Property Law Documents

Property Taxes

Georgia Individual Income Tax Forms and Instructions 2024

This document provides detailed instructions and forms for filing Georgia individual income tax for the year 2024. It includes information about electronic filing, payment methods, and tax credits. The guide also highlights new developments and offers tips for filing your tax return accurately.

Property Taxes

Connecticut CERT-119: Exempt Purchases by Qualifying Organizations

This document is Connecticut's CERT-119 form for exempt purchases by qualifying organizations. It provides guidelines for organizations on how to issue this certificate when purchasing items. It also includes instructions for both the purchaser and the seller.

Property Taxes

Form 8863: Education Credits - IRS 2023

Form 8863 is used to claim education credits, including the American Opportunity and Lifetime Learning Credits. It's essential for taxpayers seeking education-related tax benefits. This guide helps you understand how to fill it out.

Property Taxes

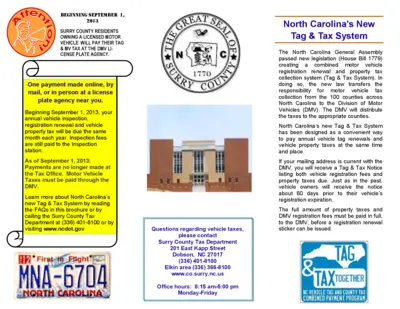

North Carolina Tag & Tax System Guide

This file contains detailed information about the North Carolina Tag & Tax System, including FAQs and instructions for Surry County residents. It explains the new legislation, combined payment procedure, and provides contact information for the DMV and Surry County Tax Department.

Property Taxes

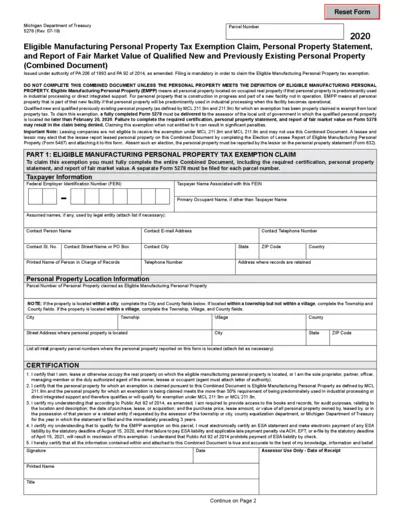

Personal Property Tax Exemption Claim Form

This document is for claiming the Eligible Manufacturing Personal Property tax exemption. It includes a personal property statement and report of fair market value. Filing is mandatory to claim the exemption.

Property Taxes

IRS Form 1099-G Instructions and Guidelines 2024

This file provides instructions and guidelines for IRS Form 1099-G, an information return used to report certain government payments. Detailed instructions are provided to help fill it accurately. Make sure to follow the guidelines properly to avoid penalties.

Property Taxes

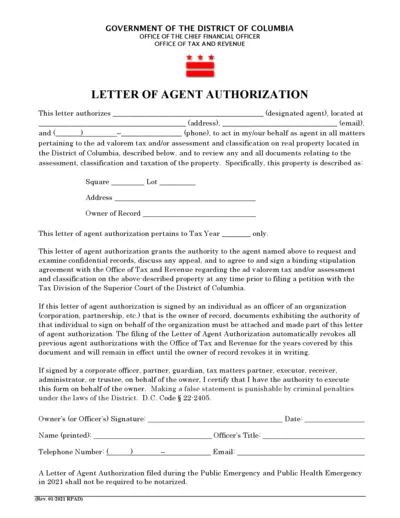

Letter of Agent Authorization for District of Columbia Tax

This file is a Letter of Agent Authorization from the Office of Tax and Revenue in the District of Columbia. It authorizes an agent to act on behalf of a property owner for matters related to ad valorem tax and property assessment. The letter grants authority to request records, discuss appeals, and sign binding agreements.

Property Taxes

TRACES PDF Converter V1.3L Light e-Tutorial

This e-tutorial provides guidance on using the TRACES PDF Converter V1.3L Light. It is intended for users who need to manage their TDS/TCS accounts. All information is for informational purposes only.

Real Estate

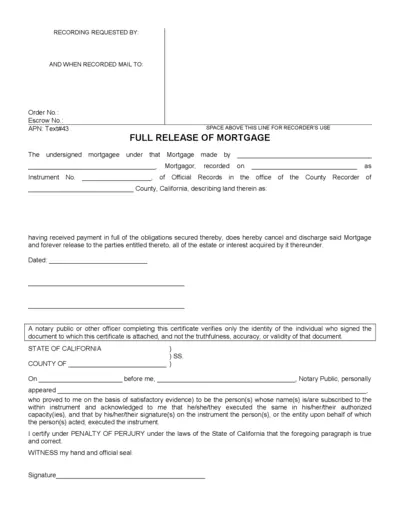

Full Release of Mortgage Form

This file is a form used for the full release of a mortgage. It contains sections for recording details, notary public verification, and mortgagee details. It's essential for cancelling and discharging a mortgage legally.

Real Estate

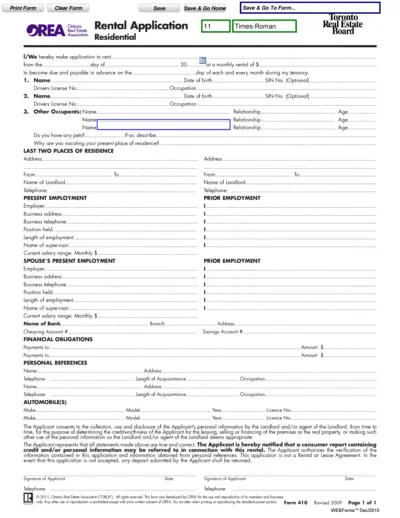

Ontario Real Estate Rental Application Form

This file is a rental application form provided by the Ontario Real Estate Association (OREA). It includes sections for applicant information, present employment, spouse's employment, financial obligations, personal references, and prior residences. The form is used to determine the creditworthiness of potential renters.

Property Taxes

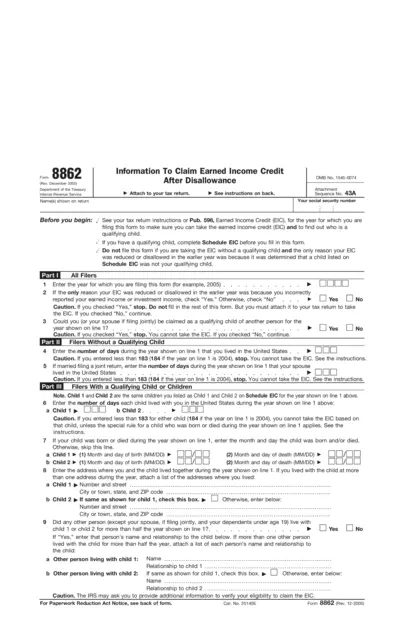

Form 8862: Information To Claim Earned Income Credit

Form 8862 is used to claim earned income credit after it was reduced or disallowed. Ensure you meet the requirements before filing. Attach it to your tax return.

Real Estate

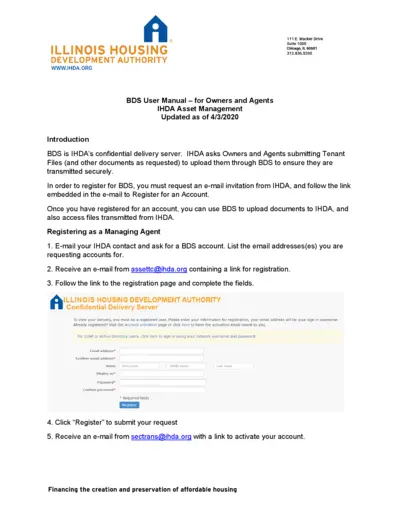

BDS User Manual for Owners and Agents

This manual provides instructions for owners and agents on how to use the Illinois Housing Development Authority's confidential delivery server. It guides users through the registration process and details on how to securely upload documents. The manual also offers steps on how to access files transmitted from IHDA.