Property Law Documents

Property Taxes

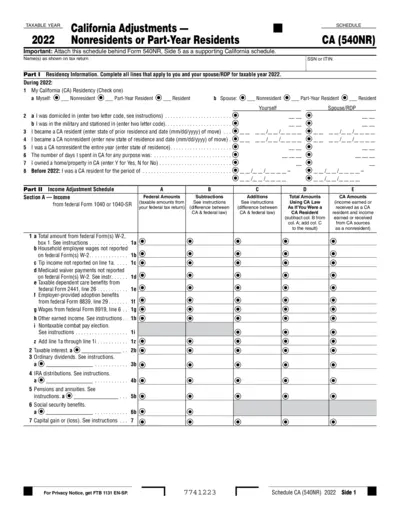

California Adjustments Nonresidents Part-Year Residents 2022

This document provides California adjustments for nonresidents or part-year residents for the taxable year 2022. It includes detailed sections on income adjustments, additional income, and adjustments to income, along with residency information. Essential for taxpayers completing Form 540NR.

Property Taxes

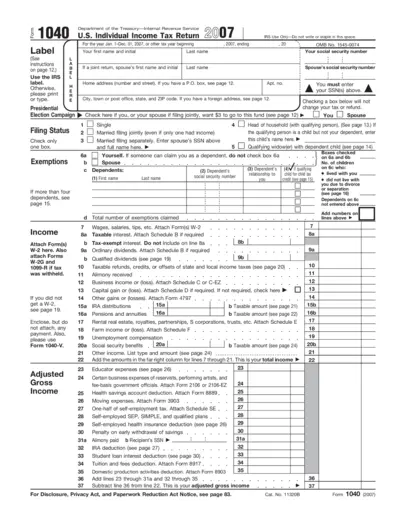

2007 IRS Form 1040 - U.S. Individual Income Tax Return

The 2007 IRS Form 1040 is used by U.S. taxpayers to file an annual income tax return. The form includes sections for personal information, income, deductions, and credits. Make sure you have all relevant documents, such as W-2s and 1099s, before you begin.

Zoning Regulations

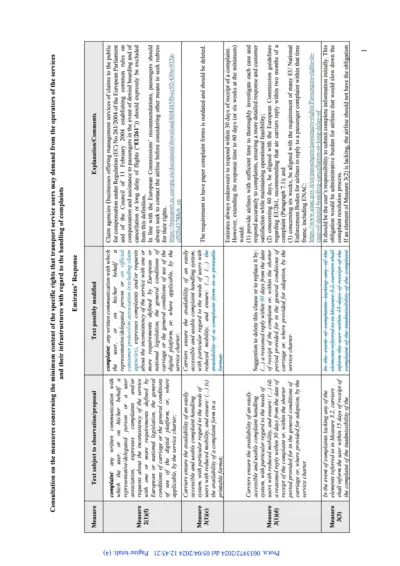

Consultation on Measures for Transport Service Users' Rights

This document outlines the measures concerning the minimum content of specific rights that transport service users can demand from operators. It addresses complaint handling and the obligations of carriers to ensure accessible systems for users, especially those with reduced mobility. Additionally, it includes guidelines for carriers to provide annual analysis and public information regarding complaints received.

Property Taxes

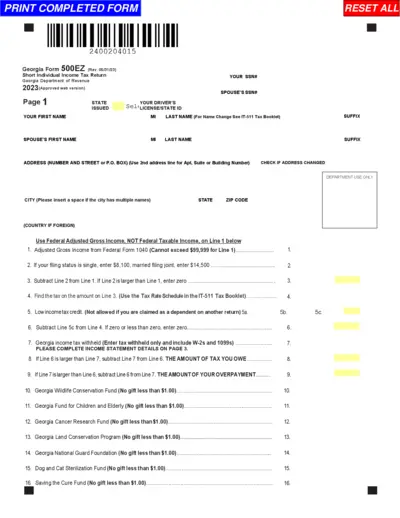

Georgia Form 500EZ - Short Individual Income Tax Return 2023

The Georgia Form 500EZ is a short individual income tax return form for state residents. It's meant for those who meet specific requirements such as having an income below $99,999 and not itemizing deductions. This form is used to calculate and report your state tax obligations for the year 2023.

Property Taxes

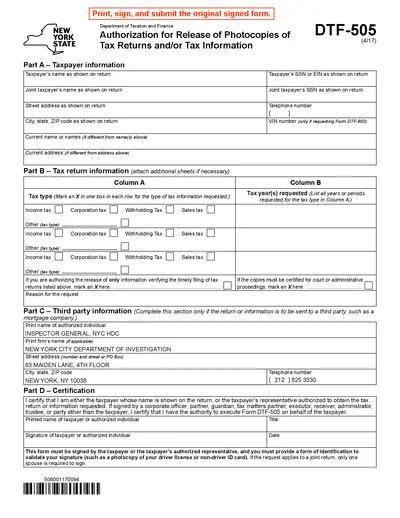

Authorization for Release of Tax Information - NY State

Authorization for Release of Photocopies of Tax Returns and/or Tax Information (DTF-505) from New York State. This form is used to request copies of e-filed or paper tax returns. Ensure to provide identification and processing fee.

Real Estate

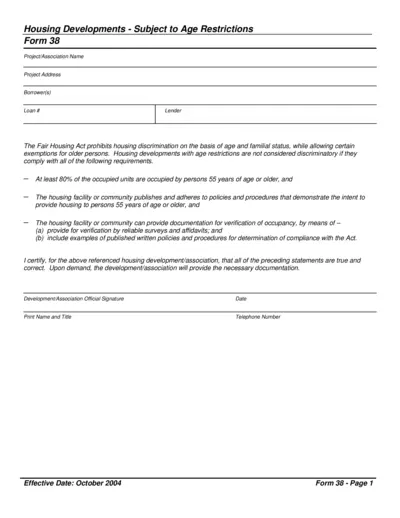

Age-Restricted Housing Developments Compliance Form

This form ensures that housing developments comply with legal age restrictions. It certifies occupancy by persons 55 years or older. Provides verification documentation.

Real Estate

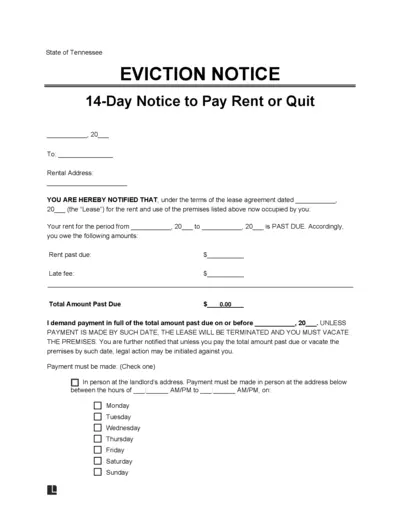

Tennessee Eviction Notice - 14 Day Notice to Pay or Quit

This document is a 14-day eviction notice for tenants in Tennessee who have not paid their rent. It provides legal notice that tenants must pay the rent owed or vacate the premises within 14 days to avoid legal action. This notice includes space for landlord information, payment details, and service proof.

Property Taxes

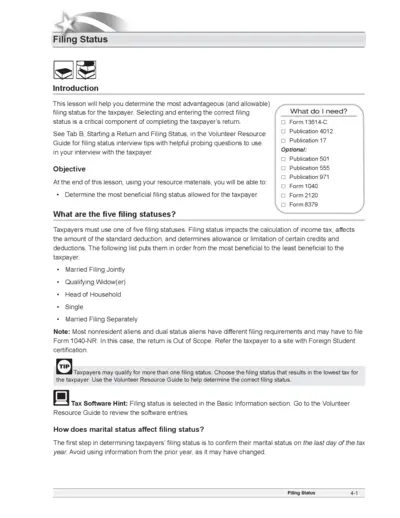

Filing Status Guide for Taxpayers

This file helps determine the most advantageous filing status for taxpayers and provides instructions for completing necessary forms. It includes information about different filing statuses and their requirements.

Real Estate

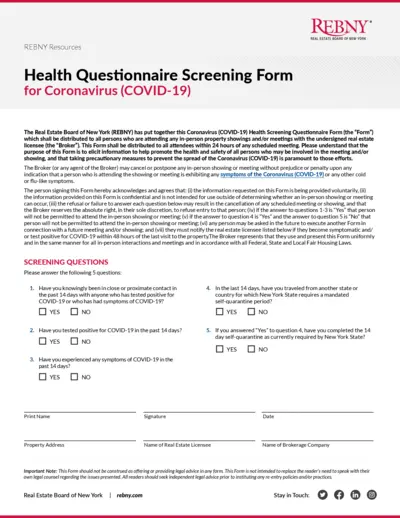

Coronavirus Health Questionnaire Screening Form

This form is created by the Real Estate Board of New York (REBNY) to ensure health and safety during in-person property showings or meetings by screening attendees for COVID-19 risks.

Property Taxes

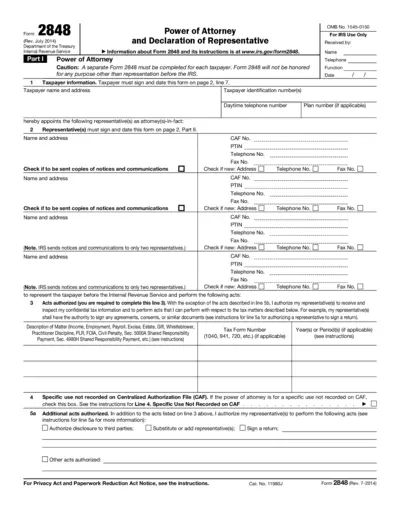

Form 2848 Power of Attorney and Declaration of Representative

Form 2848 allows taxpayers to appoint a representative before the IRS. This form is necessary for authorizing individuals to represent you and receive confidential tax information. Completing and submitting Form 2848 ensures your tax matters are handled as per your decisions.

Property Taxes

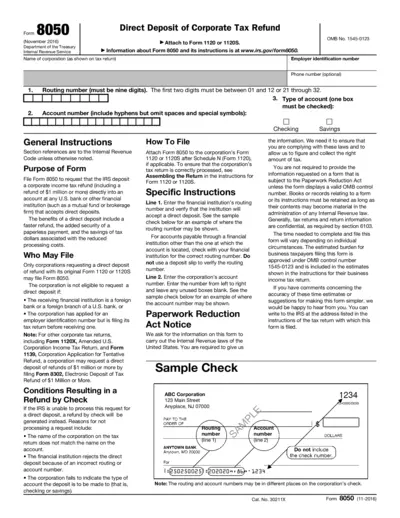

Direct Deposit of Corporate Tax Refund (Form 8050)

Form 8050 allows corporations to request a direct deposit of their corporate tax refund into any U.S. bank or financial institution. It provides instructions on how to complete the form and attach it to the corporate tax return. This form ensures a faster, more secure refund process.

Property Taxes

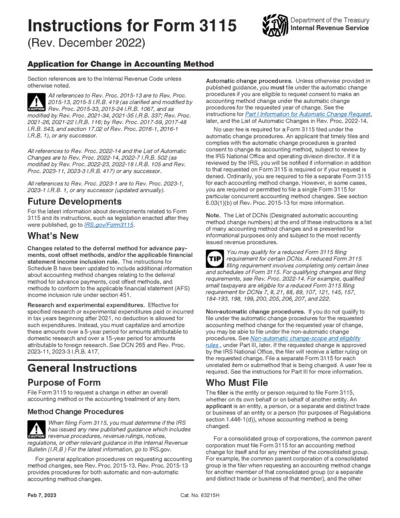

Instructions for Form 3115: Change in Accounting Method

This file provides detailed instructions for IRS Form 3115, which is used to request a change in accounting method. It includes guidance on the latest IRS regulations and procedures. Additionally, it offers specific steps for both automatic and non-automatic change requests.