Personal Finance Documents

Tax Forms

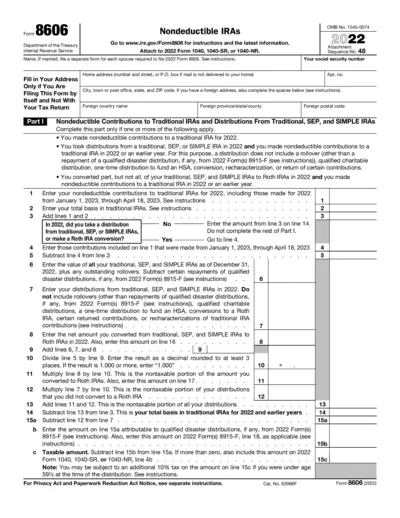

Form 8606: Nondeductible IRAs Instructions for 2022

Form 8606 is used to report nondeductible contributions to traditional IRAs and distributions from traditional, SEP, and SIMPLE IRAs. This form is essential for taxpayers who have made nondeductible contributions in 2022. Accurate completion ensures compliance with IRS regulations.

Banking

Deposit Agreement and Instructions Document

This file provides detailed information on the deposit agreement for Regions Bank. It outlines important terms, conditions, and instructions for managing deposit accounts. Users will find guidance on filling out the necessary forms and understanding their rights and responsibilities.

Banking

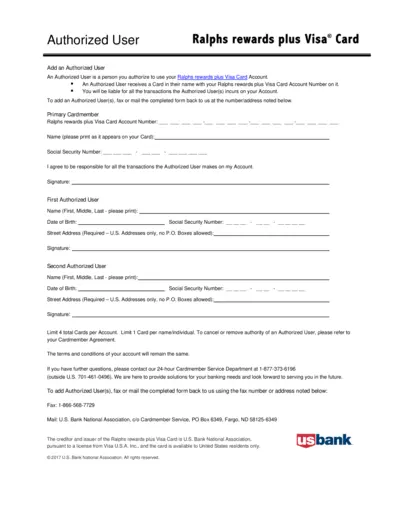

Add Authorized User to Ralphs Rewards Visa Card

This document provides instructions for adding an authorized user to your Ralphs rewards plus Visa Card. It outlines the necessary information and steps required for submission. Ideal for primary cardholders looking to extend card access.

Banking

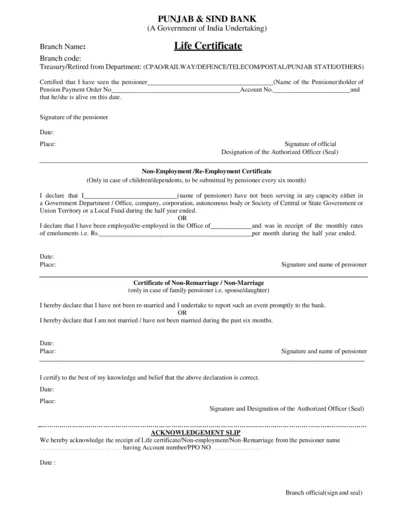

Life Certificate Submission Instructions

This document provides pensioners with a life certificate to verify their living status. It is essential for the continuous receipt of pension benefits. Follow the instructions to properly complete and submit the form.

Tax Forms

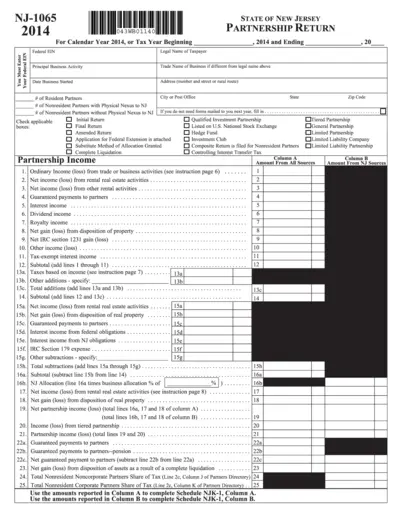

New Jersey Partnership Return NJ-1065 Form

The NJ-1065 form is essential for partnerships operating in New Jersey. This document facilitates the reporting of income, deductions, and credits for partnerships. It is crucial for ensuring compliance with state tax regulations.

Tax Forms

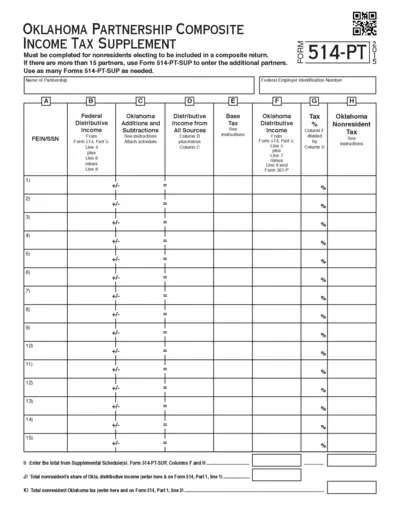

Oklahoma Partnership Composite Income Tax Supplement

This form is essential for nonresidents electing to be part of a composite return for Oklahoma income tax purposes. It helps report distributive income accurately and ensures compliance with state regulations. Use this form if there are over 15 partners to streamline the filing process.

Tax Forms

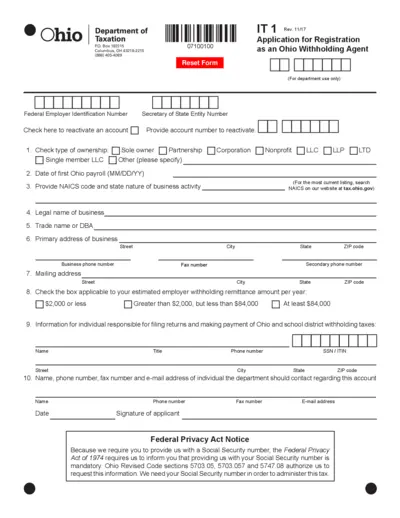

Ohio Withholding Agent Registration Application

This file contains the application for registering as an Ohio withholding agent. It provides essential information needed for tax compliance and withholding in Ohio. Users must complete it accurately to ensure proper processing of payroll taxes.

Tax Forms

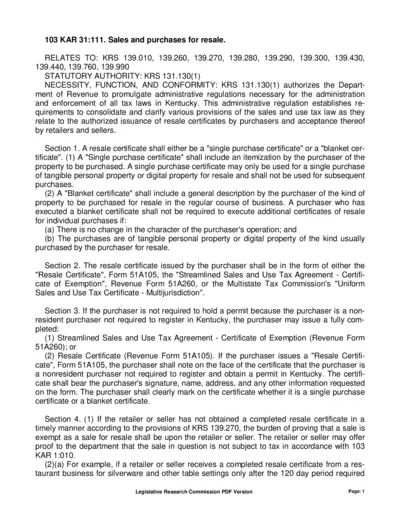

Sales and Purchases for Resale Instructions

This file provides detailed instructions on the use of resale certificates in Kentucky. It helps businesses understand the requirements for purchasing goods for resale. Essential for retailers and sellers in compliance with tax laws.

Banking

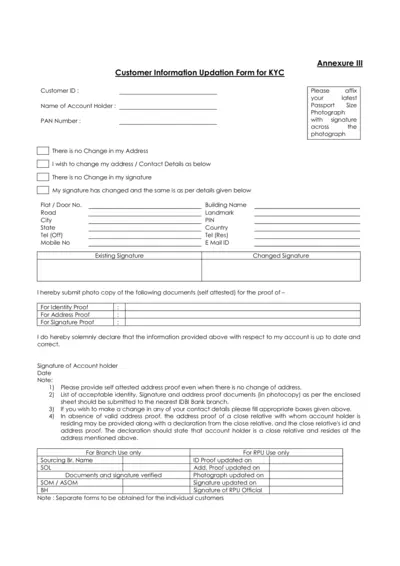

Customer Information Updation Form for KYC

This form is essential for KYC compliance and customer information updating. Users can update personal details such as address, signature, and contact information. It provides a clear guide for necessary proof documents required for the process.

Tax Forms

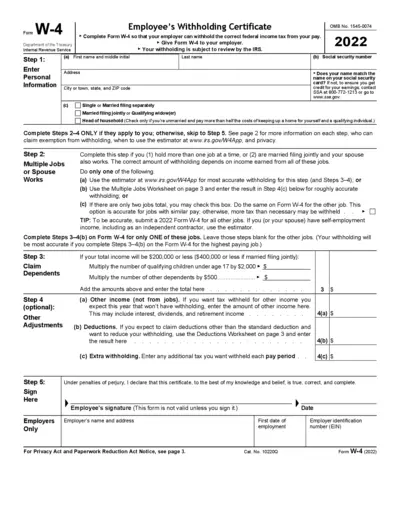

IRS Employee Withholding Certificate Form W-4

The Employee's Withholding Certificate, Form W-4 is essential for employees to inform their employers on withholding federal income tax from their paychecks. This form aids in calculating the correct amount of federal tax to withhold based on personal circumstances. Continue updating your W-4 when your personal or financial situation changes.

Estate Planning

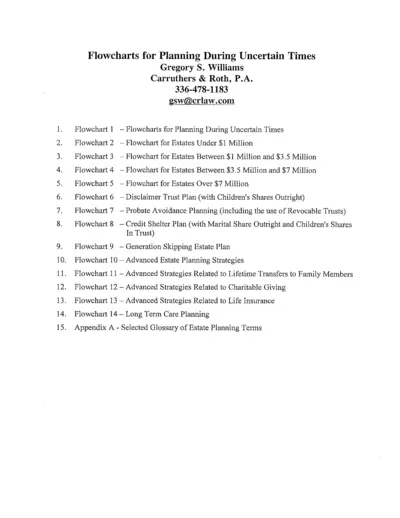

Flowcharts for Planning During Uncertain Times

This document provides a comprehensive series of flowcharts designed to assist individuals in making informed estate planning decisions during uncertain times. It covers various estate sizes and planning options, ensuring you can navigate complex decisions effectively. Ideal for anyone facing uncertainties in estate management or planning.

Tax Forms

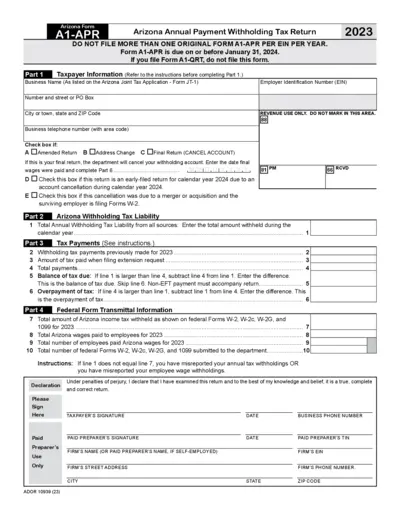

Arizona A1-APR Annual Payment Withholding Tax Return 2023

The Arizona A1-APR form is essential for businesses to report their annual payment withholding tax. This form must be filed by January 31, 2024. Ensure accurate information to avoid penalties.