Personal Finance Documents

Tax Forms

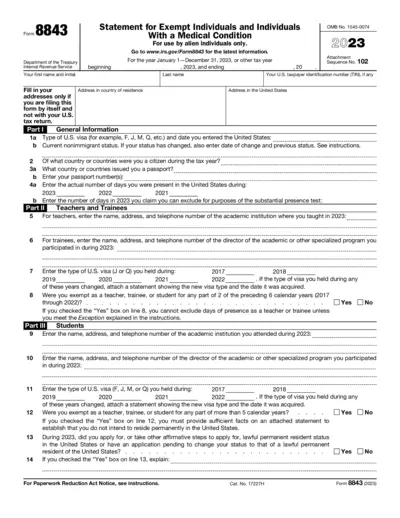

Form 8843 Instructions for Exempt Individuals 2023

Form 8843 is a statement for exempt individuals and individuals with a medical condition for the tax year 2023. It facilitates the declaration of presence in the U.S. and specific circumstances for exemptions. Ensure to follow the guidelines to complete your filing accurately.

Investment Accounts

Fidelity Advisor IRA Beneficiary Distribution Request

This document is a Fidelity Advisor IRA Beneficiary Distribution Request form. It allows beneficiaries to initiate a distribution from a Fidelity Advisor IRA Beneficiary Distribution Account. Be sure to follow the instructions carefully to ensure proper processing of the request.

Banking

GO2Bank Deposit Account Agreement Overview

This Deposit Account Agreement outlines the terms and conditions related to GO2Bank's Visa debit card and deposit accounts. It details fees, policies, and the application process for opening an account. Ideal for users seeking clear information on banking services and regulatory compliance.

Banking

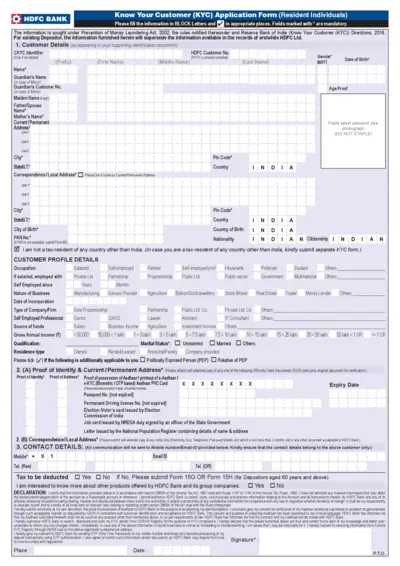

HDFC Bank KYC Application Form for Residents

The HDFC Bank KYC Application Form is designed for resident individuals to comply with the Know Your Customer requirements. This form is essential for opening or updating your account to ensure adherence to regulatory standards. Users must provide accurate and up-to-date information as directed.

Tax Forms

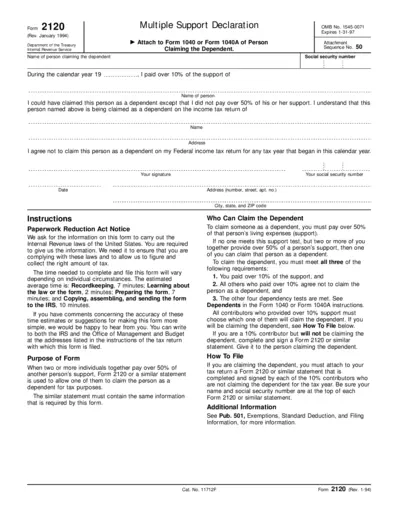

Form 2120 - Multiple Support Declaration for Dependents

Form 2120 allows individuals to declare dependents for tax purposes when two or more people contribute to their support. It outlines the requirements for claiming a dependent based on support percentages. This essential form helps clarify tax responsibility among contributors.

Tax Forms

IRS Tax Form Draft 1099-QA Instructions

This document provides early release draft instructions for filling out Form 1099-QA related to distributions from ABLE accounts. It serves as a guide to ensure correct reporting and compliance with IRS regulations. Users should refer to this draft for informational purposes and wait for the final version for filing.

Tax Forms

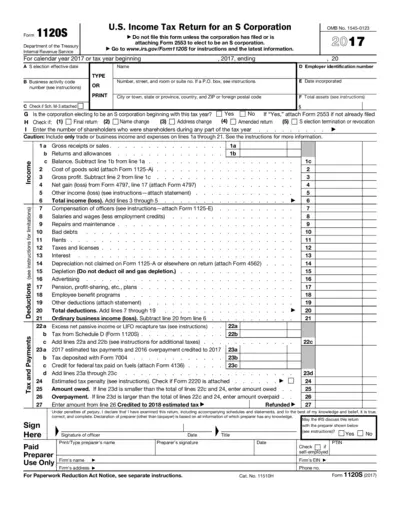

US Income Tax Return for S Corporation Form 1120S

This file is the official U.S. Income Tax Return for S Corporations (Form 1120S). It provides essential guidelines and fields for accurate tax reporting. Use this form to file taxes for S Corporations, ensuring compliance with IRS regulations.

Tax Forms

Fidelity Investments Form 1099-SA Distributions HSA

This document is your Form 1099-SA for Health Savings Account (HSA) distributions. It contains essential information for reporting your total HSA distributions and any associated earnings. Ensure you adhere to IRS regulations when using this form for tax purposes.

Retirement Plans

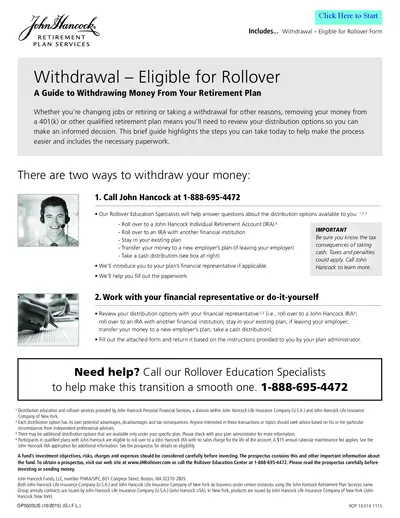

Withdrawal Eligible for Rollover Guide

This guide provides essential instructions for withdrawing money from your retirement plan. Understand your options and fill out the necessary forms accurately. Make informed decisions about your retirement planning with our helpful insights.

Tax Forms

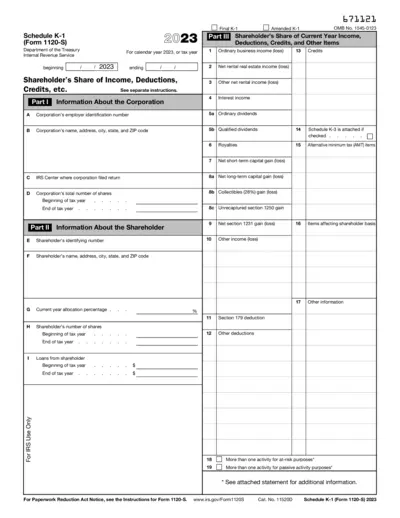

Schedule K-1 Form 1120-S 2023 Detailed Guide

Schedule K-1 (Form 1120-S) is used to report each shareholder's share of income, deductions, and credits for tax year 2023. This form is essential for S corporations to ensure accurate tax reporting. Understanding how to properly fill out this form is crucial for compliance with IRS regulations.

Tax Forms

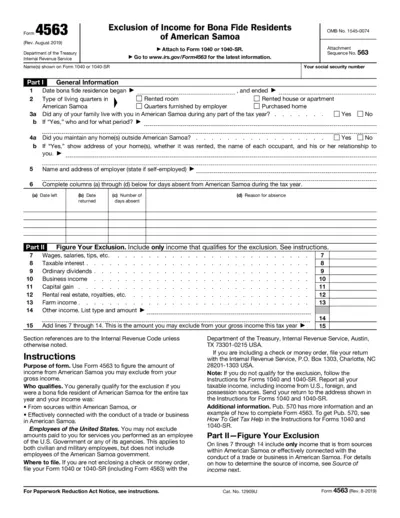

Form 4563 Exclusion of Income for American Samoa

Form 4563 is used to determine the exclusion of income for bona fide residents of American Samoa. It helps individuals exclude qualifying income from their gross income for tax purposes. Follow the instructions provided on the form for accurate filing.

Tax Forms

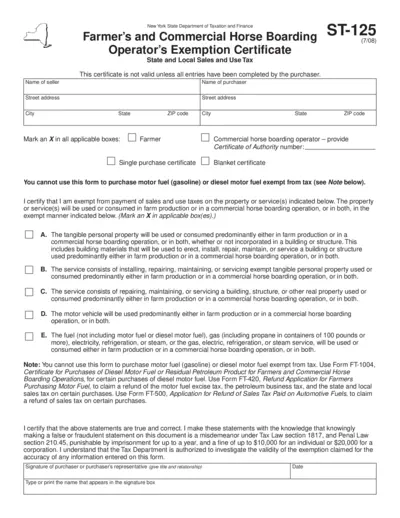

Farmers and Commercial Horse Boarding Tax Exemption

This certificate allows farmers and commercial horse boarding operators in New York to claim sales and use tax exemptions. It must be filled out and presented to sellers. The exemption applies to property and services used predominantly in farm production or boarding operations.