NOC Template for Change of Tax Jurisdiction - FBR Pakistan

This file is a format for the NOC template required for changing tax jurisdiction as prescribed by the Federal Board of Revenue (FBR) Pakistan. It includes detailed instructions and necessary information fields. The template ensures compliance with the FBR's regulations to facilitate jurisdiction change procedures.

Edit, Download, and Sign the NOC Template for Change of Tax Jurisdiction - FBR Pakistan

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, you need to provide the taxpayer's profile and jurisdiction details. Ensure compliance by completing all required sections accurately. This form will then be reviewed by the Chief Commissioner-IR for approval.

How to fill out the NOC Template for Change of Tax Jurisdiction - FBR Pakistan?

1

Gather the taxpayer's profile information from the 181 Form.

2

Fill in the present and requested jurisdictions.

3

Complete the taxpayer's history section including past transfers and pending proceedings.

4

Specify the reason for the jurisdiction change.

5

Review and submit the form to be signed by the Chief Commissioner-IR.

Who needs the NOC Template for Change of Tax Jurisdiction - FBR Pakistan?

1

A taxpayer who recently changed their business address and needs to update their tax jurisdiction.

2

Individuals or businesses wrongly assigned to a jurisdiction and seeking correction.

3

Companies undergoing restructuring that necessitates a jurisdiction change.

4

Tax consultants assisting clients in updating their jurisdiction information.

5

Taxpayers with pending recovery proceedings that require jurisdiction updates.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the NOC Template for Change of Tax Jurisdiction - FBR Pakistan along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your NOC Template for Change of Tax Jurisdiction - FBR Pakistan online.

You can easily edit this PDF on PrintFriendly using our built-in editor. Make necessary changes to the taxpayer's profile, jurisdiction details and review the form. Save the updated form for submission.

Add your legally-binding signature.

Sign your PDF on PrintFriendly seamlessly using our integrated e-signature tool. Add your signature to the designated fields in the form and ensure it's positioned correctly. Save the signed document for final submission.

Share your form instantly.

Share your PDF directly from PrintFriendly with ease. Use our platform to send the completed form via email or generate a shareable link. Ensure your recipients have access to the required form quickly and efficiently.

How do I edit the NOC Template for Change of Tax Jurisdiction - FBR Pakistan online?

You can easily edit this PDF on PrintFriendly using our built-in editor. Make necessary changes to the taxpayer's profile, jurisdiction details and review the form. Save the updated form for submission.

1

Open the PDF in PrintFriendly's editor.

2

Edit the taxpayer profile and jurisdiction sections by entering the required information.

3

Complete the taxpayer history and reasons for jurisdiction change sections.

4

Review the entire form for accuracy and completeness.

5

Save your edited form for future access and submission.

What are the instructions for submitting this form?

Submit the completed form via email to member_ir@fbr.gov.pk or via fax to (051)920-5593. Physical submissions can be made to the Federal Board of Revenue, Inland Revenue, *******, Islamabad. Ensure all sections are accurately filled and signed before submission. For online submissions, use the FBR's official portal. Double-check all information to avoid processing delays and maintain compliance with regulatory requirements.

What are the important dates for this form in 2024 and 2025?

Important dates for this form include the issuance date of 19th Sept 2023 and adherence to related notifications such as F.No.4(345) Jurisdiction/2015-285326-R dated 17.12.2019.

What is the purpose of this form?

The purpose of this form is to facilitate the process of changing a taxpayer's jurisdiction as per the Federal Board of Revenue (FBR) regulations. It is designed to ensure proper documentation and compliance when transferring jurisdictional authority. The form captures essential information required for an approved change, including taxpayer details, current and target jurisdictions, and the reasons for the change.

Tell me about this form and its components and fields line-by-line.

- 1. Taxpayer's Profile: Includes the taxpayer's name, NTN/CNIC, principal activity, and address.

- 2. Present & Requested Jurisdictions: Details the current and target jurisdictions for the taxpayer.

- 3. Taxpayer's History: Information about any previous transfers, pending audits, recovery proceedings, and refunds.

- 4. Reason for Change of Jurisdiction: Specifies the reason for the change and the impact of the transfer on revenue.

- 5. Remarks: Additional comments or notes, usually from the Chief Commissioner-IR.

What happens if I fail to submit this form?

Failure to submit this form can result in non-compliance with FBR regulations, delaying the jurisdiction change process. Potential penalties may also be imposed for missing deadlines.

- Non-Compliance: Failure to comply with jurisdiction change regulations as prescribed by the FBR.

- Delays: Prolonged processing times and potential operational setbacks.

- Penalties: Potential financial penalties imposed for missing submission deadlines.

How do I know when to use this form?

- 1. Change of Business Address: When your business address has changed, requiring an update in tax jurisdiction.

- 2. Incorrect Jurisdiction Assignment: If you were wrongly assigned a jurisdiction and need correction.

- 3. Restructuring: During company restructuring that involves jurisdictional changes.

- 4. Pending Recovery Proceedings: If there are pending recovery proceedings that necessitate an update in jurisdiction.

- 5. CNIC Address Update: When your CNIC address has changed, prompting a jurisdiction update.

Frequently Asked Questions

How do I access the NOC template for tax jurisdiction change?

Access the template through the Federal Board of Revenue website or download it from PrintFriendly.

Can I edit the NOC template on PrintFriendly?

Yes, you can edit the template using PrintFriendly's built-in PDF editor.

Is there a way to sign the NOC template online?

Absolutely, use PrintFriendly's e-signature tool to add your signature to the template.

How can I share the completed NOC template?

You can share the completed template via email or by generating a shareable link on PrintFriendly.

What information is required in the NOC template?

You need to provide the taxpayer’s profile, present and requested jurisdiction details, taxpayer’s history, and reasons for jurisdiction change.

Who needs to sign the NOC template?

The Chief Commissioner-IR needs to sign the NOC template after review.

Is the NOC template available in multiple formats?

The template is primarily available in PDF format for ease of use and editing.

How do I know if I need to change my tax jurisdiction?

You need to change your tax jurisdiction if there are changes in your business address, CNIC address, or if you were wrongly assigned a jurisdiction.

What happens if I submit incorrect information on the NOC template?

Submitting incorrect information may delay the processing of your request, so ensure accuracy before submission.

Can I save the changes made to the NOC template on PrintFriendly?

Yes, you can save all the changes made to the template on PrintFriendly for future access.

Related Documents - NOC Jurisdiction Change Template

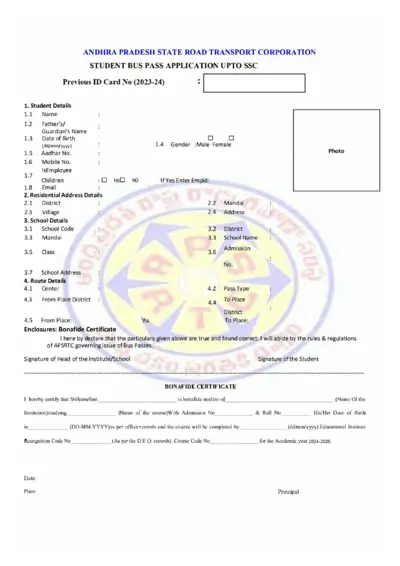

Andhra Pradesh State Road Transport Corporation Student Bus Pass Application

The Andhra Pradesh State Road Transport Corporation (APSRTC) Student Bus Pass Application form is for students up to SSC who need to apply for a bus pass for the academic year 2024-2025. This form includes personal details, school details, route details, and requires a bonafide certificate. Completing this form allows students to travel on APSRTC buses between their residence and school at a concessional fare.

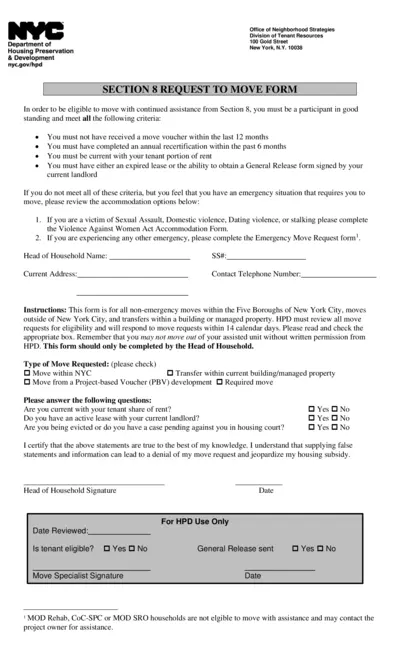

NYC Section 8 Request to Move Form

The NYC Section 8 Request to Move Form is for participants in good standing to move with continued assistance. Participants must meet specific criteria and obtain necessary approvals. The form includes options for non-emergency and emergency moves.

Cheyenne Transit ADA Paratransit Eligibility Application

This file includes the application and instructions for Cheyenne Transit's ADA Paratransit service. It details the eligibility criteria and provides guidelines on how to complete the form. The document must be filled out in full and submitted to determine eligibility for Paratransit service.

Council-Manager Government Roles and Responsibilities Guide

This file provides detailed information about the roles and responsibilities of key officials in a council-manager government structure, including the mayor, city manager, and elected officials. It also explains how residents can participate in the government decision-making process.

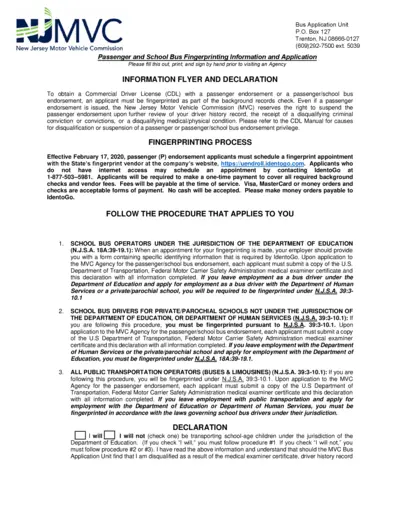

Passenger and School Bus Driver Application

This file provides detailed instructions and forms required for obtaining a Commercial Driver License (CDL) with a passenger or passenger/school bus endorsement in New Jersey. It includes fingerprinting information, medical examiner certificate requirements, and a declaration form. Applicants must complete the form, print, and sign it before visiting an Agency or the New Jersey Motor Vehicle Commission.

Facility Clearance (FCL) Orientation Handbook - March 2021

This handbook provides a comprehensive orientation to the Facility Clearance (FCL) process. It outlines responsibilities, deadlines, and guidance. It includes detailed process information and required forms.

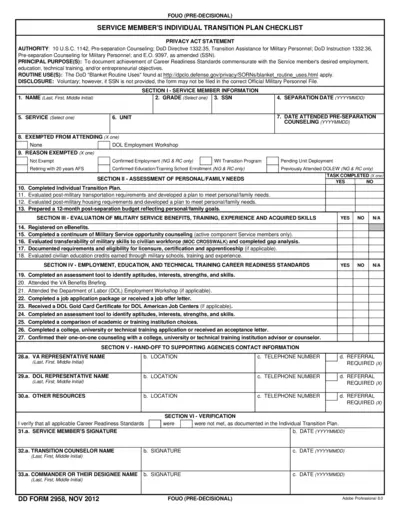

Service Member's Individual Transition Plan Checklist

This file is a checklist intended for service members to document and certify the achievement of career readiness standards as they transition out of the military. It includes sections for personal and family needs assessment, evaluation of military service benefits and acquired skills, career readiness standards, and contact information for supporting agencies. The checklist must be completed and verified by the service member, transition counselor, and unit commander prior to separation.

Bangladesh Judicial Service Commission Form Instructions

This document provides detailed instructions for filling out and submitting the Bangladesh Judicial Service Commission form, including essential deadlines and required fields.

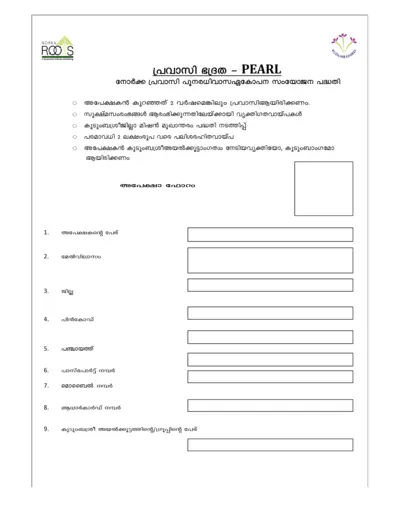

NORKA, RØD S - Government of Kerala Undertaking File

This document is issued by the Government of Kerala and pertains to various government-related undertakings. It provides important instructions and details necessary for various procedures. Users should follow the guidelines carefully to ensure compliance.

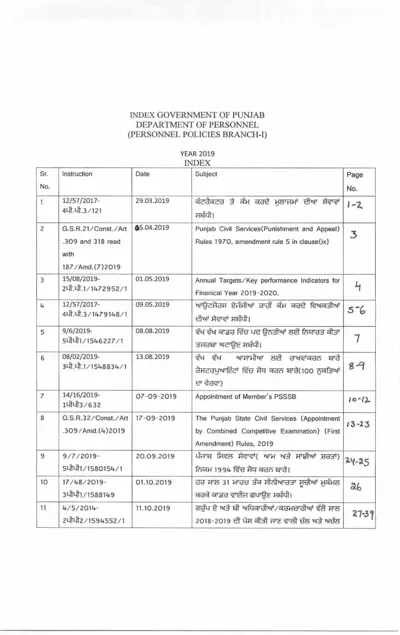

GOVERNMENT OF PUNJAB DEPARTMENT OF PERSONNEL MANUAL 2019

This document is a manual by the Government of Punjab's Department of Personnel, outlining various personnel policies and instructions issued in the year 2019. It includes amendments, performance indicators, appointment procedures, and relevant rules for civil services and recruitment. The manual serves as a comprehensive guide for personnel management and related administrative processes.

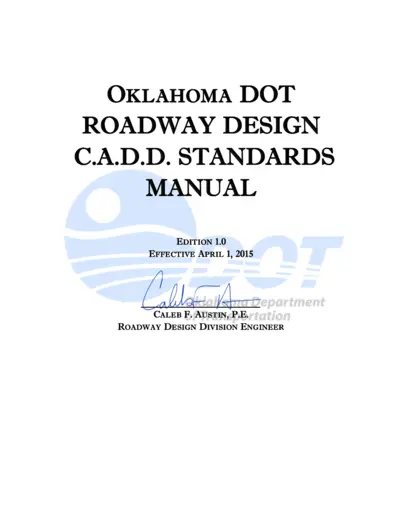

Oklahoma DOT Roadway Design CADD Standards Manual

The Oklahoma DOT Roadway Design CADD Standards Manual effective April 1, 2015 details the best practices for all related engineering work. Following these standards ensures readability, uniformity, and proficiency in design plans. This manual is essential for designers working with or for the Oklahoma Department of Transportation.

Affordable Connectivity Program Application Form FCC Form 5645

FCC Form 5645 is an application form for the Affordable Connectivity Program (ACP) that provides monthly internet service discounts and a one-time device benefit for qualifying low-income consumers. The form includes sections for personal information, identity verification, and household details. Instructions for submission and required documentation are also provided.