Finance Documents

Finance

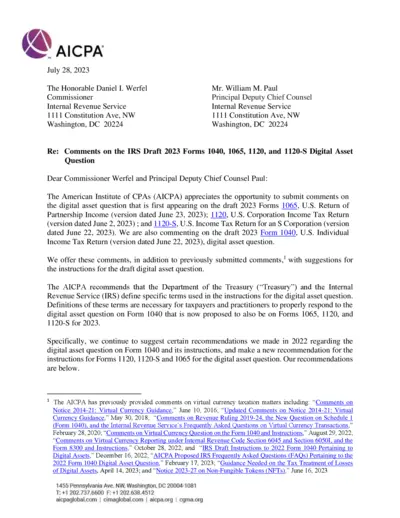

AICPA Comments on Draft 2023 IRS Forms 1040, 1065, 1120, 1120-S

The AICPA's comments on the IRS draft 2023 forms regarding digital asset questions provide recommendations for the form instructions. This document addresses the need for clearer definitions and examples to help taxpayers accurately respond. Relevant for anyone dealing with digital assets in their tax return.

Finance

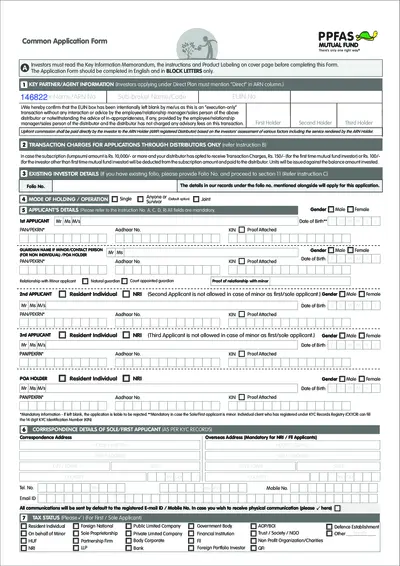

Common Application Form for PPFAS Mutual Fund

This form is used by investors to apply for PPFAS Mutual Fund schemes. It includes sections for key partner information, transaction charges, investor details, mode of holding, applicant's details, correspondence details, and more. Ensure to read the Key Information Memorandum and instructions before filling out the form.

Finance

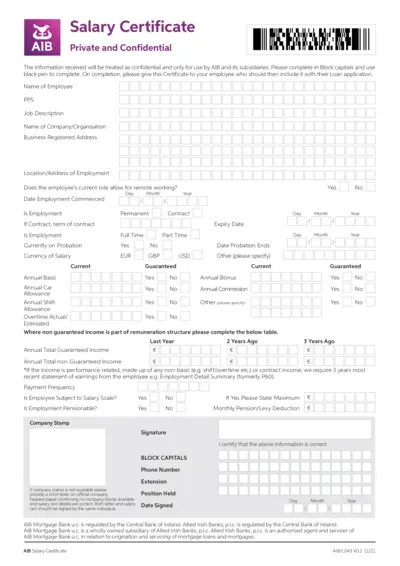

AIB Salary Certificate - Employee Loan Application

This file is a Salary Certificate issued by AIB for employee loan applications. It collects employee details, employment status, guaranteed and non-guaranteed income, and other relevant salary information. The form must be completed and submitted by employees with their loan applications.

Finance

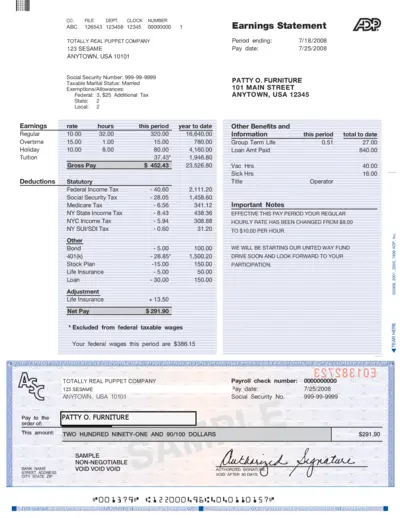

Earnings Statement and Payroll Information

This file contains the earnings statement and payroll information for the employee, including deductions, gross pay, and net pay details. It also contains important notes regarding pay rate changes and other benefits information. Additionally, the file provides details about any loans and group term life insurance.

Finance

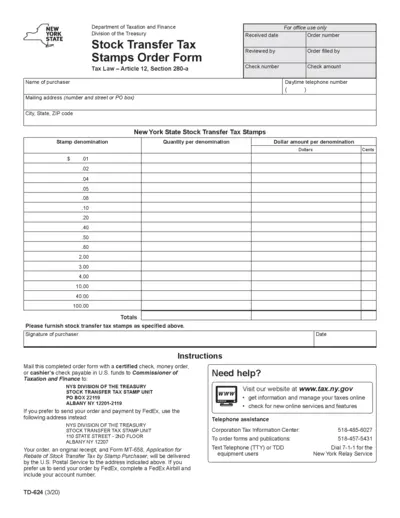

New York State Stock Transfer Tax Stamps Order Form

This document is a New York State Stock Transfer Tax Stamps Order Form. It is used to order stock transfer tax stamps in various denominations. The form must be mailed with payment to the NYS Division of the Treasury.

Finance

Real Property Tax Credit Guide for Lower-Income Families

This file provides a comprehensive overview of the Real Property Tax Credit, helping senior citizens and lower-income households in New York State understand tax credit eligibility, calculate their property tax burden, and apply for the credit.

Finance

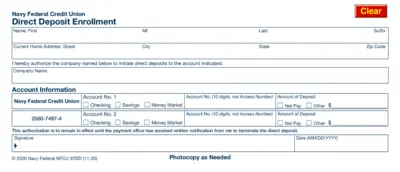

Navy Federal Credit Union Direct Deposit Enrollment

The Navy Federal Credit Union Direct Deposit Enrollment form authorizes the initiation of direct deposits into your account. Fill out your personal information, account details, and deposit amounts. Sign and date the form to finalize your direct deposit setup.

Finance

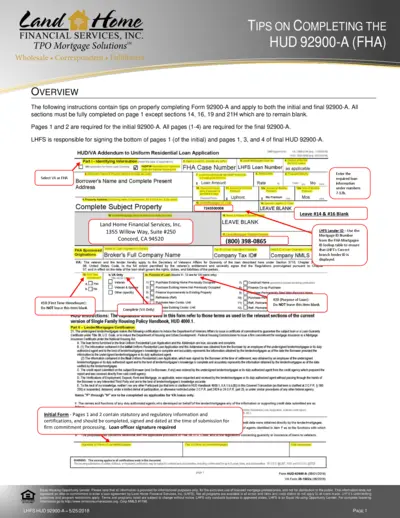

Tips on Completing the HUD 92900-A (FHA)

This file provides detailed instructions on how to properly complete Form 92900-A for FHA loans. It applies to both the initial and final versions of the form. Users are guided on which sections to fill and which sections to leave blank.

Finance

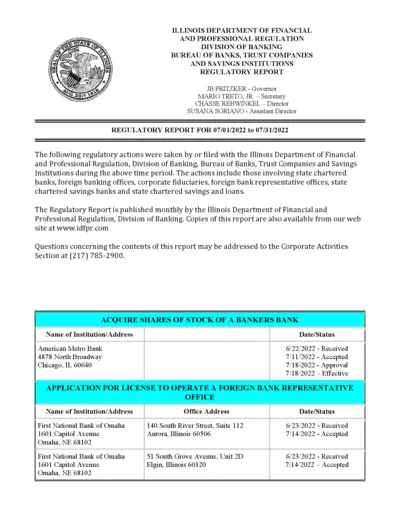

Illinois Financial Regulatory Report July 2022

This document is the regulatory report for the Illinois Department of Financial and Professional Regulation, Division of Banking for July 2022. It includes regulatory actions for state chartered banks, foreign banking offices, and other financial institutions. The report is published monthly and provides updates on various financial regulatory activities.

Finance

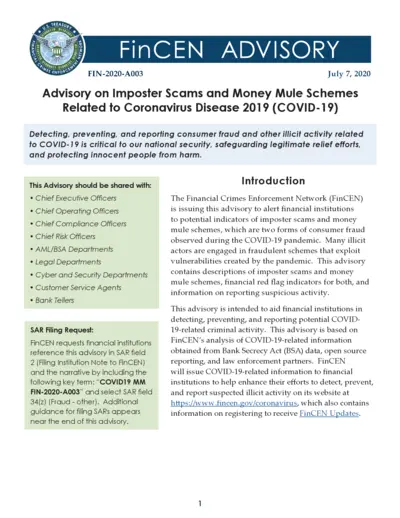

Advisory on Imposter Scams and Money Mule Schemes

This advisory alerts financial institutions to indicators of imposter scams and money mule schemes during COVID-19. It provides guidance on detecting, preventing, and reporting fraudulent activity. It also includes red flag indicators and reporting instructions.

Finance

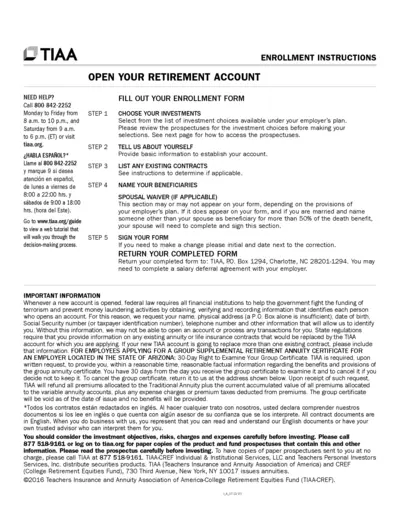

TIAA Retirement Account Enrollment Instructions

This document provides step-by-step instructions for opening a retirement account with TIAA. It includes information about choosing investments, providing personal details, and naming beneficiaries. It also highlights important information and requirements for different states.

Finance

Instructions for Form 1065 | Partnership Income Return 2023

The document provides detailed instructions for filling out Form 1065, the U.S. Return of Partnership Income for the year 2023. It includes information about who must file, electronic filing, penalties, and specific line-item instructions. The instructions also cover recent updates and changes in tax laws and regulations.