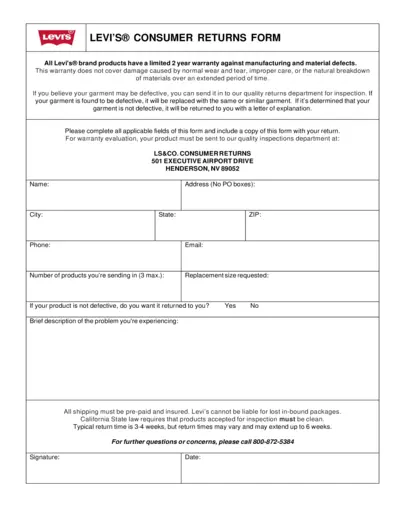

Levi's Consumer Returns Form Instructions

This file contains important information about Levi's consumer returns process. It details the warranty policy and provides a returns form for products. Users can find instructions on how to complete and submit the form.