Personal Finance Documents

Banking

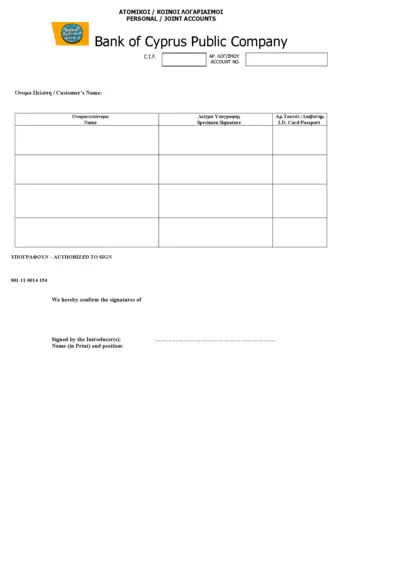

Personal Joint Accounts Application Form

This document serves as an application form for opening personal and joint accounts. It contains necessary fields to provide personal information for account setup. Users must fill out the form accurately to ensure compliance with banking regulations.

Banking

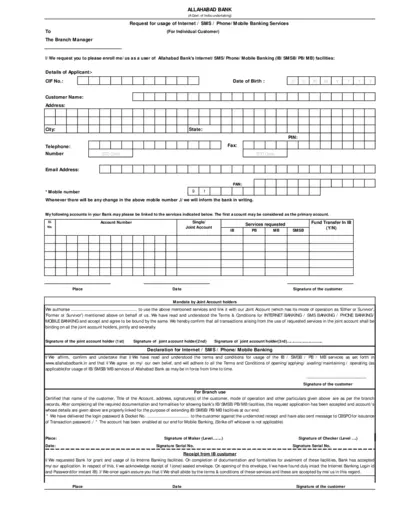

Internet Banking Request Form for Allahabad Bank

This file is a request form for enrolling in Internet banking services with Allahabad Bank. It includes personal details, account information, and required signatures. Ensure to follow the instructions carefully to facilitate the effortless processing of your request.

Tax Forms

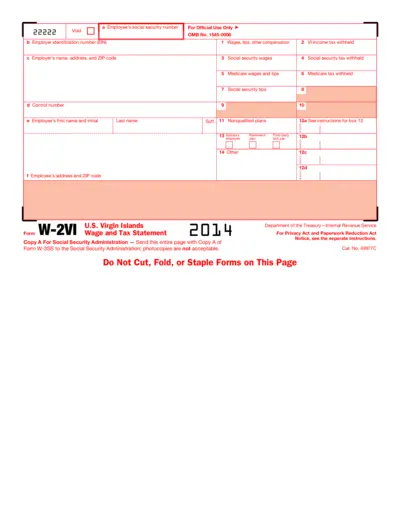

W-2VI Wage and Tax Statement for U.S. Virgin Islands

This W-2VI form is used for reporting wages and tax withheld for employees working in the U.S. Virgin Islands. It is essential for accurate tax filings. Utilize this document to ensure compliance with IRS regulations.

Tax Forms

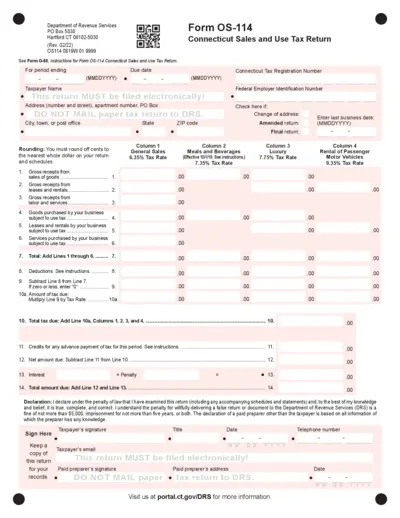

Connecticut Sales and Use Tax Return OS-114

This file contains the Connecticut Sales and Use Tax Return OS-114, required for filing sales taxes in Connecticut. It includes instructions for completing the form and deadlines for submission. Ensure electronic filing to avoid penalties.

Banking

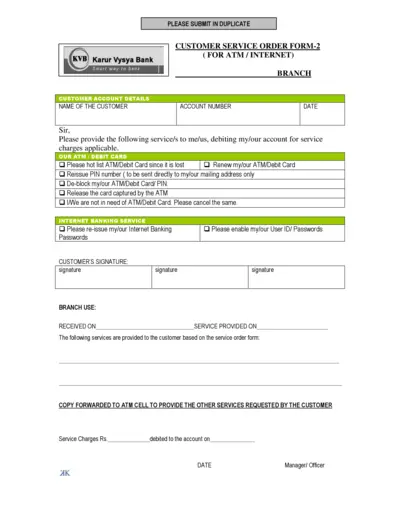

Karur Vysya Bank Customer Service Order Form

This form is used to request various banking services from Karur Vysya Bank. Users can provide specific instructions for their ATM and Internet banking needs. It's essential for managing services securely and efficiently.

Tax Forms

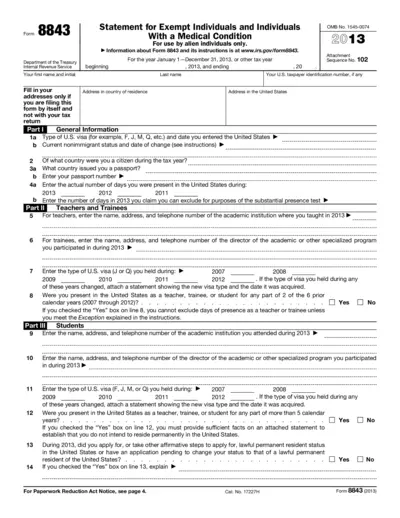

Form 8843 Instructions for Exempt Individuals

Form 8843 is a statement for exempt individuals and those with medical conditions, outlining the basis for excluding days of presence in the U.S. This form is essential for alien individuals who need to explain their presence in the country for tax purposes. Accurate completion and submission of this form can help avoid penalties.

Tax Forms

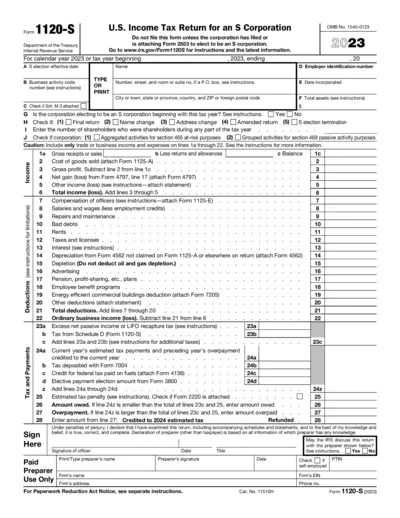

Form 1120-S: U.S. Income Tax Return for S Corporation

Form 1120-S is used by S Corporations to report income, deductions, and other tax-related information. This form must be filed annually by all S Corporations. The purpose of this form is to ensure compliance with IRS regulations for S Corporations.

Banking

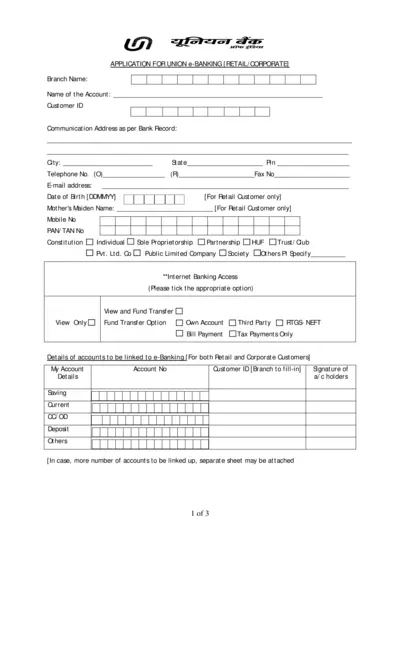

Application for Union e-Banking Services

This form is necessary for customers seeking access to Union e-Banking services, whether retail or corporate. It provides essential details necessary for setting up internet banking access. Fill it out carefully to enjoy a streamlined banking experience.

Tax Forms

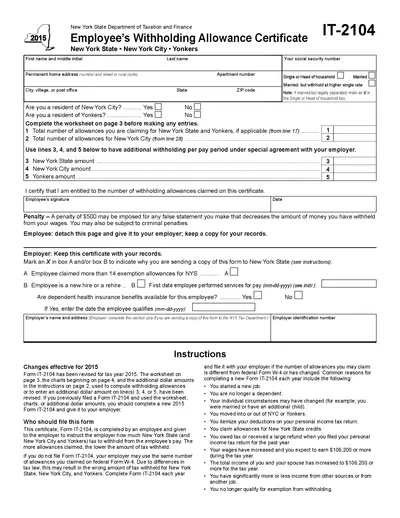

New York State Employee's Withholding Certificate

The IT-2104 form is essential for New York employees to declare their withholding allowances. It guides employers on the appropriate tax withholding from payroll. Fill it out accurately to ensure proper tax management.

Tax Forms

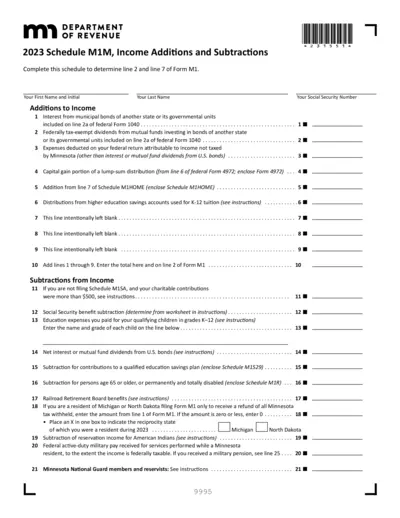

2023 Schedule M1M Income Additions and Subtractions

This file contains instructions and forms for the 2023 Schedule M1M. It is vital for determining income additions and subtractions for tax purposes. Complete this schedule accurately to ensure compliance with Minnesota tax regulations.

Tax Forms

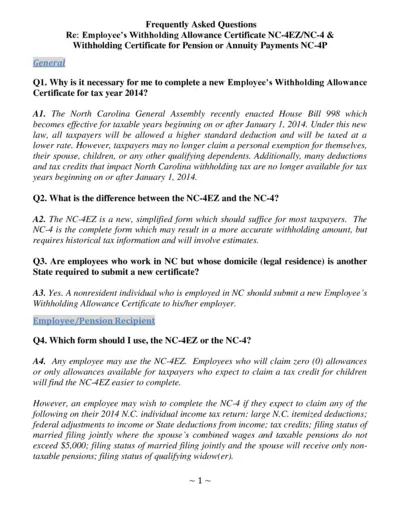

Employee Withholding Allowance Certificate FAQs 2014

This document provides essential information regarding the Employee's Withholding Allowance Certificate NC-4EZ/NC-4 and withholdings for pension or annuity payments. It includes FAQs that clarify the differences between various forms, their necessity, and procedures for completion. Ideal for North Carolina taxpayers seeking to understand their withholding allowances for the tax year 2014.

Banking

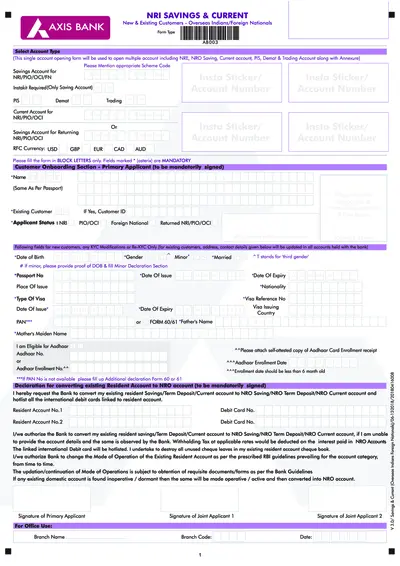

NRI Savings and Current Account Opening Form

This comprehensive NRI savings and current account form is intended for non-resident Indians looking to open an account with Axis Bank. Users will find step-by-step instructions, including KYC requirements and account types. This form can be used for multiple account types including NRE, NRO, and more.