Property Law Documents

Real Estate

Understanding and Using Colorado Deeds for Real Estate Transactions

This file provides an overview of the different types of deed forms available in Colorado, describing their basic characteristics and appropriateness for various circumstances.

Property Taxes

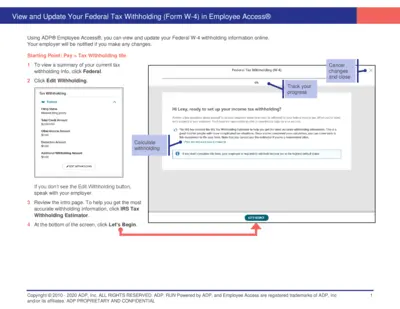

View and Update Federal Tax Withholding (Form W-4) in Employee Access

This file provides detailed instructions on how to view and update your Federal W-4 withholding information online using ADP Employee Access. It includes steps for verifying personal information, calculating withholding, and submitting the form to your employer. This guide is useful for employees who need to adjust their federal tax withholding.

Real Estate

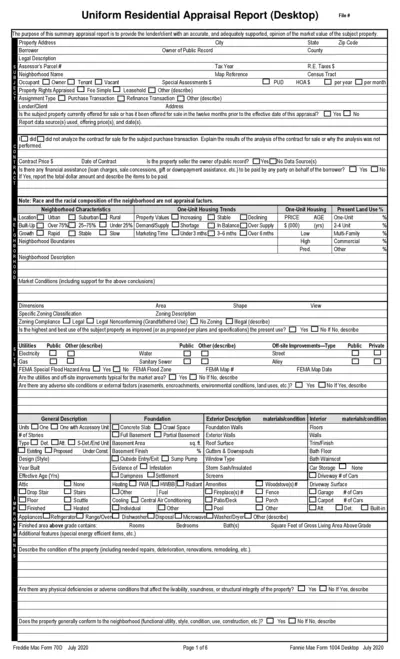

Uniform Residential Appraisal Report (Desktop)

The Uniform Residential Appraisal Report (Desktop) provides an accurate and adequately supported opinion of the market value of the subject property. This report is essential for lenders/clients needing a summary appraisal of a residential property. It includes details on property characteristics, neighborhood dynamics, and market trends.

Property Taxes

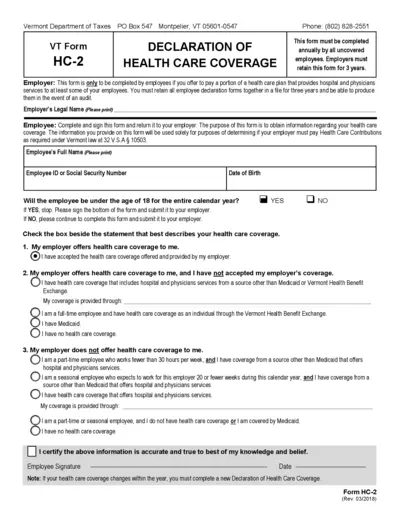

Vermont HC-2 Declaration of Health Care Coverage

This form, required by the Vermont Department of Taxes, must be completed annually by uncovered employees to declare their health care coverage status. Employers must retain this form for three years for auditing purposes. It helps determine if Health Care Contributions are required by the employer under Vermont law.

Property Taxes

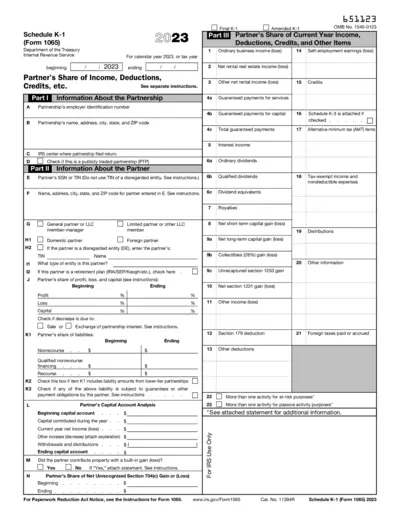

2023 Schedule K-1 Form 1065 Instructions and Details

This file provides the details and instructions required to fill out the 2023 Schedule K-1 form. It includes specific information about the partnership, partner's share of income, deductions, credits, and other relevant data. It's essential for accurate tax reporting.

Real Estate

Strengthen Your QC Program: Fannie Mae Quality Control Plan Guide

This document provides insights into creating a strong QC plan, highlighting common gaps and offering strategies to improve your QC plan. It includes requirements, sampling methodologies, and documentation processes vital for lenders to meet Fannie Mae's guidelines.

Property Taxes

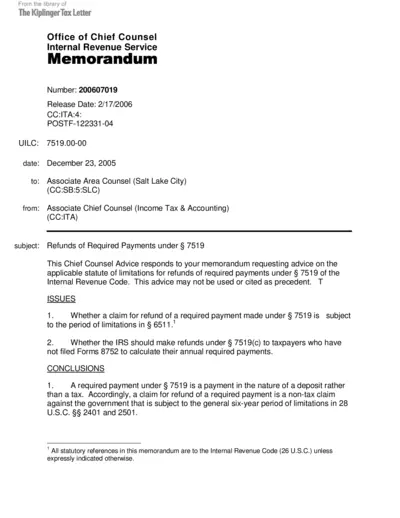

Refunds of Required Payments under Section 7519

This document provides guidance on the statute of limitations applicable to refunds of required payments under Section 7519 of the Internal Revenue Code. It addresses issues such as the period of limitations and the requirement for entities to file Forms 8752. The advice cannot be used as a precedent.

Property Taxes

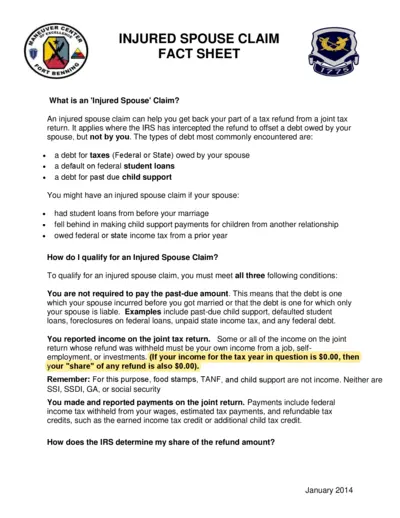

Injured Spouse Claim Form Instructions and FAQs

This document provides detailed instructions and FAQs for filing an Injured Spouse Claim to recover part of a tax refund intercepted by the IRS due to your spouse's debt. It explains eligibility criteria, the filing process, and important considerations. Learn how to complete Form 8379 and reclaim your portion of the tax refund.

Property Taxes

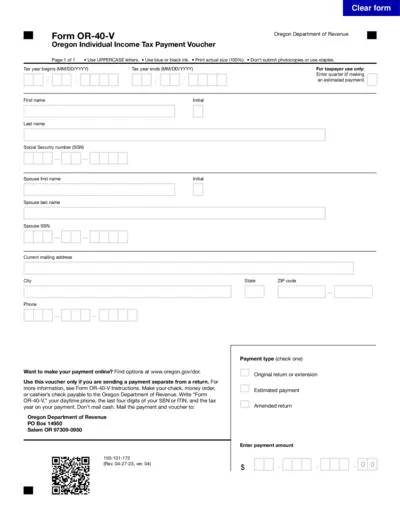

Oregon Individual Income Tax Payment Voucher Form OR-40-V

This form is used by individuals to submit income tax payments to the Oregon Department of Revenue. Fill out the form with the required details and mail it with your payment. Ensure all information is accurate to avoid any processing delays.

Real Estate

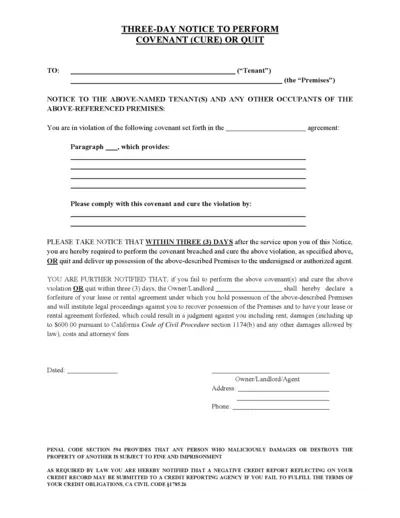

Three-Day Notice to Perform Covenant or Quit - Instructions

This file provides a three-day notice to tenants to comply with a specific covenant or vacate the premises. It outlines the violation, required actions, and legal consequences for non-compliance. Essential for landlords managing rental properties.

Property Taxes

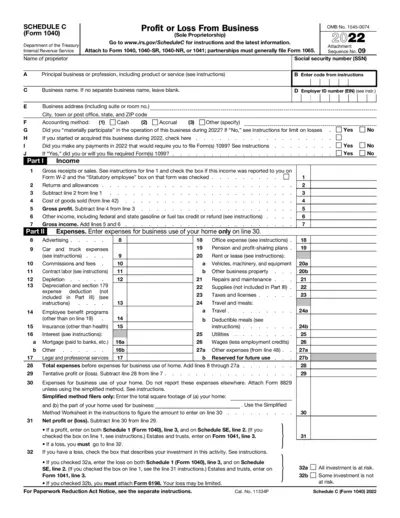

Schedule C (Form 1040) 2022 - Profit or Loss From Business

The Schedule C (Form 1040) is used to report income or loss from a business. It is required for sole proprietors. This form helps individuals calculate their business profit or loss.

Property Taxes

2022 Form 1041-ES Estimated Income Tax for Estates and Trusts

Form 1041-ES is used to figure and pay estimated tax for an estate or trust. It helps avoid penalties for underpayment by calculating the required estimated tax payments. Instructions include how to complete the form and important exceptions.