Property Law Documents

Property Taxes

Missouri Individual Income Tax Long Form MO-1040 Filing Instructions

The Missouri Department of Revenue Form MO-1040 is used for individual income tax filing. This long form is for taxpayers with specific deductions, exemptions, or other filing situations. The instructions provided outline electronic filing options, benefits, and submission addresses.

Property Taxes

2019 Instructions for Forms W-2G and 5754

This file provides instructions for filing Forms W-2G and 5754. It includes details about withholding, reporting requirements, and specific instructions for different types of gambling winnings. It also includes information on backup withholding and requirements for payee identification.

Property Taxes

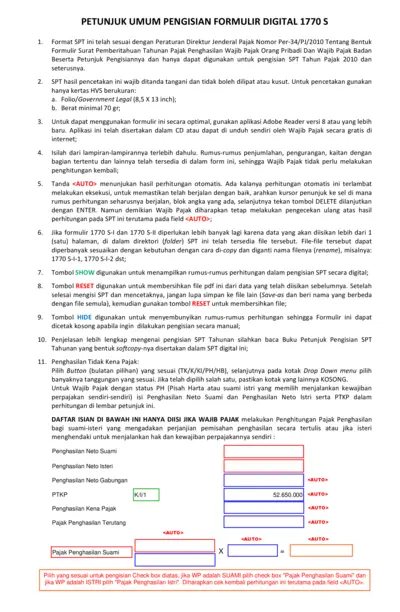

Petunjuk Umum Pengisian Formulir Digital 1770 S

This file provides detailed instructions for filling out the digital Formulir 1770 S for individual taxpayers in Indonesia. It aligns with Peraturan Direktur Jenderal Pajak Nomor Per-34/PJ/2010. Follow the guidelines to ensure accurate tax reporting.

Property Taxes

2022 Instructions for Form 592-Q

The 2022 Instructions for Form 592-Q provide guidance for completing and submitting the Payment Voucher for Pass-Through Entity Withholding. This form is used to remit withholding payments reported on Form 592-PTE. Detailed information on backup withholding and the required payment dates are included.

Property Taxes

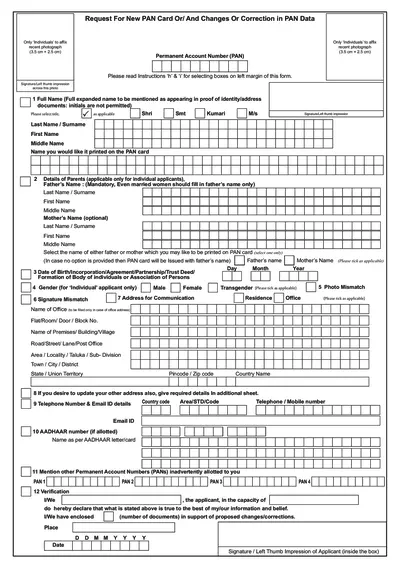

Request for New PAN Card or Corrections in PAN Data

This file is used to request a new PAN card or update/correct existing PAN data for individuals. It includes personal details, address, and contact information. The form must be filled out accurately and submitted with the necessary documents.

Property Taxes

Exempt Organization Return Due Dates - Tax Year 2022

This document outlines the return due dates for exempt organizations' tax filings for the year 2022. It includes original and extended due dates, specific forms, and exceptions when deadlines fall on weekends or holidays. This table serves as a reference for timely and extended filing dates.

Property Taxes

Form 1099-A - Acquisition or Abandonment of Secured Property

Form 1099-A is a tax form used by lenders to report the acquisition or abandonment of secured property. This form is crucial for borrowers who need to report income or loss from such transactions. The information provided in Form 1099-A is used to determine potential gains or losses and tax liabilities.

Real Estate

Property Valuation and Appraisal Guide

This document provides a comprehensive guide on property valuation and appraisal methods, theoretical concepts of value, and the appraiser's role. It outlines various types of appraisal reports and approaches to value. Essential for real estate professionals.

Property Taxes

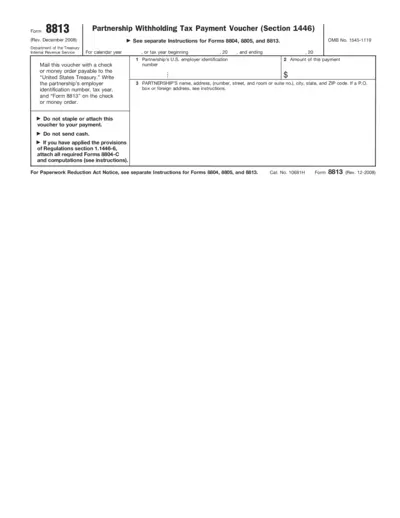

Partnership Withholding Tax Payment Voucher (Form 8813)

Form 8813 is used by partnerships to make withholding tax payments under Section 1446. It includes instructions for completing the form and payment details. Separate instructions are provided for Forms 8804, 8805, and 8813.

Real Estate

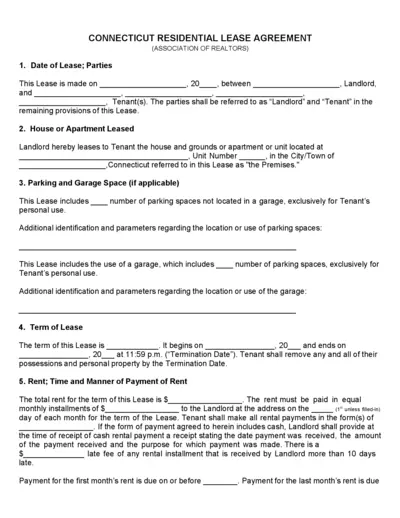

Connecticut Residential Lease Agreement for Apartment and House Rentals

This file outlines the terms and conditions for leasing a residential property in Connecticut. It includes important details about rent, security deposit, use of premises, and other lease obligations. Ideal for landlords and tenants seeking a comprehensive lease agreement.

Property Taxes

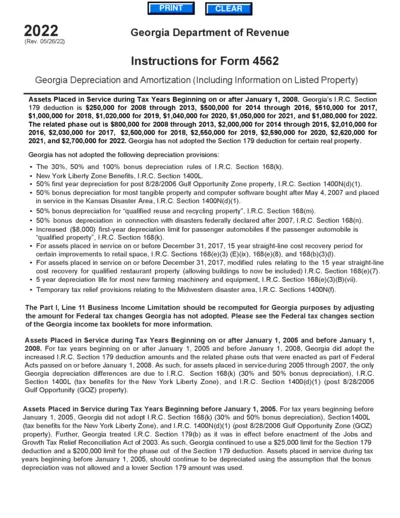

Georgia Department of Revenue Form 4562 Instructions

Detailed instructions for completing the Georgia Department of Revenue Form 4562. This guide covers Georgia Depreciation and Amortization rules for assets placed in service from 2005 to 2022. It includes information on I.R.C. Section 179 and other tax regulations.

Property Taxes

AARP Foundation Tax-Aide NY3 Intake Form TY 2023 Instructions

This document is a comprehensive guide provided by AARP Foundation Tax-Aide regarding the preparation of tax returns for the year 2023 using the NY3 Intake Information Form. It includes necessary requirements, documents needed, and instructions for both counselors and filers. It also covers various tax credits, deductions, and additional forms that may be applicable.