Personal Finance Documents

Tax Forms

2008 New Jersey W-2 Wage and Tax Statement Guidelines

This document provides New Jersey employers with official 2008 W-2 reporting guidelines, including reporting of Unemployment Insurance, Workforce Development, and Disability Insurance contributions.

Tax Forms

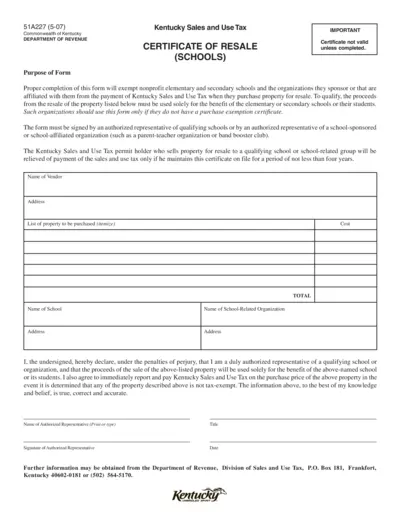

Kentucky Sales and Use Tax Certificate of Resale

This form is for nonprofit elementary and secondary schools in Kentucky to be exempt from sales and use tax when purchasing property for resale. An authorized representative must complete and sign this form. It should be kept on file for at least four years.

Tax Forms

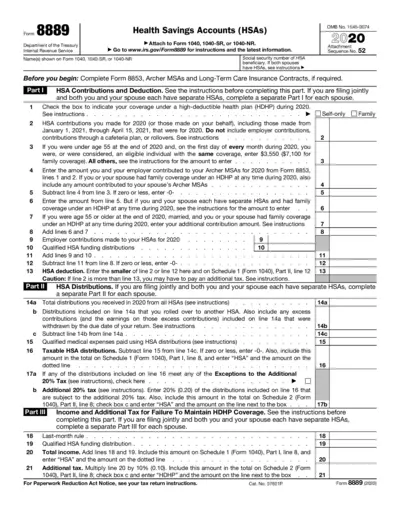

Form 8889: Health Savings Accounts (HSAs) Instructions

Form 8889 is used to report Health Savings Accounts (HSAs) contributions, deductions, and distributions. It's attached to Form 1040, 1040-SR, or 1040-NR. Complete the form as per the instructions and latest information provided by the IRS.

Tax Forms

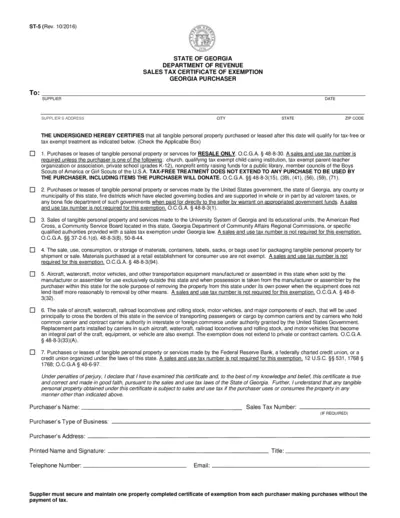

Georgia Sales Tax Certificate of Exemption

The Georgia Sales Tax Certificate of Exemption is used for claiming exemption from sales tax on certain purchases or leases in Georgia. It is applicable to various entities such as government bodies, educational institutions, and specific non-profits. This document certifies that the purchase qualifies for tax-free treatment.

Banking

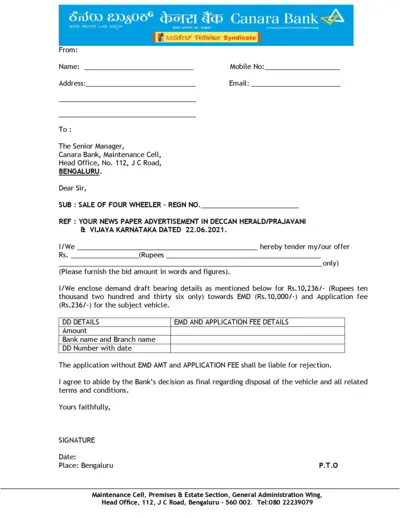

Canara Bank 4-Wheeler Sale Form

This file is a tender offer form for the sale of a four-wheeler by Canara Bank. It contains details about bid amounts, EMD, and submission instructions. The form is for interested buyers of the bank's vehicle.

Banking

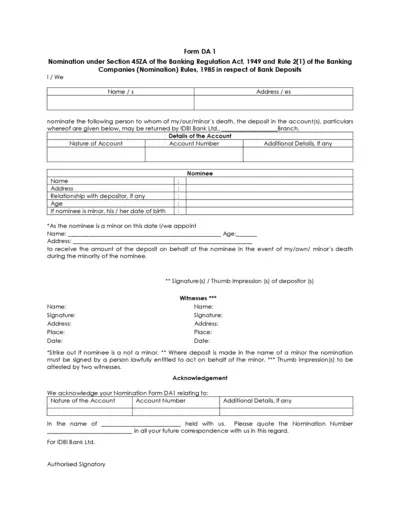

Form DA 1: Nomination under Section 45ZA of Banking Regulation Act

Form DA 1 allows individuals to nominate a person to receive their bank deposits in case of their death. It is regulated under Section 45ZA of the Banking Regulation Act, 1949 and the Banking Companies (Nomination) Rules, 1985. It ensures the smooth transfer of funds to the nominee.

Tax Forms

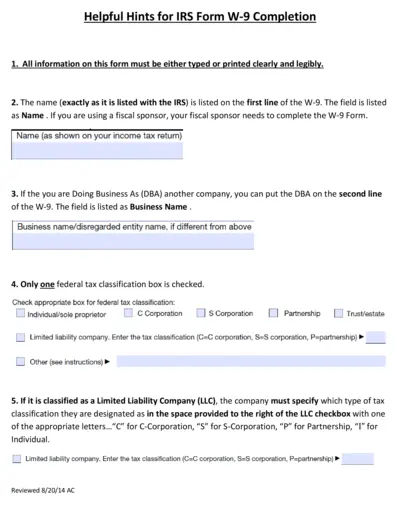

Helpful Hints for IRS Form W-9 Completion

This document provides detailed instructions on how to complete the IRS Form W-9. It includes information on filling out the form correctly, providing necessary tax classification details, and ensuring all required fields are completed accurately. It is essential for proper compliance and tax reporting.

Banking

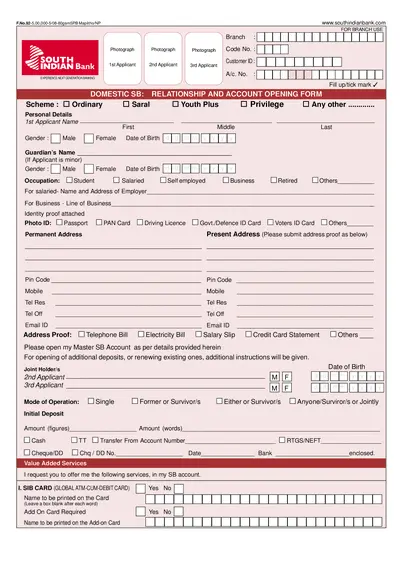

South Indian Bank: Relationship and Account Opening Form

This file is an account opening form for South Indian Bank. It includes sections for applicant details, identification proofs, and services required. Additionally, it contains declarations and nomination information.

Tax Forms

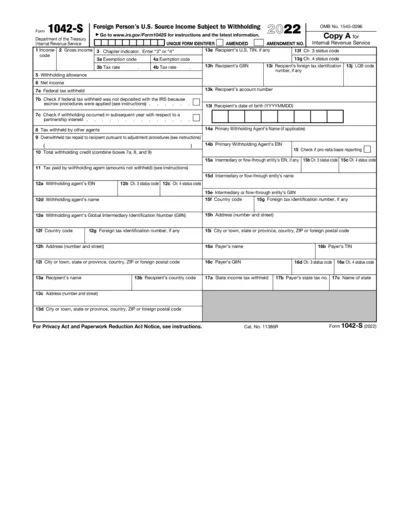

Foreign Person's U.S. Source Income Withholding Form 1042-S

This file is Form 1042-S for 2022, used to report income subject to withholding for nonresident aliens. It includes fields for income code, gross income, tax withheld, and recipient details. The form must be filed by withholding agents to report U.S. source income paid to foreign persons.

Loans

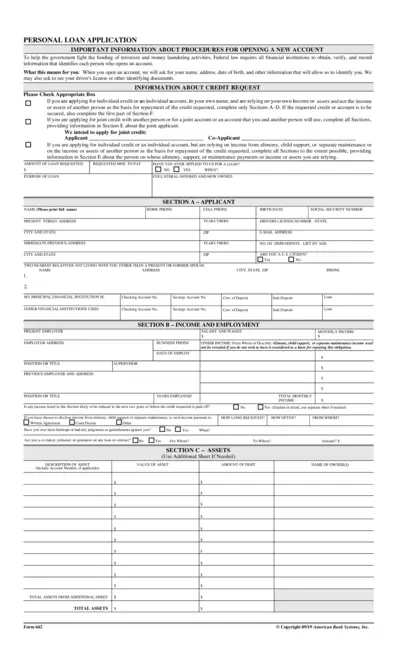

Personal Loan Application Form and Instructions

This file is a personal loan application form that includes sections for applicant information, loan amount, collateral, income, employment details, and more. Users need to fill out personal details, employment history, and financial data to apply for a loan. The form also includes important insurance disclosures and instructions on how to submit the form.

Banking

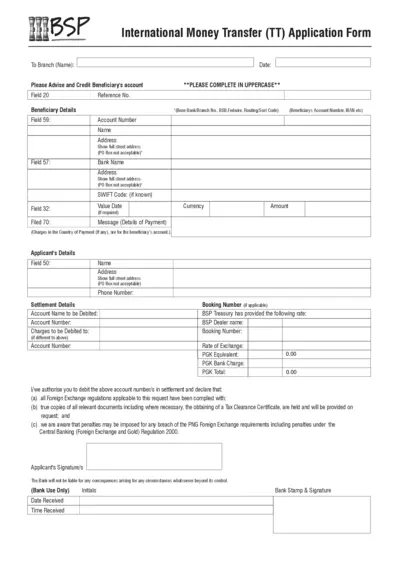

BSP International Money Transfer Application Form

This file is an application form used for BSP International Money Transfers (TT). It requires the user's details, beneficiary's details, and settlement information. The form must be filled out in uppercase.

Tax Forms

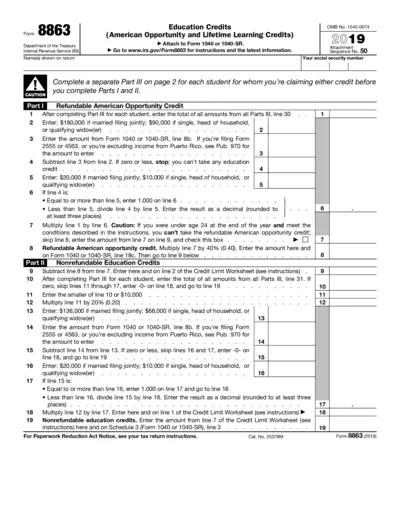

Form 8863: Education Credits

Form 8863 is used to claim education credits, including the American Opportunity and Lifetime Learning Credits. Attach to Form 1040 or 1040-SR.