Property Law Documents

Real Estate

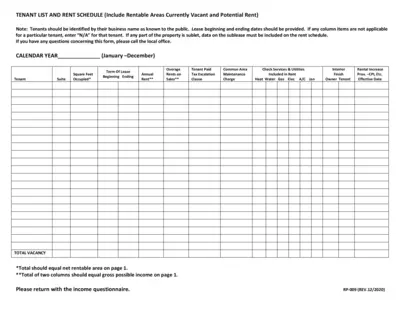

Tenant List and Rent Schedule Form

This form is used for detailing the tenant list and rent schedule for a property. It includes information on lease terms, rent, and common area charges. The form also covers vacant rentable areas and potential rental income.

Property Taxes

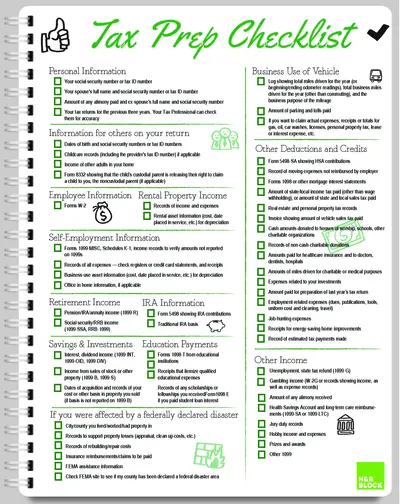

Tax Preparation Checklist Guide

This file provides a detailed checklist for gathering all necessary personal, income, and deduction information required for tax preparation. Use this guide to ensure you have all the required documents and information before filing your taxes. It includes sections on personal information, income records, rental income, self-employment details, retirement income, savings, investments, and more.

Property Taxes

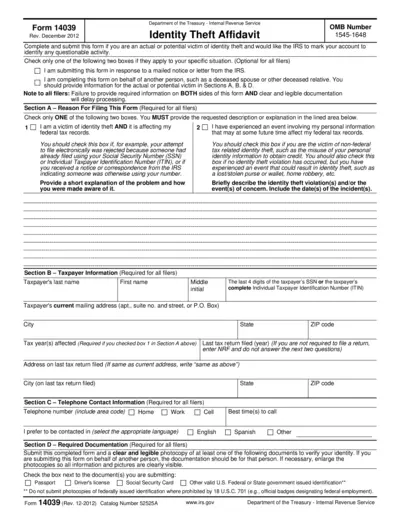

IRS Identity Theft Affidavit Form 14039 - Instructions & Details

Form 14039, Identity Theft Affidavit, is used to report identity theft issues to the IRS. This form helps individuals mark their account to identify any questionable activities. Complete and submit this form with the required documentation.

Property Taxes

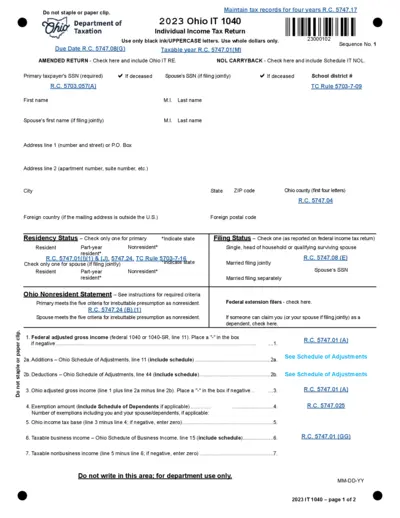

Ohio IT 1040 Individual Income Tax Return 2023

This file is for the 2023 Ohio IT 1040 Individual Income Tax Return. It includes detailed instructions for residents, nonresidents, and part-year residents. It also provides information on credits, deductions, and income reporting.

Property Taxes

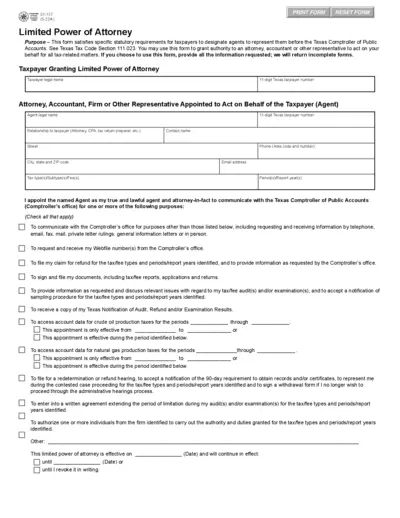

Texas Comptroller Limited Power of Attorney Form

This form grants limited power of attorney for taxpayers to designate agents. It allows representatives to act on taxpayers' behalf. Ensure all required information is provided.

Deed Transactions

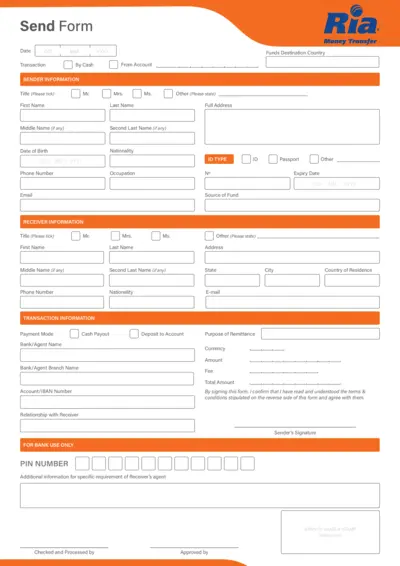

Send Form And Terms Conditions for Money Transfer

This file contains the Send Form for money transactions along with the terms and conditions. It includes sender and receiver information, transaction details, and bank use sections. Ensure accurate information to avoid delays.

Property Taxes

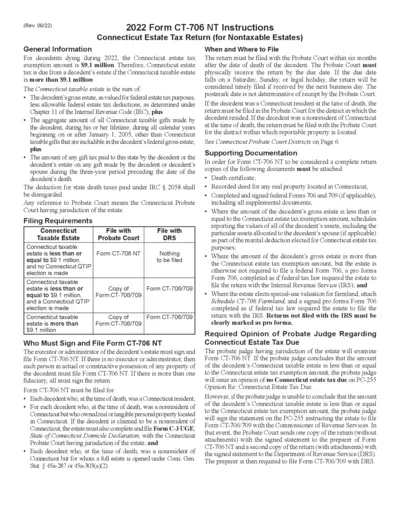

CT-706 NT Nontaxable Estates Form Instructions

This document provides detailed instructions for filling out the Connecticut Estate Tax Return (CT-706 NT) for non-taxable estates. It includes filing requirements, necessary documentation, and steps for proper submission.

Property Taxes

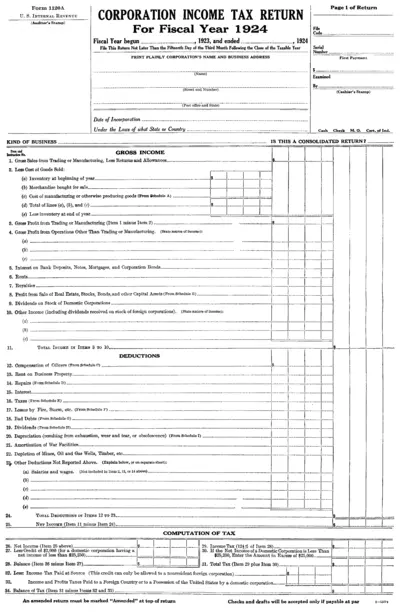

Form 1120A Corporation Income Tax Return for 1924

Form 1120A is a U.S. Corporation Income Tax Return for the fiscal year 1924. It includes instructions for calculating gross income, deductions, and tax. Corporations must file this return no later than the fifteenth day of the third month following the close of the taxable year.

Property Taxes

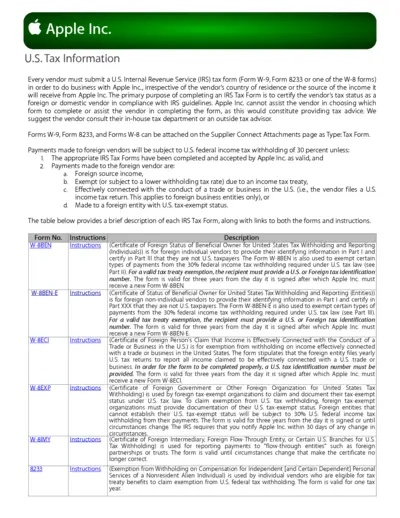

Apple Inc. U.S. Tax Information Forms for Vendors

This file provides information on U.S. tax forms required by Apple Inc. for vendors. It outlines the types of forms available and their specific use cases. The instructions for filling out and submitting the forms are included.

Real Estate

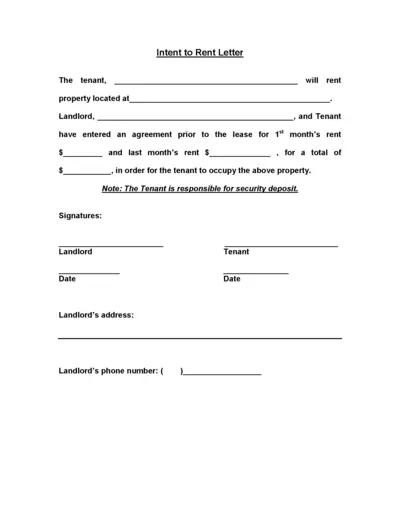

Intent to Rent Letter Template for Landlords and Tenants

This Intent to Rent Letter helps landlords and tenants outline the terms for renting a property. It specifies the monthly rent, security deposit, and signatures of both parties. Use this document to ensure understanding and agreement before the lease begins.

Property Taxes

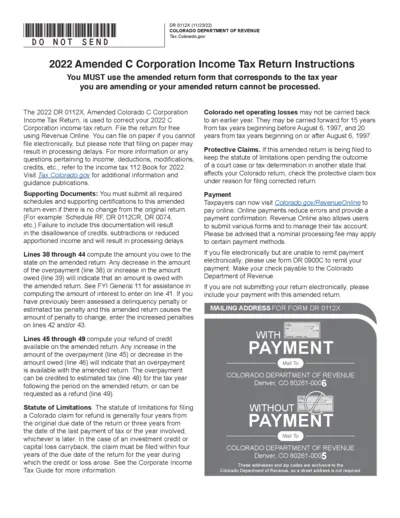

2022 Amended C Corporation Income Tax Return Instructions

The 2022 Amended Colorado C Corporation Income Tax Return Instructions provide guidelines for correcting your 2022 return. It includes details about necessary documents, interest calculations, and statute of limitations. Visit Tax.Colorado.gov for more information.

Property Taxes

Aircraft Personal Property Tax Return Form Instructions

This document contains instructions and details for filing the Aircraft Personal Property Tax Return form. Users can find step-by-step guidelines on how to properly complete and submit the form. Additionally, it provides information on legal requirements and revisions.