Personal Finance Documents

Tax Forms

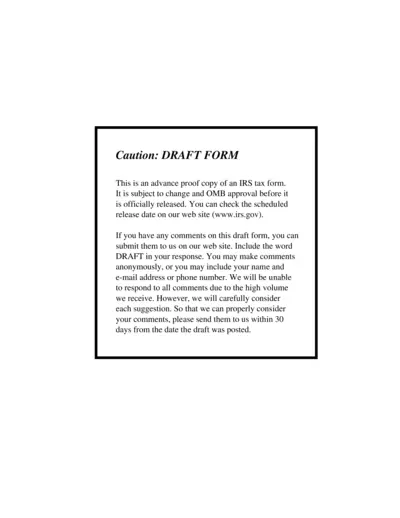

IRS Form 4563 Instructions for American Samoa Residents

This document provides essential instructions for completing IRS Form 4563. It is designed for bona fide residents of American Samoa to claim an exclusion of income. Familiarizing yourself with this form will ensure accurate submission and compliance with IRS guidelines.

Banking

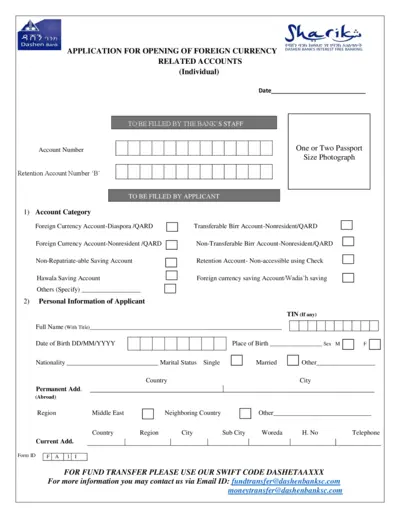

Dashen Bank Foreign Currency Account Application

This document serves as an application for opening foreign currency accounts at Dashen Bank. It contains necessary instructions and requirements for potential applicants. Ensure all information is filled out correctly for successful processing.

Tax Forms

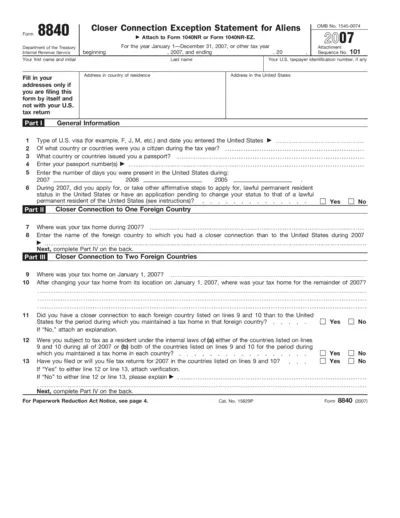

Form 8840 Closer Connection Exception Statement

Form 8840 is an IRS form designed for aliens to claim a closer connection to foreign countries for tax purposes. It is essential for those who want to establish nonresident status in the U.S. and avoid being taxed as residents. This form comprises various sections that detail personal information and tax residency.

Tax Forms

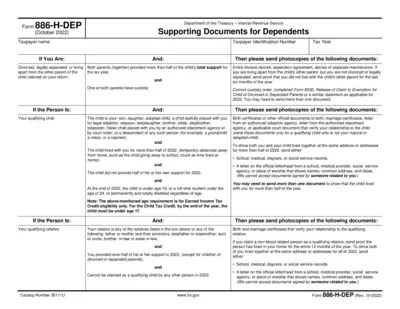

Supporting Documents for Dependents - Form 886-H-DEP

Form 886-H-DEP provides instructions for submitting necessary supporting documents related to dependents for tax purposes. It includes guidance for taxpayers who are divorced or separated. Ensure you have the correct documents to qualify for tax credits.

Tax Forms

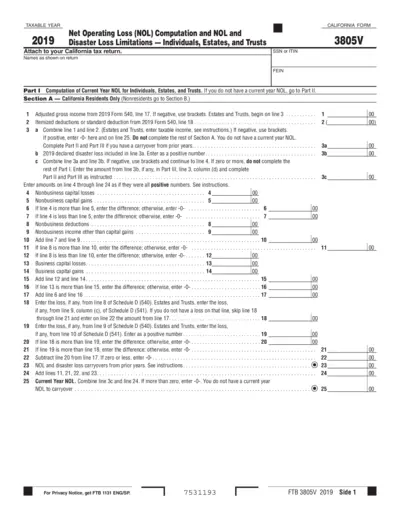

California NOL Computation and Limitations 2019

This document provides essential instructions for calculating 2019 Net Operating Loss (NOL) for California tax purposes. It helps individuals, estates, and trusts understand their qualifications and limitations. Follow the guidelines carefully to ensure accurate tax reporting.

Tax Forms

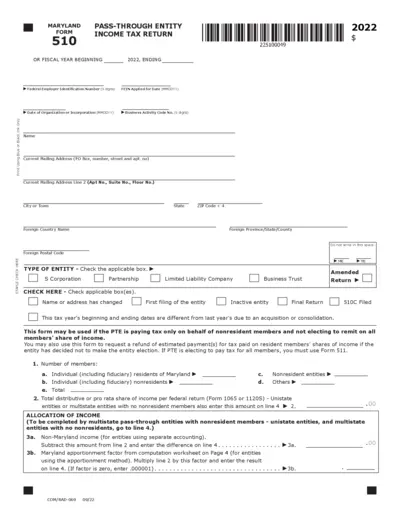

Maryland 510 Pass-Through Entity Income Tax Return

The Maryland Form 510 is a vital document for pass-through entities to report income on behalf of its members. It captures the entity's tax obligations for nonresident members for the tax year 2022. This form is essential for compliance and accurate tax reporting.

Tax Forms

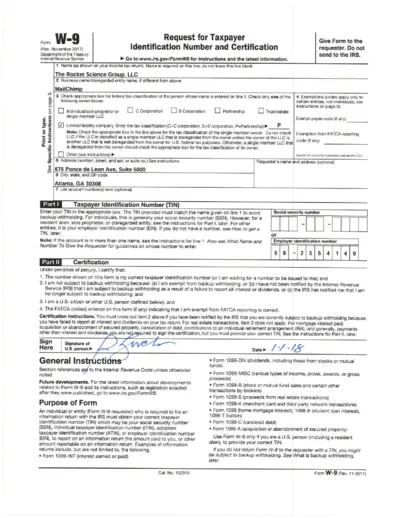

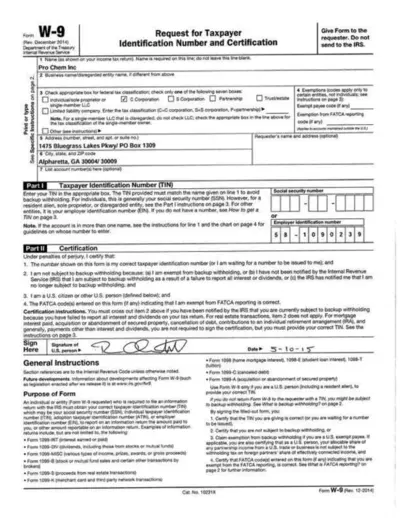

Request for Taxpayer Identification Number and Certification

The W-9 form is essential for individuals or entities requesting taxpayer identification information. It serves as a certification that the information provided is accurate. Completing this form enables proper tax reporting and avoids backup withholding.

Tax Forms

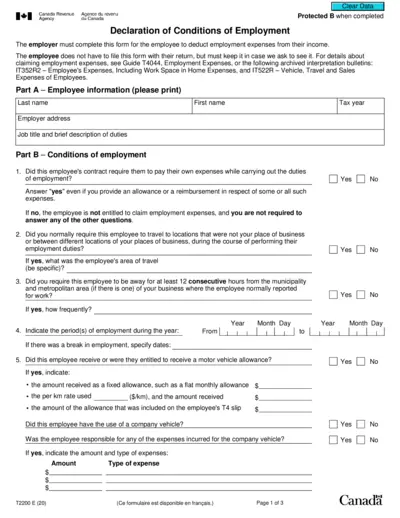

Canada Employment Expenses Declaration Form T2200 E

The T2200 E form is used for declaring employment-related expenses in Canada. Employers complete this form to allow employees to claim work-related expenses on their tax returns. Ensure you retain this form for your records, as it may be requested by the Canada Revenue Agency.

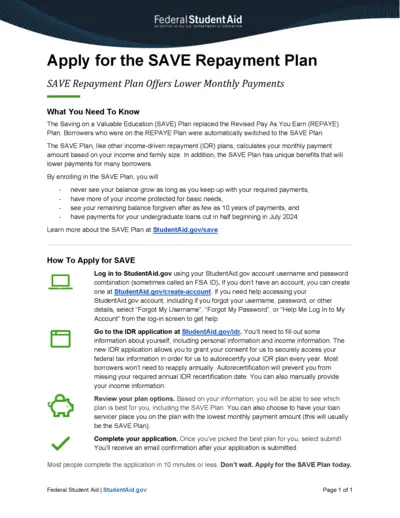

Loans

Apply for the SAVE Repayment Plan Efficiently

This file provides crucial information about the SAVE Repayment Plan. It offers guidance on applying and understanding the benefits of the plan. Ideal for borrowers seeking lower monthly payments based on income.

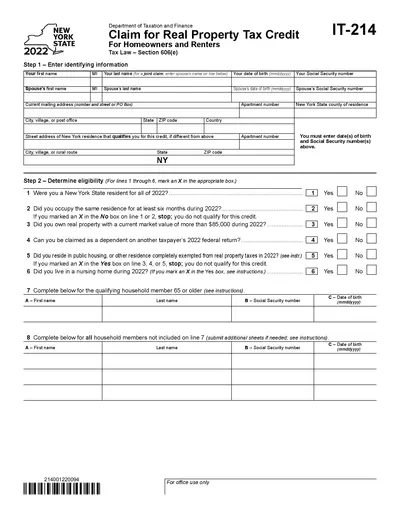

Tax Forms

New York State IT-214 Form for Property Tax Credit

The NYS IT-214 form allows homeowners and renters to claim a real property tax credit. It determines eligibility based on residency and income levels. Completing this form can provide significant financial relief for qualifying individuals.

Tax Forms

Form W-9 Instructions by IRS for Tax Identification

This file contains Form W-9, Request for Taxpayer Identification Number and Certification. It is used by individuals and entities to provide their correct taxpayer identification number (TIN) to requesters. Essential for tax documentation and regulatory compliance.

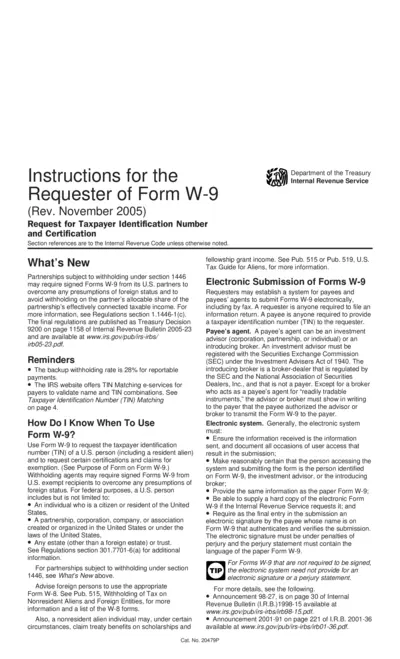

Tax Forms

Instructions for Form W-9 and Tax Identification

This document provides essential instructions for completing Form W-9. It outlines who needs to fill out the form and how to submit it accurately. Ensure compliance by following these guidelines.