Property Law Documents

Real Estate

Standard Rent-To-Own Agreement for Real Estate

This document outlines a Rent-To-Own agreement between a landlord and a tenant, detailing the terms and conditions for leasing and the option to purchase the property.

Real Estate

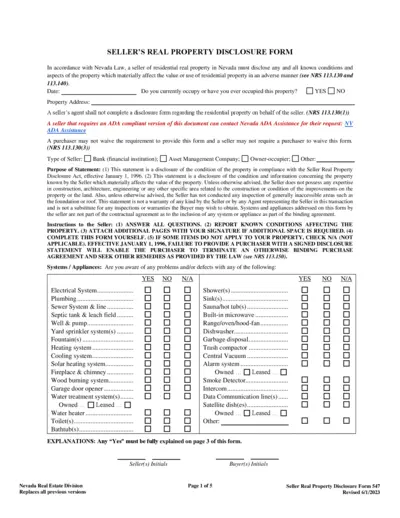

Seller's Real Property Disclosure Form for Nevada

The Seller's Real Property Disclosure Form is a mandatory document for sellers of residential property in Nevada. This form discloses the property's known conditions and other relevant information. It affects the value of the property and its use.

Property Taxes

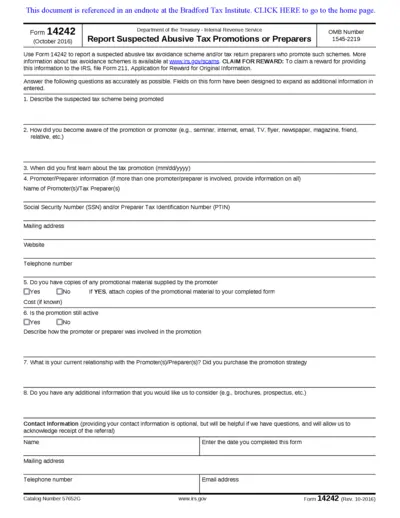

Report Suspected Abusive Tax Promotions or Preparers

This form is used to report suspected abusive tax avoidance schemes and tax return preparers promoting such schemes. It provides detailed instructions on how to complete and submit the form. Use Form 14242 to ensure compliance with IRS rules and regulations.

Property Taxes

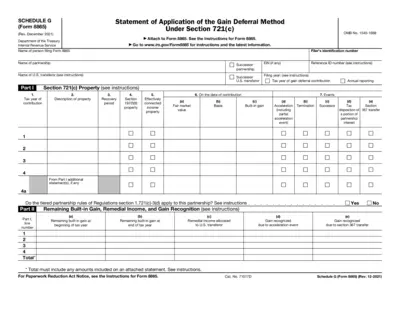

Schedule G (Form 8865) Instructions and Details

Schedule G (Form 8865) is used for the Statement of Application of the Gain Deferral Method under Section 721(c). It must be attached to Form 8865. This document provides instructions and required details for filing Schedule G.

Property Taxes

IRS Publication 1239: Specifications for Electronic Filing

Publication 1239 provides specifications for electronic filing of Form 8027, Employer's Annual Information Return of Tip Income, and Allocated Tips, for Tax Year 2023. It includes general information, filing requirements, data communication guidelines, record format specifications, and more. Essential for businesses handling tip income reporting.

Property Taxes

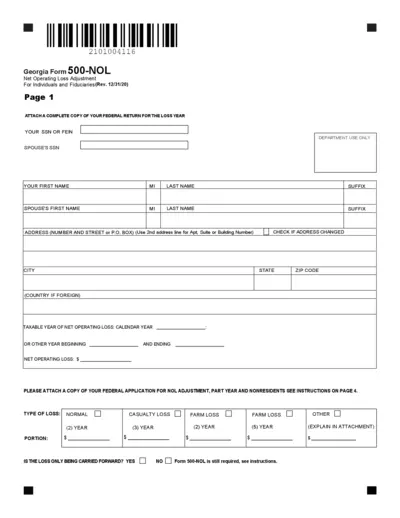

Georgia Form 500-NOL: Net Operating Loss Adjustment

This document is the Georgia Form 500-NOL, used for adjusting net operating losses for individuals and fiduciaries. It includes fields for personal information, loss types, and detailed income adjustments. The form must be filled out accurately and a complete copy of your federal return is required.

Property Taxes

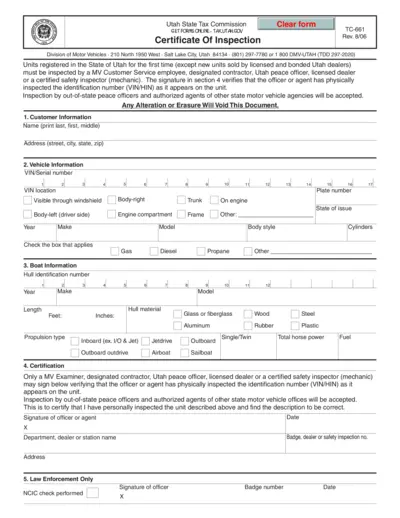

Certificate Of Inspection - Utah State Tax Commission

This document is a Certificate Of Inspection required for units being registered in the State of Utah for the first time. It must be completed by a designated inspector and physically inspected. Alterations or erasures will void the document.

Property Taxes

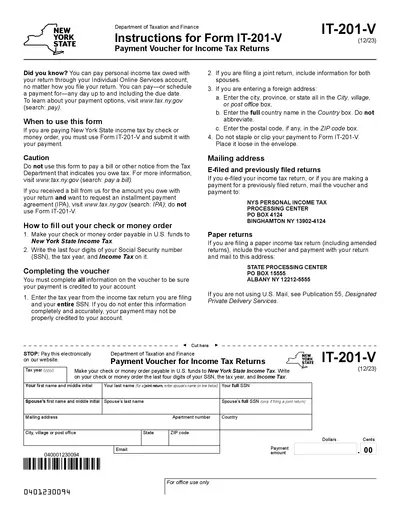

Instructions for Form IT-201-V Payment Voucher

This document provides instructions for filling out Form IT-201-V, which is used to submit payments for New York State income taxes by check or money order. It details when to use the form, how to complete it accurately, and where to mail it. The file also includes important contact information and privacy notices.

Property Taxes

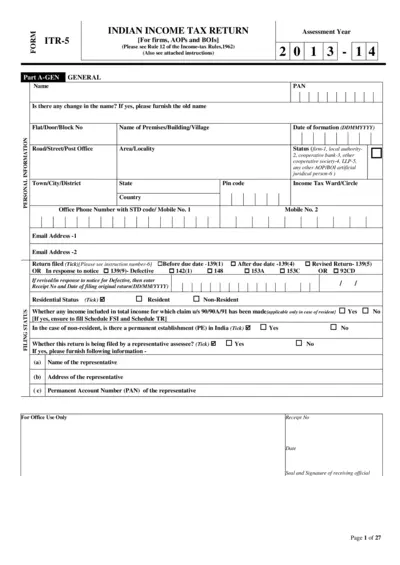

Indian Income Tax Return Form ITR-5 for Firms and AOPs

Form ITR-5 is used for filing income tax returns by firms, Association of Persons (AOPs) and Body of Individuals (BOIs) in India. This form is applicable as per Rule 12 of the Income-tax Rules, 1962. It includes various schedules and details that need to be filled accurately.

Property Taxes

Tax Preparation Tips for Uber Partners Using TurboTax

This file provides tax preparation tips specifically for Uber Partners, focusing on how to report income and minimize taxes using TurboTax. It includes detailed guidance on income earned, tax-deductible expenses, mileage, and other essential information for filing taxes as an independent contractor.

Property Taxes

Instructions for Form SS-8 (Rev. January 2024)

Form SS-8 is used to request a determination of worker status for federal employment taxes and income tax withholding. The form is filed by either the worker or the firm to clarify worker classification. Use this form for federal tax matters only.

Property Taxes

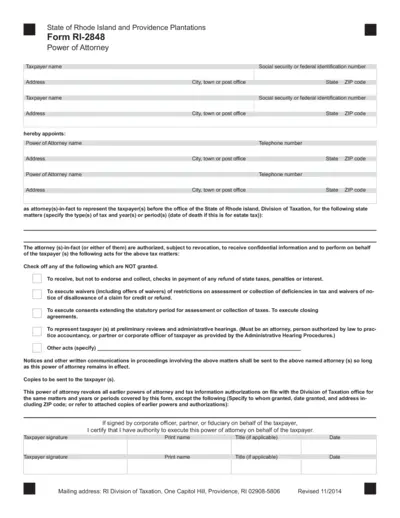

State of Rhode Island Tax Power of Attorney Form RI-2848

Form RI-2848 allows a taxpayer to appoint a representative for tax matters in Rhode Island. This form must be filled out completely for it to be valid. It must also be signed by the taxpayer and, in some cases, a notary or two witnesses.