Cross-Border Taxation Documents

Cross-Border Taxation

Pennsylvania Property Tax Rent Rebate Program 2022

This file contains essential information for the Pennsylvania Property Tax and Rent Rebate Program. It provides details on eligibility, application instructions, and important deadlines for rebates. Ideal for seniors, widows, and individuals with disabilities seeking financial assistance.

Cross-Border Taxation

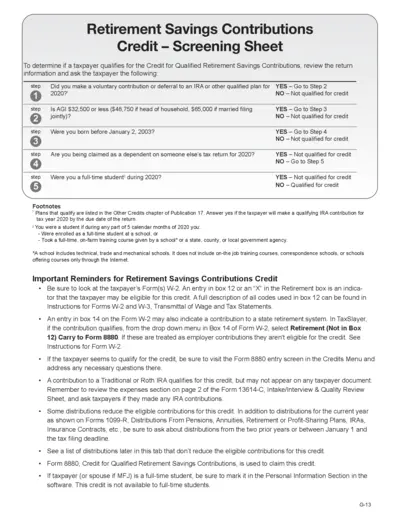

Retirement Savings Contributions Credit Instructions

This file contains instructions for taxpayers on qualifying for the Credit for Qualified Retirement Savings Contributions. It guides users through eligibility criteria and steps to claim the credit. Use this resource to navigate tax credits effectively.

Cross-Border Taxation

DC Withholding Tax Reporting Instructions for 2023

This file contains the employer/payor withholding tax reporting instructions for the year 2023. It includes essential details on filing the FR-900Q form each quarter. Employers should refer to this file for guidelines to ensure compliance with DC tax laws.

Cross-Border Taxation

2022 W-2 and 1099 Electronic Filing Instructions

This file outlines the requirements and deadlines for filing W-2s and 1099s electronically for the tax year 2022. It provides step-by-step filing instructions and important information for businesses. Ensure compliance with Iowa Department of Revenue regulations.

Cross-Border Taxation

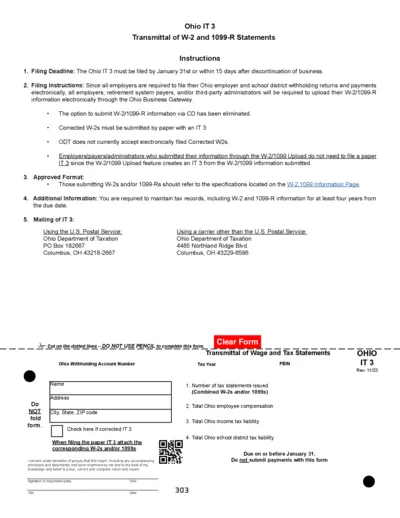

Ohio IT 3 W-2 and 1099-R Filing Instructions and Details

This document provides comprehensive instructions for filing the Ohio IT 3 form, including W-2 and 1099-R statements. It outlines filing deadlines, electronic submission processes, and additional information for employers. Ensure compliance with Ohio tax regulations using this essential guide.

Cross-Border Taxation

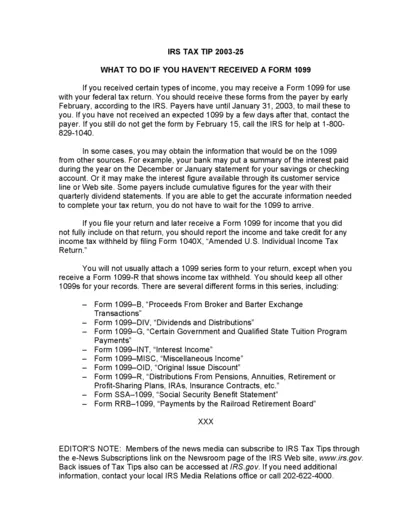

IRS Tax Tip 2003-25 Guide for Missing Form 1099

This file provides essential information on what to do if you haven't received a Form 1099. It includes instructions on contacting the payer and the IRS, along with insights on reporting the income accurately. Users will find useful guidelines to ensure they meet tax filing requirements properly.

Cross-Border Taxation

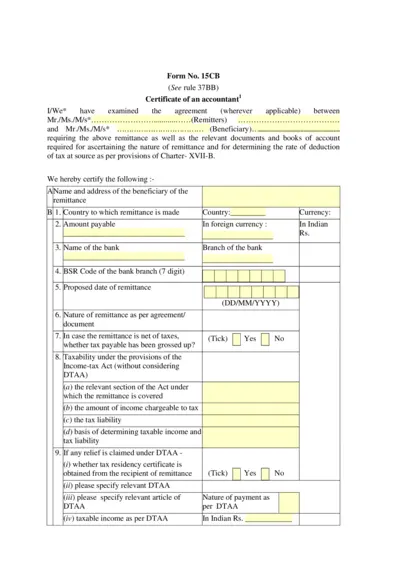

Form 15CB: Certificate for Remittance Tax Compliance

Form 15CB is a certificate required for foreign remittances involving tax deductions. It details the nature of the remittance and tax liabilities as per the Income Tax Act. Accountants must complete this form to certify tax compliance before remittance.

Cross-Border Taxation

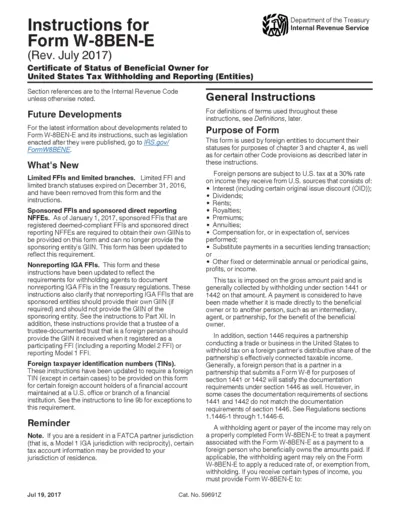

W-8BEN-E Form Instructions for Tax Compliance

This document provides comprehensive instructions for completing Form W-8BEN-E, which certifies the status of beneficial owners for tax reporting. It includes information on applicable rules and regulations for foreign entities. Ensure compliance with U.S. withholding tax requirements by following the guidelines provided.

Cross-Border Taxation

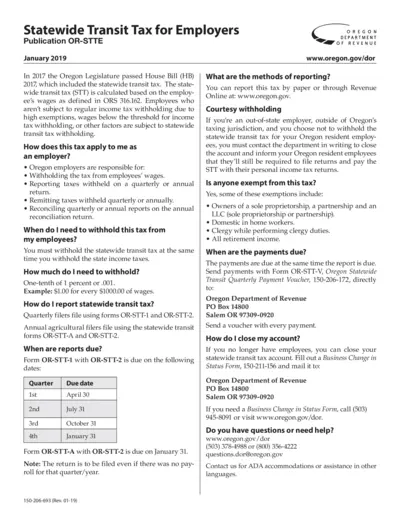

Statewide Transit Tax Employer Instructions Oregon

This document provides essential details about the Statewide Transit Tax in Oregon for employers. It outlines tax withholding responsibilities, reporting methods, and exemptions. Employers must stay compliant with these instructions to avoid penalties.

Cross-Border Taxation

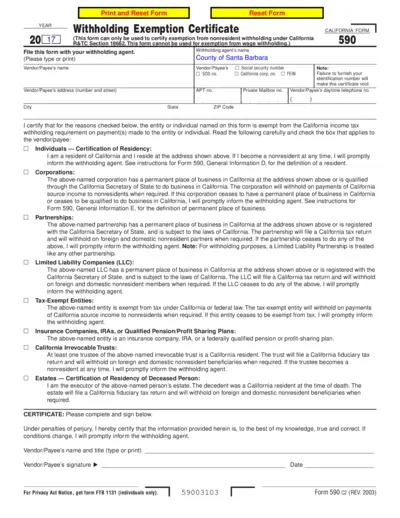

California Form 590 Withholding Exemption Certificate

California Form 590 is used to certify exemption from nonresidential withholding. Ensure that the appropriate sections are filled out accurately. This is essential for residents and entities wishing to avoid unnecessary tax withholdings.

Cross-Border Taxation

Virginia Income Tax Withholding Guide for Employers

This guide provides essential information for Virginia employers on income tax withholding. It covers who must register, forms, and filing requirements. A must-have resource for compliance and tax assistance.

Cross-Border Taxation

Instructions for Form EL-1040X East Lansing Tax Return

This file provides comprehensive instructions for filing the EL-1040X, an amended individual income tax return for East Lansing residents. It guides users through correcting previously filed returns and outlines necessary documents for submission. Essential for residents and nonresidents alike who need to amend their income tax returns effectively.