Form 1023 Checklist for 501(c)(3) Exemption

The Form 1023 Checklist provides essential instructions for organizations applying for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. It includes a detailed list of required documents and proper assembly guidelines to ensure a complete application. This file is crucial for entities seeking tax-exempt status.

Edit, Download, and Sign the Form 1023 Checklist for 501(c)(3) Exemption

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the Form 1023 Checklist, gather all required documents as listed. Ensure each section is completed accurately to avoid delays. Follow the provided instructions to assemble your application correctly.

How to fill out the Form 1023 Checklist for 501(c)(3) Exemption?

1

Gather all necessary documents and forms.

2

Complete Parts I through XI of Form 1023.

3

Check each box on the checklist to ensure completion.

4

Organize the application materials in the specified order.

5

Submit the application with the user fee payment.

Who needs the Form 1023 Checklist for 501(c)(3) Exemption?

1

Nonprofits applying for tax-exempt status need this form.

2

Educational institutions needing federal tax exemption will use this form.

3

Charitable organizations seeking to qualify for grants require it.

4

Religious entities applying for exemption must submit this form.

5

Foundations looking to prove their tax-exempt status will need this checklist.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Form 1023 Checklist for 501(c)(3) Exemption along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Form 1023 Checklist for 501(c)(3) Exemption online.

Edit your PDF directly on PrintFriendly by using our intuitive editing tools. You can easily modify existing text, add new sections, and adjust the layout to suit your needs. Enhance your PDF for submission without hassle.

Add your legally-binding signature.

Signing your PDF on PrintFriendly is straightforward and efficient. Utilize our electronic signature feature to add your signature directly on the document. Ensure your application is officially signed before submission.

Share your form instantly.

Sharing your PDF is simple with PrintFriendly's sharing options. You can quickly send your edited PDF via email or generate a shareable link. Collaborate with others by securely sharing your document effortlessly.

How do I edit the Form 1023 Checklist for 501(c)(3) Exemption online?

Edit your PDF directly on PrintFriendly by using our intuitive editing tools. You can easily modify existing text, add new sections, and adjust the layout to suit your needs. Enhance your PDF for submission without hassle.

1

Open the PDF file you want to edit in PrintFriendly.

2

Use the editing tools to modify text or add content.

3

Adjust the layout as needed to ensure clarity.

4

Review your changes to confirm accuracy.

5

Download or share the updated PDF once completed.

What are the instructions for submitting this form?

To submit Form 1023, send your completed application and user fee payment to the Internal Revenue Service at P.O. Box 192, Covington, KY 41012-0192. If using express mail, send it to 201 West Rivercenter Blvd., Attn: Extracting Stop 312, Covington, KY 41011. Ensure all required documents are included to avoid processing delays.

What are the important dates for this form in 2024 and 2025?

For 2024, submissions should be completed by July 15 to avoid delays. For 2025, ensure all applications are submitted by the same date to remain compliant with IRS requirements.

What is the purpose of this form?

The purpose of Form 1023 is to allow organizations to apply for recognition of exemption under Section 501(c)(3). This form outlines the necessary steps and documentation needed for the IRS to grant tax-exempt status. Filling and submitting this form correctly is crucial for nonprofits to operate without tax liabilities.

Tell me about this form and its components and fields line-by-line.

- 1. Part I: Identification of the organization.

- 2. Part II: Required documentation.

- 3. Part III: Purpose and activities.

- 4. Part IV: Financial information.

- 5. Part V: Signature of authorized official.

What happens if I fail to submit this form?

Failure to submit Form 1023 correctly can result in significant delays in your application process. Without proper filing, your organization may not be recognized as tax-exempt, affecting funding opportunities.

- Incomplete Application: An incomplete application may lead to rejection by the IRS.

- Missing Supporting Documents: Failure to provide necessary documents can hinder the application review.

- Delayed Processing: Missing information can extend the review time significantly.

How do I know when to use this form?

- 1. Applying for Nonprofit Status: Organizations that qualify for tax exemption.

- 2. Seeking Grants: Nonprofits looking for funding sources.

- 3. Maintaining Tax Compliance: To ensure compliance with IRS regulations and avoid penalties.

Frequently Asked Questions

What is Form 1023?

Form 1023 is an application for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code.

How do I fill out Form 1023?

You can fill out Form 1023 by gathering the required documents, completing the form, and following the checklist.

Can I edit Form 1023 on PrintFriendly?

Yes, PrintFriendly allows you to edit your PDF version of Form 1023 easily.

How do I share my completed Form 1023?

You can share your completed PDF via email or by generating a shareable link.

What should I include with my Form 1023 submission?

Include the completed checklist, necessary articles, bylaws, and user fee payment.

How can I sign my Form 1023?

You can electronically sign your Form 1023 using the signing feature on PrintFriendly.

What if I miss a required section in Form 1023?

Missing sections may result in your application being returned as incomplete.

Do I need a specific format for supporting documents?

Yes, ensure all supporting documents are assembled and formatted as specified in the instructions.

What happens after I submit Form 1023?

After submission, the IRS will review your application for recognition of exemption.

How long does approval take?

Approval times for Form 1023 can vary, but it is generally recommended to allow several months.

Related Documents - Form 1023 Checklist

Blackbaud Online Express Overview

Blackbaud Online Express is a cloud-based online fundraising and marketing tool integrated with The Raiser's Edge. It offers features like online fundraising, email marketing, and dashboard metrics to help nonprofits. The tool is user-friendly with pre-designed templates and a drag-and-drop editor.

ISA 28th Session Administrative Note 2023

This file contains administrative notes for the 28th session of the International Seabed Authority held in 2023. It includes contact information, travel guidelines, transportation services, and lunch options. Delegates are provided with essential details to facilitate their participation.

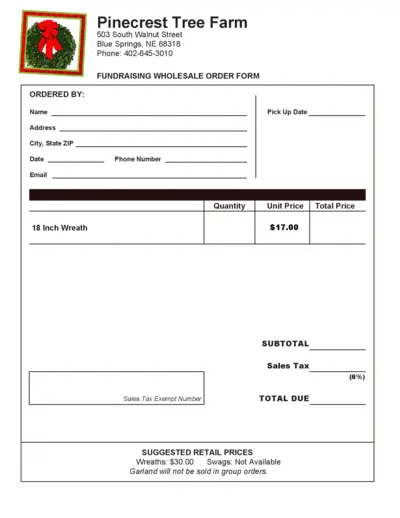

Fundraising Wholesale Order Form for Pinecrest Tree Farm

This PDF file is used for placing wholesale fundraising orders at Pinecrest Tree Farm. It includes sections for contact information, product order quantities, and pricing details. Suitable for managing wreath and swag orders.

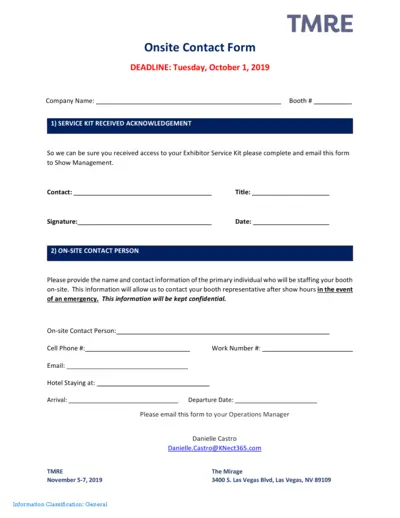

TMRE Onsite Contact Form: Acknowledgement and Contact Info

This file is used for acknowledging receipt of the service kit and providing on-site contact information for The Mirage event in November 2019. It ensures that the event management can reach the booth representative in case of emergencies and confirms that the exhibitor has successfully received the service kit.

Wonderfly Events Planning Agreement

This file is an Event Planning Agreement between a client and Wonderfly Events LLC for planning and hosting an event. It outlines the duties of Wonderfly, payment terms, rescheduling and cancellation policies, and use of property. It also includes important details for both parties to adhere to.

Annual Gift Basket Drive Volunteer Information

This file provides details and instructions about volunteering for the Annual Gift Basket Drive, including the required skills, time commitment, and how to get involved. It covers the event's purpose, location, and contact information for prospective volunteers. Perfect for anyone looking to contribute to a good cause during the holiday season.

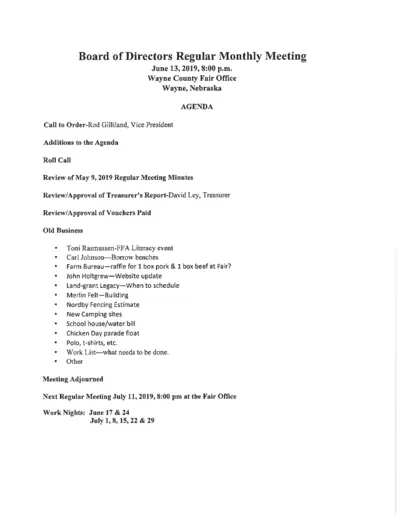

Wayne County Fair Board Meeting and Accounts Payable Details

This document includes the details of the Wayne County Fair Board of Directors Regular Monthly Meeting on June 13, 2019, and the accounts payable records. It also contains the minutes of the Regular Monthly Directors Meeting on May 9, 2019.

Mr. Omelette Menu Packages for Special Events

This file contains detailed information about Mr. Omelette's menu packages, including various omelette selections, salads, breads, and optional services to enhance your party. It provides pricing details and additional services available for an unforgettable event.

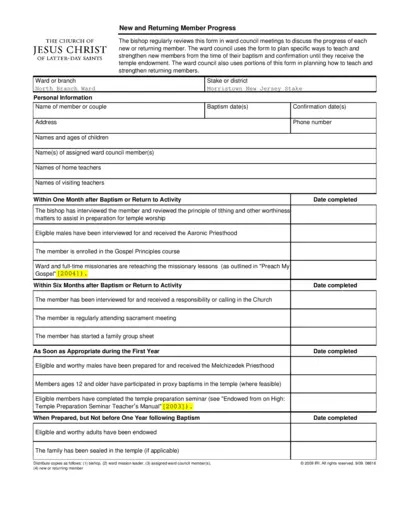

New and Returning Member Progress Form

This file helps the bishop and ward council to monitor and guide the progress of new or returning members from baptism to temple endowment. It includes instructions and fields for various stages of spiritual growth and activity in the church. Essential information and dates are recorded to ensure proper fellowship and support.

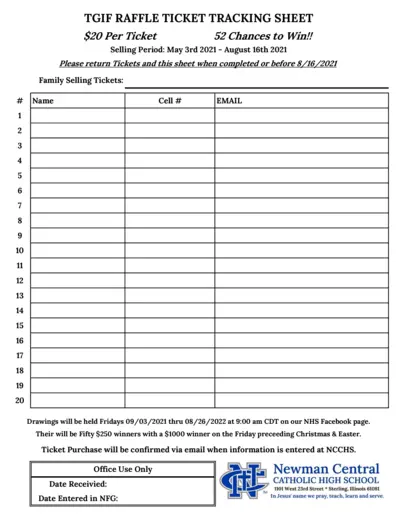

TGIF Raffle Ticket Tracking Sheet - Detailed Instructions & Information

The TGIF Raffle Ticket Tracking Sheet is designed to help you keep track of raffle ticket sales and participant information. It includes sections for recording ticket purchases, drawing dates, and winner announcements. Use this sheet to ensure all entries are accurately recorded and easily accessible.

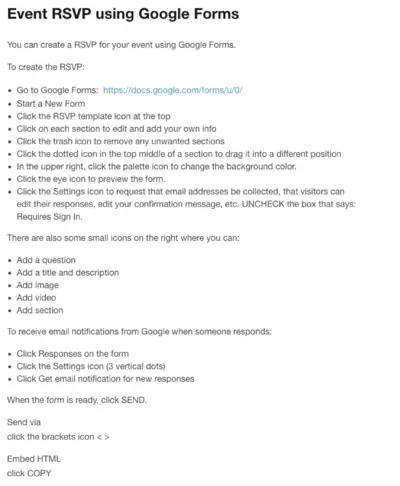

Event RSVP using Google Forms

Create your event RSVP using Google Forms with this simple guide. Edit sections, add questions, change the background color, and send the form effortlessly. Receive email notifications for responses.

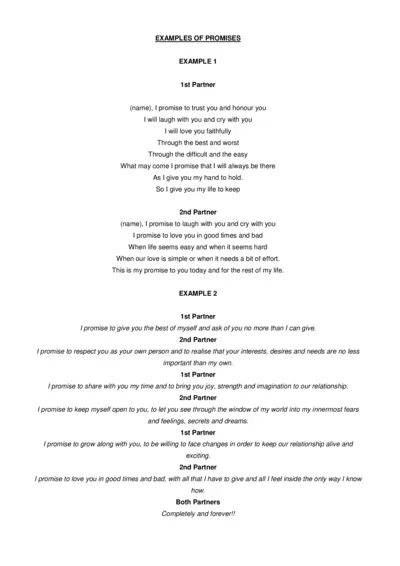

Examples of Wedding Vows and Promises

This file contains various examples of wedding vows and promises for partners to use as inspiration for their own ceremony. These examples can help couples express their love, commitment, and support for each other. Ideal for anyone planning a wedding and looking for meaningful vows.