Edit, Download, and Sign the Application to Tax a Heavy Goods Vehicle

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, ensure you have all necessary documents ready. Start by accurately filling in your details in capital letters. Finally, review your entries before submission.

How to fill out the Application to Tax a Heavy Goods Vehicle?

1

Read the instructions carefully.

2

Fill in your personal and vehicle details.

3

Select the appropriate tax band.

4

Provide necessary supporting documents.

5

Submit the form at a Post Office.

Who needs the Application to Tax a Heavy Goods Vehicle?

1

Fleet operators need this file to tax their HGVs.

2

Individual drivers of heavy vehicles must complete this application.

3

Business owners operating goods vehicles need to ensure compliance.

4

Transport companies require this file for legal vehicle operations.

5

New vehicle keepers must tax their HGVs promptly.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Application to Tax a Heavy Goods Vehicle along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Application to Tax a Heavy Goods Vehicle online.

Editing your PDF on PrintFriendly is simple and user-friendly. Click on the edit button to modify any text or fields. Once satisfied with your adjustments, save your edited document with ease.

Add your legally-binding signature.

Signing your PDF on PrintFriendly is a straightforward process. Use our intuitive signing feature to add your signature digitally. Make your document official in just a few clicks.

Share your form instantly.

Sharing your PDF on PrintFriendly is quick and efficient. Use the share options to send your document directly via email or social media. Connect effortlessly with your audience on multiple platforms.

How do I edit the Application to Tax a Heavy Goods Vehicle online?

Editing your PDF on PrintFriendly is simple and user-friendly. Click on the edit button to modify any text or fields. Once satisfied with your adjustments, save your edited document with ease.

1

Open the PDF document you want to edit.

2

Click on the 'Edit' button to enter editing mode.

3

Make the necessary changes to text and fields.

4

Review your edits carefully before proceeding.

5

Save the updated document for your records.

What are the instructions for submitting this form?

To submit this form, visit your nearest Post Office that handles vehicle tax applications. Ensure all documents, such as your V5C and MOT certificate, are included. If submitting by post, send your completed application to DVLA, Swansea SA6 7JL. For any queries, you may contact them directly via phone.

What are the important dates for this form in 2024 and 2025?

For 2024, ensure you submit your applications before the tax period begins on April 1st. Renewal applications should ideally be submitted at least four weeks in advance. For 2025, similar timelines will apply, with a focus on timely submissions.

What is the purpose of this form?

The primary purpose of this form is to allow vehicle owners to apply for tax on their Heavy Goods Vehicles. It ensures compliance with legal vehicle operation standards. By accurately completing and submitting this form, vehicle owners contribute to road safety and regulation.

Tell me about this form and its components and fields line-by-line.

- 1. Title: Your title (Mr, Mrs, Miss, Ms) for identification.

- 2. Company Name: If applicable, provide the company name.

- 3. Registration Number: The vehicle’s registration number.

- 4. Make: Manufacturer of the vehicle.

- 5. Vehicle Weight: The total weight of the heavy goods vehicle.

- 6. Number of Axles: Specification of axles on the vehicle.

- 7. Tax Class: Type of tax the vehicle falls under.

- 8. Insurance Proof: Proof of insurance document.

What happens if I fail to submit this form?

Failure to submit this form can lead to legal repercussions including fines and prosecution. Vehicle usage without valid tax can disrupt business operations. It is crucial to comply with all submission deadlines to avoid complications.

- Potential Fines: Non-compliance may result in hefty fines.

- Legal Action: Continued usage of an untaxed vehicle can lead to further legal action.

- Business Disruption: Operational challenges may arise from a lack of tax compliance.

How do I know when to use this form?

- 1. Tax Application for HGV: Use this form to apply for the tax specifically for heavy goods vehicles.

- 2. New Ownership Taxing: Apply when you acquire a new HGV that requires taxing.

- 3. Fleet Management: Business operators managing a fleet of HGVs must submit this application.

Frequently Asked Questions

How do I start the tax application process?

Begin by accessing the form and gathering your vehicle information.

What documents do I need to tax my HGV?

You will need your V5C Registration Certificate, MOT/vehicle test certificate, and proof of insurance.

Can I pay for the tax application online?

Yes, you can pay using various methods including debit and credit cards at a Post Office.

Is there a deadline for submitting this form?

It's best to submit as soon as possible, especially if you are a new keeper.

What if my application is denied?

You will receive a notification explaining the reasons for denial and possible next steps.

How long does the tax application process take?

Processing times can vary, but you can generally expect a quick turnaround.

What tax band does my HGV fall into?

Consult the tax rate tables provided by the government to determine your tax band.

Can I tax my HGV at any Post Office?

You must visit a Post Office that deals specifically with vehicle tax.

What happens if I don’t submit this application?

Failure to submit may result in fines or other legal implications.

Can I keep a copy of my application after submission?

Yes, it is advisable to keep a copy for your records.

Related Documents - HGV Tax Application

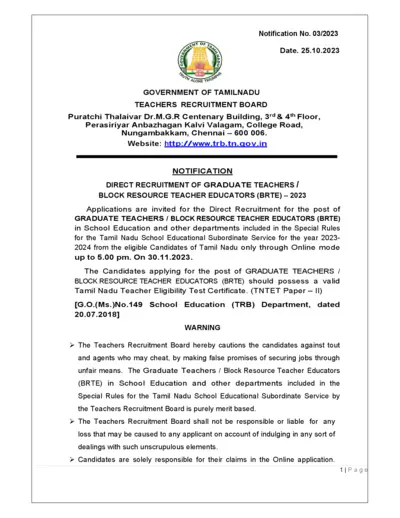

2023 Notification for Graduate Teachers Recruitment in Tamil Nadu

This file is the official notification for the direct recruitment of graduate teachers and block resource teacher educators in Tamil Nadu for the year 2023-2024. It includes important dates, application instructions, and details of vacancies. Eligible candidates must submit their applications online.

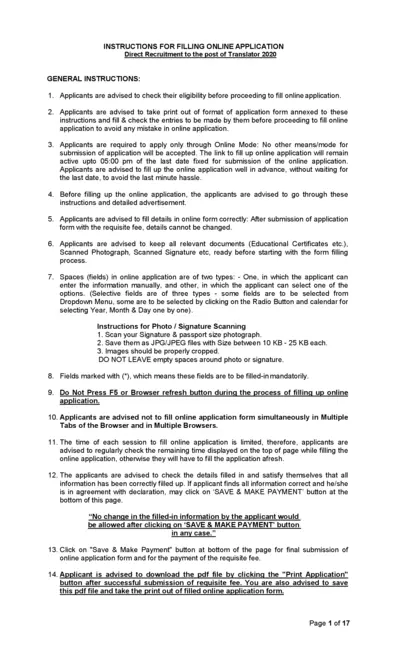

Instructions for Filling Online Application for Translator Post 2020

This document provides detailed instructions for filling out the online application for the direct recruitment of the Translator post in 2020. It includes steps for registration, filling the form, payment of fees, and submission. It also covers special categories and important guidelines to avoid errors.

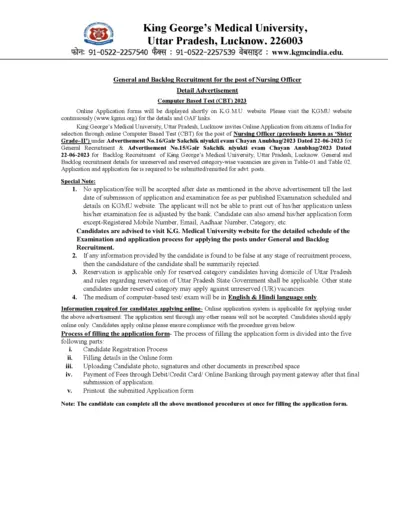

KGMU Nursing Officer Recruitment 2023 Instructions and Details

This document provides detailed instructions and information for applying to the Nursing Officer post through KGMU's Computer Based Test (CBT) 2023. It includes eligibility criteria, application process, important dates, and reservation details. Applicants must follow the specified procedures to ensure their applications are accepted.

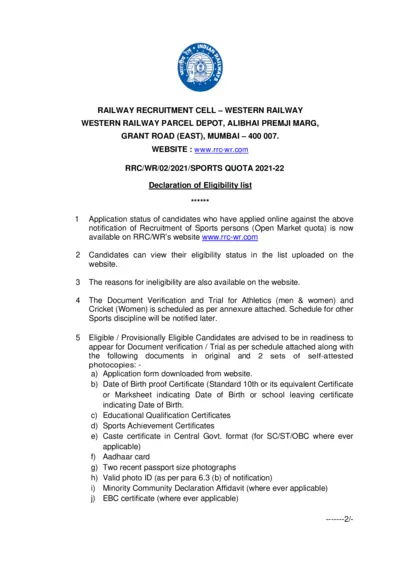

Western Railway Sports Quota Recruitment Form 2021-22

This document provides information about the eligibility list, document verification, and trial dates for candidates who have applied for the Western Railway Sports Quota Recruitment 2021-22. It includes necessary instructions and requirements for candidates to participate in the selection process. Important dates, document requirements, and venue details are also included.

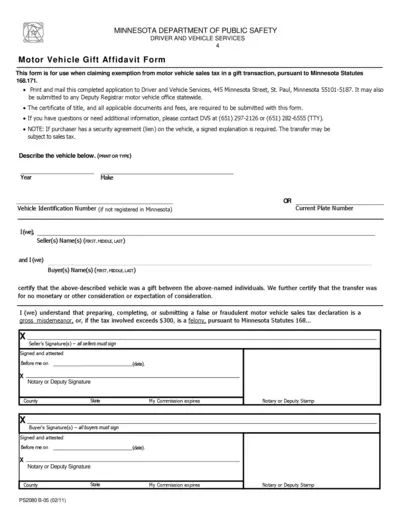

Minnesota Motor Vehicle Gift Affidavit Form

The Minnesota Motor Vehicle Gift Affidavit Form is used to claim exemption from motor vehicle sales tax in a gift transaction. This form requires specific vehicle details, the names and signatures of both parties, and must be notarized. Submit the form along with the certificate of title and applicable documents and fees.

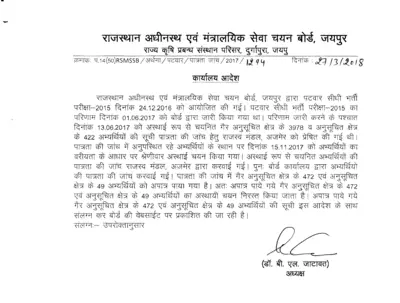

Rajasthan Patwari Recruitment 2015 - Eligibility Check and Results

This file contains details of the eligibility check and the results of the Patwari Recruitment Exam conducted in 2015 by the Rajasthan Subordinate and Ministerial Services Selection Board, Jaipur. It includes lists of selected and disqualified candidates along with their respective categories and reasons for disqualification.

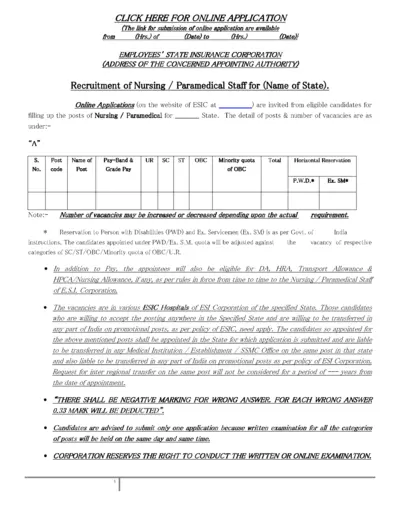

ESIC Recruitment Online Application for Nursing/Paramedical Staff

This file contains the ESIC recruitment details and instructions for applying online for Nursing and Paramedical Staff. It includes information on age limit, educational qualifications, fee structure, and mode of payment. It also provides guidelines for filling out the online application form.

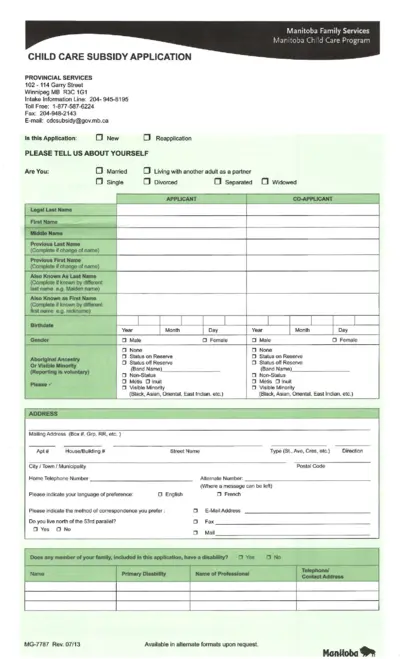

Manitoba Child Care Subsidy Application Form

This file contains the Manitoba Child Care Subsidy Application form for families needing child care assistance. It includes sections on applicant information, reason for child care, and co-applicant details. Instructions for filling out and submitting the form are also provided.

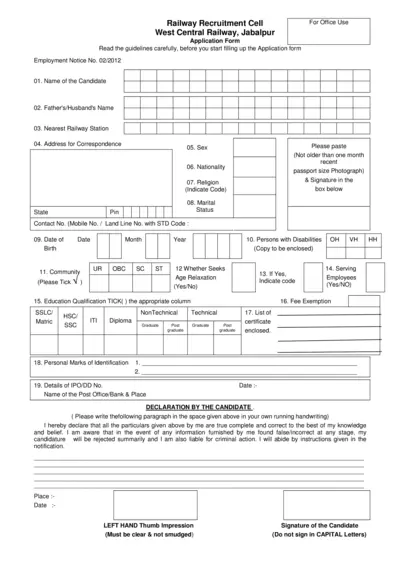

West Central Railway Recruitment Application Form 2012

This application form is for candidates applying for job positions at the West Central Railway, Jabalpur. It details the personal and professional information required from applicants. Ensure you read the guidelines carefully before filling out the form.

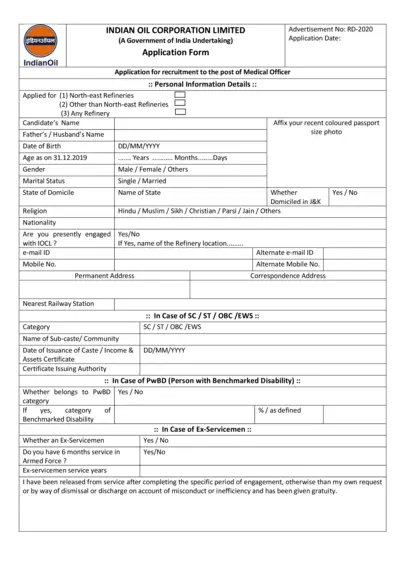

Indian Oil Corporation Medical Officer Recruitment Form

This file contains the application form for the Medical Officer recruitment at Indian Oil Corporation Limited. It includes sections for personal information, qualifications, experience, and documentation required. Submit the completed form by the specified deadline to apply for the position.

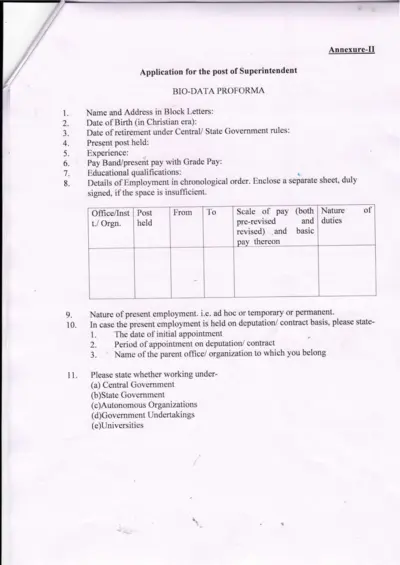

Application for the post of Superintendent - Bio-data Proforma

This is an application form for the post of Superintendent. It captures personal details, employment history, and educational qualifications. It includes verification and certification by the employer or head of the office.

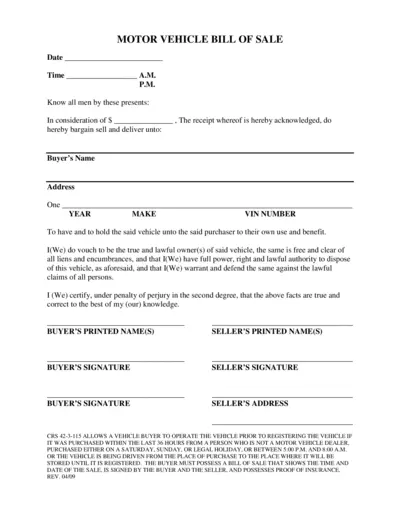

Motor Vehicle Bill of Sale Document for Transactions

The Motor Vehicle Bill of Sale document is essential for vehicle transactions, detailing buyer and seller information. It ensures the legal transfer of vehicle ownership. This form includes fields for date, time, buyer's details, vehicle information, and signatures.