FTB 5870A Instructions: Tax on Trust Distributions

The FTB 5870A instructions provide guidance on calculating tax on accumulation distributions from trusts. This document is essential for taxpayers dealing with foreign or domestic trusts. It ensures compliance with California tax laws and aligns with federal regulations.

Edit, Download, and Sign the FTB 5870A Instructions: Tax on Trust Distributions

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out form FTB 5870A, first gather all necessary information regarding your trust distributions. Next, follow the structured sections of the form, inputting your data accurately. Lastly, review all entries to ensure compliance before submitting.

How to fill out the FTB 5870A Instructions: Tax on Trust Distributions?

1

Gather your trust distribution information.

2

Complete Part I if you are a non-contingent beneficiary.

3

If you are a contingent beneficiary, fill out Part II.

4

Double-check all entries for accuracy.

5

Submit your completed form along with your tax return.

Who needs the FTB 5870A Instructions: Tax on Trust Distributions?

1

Beneficiaries of a trust who received distributions.

2

Trustees managing distribution from a California trust.

3

Tax professionals assisting clients with trust-related taxes.

4

Individuals dealing with foreign trusts and U.S. tax compliance.

5

Estate planners advising on tax implications of trust distributions.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the FTB 5870A Instructions: Tax on Trust Distributions along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your FTB 5870A Instructions: Tax on Trust Distributions online.

Editing PDF forms like FTB 5870A is simple with PrintFriendly. You can make changes directly to the fields, allowing for streamlined data entry. Ensure that all information is updated before saving or printing your edited file.

Add your legally-binding signature.

Signing your FTB 5870A document is now easier than ever on PrintFriendly. You can add your signature electronically to ensure your submission is finalized. This feature offers a hassle-free solution to complete your tax forms.

Share your form instantly.

Sharing your edited PDF documents on PrintFriendly is straightforward. You can easily send the file via email or other sharing options directly from the platform. This enables quick collaboration and submission of your forms.

How do I edit the FTB 5870A Instructions: Tax on Trust Distributions online?

Editing PDF forms like FTB 5870A is simple with PrintFriendly. You can make changes directly to the fields, allowing for streamlined data entry. Ensure that all information is updated before saving or printing your edited file.

1

Open the PDF in the PrintFriendly editor.

2

Select the fields you wish to modify.

3

Enter your information accurately.

4

Review the changes to ensure correctness.

5

Download or print your edited form.

What are the instructions for submitting this form?

To submit your completed FTB 5870A form, attach it to your California state income tax return. You can mail your tax return to the California Franchise Tax Board at PO Box 942840, Sacramento, CA 94240-0040. For questions regarding submission methods, consider contacting their office at 800-852-5711 for guidance.

What are the important dates for this form in 2024 and 2025?

For the FTB 5870A form, important deadlines include the filing date, typically April 15th each year. Adjustments and updates in tax regulations may lead to changes in these dates, so it’s essential to stay informed.

What is the purpose of this form?

The FTB 5870A form serves as a means for California taxpayers to report tax on trust distributions. Its primary purpose is to ensure that accumulation distributions from trusts are taxed appropriately under state laws. This form also aligns California's taxation with federal regulations.

Tell me about this form and its components and fields line-by-line.

- 1. Amount Distributed: The total amount distributed in the current year.

- 2. Undistributed Net Income: Income deemed distributed that was accumulated in prior years.

- 3. Taxable Income: The taxable income for specified prior years.

- 4. Residency Status: Indicates California residency during distribution.

- 5. Trustee Information: Details about the trustee managing the trust.

What happens if I fail to submit this form?

Failure to submit the FTB 5870A form may result in penalties or additional taxes owed. California’s tax authority holds the right to audit and assess taxes based on unreported distributions. It is crucial to ensure accurate and timely submission to avoid complications.

- Penalties for Late Submission: Late submissions may incur financial penalties as established by state law.

- Increased Tax Liability: Failure to report can lead to an increased tax liability based on unreported income.

- Audit Risk: Not submitting required forms heightens the risk of being audited by tax authorities.

How do I know when to use this form?

- 1. When Distributing Income: Use the form to report tax on income distributed from the trust.

- 2. Tax Filing for Beneficiaries: Beneficiaries must include this form when filing state tax returns.

- 3. Complying with California Tax Laws: Ensure compliance with state laws regarding trust distributions.

Frequently Asked Questions

How do I edit the FTB 5870A form?

Simply open the form in our PDF editor and modify the necessary fields.

Can I save the changes made to the FTB 5870A?

You can download the edited PDF after making the necessary changes.

Is there a limit to how many times I can edit this PDF?

You can edit the PDF as many times as needed before finalizing.

Do I need an account to edit the PDF?

No account is necessary to edit and download your PDF files.

Can I share the edited PDF with someone?

Yes, you can share the PDF via email or other methods directly from our platform.

How can I sign the FTB 5870A?

You can add your electronic signature within the editor before downloading.

What if I encounter issues while editing?

Please contact our support team for assistance with editing.

Is the form available for international users?

Yes, anyone can access and edit the form as long as they have the PDF.

Will my changes be saved automatically?

You need to download the PDF to save your edited changes.

Can I print the form after editing?

Absolutely, you can print the form directly after editing.

Related Documents - FTB 5870A

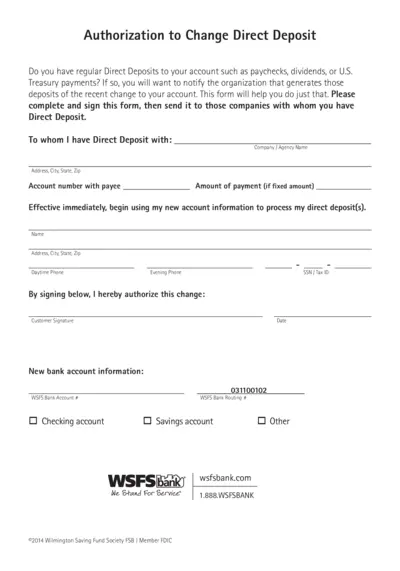

Authorization to Change Direct Deposit Form

This form is for notifying organizations of changes to your direct deposit account. Complete and sign this form and send it to the companies handling your direct deposits. The form includes sections for personal information and new account details.

Sprouts Farmers Market 2023 Annual Meeting Proxy Statement

This document contains details about the 2023 Annual Meeting of Stockholders for Sprouts Farmers Market, Inc. It includes information on the meeting date, items of business, and instructions for proxy voting. Access to proxy materials and voting instructions are also provided.

Application for Approval of Details Reserved by Condition Planning

This file is an application for approval of details reserved by condition following the grant of planning permission or listed building consent. It provides information on how to submit the necessary details for approval by the Local Planning Authority. The file includes instructions for both online and offline submission.

Implementation of Thrift Savings Plan Roth Contributions

This file provides information and requirements for uniformed services to modify their payroll systems to accommodate the Thrift Savings Plan (TSP) Roth contributions. It outlines definitions, rules, and procedures for TSP Roth contributions, including catch-up contributions for those aged 50 and older. The document also includes target implementation dates and contacts for inquiries.

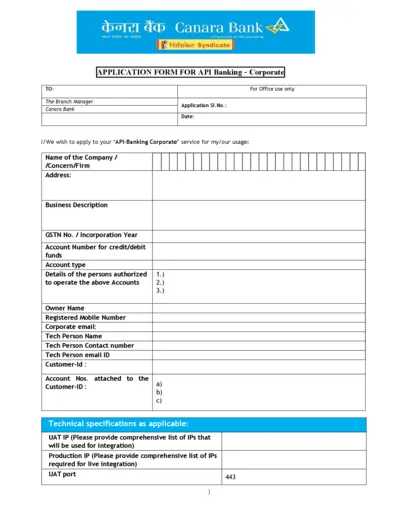

Canara Bank API Banking Application Form

This file is an application form for Canara Bank's API Banking services for corporate entities. The form includes sections to provide company details, technical specifications and authorized personnel. It requires the applicant to declare understanding and acceptance of terms and conditions related to the service.

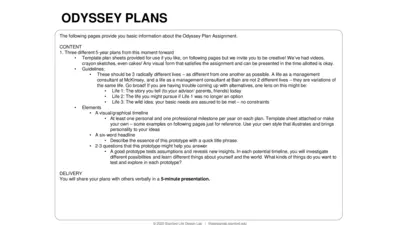

Odyssey Plan Assignment Guide: Create Your Future in 3 Steps

This file provides the guidelines and templates for creating three distinct 5-year Odyssey Plans. It encourages creative visual representations and exploration of multiple life possibilities. It is designed to help users test assumptions and gain new insights about potential life paths.

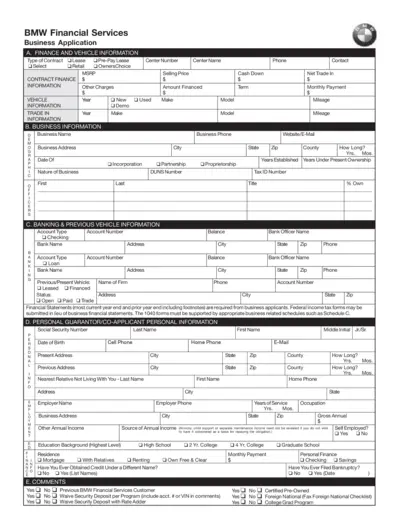

BMW Financial Services Business Application Form

This form is used to apply for various financing options through BMW Financial Services, including lease, retail, pre-pay lease, and OwnersChoice. It collects detailed information about finance, vehicle, business, banking, and personal guarantor information. Instructions and certifications required for business entities and personal guarantors are included.

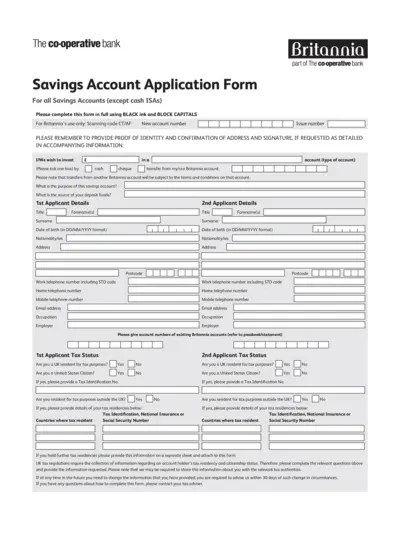

Savings Account Application Form - The Co-operative Bank

This application form is needed to apply for a savings account with The Co-operative Bank. It requires personal information, tax status, and account preferences. Follow the instructions carefully for successful submission.

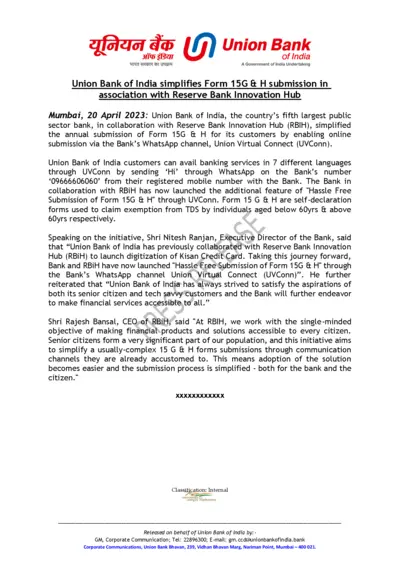

Union Bank of India Simplifies Form 15G & H Submission via WhatsApp

Union Bank of India has simplified the annual submission of Form 15G & H by enabling online submission via its WhatsApp channel Union Virtual Connect in association with RBIH. This initiative aims to make the submission process easier for senior citizens and tech-savvy customers. It provides banking services in 7 different languages through WhatsApp.

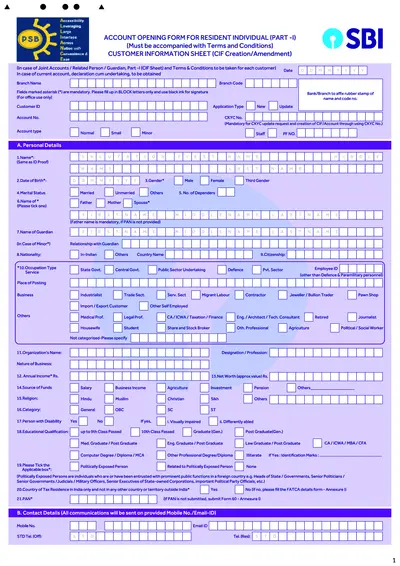

SBI Account Opening Form for Resident Individuals

This file is an account opening form for resident individuals of SBI. It includes detailed sections that need to be filled for creating a Customer Information File. The form must be accompanied by terms and conditions and is suitable for various types of accounts including saving bank, current account, and term deposits.

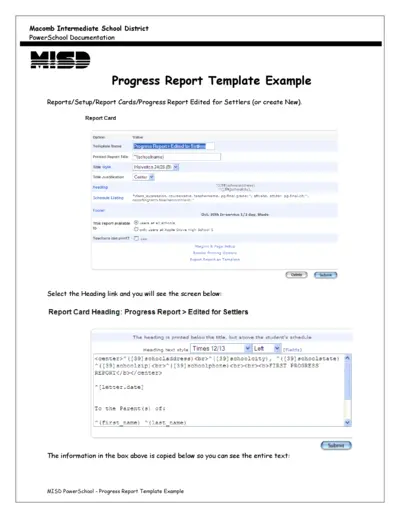

MISD PowerSchool - Progress Report Template

This file provides a detailed example of a Progress Report Template for the MISD PowerSchool system. It includes instructions on how to set up and customize the report. Users can learn how to fill in the template with student information and schedule data.

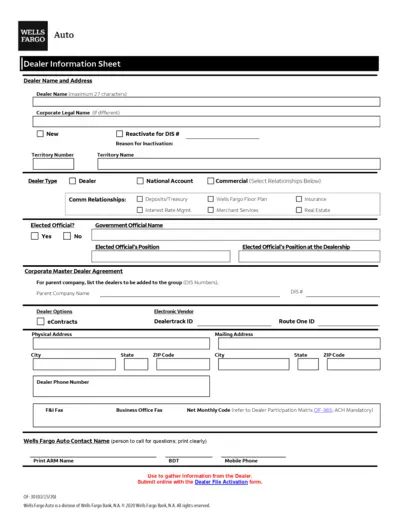

Wells Fargo Auto Dealer Profile Form

This document contains information and instructions for Wells Fargo Auto Dealers on completing the Dealer Information Sheet, ACH Profile Authorization Form, and Franchise Dealer Profile. Dealer's details, bank account information, and dealership legal details are required.