Personal Finance Documents

Tax Forms

Instructions for Form 1120-IC-DISC (2017)

Form 1120-IC-DISC is an essential document for interest charge domestic international sales corporations. It provides guidelines on filing requirements, penalties, and necessary documentation. Understanding and correctly completing this form is crucial for compliance with U.S. tax regulations.

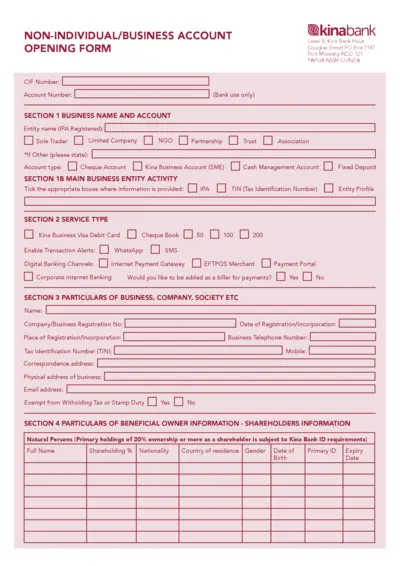

Banking

Business Account Opening Form PDF Instructions

This document provides a comprehensive form for opening a business account. It includes all necessary details and instructions for potential applicants. A must-read for businesses looking to engage with Kina Bank.

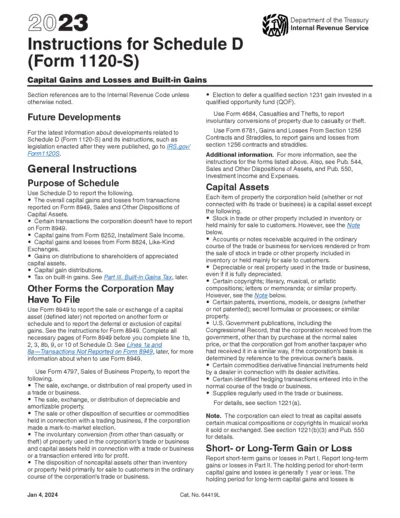

Tax Forms

Instructions for Schedule D Form 1120-S Capital Gains

This file provides essential instructions for filing Schedule D of Form 1120-S, detailing capital gains and losses. It offers guidance on reporting transactions and understanding related tax implications. Corporations can benefit from following these instructions to comply with IRS requirements.

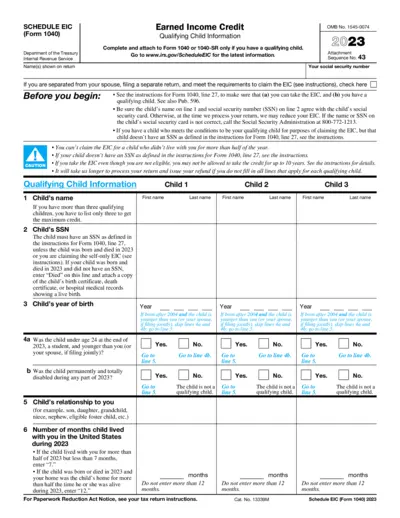

Tax Forms

Schedule EIC Form 1040 Earned Income Credit 2023

This file contains the Earned Income Credit form and its detailed instructions. It helps claim the Earned Income Credit if you have a qualifying child. Utilize the information to ensure accurate completion for tax purposes.

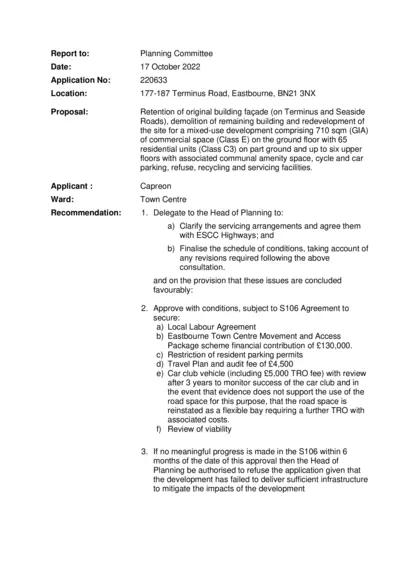

Estate Planning

Eastbourne Planning Application Report 2022

This file contains the detailed report for the retention and redevelopment of the site at 177-187 Terminus Road. It includes the proposal, recommendations, and relevant planning policies. Essential for stakeholders involved in urban planning in Eastbourne.

Tax Forms

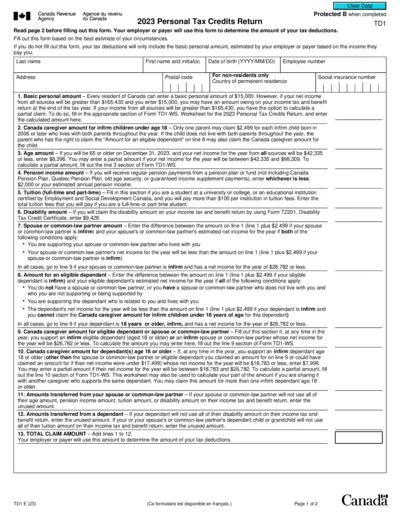

2023 Personal Tax Credits Return TD1 Guidance

The 2023 Personal Tax Credits Return (TD1) form is essential for Canadian residents to determine correct tax deductions. This form allows individuals to claim various personal tax credits based on their specific circumstances. Completing the TD1 accurately ensures proper deductions to avoid any year-end tax liabilities.

Tax Forms

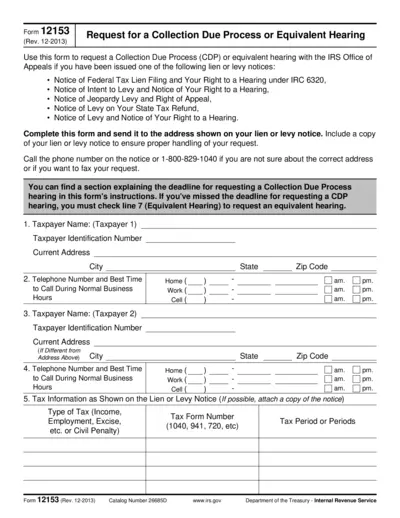

Form 12153 Request for Collection Due Process Hearing

Form 12153 allows taxpayers to request a Collection Due Process or equivalent hearing with the IRS regarding lien or levy notices. It is essential for ensuring taxpayer rights are upheld. Proper completion and submission of this form are necessary to initiate the hearing process.

Loans

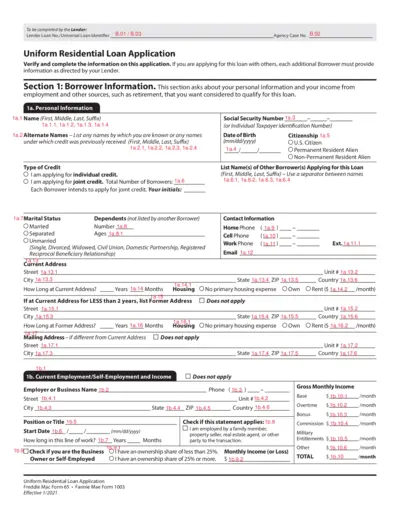

Uniform Residential Loan Application Guidelines

This file contains essential guidelines for completing a Uniform Residential Loan Application. It provides detailed instructions on borrower information, financial details, and the submission process. Perfect for anyone seeking a mortgage loan.

Tax Forms

Form FTB 3582 Instructions for Electronic Payments

This document provides essential instructions for completing Form FTB 3582, a payment voucher for individual e-filed returns. It outlines mandatory electronic payment requirements and the steps for submitting your voucher. Use this guide to ensure compliance and avoid penalties.

Loans

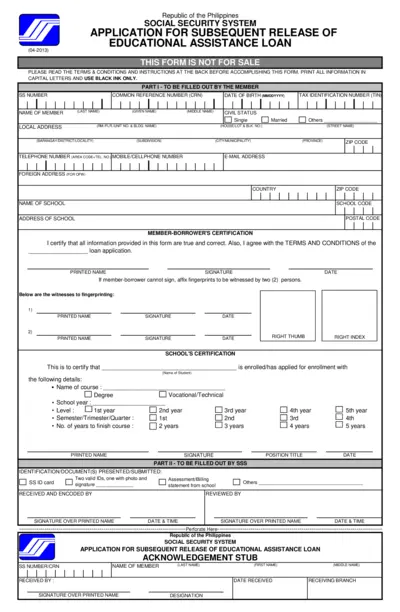

Educational Assistance Loan Application Form

This form allows members of the Social Security System to apply for educational assistance loans. It outlines the necessary requirements for eligibility, filling instructions, and important terms. Ensure to follow the instructions carefully for successful submission.

Loans

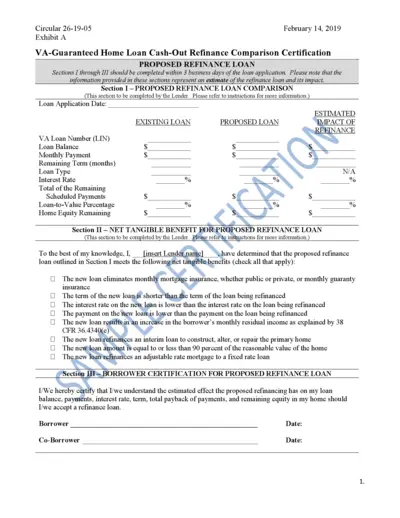

VA Home Loan Cash-Out Refinance Comparison

This file contains detailed certification information for VA Guaranteed Home Loans. It offers key comparisons between existing loans and proposed cash-out refinance loans. Utilize this document to understand refinancing impacts and requirements.

Tax Forms

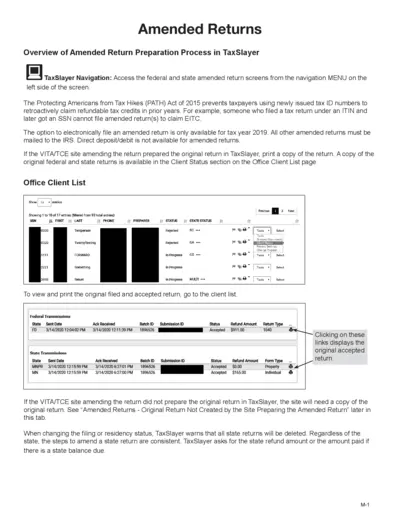

Amended Tax Return Filling Instructions with TaxSlayer

This document provides an overview of the amended return preparation process in TaxSlayer. Users will learn step-by-step instructions to properly fill out their amended returns. It is essential for those needing to make corrections to previously filed tax returns.