Property Law Documents

Real Estate

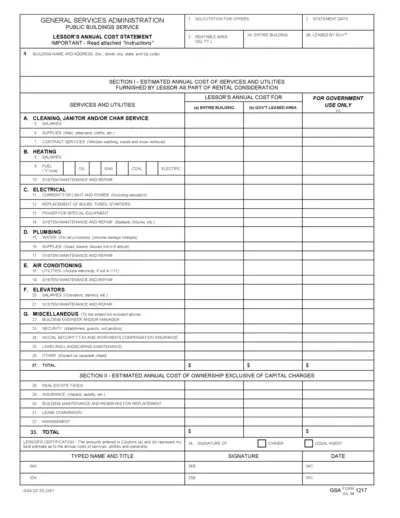

Lessor's Annual Cost Statement Instructions and Details

This file contains the Lessor's Annual Cost Statement form and detailed instructions for filling it out, including cost estimates for services, utilities, and ownership.

Property Taxes

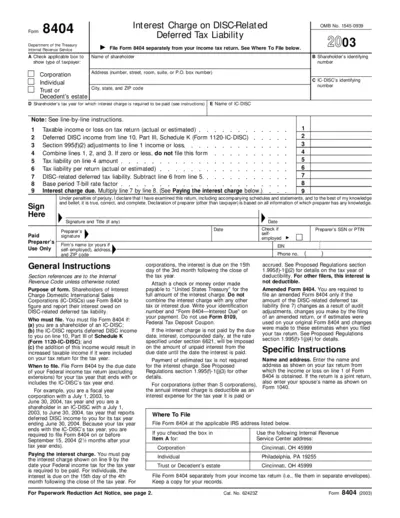

Form 8404 - Interest Charge on DISC-Related Deferred Tax Liability

Form 8404 is used by shareholders of Interest Charge Domestic International Sales Corporations (IC-DISCs) to calculate and report interest owed on DISC-related deferred tax liability. Instructions include who must file, when to file, paying the interest charge, and other computation rules. It also explains how to enter necessary information such as taxpayer details and identifying numbers.

Real Estate

Zillow Rental Application Process Guide

This file provides a comprehensive guide on how to use Zillow's online rental application and screening tool. It includes steps for enabling applications, inviting applicants, reviewing information, managing applicants, and creating lease agreements. The guide is useful for landlords looking to streamline their tenant application process.

Property Taxes

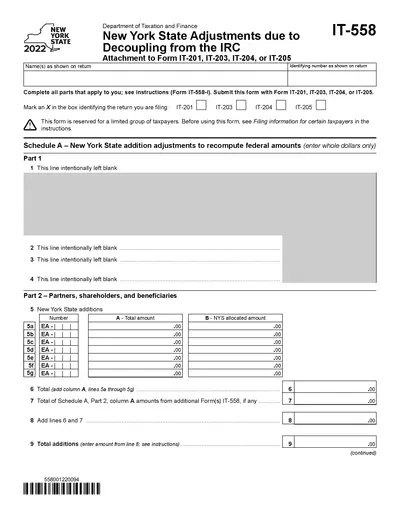

New York State 2022 Adjustments Due to Decoupling from the IRC

This file contains the New York State Adjustments due to Decoupling from the IRC for the year 2022. It is used as an attachment to Form IT-201, IT-203, IT-204, or IT-205. Complete all relevant parts and submit it with the appropriate form.

Property Taxes

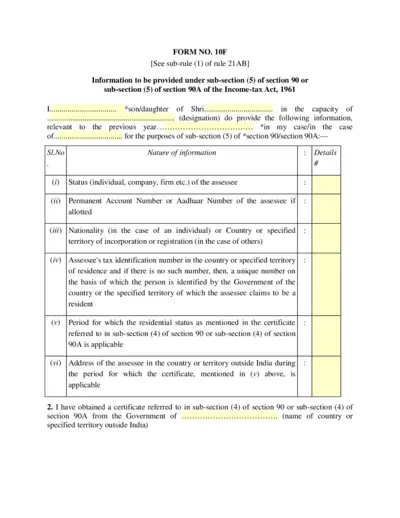

Income Tax Form 10F - Information under Section 90/90A

Form 10F is required for providing information under sub-section (5) of section 90 or sub-section (5) of section 90A of the Income-tax Act, 1961. It is used to supply details relevant to a previous year for tax purposes. The form includes personal, tax, and residency details to claim relief under tax treaties.

Property Taxes

Kentucky Income Tax Withholding Instructions for Employers

This file provides detailed instructions for employers regarding Kentucky income tax withholding. It includes information on filing requirements, exemption certificates, and much more. This document is essential for employers in Kentucky.

Property Taxes

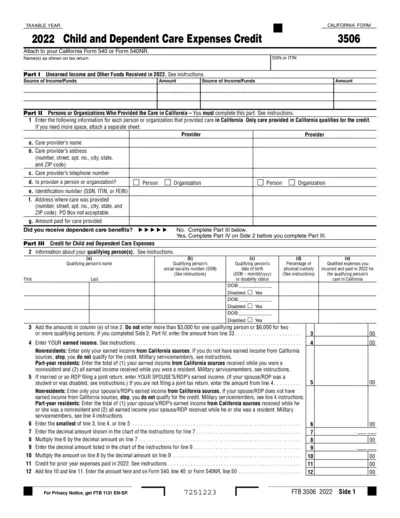

2022 California Child and Dependent Care Expenses Credit Form

This document is the 2022 California Form 3506 for claiming Child and Dependent Care Expenses Credit. It should be attached to California Form 540 or Form 540NR. Ensure that all required fields are completed and additional sheets are attached if necessary.

Property Taxes

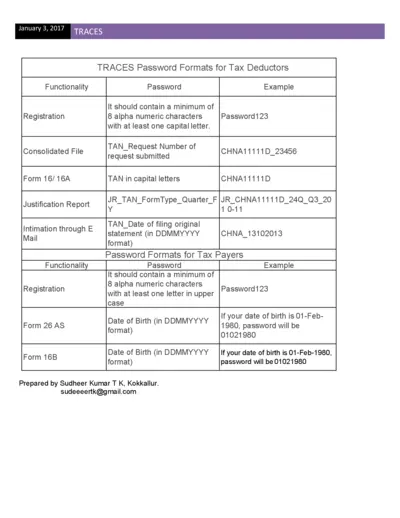

TRACES Password Formats and Functionality Guide for Tax Deductors and Tax Payers

This document provides guidance on TRACES password formats for tax deductors and tax payers. It includes detailed examples and instructions for various forms such as Form 16/16A and Form 26AS. Users will find step-by-step guidance on how to register and create passwords.

Real Estate

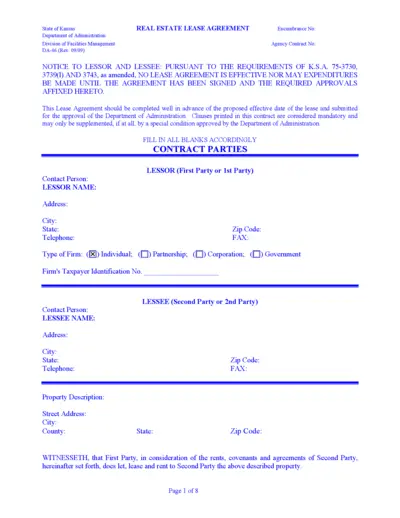

Kansas Real Estate Lease Agreement DA-46 Form

This file is a Real Estate Lease Agreement form used by the State of Kansas. It outlines the terms, rental payments, and responsibilities of both parties involved in the lease. The form also details the utilities, additional services, subletting rights, and repair obligations.

Property Taxes

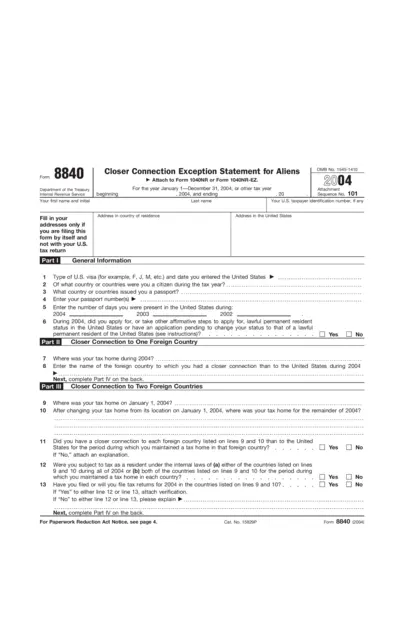

Closer Connection Exception Statement for Aliens - 2004

Form 8840, the Closer Connection Exception Statement for Aliens, ensures nonresident status claims for tax purposes. Attach it to Form 1040NR or 1040NR-EZ. Complete this form to comply with IRS regulations if you meet the closer connection exception.

Property Taxes

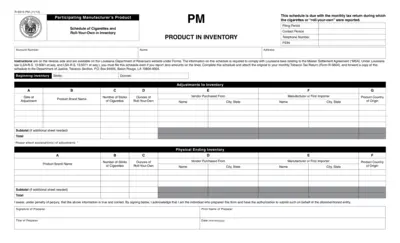

Louisiana Participating Manufacturer's Tobacco Inventory Schedule

This file contains the schedule for listing cigarettes and roll-your-own tobacco products for Participating Manufacturers in Louisiana. It is necessary for compliance with the Master Settlement Agreement (MSA). The file also includes instructions for reporting inventory adjustments and physical ending inventory.

Property Taxes

Indiana W-2G and 1099 Filing Requirements Guide

This file provides detailed instructions and requirements for filing W-2G and 1099 forms in Indiana. It includes guidelines for electronic filing, sequence of records, and specific IRS format. The document also covers administrative highlights and important information for taxpayers.