Personal Finance Documents

Tax Forms

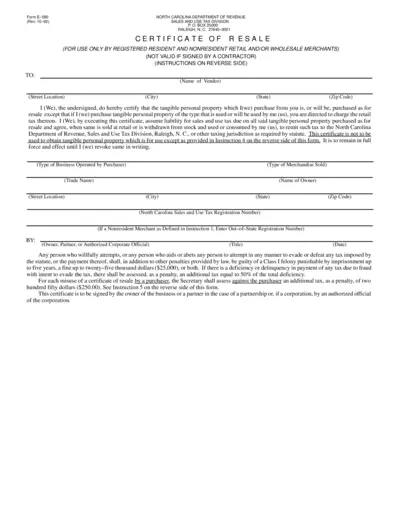

North Carolina Resale Certificate Form E-590 Instructions

This file contains the North Carolina Resale Certificate E-590, which is used by registered merchants for tax-exempt purchases. It outlines the necessary details and instructions for properly filling out the form. Ensure to adhere to the provided guidelines to avoid any penalties associated with misuse.

Loans

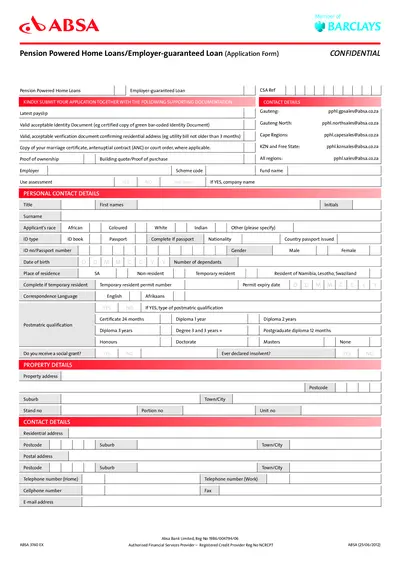

ABSA Pension Powered Home Loans Application Form

This document is an application form for ABSA's Pension Powered Home Loans. It outlines the required supporting documentation and personal information needed. Utilize this form to apply for a home loan backed by pension funds.

Tax Forms

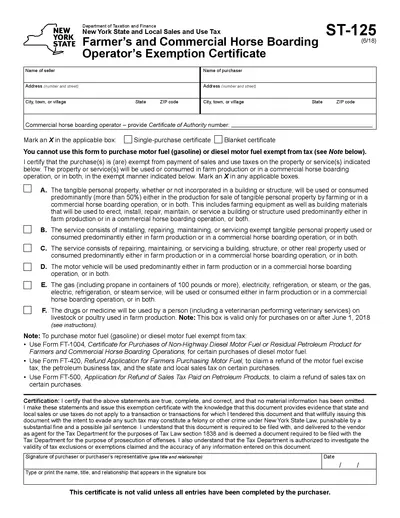

New York State Tax Exemption Certificate ST-125

The New York State ST-125 form is used to certify that a purchase is exempt from sales and use tax. This certificate applies to tangible personal property and specific services related to farm production and commercial horse boarding operations. It is essential for farmers and horse boarding operators to validate their tax-exempt purchases.

Tax Forms

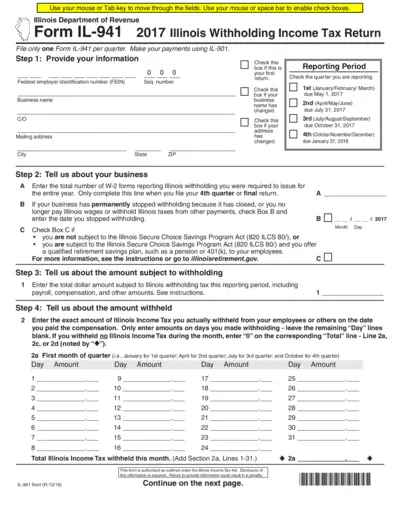

2017 Illinois Withholding Income Tax Return IL-941

The 2017 Illinois Withholding Income Tax Return (IL-941) is essential for businesses to report income tax withheld from employees. It guides employers in filing accurate tax returns quarterly. Complete the form to ensure compliance with Illinois tax regulations.

Banking

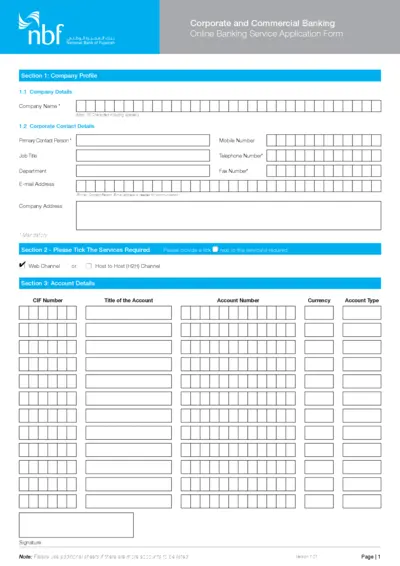

National Bank of Fujairah Online Banking Application

This form is used to apply for online banking services with the National Bank of Fujairah. It captures essential company and user information for corporate and commercial banking services. Ensure all mandatory fields are completed for successful processing.

Tax Forms

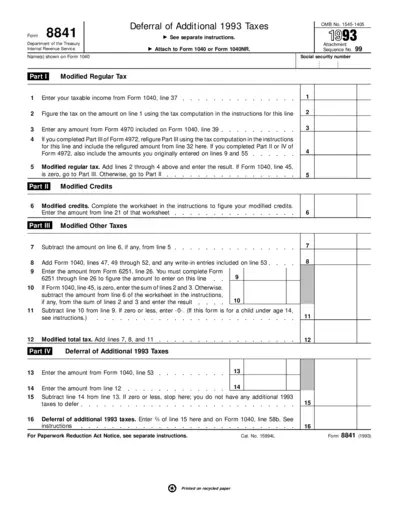

Form 8841 Instructions for Deferral of Taxes

Form 8841 is used by taxpayers to report certain deferrals of additional taxes for the tax year 1993. This form must be attached to Form 1040 or Form 1040NR. It includes detailed calculations related to modified regular tax and modified credits.

Banking

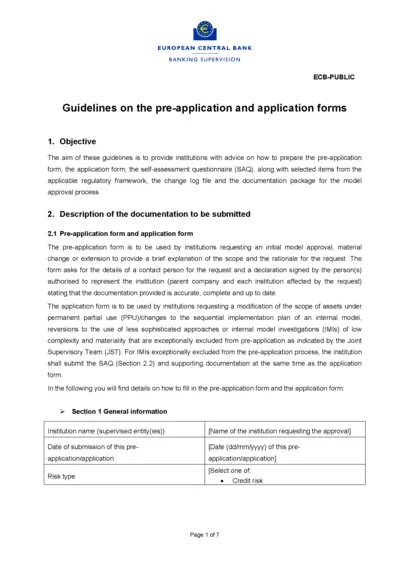

Guidelines for ECB Pre-Application and Application Forms

This document provides comprehensive guidelines for institutions on how to prepare the pre-application and application forms for model approval. It includes detailed instructions on completing the self-assessment questionnaire along with pertinent regulatory framework information. Institutions must follow these guidelines to ensure accurate and complete applications.

Banking

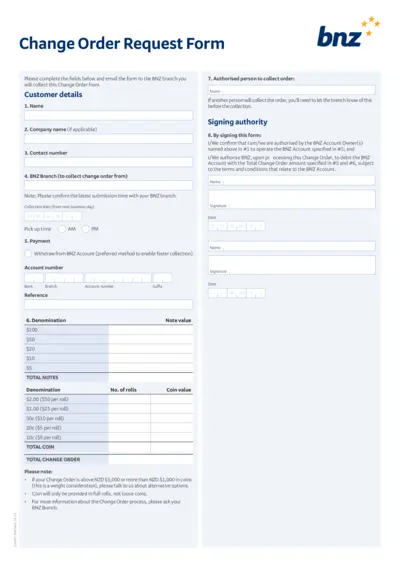

BNZ Change Order Request Form Instructions

This document contains the BNZ Change Order Request Form that customers must fill out for change orders. It includes customer details, payment options, and collection instructions. The form is essential for withdrawing cash in various denominations while ensuring a smooth process.

Tax Forms

Rideshare Tax Organizer for Self-Employed Drivers

This Rideshare Tax Organizer helps self-employed drivers track their income and expenses effectively. It's an essential tool for ensuring accurate tax filings. Use it to prepare for your tax return and maximize deductions.

Tax Forms

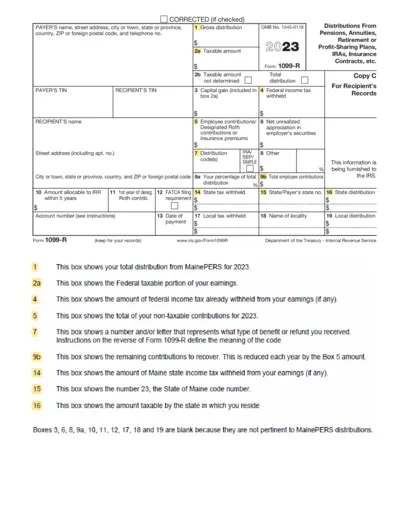

Form 1099-R Instructions for Filing 2023

This document provides essential information regarding the Form 1099-R. It outlines the details required for accurate filing, including distribution amounts. Users will find clear instructions on how to correctly fill out the form.

Tax Forms

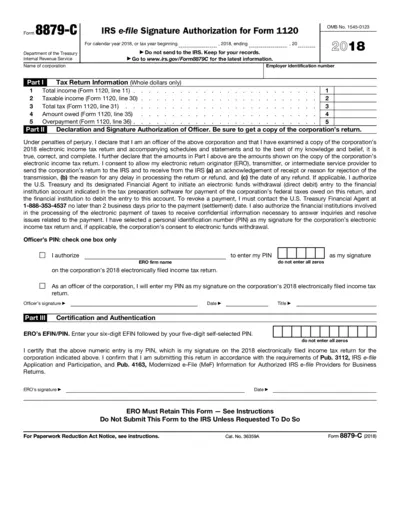

IRS Form 8879-C Signature Authorization for 2018

Form 8879-C is used for IRS e-filing of corporation tax returns. It enables a corporate officer to electronically sign the tax return using a PIN. This form must be completed and retained for records.

Banking

U.S. Bank Account Transition Information

This file contains essential details regarding the transition of State Farm Bank accounts to U.S. Bank. Users can find important dates and account information that will help them navigate the transition smoothly. It also provides contact resources for further assistance.