Property Law Documents

Zoning Regulations

FDA Cosmetic Regulations in the USA

This document outlines the FDA regulations for cosmetics marketed in the USA, whether manufactured domestically or imported. It covers the definitions, classifications, and compliance requirements. It includes acts such as the FD&C Act and the FP&L Act.

Real Estate

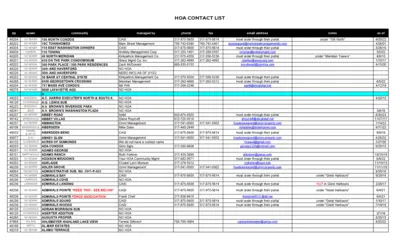

Comprehensive HOA Contact List for Various Residential Areas

This file provides a detailed list of HOA contacts including phone numbers, email addresses, and management companies for various residential areas. It is intended to help homeowners and property managers easily find and reach out to the relevant HOA for their community. The document also specifies whether the listed properties have sewer and HOA details.

Property Taxes

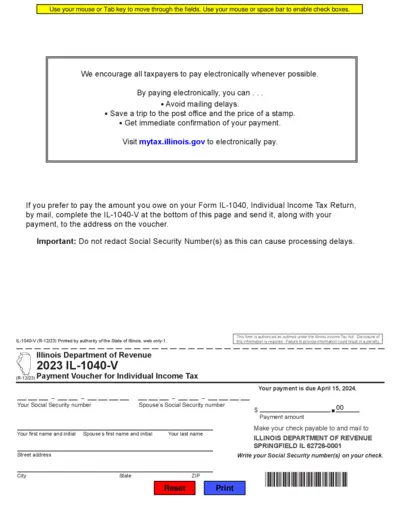

Illinois Individual Income Tax Payment Voucher IL-1040-V

The IL-1040-V form is used by taxpayers in Illinois to pay the amount they owe on their Individual Income Tax Return by mail. This form should be completed and sent along with the payment to the specified address. It is authorized under the Illinois Income Tax Act.

Real Estate

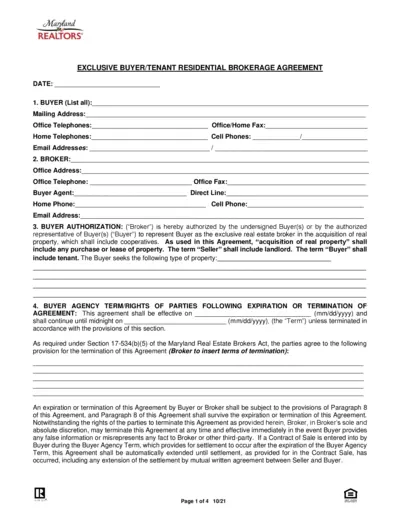

Exclusive Buyer/Tenant Representation Agreement for Maryland REALTORS

This file is an exclusive buyer/tenant residential brokerage agreement for Maryland REALTORS. It includes the terms and conditions, responsibilities of the buyer and broker, and compensation details. The document also addresses fair housing laws, limitations, and flood disclosure notices.

Property Taxes

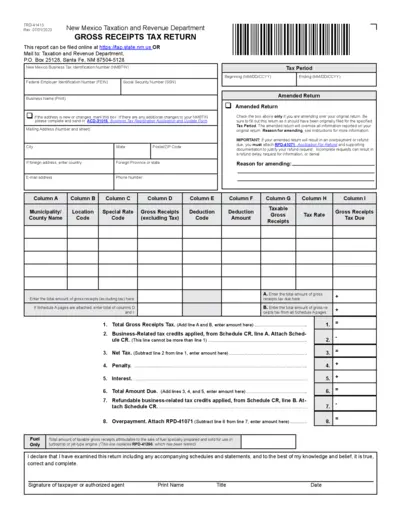

New Mexico Gross Receipts Tax Return Instructions 2023-2024

This document provides instructions on how to fill out the New Mexico Gross Receipts Tax Return. It includes details on tax credits, filing schedules, and specific fields required to complete the form. Essential for businesses operating in New Mexico.

Real Estate

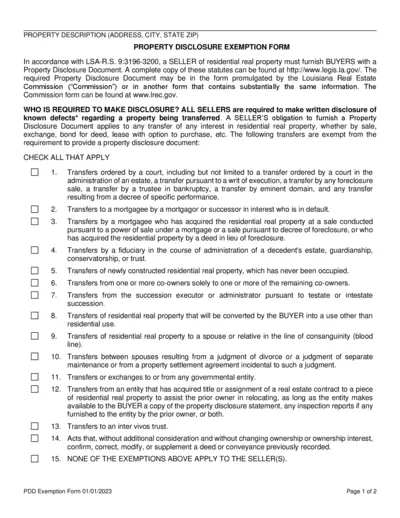

Louisiana Property Disclosure Document Exemption Form

This document provides instructions and requirements for property disclosure in the state of Louisiana. It outlines which sellers are exempt from providing the disclosure document and the specific details regarding known property defects. The document also explains the rights and duties of buyers and sellers in property transactions.

Property Taxes

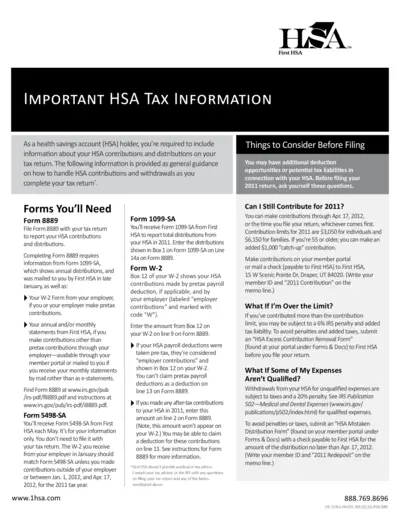

HSA Tax Information and Forms Guide

This file provides important tax information for Health Savings Account (HSA) holders, including guidance on tax forms and contributions. It outlines specific forms such as 8889, 5498-SA, and 1099-SA and offers instructions on handling HSA withdrawals and contributions. It also addresses potential tax liabilities and penalties associated with HSAs.

Property Taxes

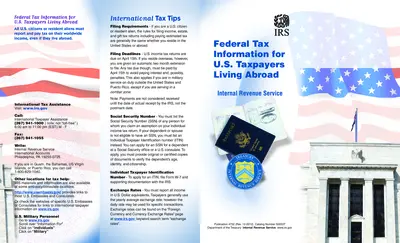

Federal Tax Information for U.S. Taxpayers Living Abroad

This document provides comprehensive federal tax information for U.S. taxpayers living abroad. It covers the filing requirements, important deadlines, and additional assistance available for international taxpayers. It also includes contact information and resources for further help.

Property Taxes

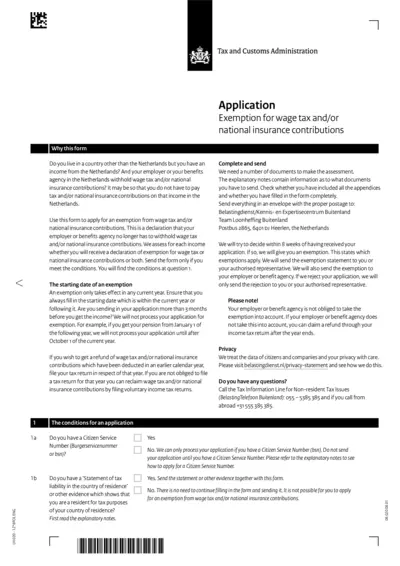

Application for Tax Exemption for Non-Residents

This form allows non-residents with income from the Netherlands to apply for exemption from wage tax and national insurance contributions. It lays out the conditions for application and details required documents. The exemptions start within the current or the following year.

Zoning Regulations

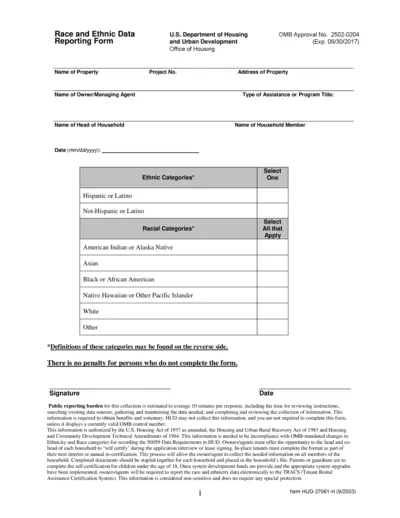

Race and Ethnic Data Reporting Form - HUD

This file is the Race and Ethnic Data Reporting Form from the U.S. Department of Housing and Urban Development. It includes sections for recording ethnic and racial categories. Completing this form is required for compliance with HUD regulations.

Property Taxes

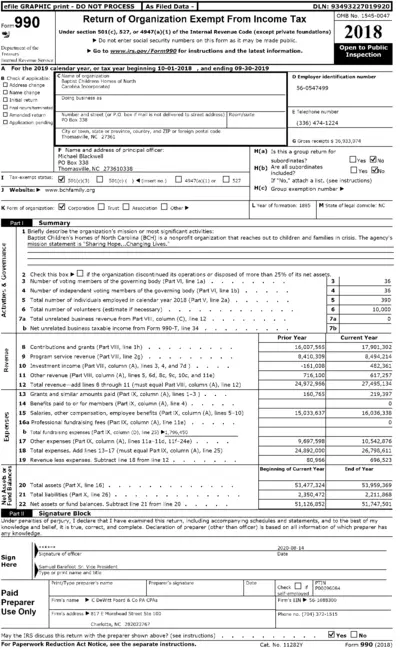

2018 Form 990 for Baptist Children's Homes of North Carolina

This file is the 2018 Form 990 for Baptist Children's Homes of North Carolina. It provides financial information about the organization, including revenue and expenses. It also includes information about the organization's mission and program services.

Property Taxes

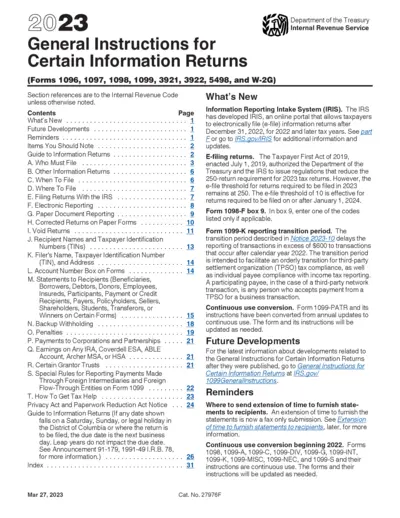

2023 General Instructions for Information Returns

This file provides general instructions for filing certain information returns with the IRS. It includes details on who must file, when to file, and how to file. The instructions cover forms such as 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G.