Kenya Revenue Authority Import/Export Declaration Form C.63

This document is the Republic of Kenya's official form for declaring imports, exports, transit, and warehousing activities. It is used by exporters, importers, and their agents to provide necessary information to the Kenya Revenue Authority's Customs & Excise Department. The form includes various fields for transportation details, item descriptions, and tax calculations.

Edit, Download, and Sign the Kenya Revenue Authority Import/Export Declaration Form C.63

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, you need to provide accurate information about the goods being imported, exported, or transited. Ensure all relevant fields, such as exporter details, clearance office, item descriptions, and tax information, are correctly completed. Submit the completed form to the Kenya Revenue Authority for processing.

How to fill out the Kenya Revenue Authority Import/Export Declaration Form C.63?

1

1. Provide exporter/consignor information.

2

2. Fill in the clearance office and regime codes.

3

3. Enter importer/consignee and declarant/agent details.

4

4. Specify transportation, goods, and tax details.

5

5. Sign and submit the form to the Kenya Revenue Authority.

Who needs the Kenya Revenue Authority Import/Export Declaration Form C.63?

1

1. Exporters who need to declare goods being sent out of Kenya.

2

2. Importers who need to declare goods being brought into Kenya.

3

3. Agents acting on behalf of exporters or importers.

4

4. Businesses involved in transit of goods through Kenya.

5

5. Warehouse operators declaring storage of goods.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Kenya Revenue Authority Import/Export Declaration Form C.63 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Kenya Revenue Authority Import/Export Declaration Form C.63 online.

With PrintFriendly, you can easily edit your PDFs for precise information. Our PDF editor allows you to add, remove, or change text and data as needed. Make necessary updates right on the platform for seamless documentation.

Add your legally-binding signature.

PrintFriendly now enables you to sign PDFs directly on the platform. Simply upload your document, apply your electronic signature, and save the signed PDF. This feature ensures security and authenticity for your forms.

Share your form instantly.

Sharing PDFs on PrintFriendly is simple and effective. After editing or signing your document, use the share feature to send it via email or generate a shareable link. Collaborate with ease and ensure everyone has access to the latest version.

How do I edit the Kenya Revenue Authority Import/Export Declaration Form C.63 online?

With PrintFriendly, you can easily edit your PDFs for precise information. Our PDF editor allows you to add, remove, or change text and data as needed. Make necessary updates right on the platform for seamless documentation.

1

1. Open the PDF form on PrintFriendly.

2

2. Use the PDF editor to enter or update information in the fields.

3

3. Make necessary adjustments, such as changing text or adding notes.

4

4. Save your changes to finalize the edited document.

5

5. Download the updated PDF to your device or share it with others.

What are the instructions for submitting this form?

To submit the completed Kenya Import/Export Declaration Form C.63, you can either do it online through the Kenya Revenue Authority's eCitizen portal or manually submit it to the nearest KRA office. Ensure all required fields are accurately completed. Online submissions can be made at www.ecitizen.go.ke. For manual submissions, visit a KRA office in your area. For any inquiries, you may contact KRA Customer Care at +254 20 4999 999, email: callcentre@kra.go.ke.

What are the important dates for this form in 2024 and 2025?

Specific submission deadlines for the Kenya Import/Export Declaration Form may vary, but generally include the dates of imports, exports, or transit entries. For 2024 and 2025, ensure to submit the form promptly based on your activity dates to avoid penalties.

What is the purpose of this form?

The Kenya Revenue Authority Import/Export Declaration Form C.63 is crucial for regulating and documenting international trade through Kenya. This form helps exporters, importers, and their agents declare the necessary details about their goods to the Customs & Excise Department, ensuring compliance with trade and tax regulations. By filling out this form accurately, businesses can facilitate the customs process, avoid penalties, and ensure smooth operation of their import/export activities.

Tell me about this form and its components and fields line-by-line.

- 1. Exporter/Consignor: Information about the exporting party, including personal identification number (PIN).

- 2. Clearance Office, Code, Regime, Code: Details of the clearance office and the specific regime code for the transaction.

- 3. Importer/Consignee: Details of the importing party, including their PIN.

- 4. Declarant/Agent: Information about the agent declaring the goods, including their identification details.

- 5. Mode of Transport, Nationality of Transport: Information about the transportation method and the nationality of the vehicle.

- 6. Manifest No., Date Arrival/Dep., AWB/B/L No.: Details of the transportation documents and arrival/departure dates.

- 7. Total Items, Total Packages: Summary of the total number of items and packages being declared.

- 8. Account holder No./Prepayment Account No., Guarantee No., Bond amount: Financial details related to the transaction, including account and bond information.

- 9. Declarant References, Valuation method/ruling: Any references provided by the declarant and the valuation method used.

- 10. Bank/Branch Ref., Terms of Delivery, Terms of Payment: Banking and financial terms related to the import/export transaction.

- 11. Location of Goods, Country of Consignment, Port of Destination: Information about goods location, consignment country, and destination port.

- 12. Estimated Period in Warehouse/Transit, Warehouse Code/Name/Address: Details about warehousing or transit periods and warehouse information.

- 13. Goods Description, Commodity Code, Net weight (KG), Customs Value: Detailed description of the goods, including commodity code, weight, and customs value.

- 14. Seal Nos., Shipping Marks & Nos./Container No.: Additional identifiers for the shipment, including seal and container numbers.

- 15. Invoice Value, Unit of Quantity, Country of Origin, S.I.T.C., Other Costs: Financial details, including invoice value, quantity, and any additional costs.

- 16. Duty/Tax Type, Rate, Duty/Tax Base, Value of Duty/Tax Due: Tax-related details, including the type, rate, base value, and due amount.

- 17. Attached Documents, Code, Number: List of attached documents with their respective codes and numbers.

- 18. Agreement Code, Number, Grand Total (Duties, Taxes and Other Charges): Agreement details and the grand total of all duties, taxes, and charges.

- 19. Declaration, Signature, Date, Place, Tel/Fax: Declarant's signature and contact information, along with the declaration date and place.

- 20. For Official Use, Proper Officer, Cheque/Cash, Amount: Reserved sections for official use by the Kenya Revenue Authority.

What happens if I fail to submit this form?

Failing to submit this form can result in significant penalties and delays in the clearance process.

- Penalties: Non-submission or late submission can attract financial penalties.

- Delays: Failure to submit the form can cause delays in processing and clearance of goods.

- Non-compliance: Not submitting the form may result in non-compliance with customs regulations, leading to further legal complications.

How do I know when to use this form?

- 1. Importing Goods: Declare goods being brought into Kenya for customs and tax purposes.

- 2. Exporting Goods: Provide details of goods being sent out of Kenya for customs clearance.

- 3. Transit Goods: Declare goods passing through Kenya to another destination.

- 4. Warehousing Goods: Report goods being stored in a warehouse in Kenya.

- 5. Agent Declaration: Used by agents acting on behalf of importers or exporters to declare the necessary information.

Frequently Asked Questions

How can I edit the Kenya Import/Export Declaration Form on PrintFriendly?

You can edit the form by opening it on PrintFriendly and using the PDF editor to update and save your information.

Can I sign the PDF form on PrintFriendly?

Yes, you can easily sign the PDF form on PrintFriendly using our e-signature feature.

Is it possible to share the completed form on PrintFriendly?

Absolutely! You can share the completed form via email or generate a shareable link on PrintFriendly.

Do I need to install any software to use PrintFriendly?

No, PrintFriendly is an online platform, and you can access all features directly from your web browser.

Can I use PrintFriendly to fill out other forms?

Yes, PrintFriendly supports filling out various PDF forms efficiently.

Does PrintFriendly support currency conversion on the form?

While PrintFriendly allows you to update currency information, it doesn't automatically convert currencies.

How do I save changes made to my form on PrintFriendly?

Save your changes by clicking the save button, and then download the updated PDF.

Is my edited form secure on PrintFriendly?

Yes, PrintFriendly ensures your forms are secure and accessible only to you.

Can I collaborate with others on PrintFriendly?

Yes, you can share your form for collaboration or review using PrintFriendly's sharing feature.

Does PrintFriendly support tax calculations on this form?

PrintFriendly allows you to fill out tax-related fields, but it doesn't perform automatic tax calculations.

Related Documents - KRA Import/Export Form

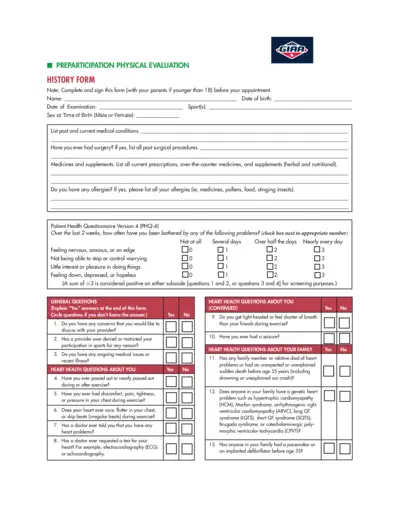

Preparticipation Physical Evaluation Form

The Preparticipation Physical Evaluation Form is used to assess the physical health and fitness of individuals before they participate in sports activities. It covers medical history, heart health, bone and joint health, and other relevant medical questions.

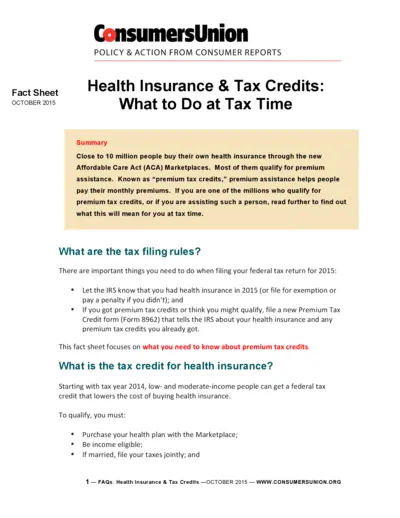

Health Insurance Tax Credits Guide 2015

This document provides a comprehensive guide on health insurance and premium tax credits for the 2015 tax year. It explains the tax filing rules, eligibility criteria, and detailed instructions for claiming and reporting premium tax credits. Essential for individuals who bought health insurance through the ACA Marketplaces.

TSP-77 Partial Withdrawal Request for Separated Employees

The TSP-77 form is used by separated employees to request a partial withdrawal from their Thrift Savings Plan account. It includes instructions for completing the form, certification, and notarization requirements. The form must be filled out completely and submitted along with necessary supporting documents.

Ray's Food Place Donation Request Form Details

This file contains the donation request form for Ray's Food Place. Complete the general information section and follow the guidelines to submit your donation request at least 30 days in advance. The form includes fields for organization details and donation specifics.

Pastoral Ministry Evaluation Form for Board of Elders

This evaluation form is designed for the Board of Elders to assess and provide feedback on a pastor's ministry. It aims to offer affirmation and identify areas for improvement. The form covers preaching, worship leading, pastoral care, administration, and more.

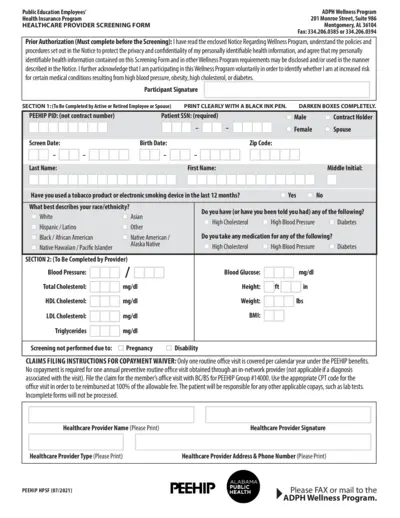

Health Provider Screening Form for PEEHIP Healthcare

This file contains the Health Provider Screening Form for PEEHIP public education employees and spouses. It includes instructions on how to fill out the form for wellness program participation. The form collects personal, medical, and screening details to assess wellness.

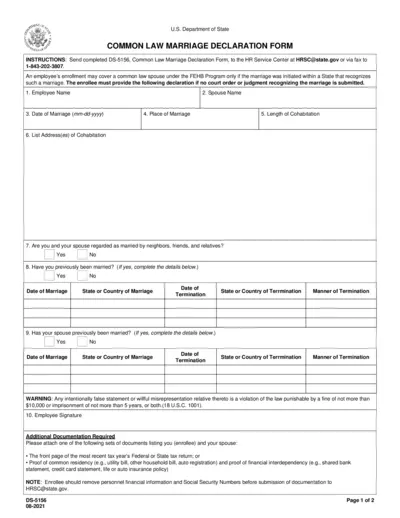

Common Law Marriage Declaration Form for FEHB Program

This form is used to declare a common law marriage for the purpose of enrolling a spouse under the Federal Employees Health Benefits (FEHB) Program. It requires personal details, marriage information, and additional documentation. Submission instructions and legal implications are included.

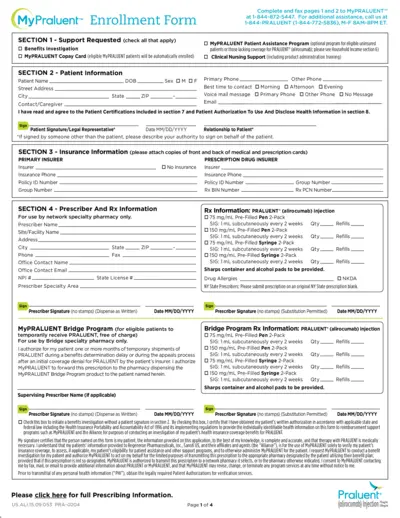

MyPRALUENT™ Enrollment Form Instructions and Details

This document provides comprehensive instructions and details for enrolling in the MyPRALUENT™ program, including benefits, patient assistance, and clinical support. It outlines the required patient, insurance, and prescriber information, as well as the steps for treatment verification and household income documentation.

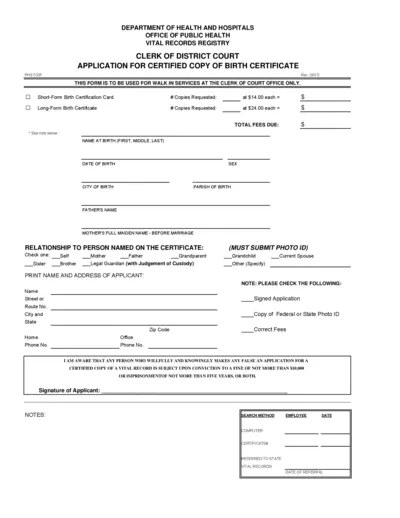

Application for Certified Copy of Birth Certificate

This form is used to request a certified copy of a birth certificate from the Clerk of Court Office. It includes details about the applicant, the person named on the certificate, and requires a photo ID and the correct fee. This form is only for walk-in services.

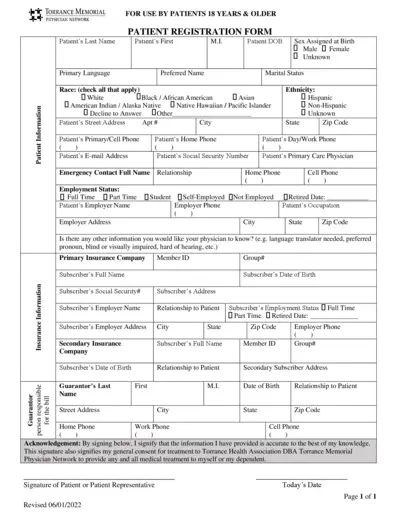

Torrance Memorial Physician Network Forms for Patients 18+

This file contains important forms for patients 18 years and older registered with Torrance Memorial Physician Network. It includes patient registration, acknowledgment of receipt of privacy practices, and financial & assignment of benefits policy forms. Complete these forms to ensure your medical records are up-to-date and to understand your financial responsibilities.

Vodafone Phone Unlocking Guide: Steps to Unlock Your Phone

This guide from Vodafone provides a step-by-step process to unlock your phone. Learn how to obtain your unlock code by filling out an online form. Follow the instructions to complete the unlocking process.

Texas Automobile Club Agent Application Form

This file is the Texas Automobile Club Agent Application or Renewal form, which must be submitted within 30 days after hiring an agent. The form includes fields for agent identification, moral character information, and requires signature from both the agent and an authorized representative of the automobile club. Filing fees and submission instructions are also provided.