Modernization of Annuities for Wealth Management

This document outlines the modernization of annuities aimed at helping wealth managers and registered investment advisors effectively meet client needs. It highlights various annuity types, their benefits, and the importance of evaluating current investments. Users will find valuable insights on how to integrate annuities into financial plans.

Edit, Download, and Sign the Modernization of Annuities for Wealth Management

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this document, begin by reviewing each section thoroughly. Follow any provided prompts or guidelines for completing specific parts. Ensure all information is accurate and up-to-date before submission.

How to fill out the Modernization of Annuities for Wealth Management?

1

Read through the document carefully.

2

Gather all necessary information.

3

Fill out the sections as prompted.

4

Review your entries for accuracy.

5

Submit the completed document.

Who needs the Modernization of Annuities for Wealth Management?

1

Financial advisors need this file to assess and recommend annuities to clients.

2

Wealth management firms require it for strategic planning and investment recommendations.

3

Individuals nearing retirement can evaluate their annuity holdings for better financial planning.

4

Estate planners utilize this information to advise clients on wealth transfer strategies.

5

Investment analysts refer to it for understanding annuity products in the market.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Modernization of Annuities for Wealth Management along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Modernization of Annuities for Wealth Management online.

You can edit this PDF on PrintFriendly by simply selecting the text you want to change. Adjust the text as needed and apply any formatting preferences directly within the editor. Once satisfied, you can download the edited version for your records.

Add your legally-binding signature.

Signing the PDF on PrintFriendly can be done easily by selecting the signature option in the editor. You can draw, type, or upload your existing signature to place it on the document. After signing, remember to save your changes and download the signed PDF.

Share your form instantly.

Sharing the PDF on PrintFriendly is straightforward; simply use the share button to generate a link. You can send this link via email or share it on social media platforms. This allows others to access the document easily.

How do I edit the Modernization of Annuities for Wealth Management online?

You can edit this PDF on PrintFriendly by simply selecting the text you want to change. Adjust the text as needed and apply any formatting preferences directly within the editor. Once satisfied, you can download the edited version for your records.

1

Open the PDF in PrintFriendly's editor.

2

Select the text you wish to edit.

3

Make the necessary changes directly within the editor.

4

Review your edits to ensure clarity and accuracy.

5

Download the updated document once all edits are complete.

What are the instructions for submitting this form?

To submit this form, gather all necessary client information and complete each section accurately. Then, send the completed form via email to submit@financialadvisor.com, or fax it to (123) 456-7890. For physical submissions, mail to Financial Advisor Group, 123 Finance St, Moneytown, NY 12345. Ensure submission is done within the required timeline.

What are the important dates for this form in 2024 and 2025?

Important dates related to annuities can vary by specific products and offerings. Typically, clients should be aware of renewal dates, policy maturity dates, and any changes in product features or benefits that may take place at the start of the new year. Always check with your annuity provider for the most accurate timelines.

What is the purpose of this form?

The purpose of this form is to provide a structured approach for financial professionals to evaluate and recommend annuity products to clients. It serves as a comprehensive guide to understanding the nuances of various annuity options available in the market. By utilizing this form, advisors can ensure that they are considering their clients' unique financial situations and goals.

Tell me about this form and its components and fields line-by-line.

- 1. Client Information: Details about the client, including contact information and financial profile.

- 2. Existing Annuity Review: An evaluation of any current annuity products the client holds.

- 3. Goals Assessment: An analysis of the client's financial goals and retirement objectives.

- 4. Recommendations: Suggestions for annuity products that may align with the client's goals.

What happens if I fail to submit this form?

If you fail to submit the form, the assessment of your annuities may be delayed, causing potential financial setbacks. It's essential to ensure the form is completed accurately and submitted promptly to avoid these issues.

- Delay in Annuity Evaluation: Without timely submission, your review process will be held up.

- Missed Opportunities for Clients: Failures in submission may result in clients losing out on better investment options.

- Inaccurate Financial Planning: Incomplete forms can lead to misguided recommendations.

How do I know when to use this form?

- 1. Annual Review: Conduct a yearly evaluation of client's financial strategies.

- 2. Major Life Changes: Assess annuity plans during significant life events such as retirement.

- 3. Investment Strategy Updates: Re-evaluate when there are updates in the investment landscape.

Frequently Asked Questions

Can I edit this PDF on PrintFriendly?

Yes, you can easily edit the PDF on PrintFriendly by using our intuitive editor to adjust text and formatting.

How do I download the edited PDF?

After making your edits, simply click the download button to save the updated PDF to your device.

What types of PDFs can I edit?

You can edit various types of PDFs, including forms and informational documents, using PrintFriendly.

Is there a limit to how many PDFs I can edit?

There are no limits to the number of PDFs you can edit using PrintFriendly.

Can I share the PDF with others after editing?

Yes, after editing, you can share the PDF via link or download and send it directly.

How can I sign my PDF document?

You can sign your PDF by selecting the sign option in the editor, allowing you to add a signature either by drawing or uploading.

What if I make a mistake while editing?

You can easily undo any changes by using the undo option in the editor.

Do I need to create an account to edit PDFs?

No, you do not need to create an account to use the editing features of PrintFriendly.

Can I customize the appearance of my PDF?

Yes, our editor allows you to change fonts, sizes, and colors when editing your PDF.

What format is the downloaded PDF?

The downloaded document will be in PDF format, preserving all your edits and changes.

Related Documents - Modern Annuities

Recovery Loan Scheme Phase 3 Application Form

This file provides guidance and instructions for UK businesses to apply for secured loans under the government-backed Recovery Loan Scheme (RLS) Phase 3 with Atom bank.

Managing Financial Affairs and Estate Planning Guide

This file provides detailed guidance on managing financial affairs and estate planning. It covers crucial legal documents and advance care planning. It also includes information on funeral planning and resources for end-of-life concerns.

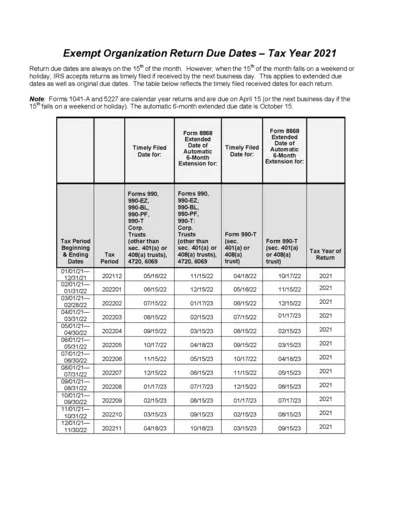

Exempt Organization Return Due Dates - Tax Year 2021

This file provides detailed information on return due dates for exempt organizations for the tax year 2021. It includes original and extended due dates, along with specific forms and filing periods. Use this guide to ensure timely submission of your tax returns.

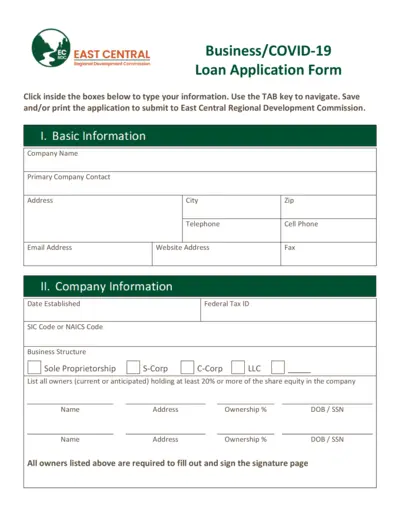

Business/COVID-19 Loan Application - East Central Regional Development Commission

This file is a loan application form provided by the East Central Regional Development Commission for businesses affected by COVID-19. It includes sections for basic information, company information, requested amount, sources and use of funds, proposed financing terms, job creation, and business profile. The application can be filled out, saved, and printed for submission.

Mobile Banking Application Download Guide

This document guides you through the process of downloading the SBI Mobile Banking application to your phone using either Bluetooth or a data cable. Detailed steps are provided for both methods to ensure a smooth installation. Ensure you follow each step carefully for successful application setup.

Foreign Income Verification Statement (T1135) Information

This document provides detailed guidelines about the Foreign Income Verification Statement (T1135) disclosure. It explains who must file it, what foreign properties must be reported, and the penalties for non-compliance. There are also instructions on how to file the form and how a tax specialist can assist.

The Modernization of Annuities: Insights for RIAs and Clients

This file provides detailed information on the modernization of annuities, designed for registered investment advisors (RIAs) and wealth managers. It covers types of annuities, their benefits, and how they integrate with financial planning tools. It also includes statistical insights on the use of annuities by pre-retirees and retirees.

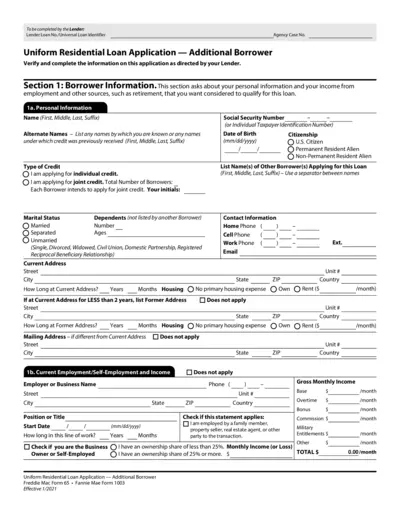

Uniform Residential Loan Application - Additional Borrower

This file is a Uniform Residential Loan Application for an additional borrower. It includes sections to fill out personal information, employment details, income sources, and other financial information required for a loan application. The file is intended to be completed by the lender and borrower.

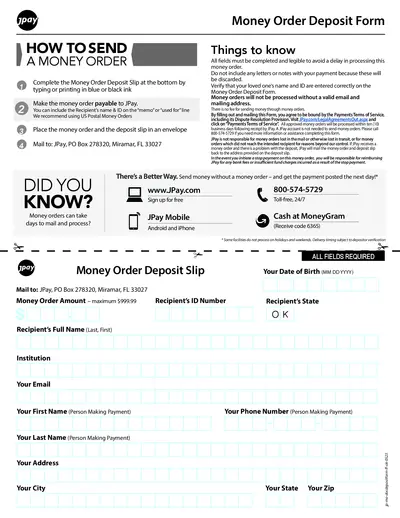

How to Send a Money Order with JPay

This document provides step-by-step instructions on sending a money order through JPay. It includes a fillable deposit slip form and important guidelines for completing and mailing your money order. Ensure all details are correct to avoid processing delays.

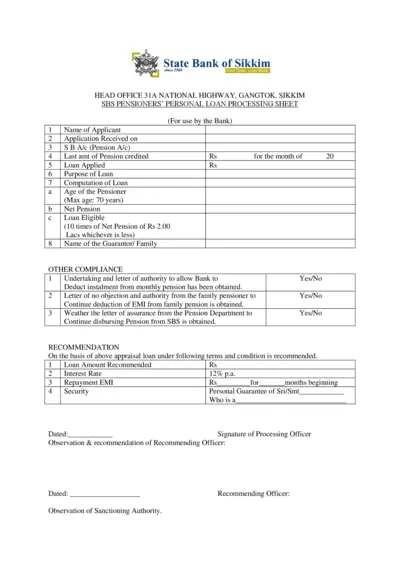

SBS Pensioners Personal Loan Processing Sheet

This document is a processing sheet for the SBS Pensioners Personal Loan for pensioners seeking loans from the State Bank of Sikkim. It guides applicants through the necessary details required for loan processing and approval. The form includes sections for applicant information, loan eligibility, and required compliance documents.

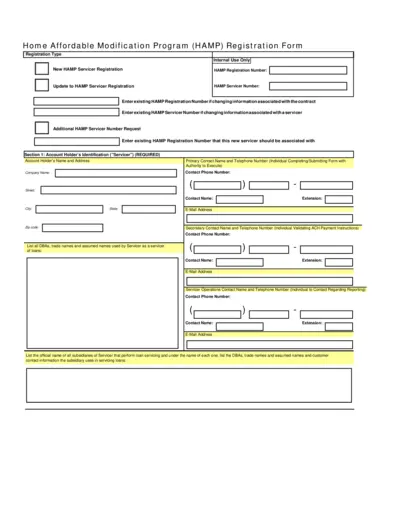

Home Affordable Modification Program Registration

This file provides essential instructions for servicers in the Home Affordable Modification Program (HAMP). It includes details about registration, ACH payment instructions, and contact information requirements. Utilize this form to ensure compliance with HAMP regulations.

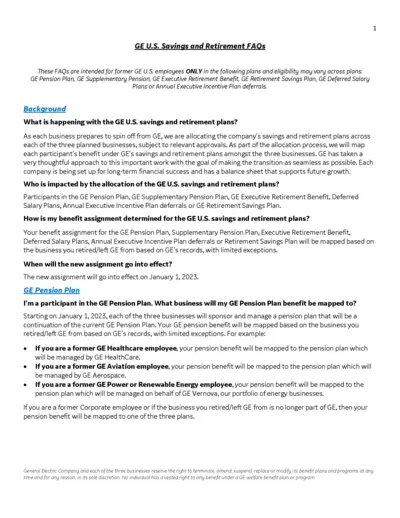

GE U.S. Savings and Retirement FAQs

This document contains essential FAQs about GE U.S. savings and retirement plans, tailored for former GE employees. It provides critical information regarding benefit assignments, pension plan mappings, and upcoming changes affecting retirement resources.