VITA/TCE Volunteer Standards of Conduct Training

This file contains essential information regarding the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. It outlines the ethical standards and conduct expected of volunteers. Users can also find resources for training and certification.

Edit, Download, and Sign the VITA/TCE Volunteer Standards of Conduct Training

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, start by carefully reviewing the Volunteer Standards of Conduct. Next, follow the instructions to complete the required sections accurately. Finally, ensure that you sign and date the form before submission.

How to fill out the VITA/TCE Volunteer Standards of Conduct Training?

1

Review the Volunteer Standards of Conduct carefully.

2

Complete the required sections of the form accurately.

3

Check your information against your valid ID.

4

Have the form signed by an approving official.

5

Submit the completed form to your designated coordinator.

Who needs the VITA/TCE Volunteer Standards of Conduct Training?

1

Volunteers in the VITA/TCE programs need this file to understand their ethical obligations.

2

Tax preparers must follow the guidelines to comply with IRS standards.

3

Quality reviewers require this file to certify their understanding of the review process.

4

Coordinators need the details to guide their teams effectively.

5

Tax law instructors use this document to teach ethical conduct to aspiring volunteers.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the VITA/TCE Volunteer Standards of Conduct Training along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your VITA/TCE Volunteer Standards of Conduct Training online.

Editing this PDF on PrintFriendly is straightforward. You can access our PDF editor to customize the document as needed. Be sure to save your changes to retain the updated information.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is an easy process. Utilize our signature tool to add your name directly onto the document. Once signed, you can download or share the signed PDF as necessary.

Share your form instantly.

Sharing your PDF on PrintFriendly is simple and convenient. Use the share functionality to send the document to your desired recipients. You can also generate a shareable link for easy access.

How do I edit the VITA/TCE Volunteer Standards of Conduct Training online?

Editing this PDF on PrintFriendly is straightforward. You can access our PDF editor to customize the document as needed. Be sure to save your changes to retain the updated information.

1

Open the PDF file in PrintFriendly's editor.

2

Select the text or sections you wish to edit.

3

Make the necessary changes to the content.

4

Once edits are complete, review your document.

5

Save the edited PDF to download or share.

What are the instructions for submitting this form?

Submit the completed Volunteer Standards of Conduct form to your program coordinator via email or fax. Alternatively, physical copies can be mailed to the designated IRS office. Ensure to keep a copy of your submission for your records.

What are the important dates for this form in 2024 and 2025?

For the year 2024, ensure to complete your training by February 15th. Certification tests must be passed before starting to volunteer. Always check with your local program for specific dates.

What is the purpose of this form?

The purpose of the VITA/TCE Volunteer Standards of Conduct is to establish a framework of ethical behavior expected from volunteers. This document ensures all participants understand their roles in maintaining the integrity of the tax assistance programs. Following these standards helps create a trustworthy environment for taxpayers seeking assistance.

Tell me about this form and its components and fields line-by-line.

- 1. Volunteer Name: The full legal name of the volunteer.

- 2. Address: The home address matching government-issued ID.

- 3. Certification Test Date: Date when the certification test was completed.

- 4. Signature: The digital or hand signature of the volunteer agreeing to the standards.

What happens if I fail to submit this form?

Failing to submit this form may result in disqualification from the VITA/TCE programs. Volunteers may also risk encountering legal ramifications if they engage in tax preparation without proper certification.

- Removal from Program: Volunteers who do not submit the form can be removed from participation.

- Legal Consequences: Engaging in unauthorized tax preparation can lead to legal issues.

- Loss of Certification: Failure to comply may result in losing certification opportunities for future service.

How do I know when to use this form?

- 1. Before Starting Service: Volunteers must complete this form prior to their first service date.

- 2. After Training Completion: This form is essential once training sessions are completed.

- 3. When Renewing Participation: Returning volunteers must resubmit this form for each new season.

Frequently Asked Questions

What is the purpose of this file?

This file serves to inform VITA/TCE volunteers about the standards of conduct they must adhere to.

How can I edit the PDF?

You can edit the PDF by accessing it via the PrintFriendly editor and making your changes.

Is there a training component associated with this file?

Yes, the file includes links to essential training resources for volunteers.

What happens if I don’t adhere to the standards?

Failing to comply may result in removal from the program and additional consequences.

Can I download the edited PDF?

Yes, after making your edits, you can download the updated PDF.

Do I need to register to use the editing features?

No registration is required to edit and download your PDF.

Is there a certification test mentioned?

Yes, volunteers must complete a certification test prior to volunteering.

Who should I contact for help?

For assistance, please contact your program coordinator.

How do I get updates on training materials?

Updates can be found in Publication 4491-X, available at the IRS website.

What if I need to sign the document?

You can use PrintFriendly's signing tool to add your signature to the PDF.

Related Documents - VITA TCE Ethics Training

Recovery Loan Scheme Phase 3 Application Form

This file provides guidance and instructions for UK businesses to apply for secured loans under the government-backed Recovery Loan Scheme (RLS) Phase 3 with Atom bank.

Managing Financial Affairs and Estate Planning Guide

This file provides detailed guidance on managing financial affairs and estate planning. It covers crucial legal documents and advance care planning. It also includes information on funeral planning and resources for end-of-life concerns.

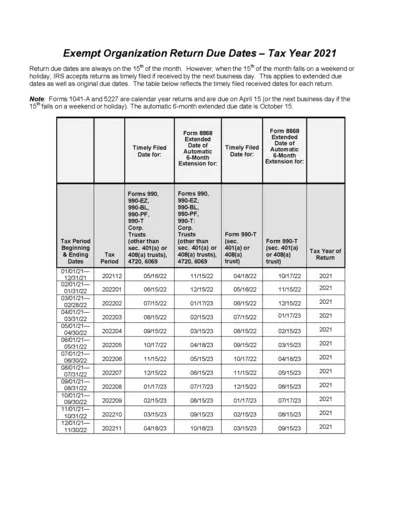

Exempt Organization Return Due Dates - Tax Year 2021

This file provides detailed information on return due dates for exempt organizations for the tax year 2021. It includes original and extended due dates, along with specific forms and filing periods. Use this guide to ensure timely submission of your tax returns.

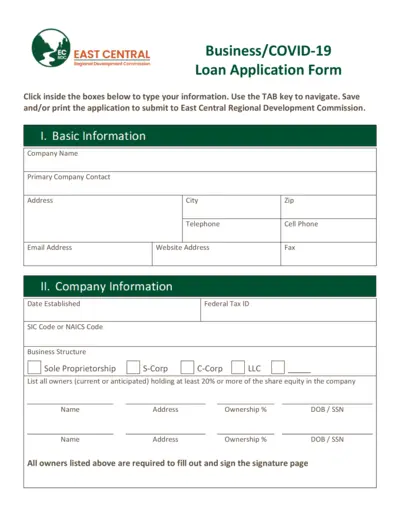

Business/COVID-19 Loan Application - East Central Regional Development Commission

This file is a loan application form provided by the East Central Regional Development Commission for businesses affected by COVID-19. It includes sections for basic information, company information, requested amount, sources and use of funds, proposed financing terms, job creation, and business profile. The application can be filled out, saved, and printed for submission.

Mobile Banking Application Download Guide

This document guides you through the process of downloading the SBI Mobile Banking application to your phone using either Bluetooth or a data cable. Detailed steps are provided for both methods to ensure a smooth installation. Ensure you follow each step carefully for successful application setup.

Foreign Income Verification Statement (T1135) Information

This document provides detailed guidelines about the Foreign Income Verification Statement (T1135) disclosure. It explains who must file it, what foreign properties must be reported, and the penalties for non-compliance. There are also instructions on how to file the form and how a tax specialist can assist.

The Modernization of Annuities: Insights for RIAs and Clients

This file provides detailed information on the modernization of annuities, designed for registered investment advisors (RIAs) and wealth managers. It covers types of annuities, their benefits, and how they integrate with financial planning tools. It also includes statistical insights on the use of annuities by pre-retirees and retirees.

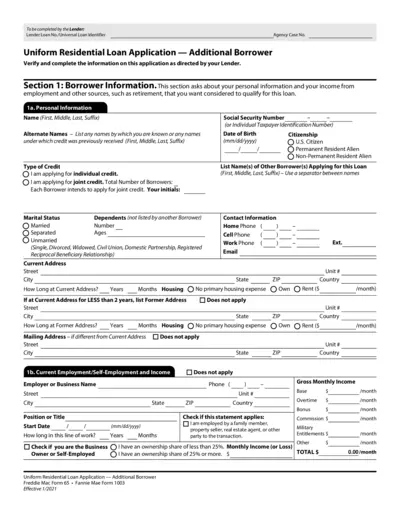

Uniform Residential Loan Application - Additional Borrower

This file is a Uniform Residential Loan Application for an additional borrower. It includes sections to fill out personal information, employment details, income sources, and other financial information required for a loan application. The file is intended to be completed by the lender and borrower.

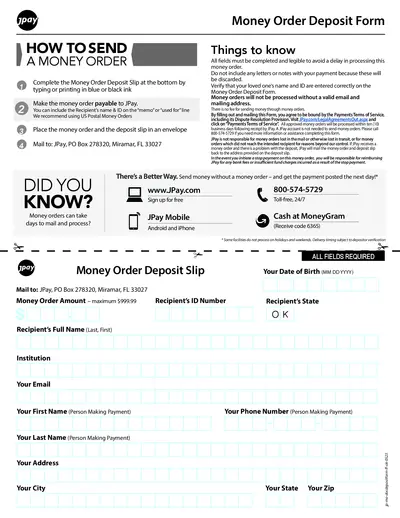

How to Send a Money Order with JPay

This document provides step-by-step instructions on sending a money order through JPay. It includes a fillable deposit slip form and important guidelines for completing and mailing your money order. Ensure all details are correct to avoid processing delays.

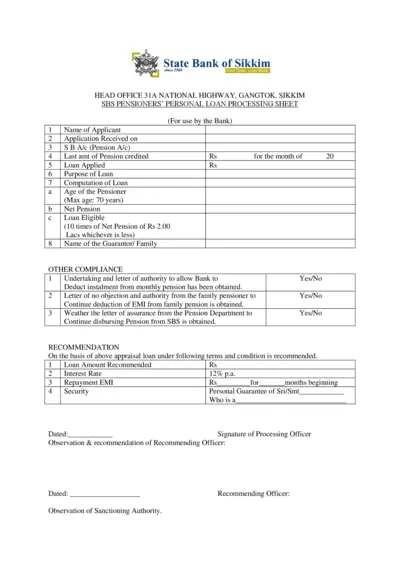

SBS Pensioners Personal Loan Processing Sheet

This document is a processing sheet for the SBS Pensioners Personal Loan for pensioners seeking loans from the State Bank of Sikkim. It guides applicants through the necessary details required for loan processing and approval. The form includes sections for applicant information, loan eligibility, and required compliance documents.

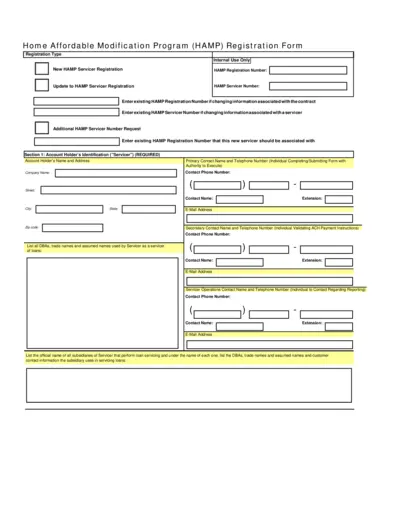

Home Affordable Modification Program Registration

This file provides essential instructions for servicers in the Home Affordable Modification Program (HAMP). It includes details about registration, ACH payment instructions, and contact information requirements. Utilize this form to ensure compliance with HAMP regulations.

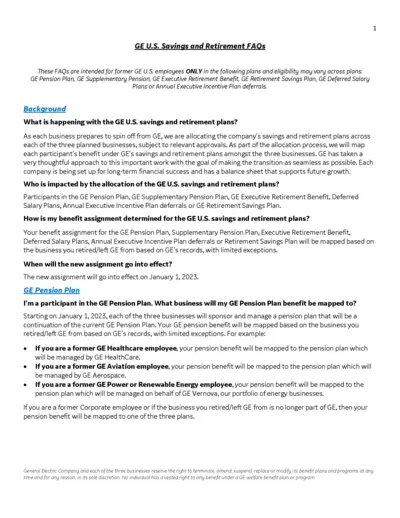

GE U.S. Savings and Retirement FAQs

This document contains essential FAQs about GE U.S. savings and retirement plans, tailored for former GE employees. It provides critical information regarding benefit assignments, pension plan mappings, and upcoming changes affecting retirement resources.