Property Law Documents

Property Taxes

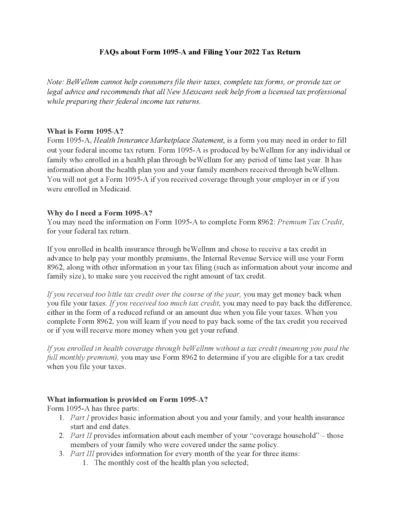

Form 1095-A FAQs for Filing 2022 Tax Return

This document contains frequently asked questions about Form 1095-A and the steps to complete Form 8962 for your 2022 tax return. BeWellnm provides this information for individuals and families who enrolled in a health plan through the marketplace.

Property Taxes

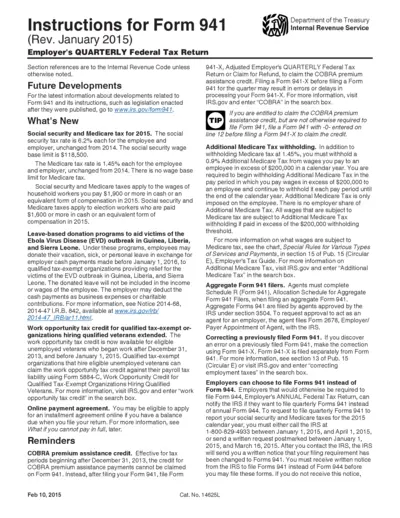

Instructions for Form 941, Employer's QUARTERLY Federal Tax Return

This document provides detailed instructions for employers on how to file Form 941, the Employer's Quarterly Federal Tax Return. It includes information on tax rates, new tax legislation, and special programs for employers.

Property Taxes

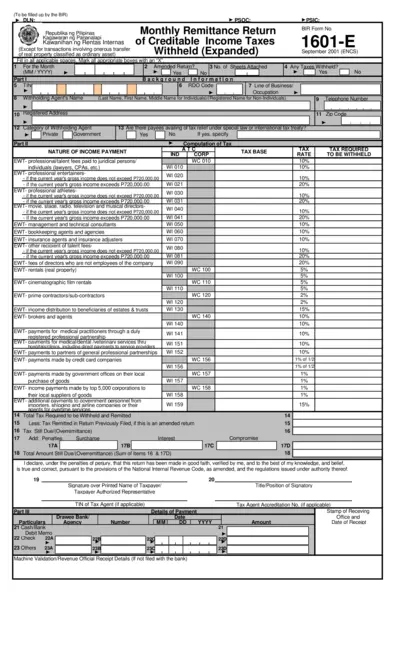

Monthly Remittance Return of Creditable Income Taxes Withheld

This document is used for the monthly remittance of creditable income taxes withheld by withholding agents. It should be filed in triplicate and submitted by every withholding agent, both individual and non-individual. Detailed instructions for filling out and submitting the form are provided.

Zoning Regulations

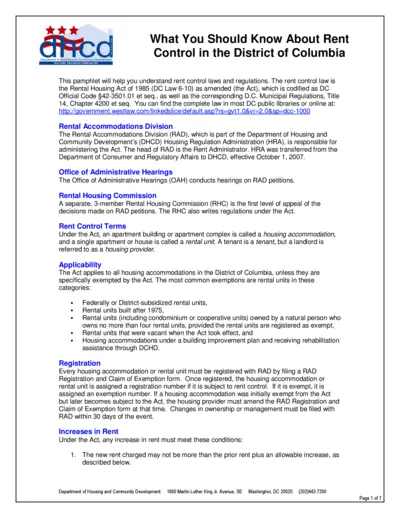

Understanding Rent Control in Washington, DC

This pamphlet provides essential details about rent control laws and regulations in Washington, DC, including the Rental Housing Act of 1985 and its amendments.

Property Taxes

Notifying Employees About the Earned Income Credit (EIC)

This file provides guidelines for employers on how to notify their employees about the Earned Income Credit (EIC). It details which employees should be notified, how and when to notify them, and how employees can claim the EIC. It includes information about required forms and notices that must be given to employees.

Property Taxes

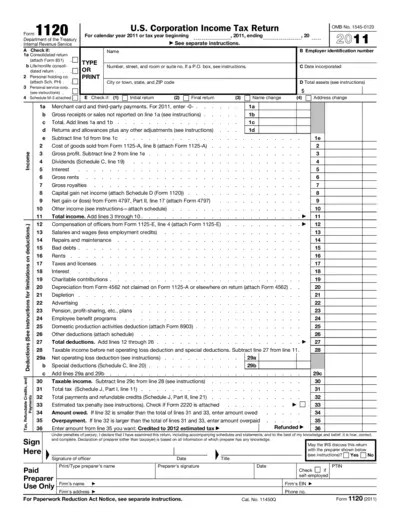

Form 1120: U.S. Corporation Income Tax Return

Form 1120 is used by corporations to file their income tax returns. It includes details on income, deductions, and tax computation. Corporations should refer to instructions for accurate completion.

Property Taxes

TransCore IFTA Fuel and Mileage Tax Reporting Services

This file provides details about TransCore's IFTA fuel and mileage tax services which help businesses manage fuel tax reporting. It includes service options, features, and instructions for compliance. Learn how you can streamline your fuel tax reporting process with TransCore.

Property Taxes

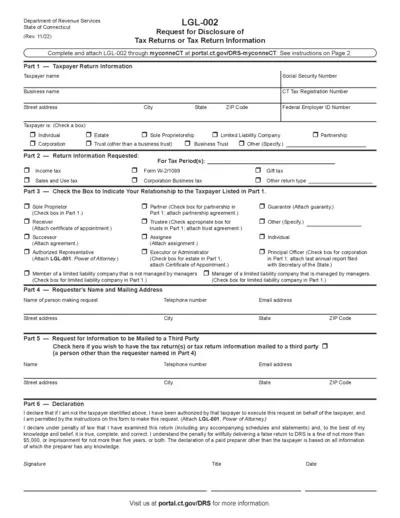

Connecticut Form LGL-002: Request for Disclosure of Tax Returns

This form, LGL-002, from the Department of Revenue Services in Connecticut is used to request tax returns or tax return information. It is applicable for various types of taxpayers including individuals, corporations, estates, and trusts. Follow the instructions provided on the second page to correctly fill out and submit the form.

Property Taxes

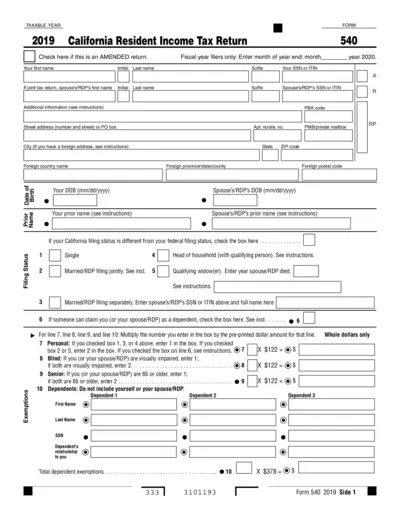

2019 California Resident Income Tax Return Form 540

This document is the California Resident Income Tax Return Form 540 for the taxable year 2019. It is used for filing state income taxes for residents of California. The form includes sections for personal information, exemptions, income, deductions, and tax calculations.

Property Taxes

2021 IRS Form 8995 Instructions: Qualified Business Income Deduction

Form 8995 instructions help taxpayers calculate the Qualified Business Income Deduction for eligible businesses. It includes details on eligibility, calculating QBI, and aggregating trades or businesses.

Property Taxes

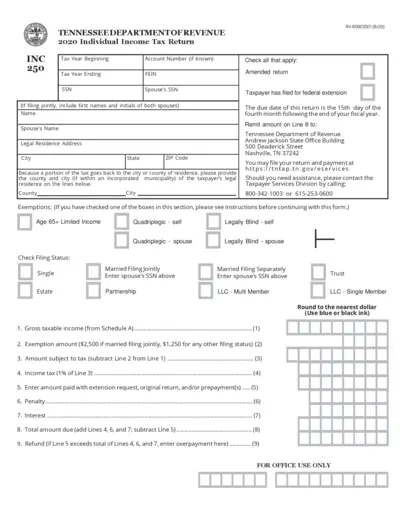

Tennessee 2020 Individual Income Tax Return

This document is the Tennessee 2020 Individual Income Tax Return form. It is used for reporting taxable interest and dividend income. The form includes sections for listing taxable and non-taxable income, calculating tax amounts, and claiming exemptions.

Property Taxes

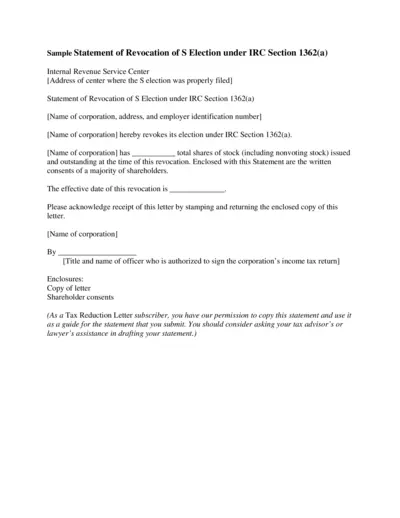

Revocation of S Election under IRC Section 1362(a)

This file contains a statement for revoking an S election under IRC Section 1362(a). It includes details such as the name of the corporation, address, and employer identification number. It also outlines the steps necessary to complete the revocation process and obtain shareholder consents.