Property Law Documents

Property Taxes

Colorado Department of Revenue E-Filers Handbook 2022

This handbook provides detailed instructions for electronic filing of federal and state income tax returns in Colorado. It includes guidelines for acceptable returns and forms, application process, requirements, submitting attachments, error codes, and contact information. It's a comprehensive guide for EROs, Transmitters, and taxpayers in Colorado.

Property Taxes

Mandatory e-Pay Waiver Request for California Franchise Tax Board

This file is for requesting a waiver from the mandatory e-pay requirement with the Franchise Tax Board of California. It includes instructions for taxpayers to request a waiver for various reasons. Follow the detailed steps to complete and submit the form properly.

Property Taxes

Colorado 1099/W-2G Income Withholding Tax Requirements

This file provides detailed instructions on the withholding tax requirements for 1099 and W-2G forms in Colorado. It includes information on opening and closing accounts, filing frequencies, and payment methods. Essential for payers who need to report income other than wages, salaries, and tips.

Property Taxes

Education Credits Lesson Plan: A Guide to Tax Benefits

This file provides an in-depth lesson plan on education credits, including guidance on who qualifies, types of credits available, and instructions for claiming the credits. It is designed to help educators and students understand the importance and process of claiming education tax benefits.

Property Taxes

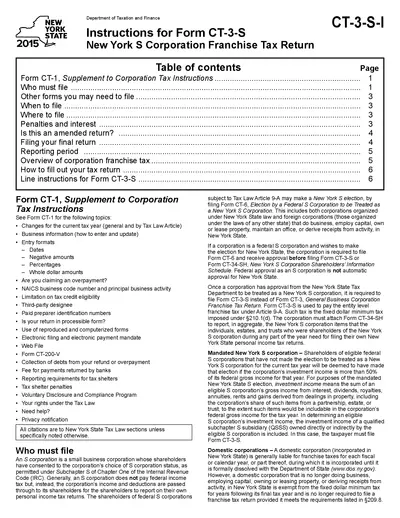

New York S Corporation Franchise Tax Return Instructions

Instructions for Form CT-3-S, the New York S Corporation Franchise Tax Return, detailing requirements and steps for filing.

Real Estate

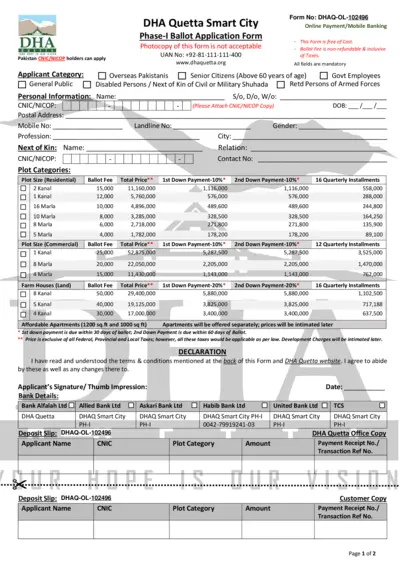

DHA Quetta Smart City Phase-I Ballot Application form for 2024.

The DHA Quetta Smart City Phase-I Ballot Application Form provides a comprehensive guide to applying for residential and commercial plots. Detailed instructions, terms, and conditions are included for applicants with different eligibility criteria. Follow the steps and guidelines to ensure successful application submission.

Property Taxes

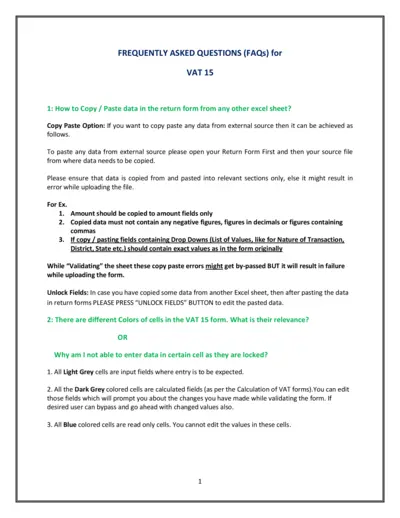

VAT 15 Form - Frequently Asked Questions (FAQs) for Filing

This file contains a list of frequently asked questions (FAQs) for filing VAT 15 form. It provides detailed instructions on how to fill out the form, explanation of color-coded fields, mandatory fields, and handling different types of transactions.

Real Estate

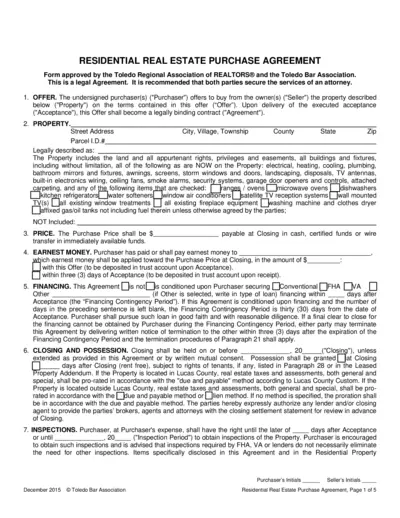

Residential Real Estate Purchase Agreement - Toledo

This file is a Residential Real Estate Purchase Agreement form approved by the Toledo Regional Association of REALTORS® and the Toledo Bar Association. It contains important terms and conditions for the purchase and sale of residential property. Both parties are advised to secure the services of an attorney to ensure all legal aspects are covered.

Property Taxes

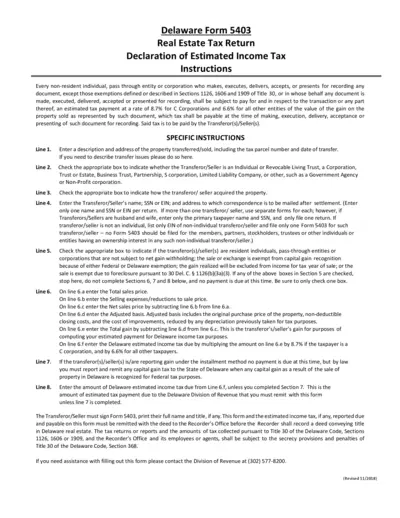

Delaware Form 5403 Real Estate Tax Return

Delaware Form 5403 is required for non-resident individuals and entities who transfer real estate in Delaware. This form ensures proper declaration and payment of estimated income tax on the gain from the sale. Specific instructions guide the seller through the completion of the form.

Property Taxes

Child Tax Credit and Additional Child Tax Credit Guide

This file provides essential information on the Child Tax Credit and Additional Child Tax Credit, including requirements, limits, and instructions for filing. It also includes step-by-step guidance on completing Form 1040A.

Property Taxes

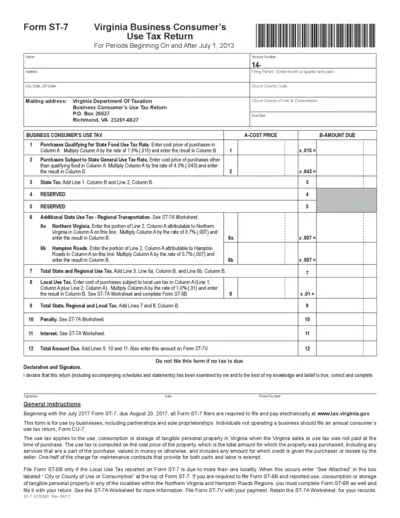

Form ST-7: Virginia Business Consumer's Use Tax Return

Form ST-7 is used by businesses in Virginia to report use tax for periods beginning on and after July 1, 2013. It provides instructions for calculating state, regional, and local use taxes. Businesses can file electronically starting from the July 2017 form.

Property Taxes

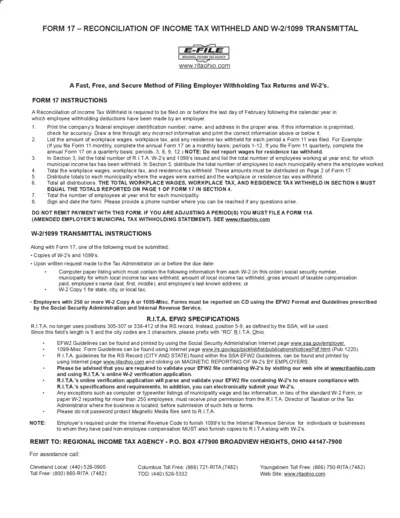

FORM 17 - Reconciliation of Income Tax Withheld and W-2/1099 Transmittal

This file contains the instructions and details needed to reconcile income taxes withheld and W-2/1099 transmittal for the Regional Income Tax Agency (R.I.T.A.). It provides guidelines on filling the form, submitting the required documents, and distributing taxes to appropriate municipalities. It's crucial for employers to complete this form accurately to ensure compliance with local tax regulations.