Application for Customs Duty Refund

This document serves as an application for individuals or businesses seeking a refund of customs duty or interest overpaid. It outlines the necessary details required for submission, ensuring prompt processing of claims. Use this guide to accurately fill out the application for a successful refund request.

Edit, Download, and Sign the Application for Customs Duty Refund

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, begin by gathering all necessary documents related to your customs duties. Ensure that all details are accurate and complete to avoid delays in processing. Follow the outlined instructions carefully to submit a valid claim.

How to fill out the Application for Customs Duty Refund?

1

Collect all necessary documentation regarding customs duties.

2

Accurately fill in all required fields of the application.

3

Double-check for any errors or omissions.

4

Sign the form where required.

5

Submit the completed application as per the instructions.

Who needs the Application for Customs Duty Refund?

1

Importers seeking to recover excess duty payments.

2

Exporters who have faced overpayment issues.

3

Customs agents processing client refunds.

4

Businesses impacted by customs reassessments.

5

Individuals claiming refunds for personal import duties.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Application for Customs Duty Refund along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Application for Customs Duty Refund online.

On PrintFriendly, editing this PDF is a breeze. Simply upload your document to our platform and use the intuitive editing tools to make necessary adjustments. Once you're satisfied with your edits, download the revised PDF for your records.

Add your legally-binding signature.

Signing your PDF on PrintFriendly is now easier than ever. You can add your signature directly onto the document using our user-friendly signing feature. Simply follow the prompts to place your signature where needed and save the signed document.

Share your form instantly.

Sharing your edited PDF is seamless with PrintFriendly. Use the share functionality to quickly distribute your document via email or social media. This allows you to collaborate easily with others or send your application to the relevant parties.

How do I edit the Application for Customs Duty Refund online?

On PrintFriendly, editing this PDF is a breeze. Simply upload your document to our platform and use the intuitive editing tools to make necessary adjustments. Once you're satisfied with your edits, download the revised PDF for your records.

1

Upload your customs refund application PDF to PrintFriendly.

2

Use the editing tools to make necessary adjustments on the form.

3

Review all changes to ensure accuracy in the document.

4

Once satisfied, save the edited document.

5

Download your final PDF for submission.

What are the instructions for submitting this form?

To submit this form, please email the completed document to the customs refund department at refunds@example.com. Alternatively, you can fax the form to 123-456-7890, or mail it to the following address: Customs Department, 1234 Customs Rd, City, State, 56789. Ensure all supporting documents are included and that you keep a copy of your submission for your records. It’s recommended to check for any specific submission guidelines that may apply.

What are the important dates for this form in 2024 and 2025?

Keep in mind that deadlines for submitting refund claims may vary. Typically, claims should be submitted as soon as you identify overpayment. For the latest updates on important dates, please consult current customs regulations.

What is the purpose of this form?

The purpose of this form is to formalize requests for refunds of customs duties or interest overpaid. It serves as a critical tool for importers and exporters to reclaim funds that should not have been paid. Understanding the necessary details and accuracy in filling out the form is essential for a successful claim process.

Tell me about this form and its components and fields line-by-line.

- 1. Import/Export document: Details of the import/export document including number and date.

- 2. Duty deposit reference: Reference number related to duty deposit and its date.

- 3. Description of goods: Clear description of the goods for which the claim is being filed.

- 4. Name and address: Contact details for the importer and customs agent.

- 5. Refund Claim under: Details of sections of the Act under which the refund is claimed.

- 6. Ground of claim: The specific reason for the refund request.

- 7. Amount of refund claim: Total refund amount being claimed.

- 8. Enclosures: List of documents being submitted in support of the claim.

- 9. Any further details: Section for any additional relevant information.

- 10. Whether any other refund claim filed: Indication of other pending claims.

- 11. Whether personal hearing required: Option to request a personal hearing.

- 12. Declaration: A summary statement confirming the accuracy of the claim.

What happens if I fail to submit this form?

Failing to submit this form correctly can result in unnecessary delays in receiving your refund. Incomplete or inaccurate information may lead to rejection of the claim. It is crucial to follow all instructions and provide all required documentation to ensure timely processing.

- Claim Rejection: Incomplete submissions may be rejected by the customs office.

- Delayed Refund: Any inaccuracies can extend the time required to process the refund.

- Legal Consequences: Incorrect claims may lead to legal disputes or penalties.

How do I know when to use this form?

- 1. Claim Overpaid Duties: File a refund when customs duties paid are higher than necessary.

- 2. Adjust for Errors: Correct any clerical errors that have resulted in overpayments.

- 3. Respond to Notifications: Utilize this form if notified of an overpayment by customs officials.

Frequently Asked Questions

What is this form for?

This form is used to apply for refunds of customs duties or interests that have been overpaid.

How do I fill out this form?

Gather all required information and documents, then complete each section of the form accurately.

Can I edit the PDF online?

Yes, you can easily edit the PDF using our built-in editing tools on PrintFriendly.

How do I submit this form?

Follow the submission instructions and use your preferred method, such as mail or online submission.

Is there a deadline for submitting this form?

It is advisable to submit the form as soon as possible upon receiving notification of the overpayment.

Can I save changes to my PDF after editing?

While you can edit and download the PDF, currently there is no save feature for future sessions.

What documents should I attach?

Attach all relevant documents supporting your refund claim, as specified in the form.

Is a signature required?

Yes, you must sign the document where indicated to validate your claim.

Can multiple claims be submitted?

Yes, if you have multiple instances of overpayment, each should be submitted on a separate form.

Who can assist me with this form?

Customs agents or legal advisors can assist you in completing the form and gathering necessary documentation.

Related Documents - Customs Duty Refund Application

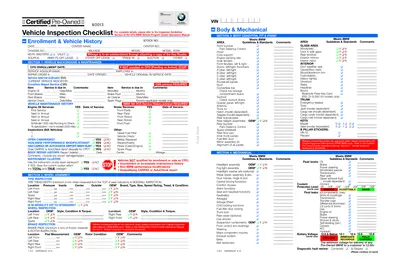

BMW Certified Pre-Owned Vehicle Inspection Checklist

This BMW Certified Pre-Owned Vehicle Inspection Checklist ensures the vehicle meets BMW's standards before resale. It covers essential vehicle information, maintenance history, and inspection details. This checklist is crucial for dealerships and service managers.

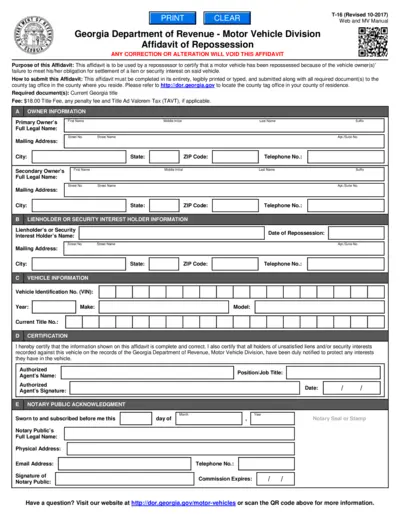

Georgia Repossession Affidavit T-16 Form Instructions

The Georgia Repossession Affidavit T-16 Form is used by repossessors to certify that a vehicle has been repossessed due to the owner's failure to meet their financial obligations. This form includes sections for owner information, lienholder information, vehicle details, and certification. The affidavit must be submitted to the county tag office along with the required documents and fees.

Virginia Vehicle Title and Registration Information

This document provides comprehensive information on how to title and register your vehicle in Virginia, including insurance requirements, safety and emissions inspection standards, and applicable fees.

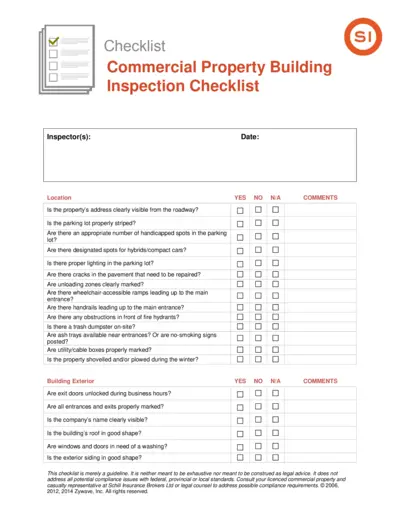

Commercial Property Building Inspection Checklist

This file is a comprehensive checklist for inspecting commercial property buildings. It includes sections on various aspects such as parking lot, building exterior, landscaping, electrical systems, fire protection, heating/cooling systems, and housekeeping. It is intended as a guideline for assessing the condition and compliance of a commercial building.

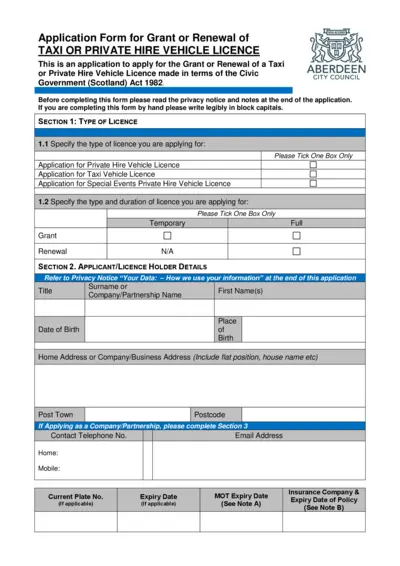

Application for Taxi or Private Hire Vehicle Licence

This file is an application form for the grant or renewal of a taxi or private hire vehicle license in Aberdeen, Scotland. It includes sections for vehicle details, applicant details, and previous convictions. Users must complete the form and submit it along with the appropriate fee.

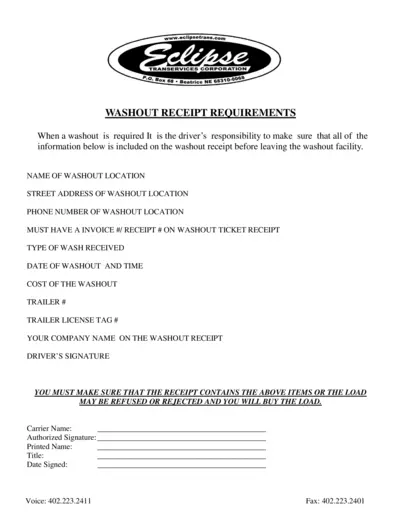

Washout Receipt Requirements - Eclipse Trans Services

This file outlines the necessary details and instructions for drivers to complete the washout receipt form, ensuring all required information is collected to avoid load refusals.

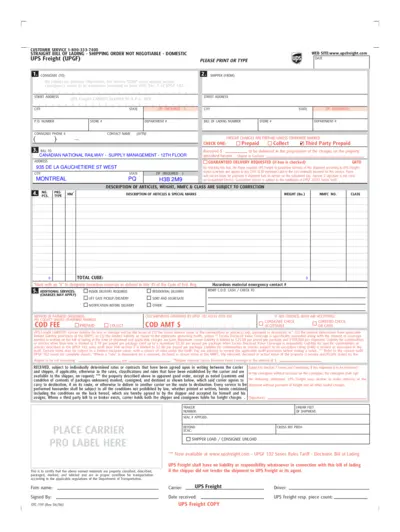

UPS Freight Bill of Lading - Domestic Shipping Form

This document is a UPS Freight Bill of Lading for domestic shipping. It contains fields for consignee, shipper, bill to, and additional services. It also outlines liability terms and conditions.

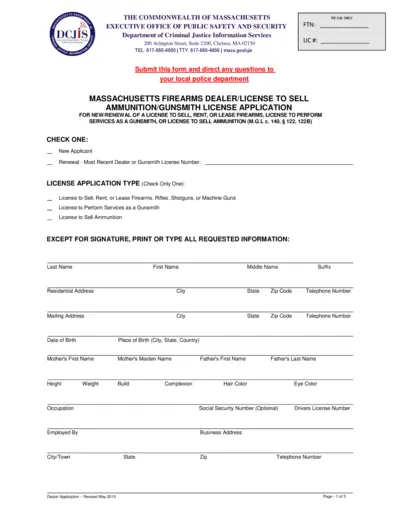

Massachusetts Firearms Dealer License Application

This file is a Massachusetts Firearms Dealer/License to Sell Ammunition/Gunsmith License Application. It includes necessary information for new or renewal of a license to sell, rent, or lease firearms. Instructions are included for filling out the form accurately and completely.

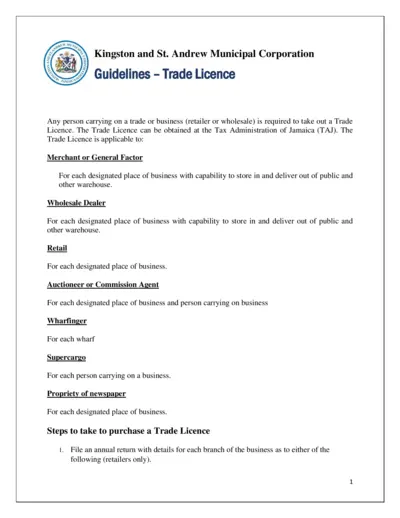

Trade Licence Guidelines - Kingston and St. Andrew Municipal Corporation

This document provides detailed guidelines for obtaining a trade license in Kingston and St. Andrew Municipal Corporation. It includes steps to file an annual return and pay the requisite fee at the Tax Administration of Jamaica. It also outlines the fees applicable for different categories of businesses.

CDL Practice Test For Truck Drivers - General Knowledge

This file contains practice tests for CDL General Knowledge for truck drivers. It includes questions on air brakes, combination vehicles, hazardous materials, and more. Using this file, aspiring truck drivers can prepare for their CDL tests.

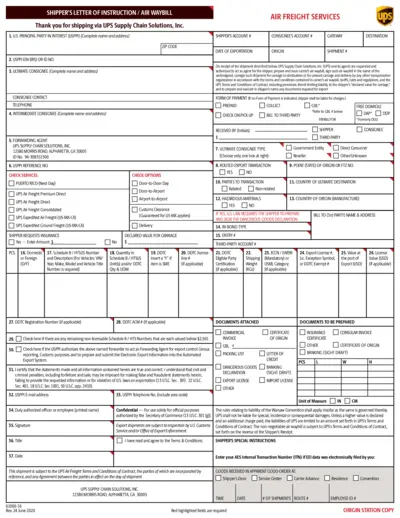

Shipper's Letter of Instruction / Air Waybill Form

This form serves as a document for shippers to detail the instructions and information required for shipping goods via UPS Supply Chain Solutions, Inc. It includes fields for the shipper's details, consignee's information, and other key shipping instructions. The form ensures compliance with export regulations and facilitates the shipping process.

Motor Carrier License and Decal Renewal Instructions

This file provides comprehensive instructions for the renewal of North Carolina Motor Carrier License and Decal. It includes details on the renewal application process, compliance checks, and online renewal steps. Additionally, it offers video guides and reminders to ensure a smooth renewal process.