Property Law Documents

Property Taxes

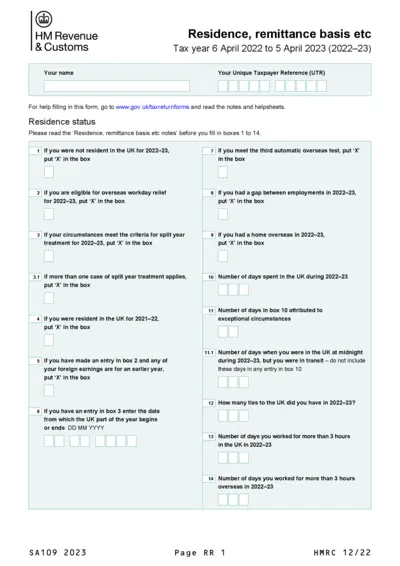

HMRC Residence, Remittance Basis Tax Form 2022-23

This document is a tax form provided by HMRC for the 2022-23 tax year. It includes sections on residence status, personal allowances, domicile, and more. Follow the detailed instructions to ensure accurate completion and submission.

Property Taxes

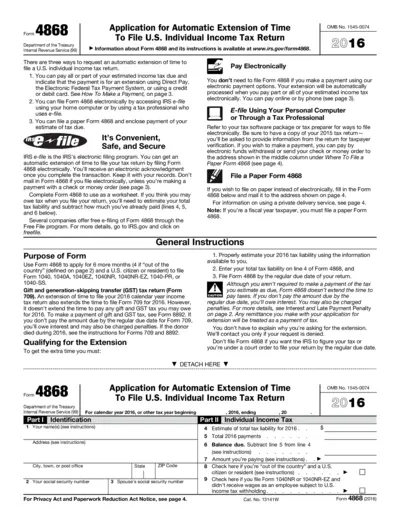

Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

This file provides comprehensive details and instructions for U.S. taxpayers on how to apply for an automatic extension of time to file their individual income tax return using Form 4868. It includes methods of submission, payment options, and important deadlines. The form is crucial for those needing extra time to prepare their tax documents accurately.

Property Taxes

Oregon Corporation Tax Payment Instructions and Form

This file contains instructions for making corporation tax payments to the Oregon Department of Revenue using Form OR-20-V. It provides details on payment options, how to mail payments, and required information. The form must be filled out accurately to ensure proper processing.

Property Taxes

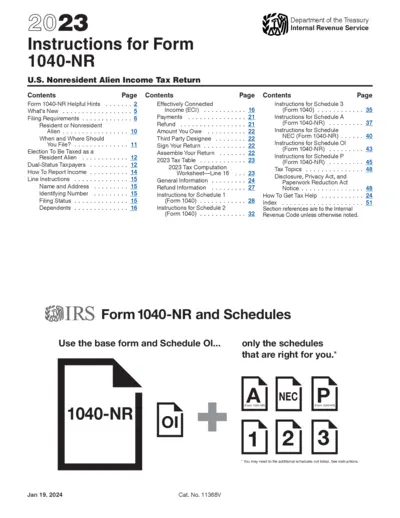

Instructions for Form 1040-NR 2023: Nonresident Alien Income Tax Return

This document provides detailed instructions for completing the 2023 Form 1040-NR, U.S. Nonresident Alien Income Tax Return. It includes helpful hints, filing requirements, and specific exceptions for nonresident aliens.

Property Taxes

Easy Guide to e-Verifying Your Income Tax Return

This file provides a step-by-step guide to e-Verifying your Income Tax Return (ITR) easily using various methods such as Aadhaar OTP, Net Banking, Bank Account, Demat Account, and Bank ATM. It aims to make the verification process quick, convenient, and eco-friendly.

Property Taxes

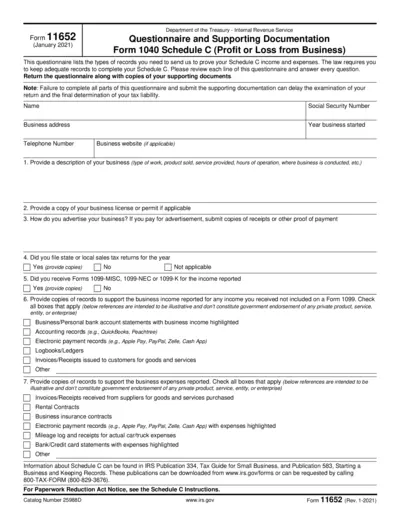

IRS Form 1040 Schedule C: Prove Business Income & Expenses

This IRS questionnaire helps you prove your Schedule C income and expenses. Fill out the details and submit supporting documents as instructed. Ensure accuracy to avoid delays in tax liability determination.

Property Taxes

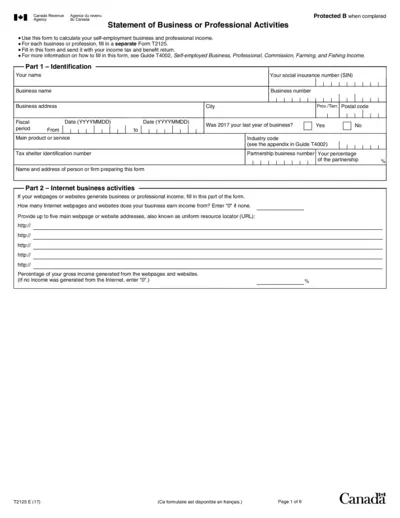

Statement of Business or Professional Activities Form T2125

This file is used to calculate self-employment business and professional income. It includes sections for business and professional income, internet activities, cost of goods sold, and net income before adjustments. Instructions, identification details, and various fields for entering financial data are provided.

Property Taxes

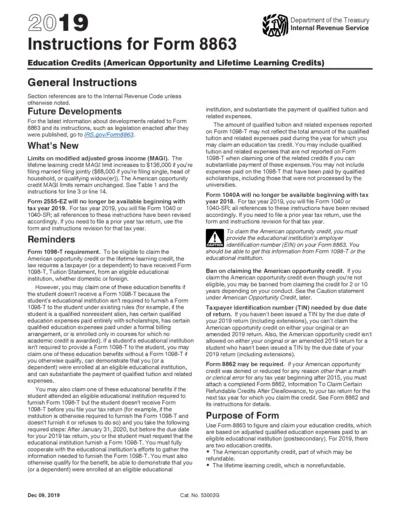

IRS Form 8863 Instructions 2019 for Education Credits

Instructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits). Includes updates for tax year 2019 and detailed guidance for taxpayers.

Property Taxes

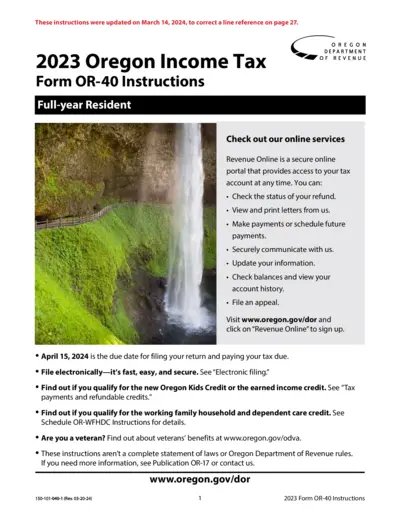

2023 Oregon Income Tax Form OR-40 Instructions

This file provides detailed instructions for filing the 2023 Oregon Income Tax Form OR-40 for full-year residents. It includes information on e-filing, tax credits, and various tax-related topics. Check out the content to ensure accurate and timely tax filing.

Real Estate

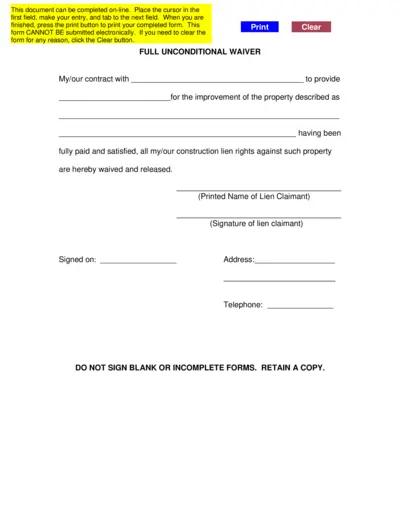

Full Unconditional Waiver Form Instructions

This document can be completed online. Place the cursor in the first field, make your entry, and tab to the next field. When you are finished, press the print button to print your completed form.

Property Taxes

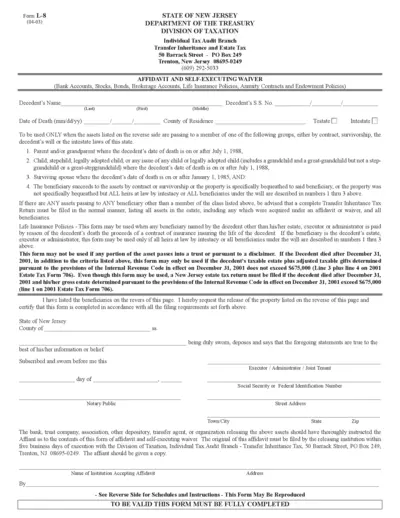

NJ Form L-8 Affidavit and Self-Executing Waiver

Form L-8 is for the release of certain assets without the need for a formal New Jersey inheritance tax waiver. It covers bank accounts, stocks, bonds, brokerage accounts, and life insurance policies. The form is used for beneficiaries including spouse, parents, grandparents, and children.

Property Taxes

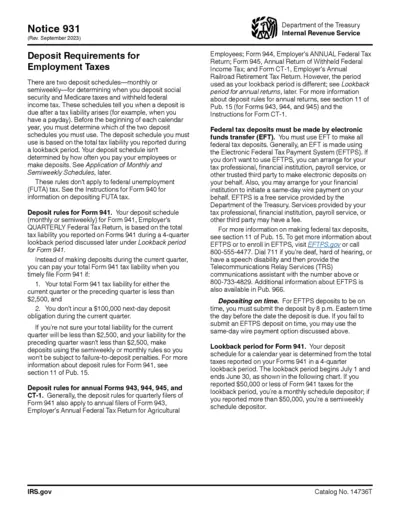

Deposit Requirements for Employment Taxes

This document provides detailed deposit requirements for employment taxes, including schedules, rules for quarterly and annual filers, and electronic funds transfer requirements. It also explains the $100,000 next-day deposit rule and provides examples for better understanding. Additionally, it outlines the lookback period calculations and adjustments.