Passive Activity Loss Limitations IT-182 for 2023

This document provides guidelines for passive activity loss limitations applicable to nonresidents and part-year residents in New York State. It is essential for accurately reporting rental real estate and other passive activities. Ensure to follow the provided instructions for correct submission.

Edit, Download, and Sign the Passive Activity Loss Limitations IT-182 for 2023

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, start by gathering all relevant information regarding your passive activities. Follow the instructions closely to enter your loss calculations accurately. Remember to double-check for any required documentation before submission.

How to fill out the Passive Activity Loss Limitations IT-182 for 2023?

1

Gather necessary documents and information.

2

Complete Part I regarding passive activity losses.

3

Fill out Part II for any special allowances applicable.

4

Complete Parts III to VIII if necessary, based on your activities.

5

Review your entries and submit with the required forms.

Who needs the Passive Activity Loss Limitations IT-182 for 2023?

1

Nonresident taxpayers who have rental real estate activities.

2

Part-year residents needing to report passive losses for their time in New York.

3

Individuals with passive activity losses from partnerships or S-corporations.

4

Tax professionals assisting clients with passive activity loss limitations.

5

Anyone interested in accurately reporting tax obligations related to real estate.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Passive Activity Loss Limitations IT-182 for 2023 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Passive Activity Loss Limitations IT-182 for 2023 online.

Editing this PDF on PrintFriendly is simple and efficient. You can adjust fields and input your information seamlessly. Our intuitive interface allows for hassle-free modifications to fit your personal or business needs.

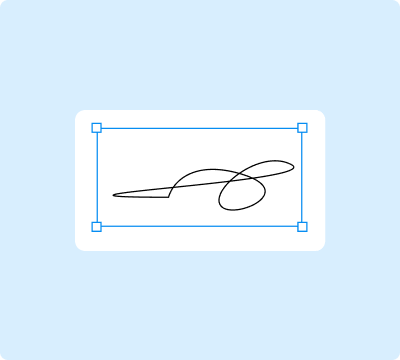

Add your legally-binding signature.

Signing this PDF on PrintFriendly is quick and convenient. Utilize our signing feature to add your signature electronically, ensuring the document is ready for submission. This eliminates the need for printing and scanning.

Share your form instantly.

Sharing the PDF on PrintFriendly can be done with just a few clicks. Send the edited document to colleagues or clients via email directly from the platform. This functionality streamlines collaboration on your tax documents.

How do I edit the Passive Activity Loss Limitations IT-182 for 2023 online?

Editing this PDF on PrintFriendly is simple and efficient. You can adjust fields and input your information seamlessly. Our intuitive interface allows for hassle-free modifications to fit your personal or business needs.

1

Open the PDF document in PrintFriendly.

2

Select the fields you wish to edit and make necessary changes.

3

Add or remove information as needed for accuracy.

4

Preview the document to ensure all edits are correct.

5

Download the finalized document for submission.

What are the instructions for submitting this form?

To submit the IT-182 form, complete the required sections accurately and ensure all calculations are correct. You can submit your form along with your main tax return form IT-203 or IT-205 either by mail or electronically, if applicable. For any inquiries, reach out to the New York State Department of Taxation and Finance for guidance on submission methods.

What are the important dates for this form in 2024 and 2025?

For the tax filing years 2024 and 2025, ensure compliance with the deadlines set by the NY State Department of Taxation. Typical filing deadlines for individual tax returns are usually April 15. Check for any state-specific extensions or modifications.

What is the purpose of this form?

The IT-182 form is designed to assist nonresidents and part-year residents in New York State in reporting their passive activity losses accurately. Understanding and utilizing this form is crucial for proper tax reporting, especially regarding rental real estate activities. The form guides users through the process of calculating and reporting these losses on their tax returns.

Tell me about this form and its components and fields line-by-line.

- 1. Part I: This section covers general passive activity loss calculations.

- 2. Part II: Special allowances for rental real estate activities with active participation.

- 3. Part III: Total losses allowed from passive activities for the tax year.

- 4. Part IV: Documents net income and losses from rental properties.

- 5. Part V: Allows for reporting of other passive activities.

What happens if I fail to submit this form?

Failure to submit this form can lead to improper reporting of your passive losses, which may result in penalties. The IRS and state tax authorities rely on accurate forms for processing returns.

- Potential Penalties: Incorrect submissions could lead to fines and fees imposed on the taxpayer.

- Delays in Processing: Failure to submit accurately can result in delays in your tax refund.

- Audit Risk: Inaccurate reporting increases the chances of an audit by tax authorities.

How do I know when to use this form?

- 1. Nonresident Rental Activities: Use this form if you have rental real estate in New York as a nonresident.

- 2. Part-Year Residency Reporting: Complete this form for losses incurred during your part-year residency.

- 3. Passive Loss From Partnerships: This form is also applicable for losses reported from partnerships or S corporations.

Frequently Asked Questions

How can I download this form?

You can download the form directly after editing by clicking the download button.

Is it possible to print this form?

Yes, once you finish editing, you can print the form directly from PrintFriendly.

Can I fill this form with my mobile device?

Absolutely! PrintFriendly is optimized for use on mobile devices.

What if I make a mistake during editing?

You can easily undo any changes or re-edit the fields to correct mistakes.

Is there an option to save my edits?

You can download your edited document, which will include all changes you made.

How do I share the document with someone else?

Use the share button to send your document via email to anyone.

Can I sign the PDF electronically?

Yes, you can add an electronic signature to your PDF using PrintFriendly.

Do I need an account to use PrintFriendly?

No account is needed to edit or download the PDF.

Can I edit multiple PDFs at once?

Currently, each PDF needs to be edited individually.

What formats can I download this form in?

You can download the edited form in PDF format.

Related Documents - NY Passive Loss Form IT-182

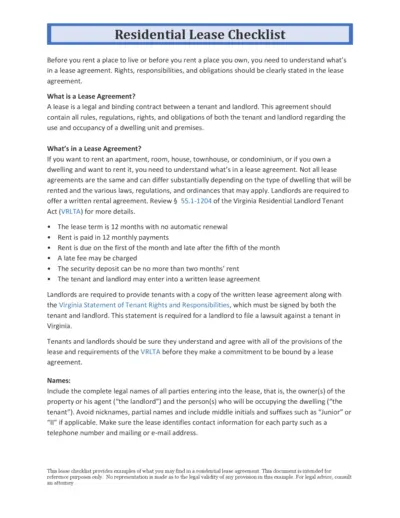

Residential Lease Agreement Checklist for Tenants and Landlords

This document provides a detailed checklist of what both tenants and landlords need to know and include in a residential lease agreement. It covers key elements such as lease terms, rent payment schedules, and maintenance responsibilities. Use this guide to ensure all rights and obligations are clearly outlined in your lease agreement.

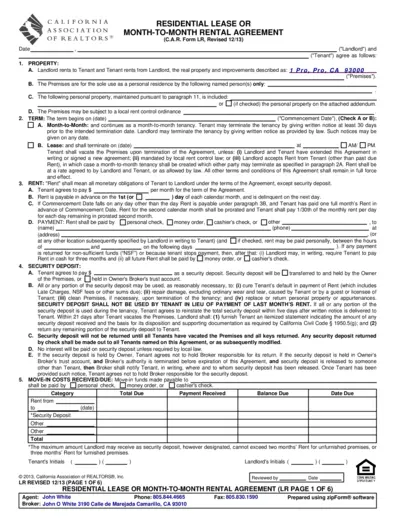

Residential Lease or Month-to-Month Rental Agreement

This file contains a comprehensive residential lease or month-to-month rental agreement used in California. It provides details on terms, obligations, and conditions for both landlords and tenants. Perfect for those seeking a standardized rental agreement form.

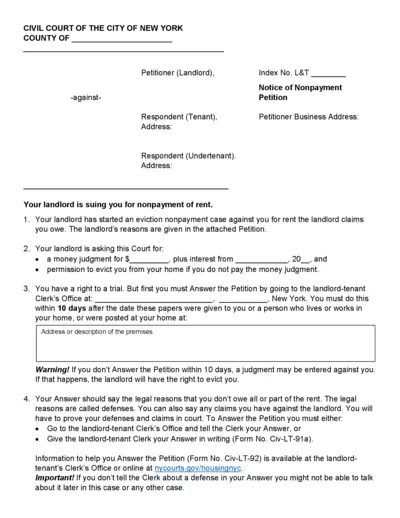

Civil Court of the City of New York Nonpayment Petition

This document is a Notice of Nonpayment Petition issued by the Civil Court of the City of New York. It details the actions that a landlord can take against a tenant for nonpayment of rent. It includes instructions on how the tenant can respond and their rights.

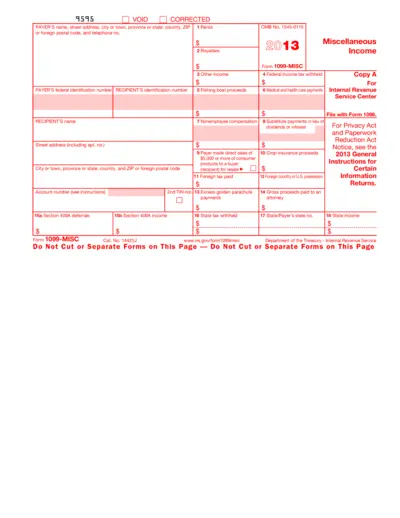

Form 1099-MISC: Miscellaneous Income for 2013

This file is a 2013 version of the IRS Form 1099-MISC used to report miscellaneous income. It includes fields for reporting various types of payments made to individuals or entities. The form is typically filed by payers to report income paid to recipients.

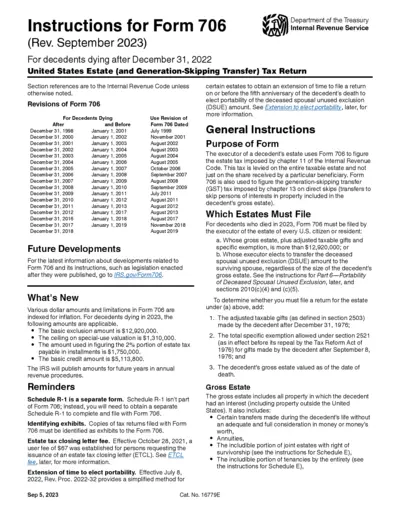

Instructions for Form 706 (Rev. September 2023)

This document provides detailed instructions for completing Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return for decedents dying after December 31, 2022. It includes information on revisions, general instructions, and specific filing requirements. The instructions also cover important updates and reminders related to the form.

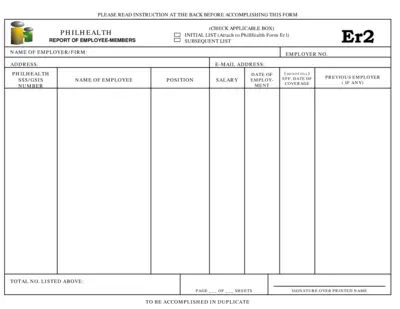

PhilHealth Report of Employee-Members Form Instructions

This file provides instructions for employers on how to fill out and submit the PhilHealth Report of Employee-Members form. It is essential for employers to report new hires to PhilHealth to ensure proper coverage. Detailed instructions and requirements are included.

Copyright Registration Form TX Instructions

This form is used for the registration of nondramatic literary works, such as fiction, nonfiction, poetry, textbooks, and computer programs. It provides detailed information on how to complete the form, including what information is required for each section and how to submit the application. Use it to ensure your work is properly registered for copyright protection.

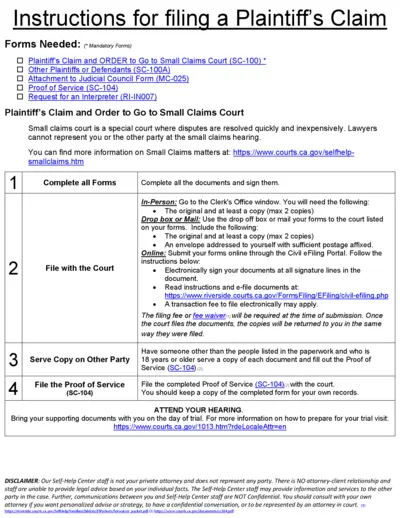

Plaintiff's Claim and Instructions for Small Claims Court

This file provides instructions and necessary forms for filing a Plaintiff's Claim in Small Claims Court. It includes details on filling out, submitting, and serving the forms. Ensure to follow the steps carefully to protect your rights.

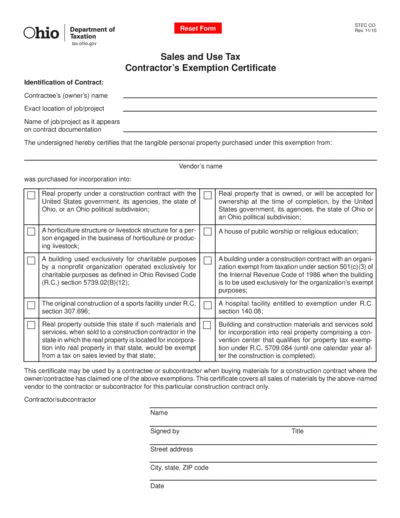

Ohio Sales and Use Tax Contractor's Exemption Certificate

This document is the Ohio Sales and Use Tax Contractor's Exemption Certificate. Contractors use this form to claim exemptions on certain taxable goods for specified exempt uses. It's crucial for contractors working with tax-exempt entities or on tax-exempt projects.

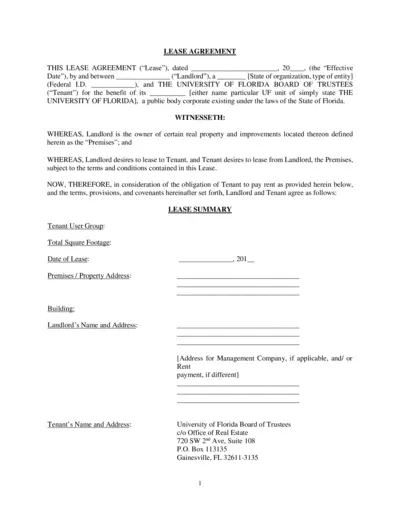

Lease Agreement for University of Florida Premises

This lease agreement file outlines the terms and conditions for renting a property owned by the Landlord to the University of Florida Board of Trustees. It covers key aspects such as lease term, rent details, improvements, and permitted use. Ideal for landlords and tenants involved in leasing agreements.

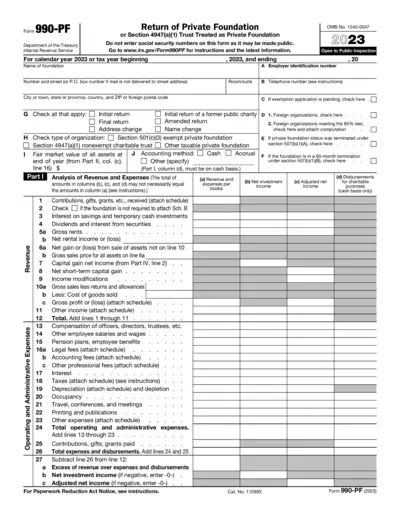

Return of Private Foundation Form 990-PF 2023

Form 990-PF is a return for private foundations required by the IRS. It includes information on revenue, expenses, and other financial details. Avoid entering social security numbers on this form.

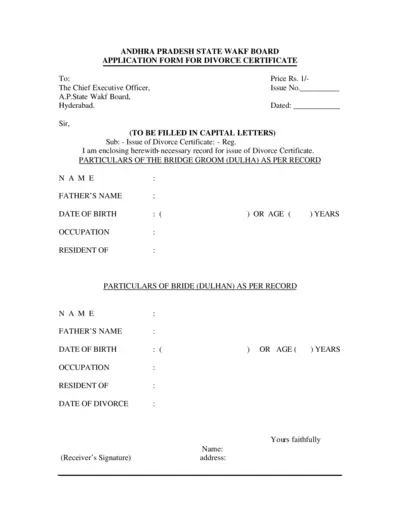

Application Form for Divorce Certificate - Andhra Pradesh State Wakf Board

This form is used to apply for a Divorce Certificate from the Andhra Pradesh State Wakf Board in Hyderabad. The form requires details of both bride and groom as per recorded information. It also includes fields for verification and office use only.