Personal Finance Documents

Savings Accounts

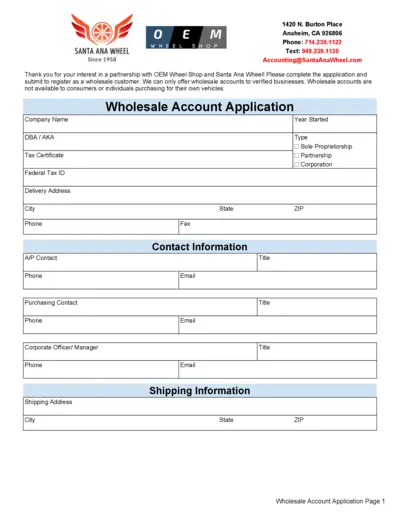

Wholesale Account Application Form - Santa Ana Wheel

This file contains the wholesale account application for Santa Ana Wheel. It provides necessary details and instructions for businesses. Complete the application to register as a wholesale customer.

Tax Forms

2021 Form 1040-V Guide for IRS Tax Payments

Form 1040-V is a payment voucher for individuals submitting tax payments. It is required if you owe a balance on your tax return. This guide provides essential instructions for filling out and submitting Form 1040-V.

Investment Accounts

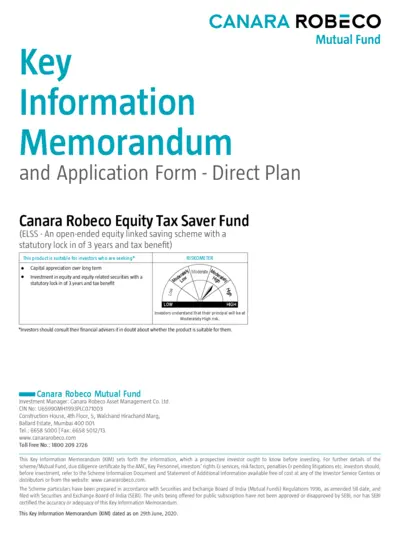

Canara Robeco Equity Tax Saver Fund KIM

This file contains essential information for investors considering Canara Robeco's Equity Tax Saver Fund. It provides details about the investment strategy, risk factors, and key information relevant for making informed investment decisions. It serves as a guide for existing and potential investors navigating their options.

Tax Forms

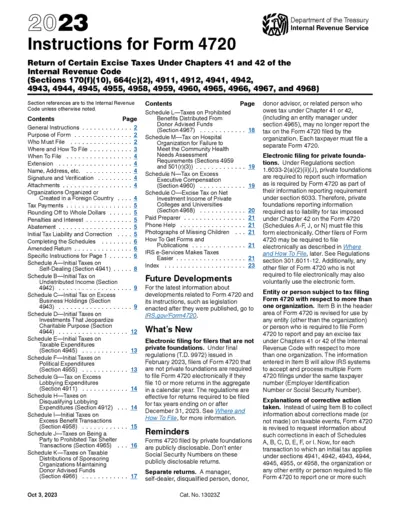

Instructions for Form 4720 - Excise Tax Reporting

This document provides essential instructions for filing Form 4720, which is used to report certain excise taxes under Chapters 41 and 42 of the Internal Revenue Code. Ideal for tax-exempt organizations and foundations, it outlines relevant sections and filing requirements. Stay compliant and avoid penalties with this detailed guidance.

Banking

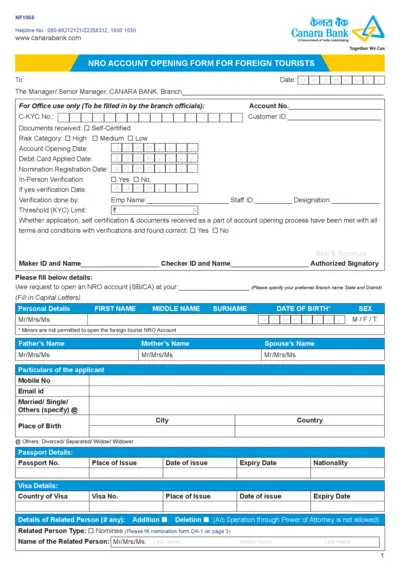

NRO Account Opening Form for Foreign Tourists

The NRO Account Opening Form is essential for foreign tourists wishing to open a Non-Resident Ordinary bank account in India. This comprehensive form collects necessary personal and financial details to facilitate account setup with Canara Bank. Ensure all sections are filled accurately to meet the bank's requirements.

Tax Forms

Instructions for Completing Form WH-4

This document contains detailed instructions for filling out Form WH-4, which is required for all Indiana employees. Learn how to correctly fill in your details to ensure proper tax withholding. Follow these guidelines to claim exemptions and ensure compliance with state tax regulations.

Tax Forms

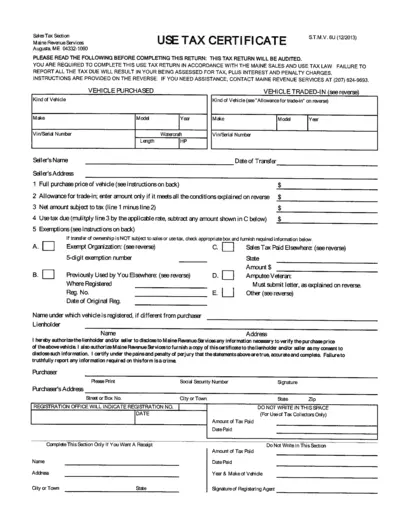

Maine Use Tax Certificate Instructions

This file contains detailed instructions for completing the Maine Use Tax Certificate. It helps individuals and organizations to understand the use tax obligations for vehicle purchases. Ensure compliance to avoid penalties by following the guidelines provided.

Estate Planning

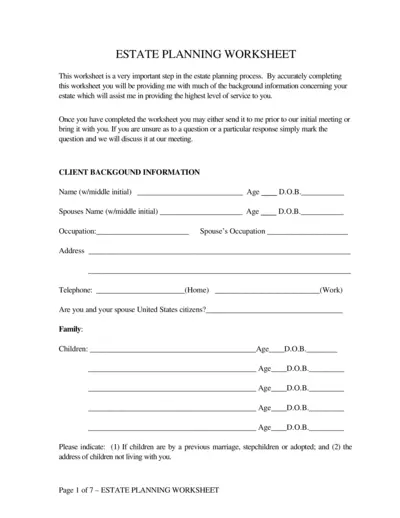

Estate Planning Worksheet for Effective Planning

The Estate Planning Worksheet is a crucial tool designed to guide individuals through the estate planning process. By accurately completing this worksheet, you'll provide essential information that aids in achieving optimal estate service. Whether you send it in prior to your meeting or bring it along, this worksheet is key to effective planning.

Tax Forms

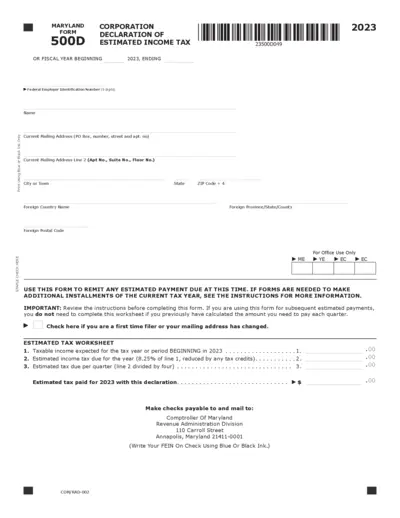

Maryland Form 500D Corporation Estimated Tax Declaration

Form 500D is essential for Maryland corporations to declare and remit their estimated income tax. This form ensures compliance with state tax laws, helping businesses avoid penalties. Properly filling out this form is crucial for effective financial planning.

Tax Forms

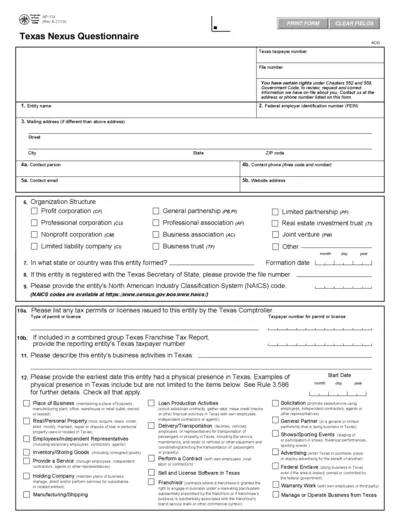

Texas Nexus Questionnaire AP-114 Submission Form

The Texas Nexus Questionnaire AP-114 is essential for entities doing business in Texas to determine franchise tax obligations. This form collects critical information regarding the entity's operations, presence, and relevant identifiers. Fill out this form to ensure compliance with Texas tax laws effectively.

Tax Forms

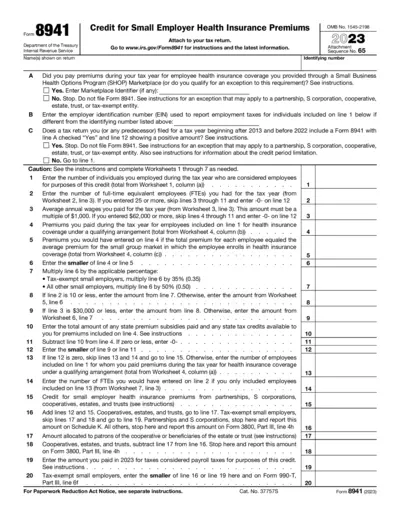

Form 8941 for Small Employer Health Insurance Premiums

Form 8941 allows small employers to claim a credit for health insurance premiums. This form is crucial for businesses using the SHOP Marketplace. Ensure accurate completion to qualify for the tax credit.

Tax Forms

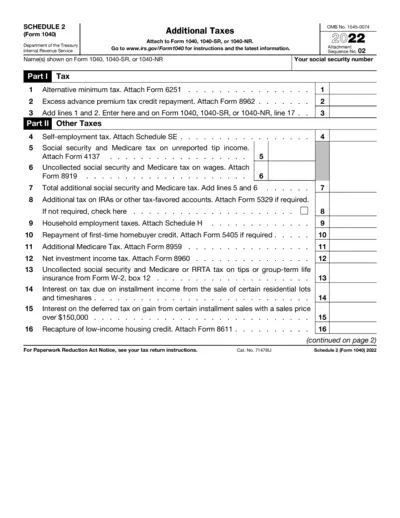

Schedule 2 Form 1040 Additional Taxes 2022

Schedule 2 of Form 1040 is used to report additional taxes owed by individuals. This includes taxes related to alternative minimum tax, self-employment tax, and more. It's essential for taxpayers to accurately complete this schedule to ensure compliance with tax regulations.