Property Law Documents

Property Taxes

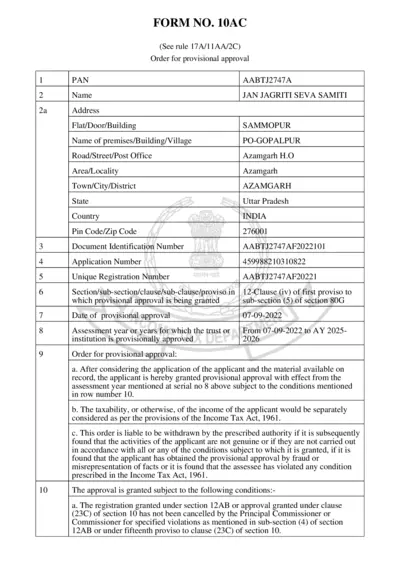

Order for Provisional Approval JAN JAGRITI SEVA SAMITI

This file contains the provisional approval order for JAN JAGRITI SEVA SAMITI, including details such as PAN, address, approval date, and conditions for approval. It also outlines the assessment years covered by the approval and the authority granting it.

Property Taxes

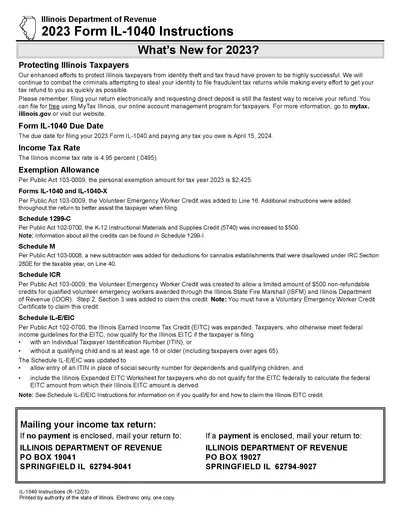

Illinois Department of Revenue, 2023 Form IL-1040 Instructions

This file contains detailed instructions and information for filing the 2023 Illinois Form IL-1040 tax return. It includes updates on tax rates, credits, and deductions relevant to Illinois taxpayers. The document also provides step-by-step guidance on how to complete and submit the form to the Illinois Department of Revenue.

Property Taxes

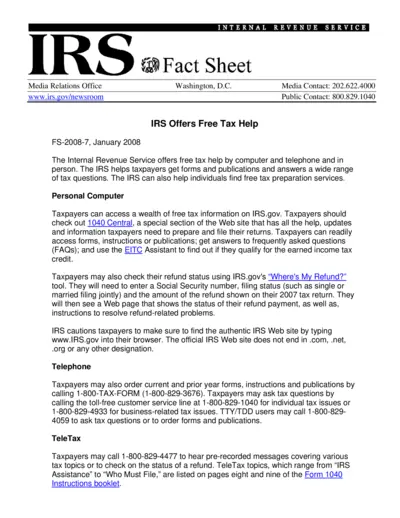

IRS Free Tax Help Guide 2008

The IRS Free Tax Help Guide provides comprehensive information on how taxpayers can access free tax assistance through various channels including computer, telephone, and in-person. It details the services available for obtaining forms and publications, checking refund status, and more.

Property Taxes

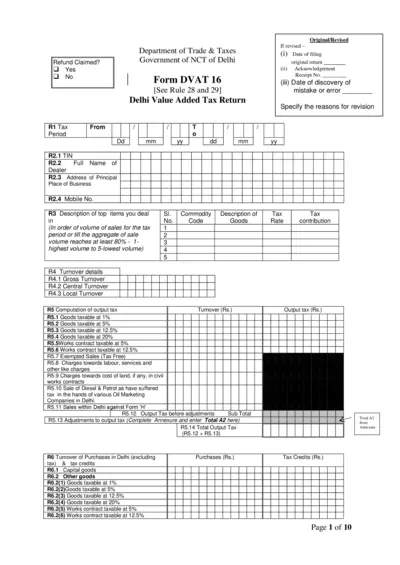

Delhi Value Added Tax Return Form DVAT 16 Instructions

This document provides detailed instructions, descriptions, and components relating to the Delhi Value Added Tax Return Form DVAT 16. It includes information about tax computation, declaration fields, important dates, and submission guidelines.

Property Taxes

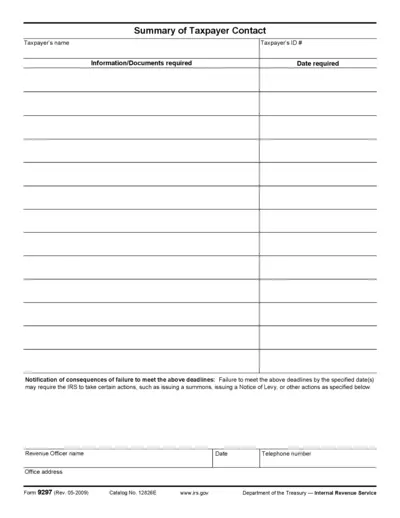

IRS Taxpayer Document Requirements and Consequences

This file details the document requirements and deadlines for taxpayers as mandated by the IRS. It includes information about consequences for failing to meet deadlines such as issuance of a summons or a Notice of Levy. Essential for tax compliance.

Property Taxes

Creating a Written Information Security Plan for Tax & Accounting

This file provides comprehensive instructions and guidelines for creating a Written Information Security Plan (WISP) tailored for tax and accounting practices. It explains the requirements under the Gramm-Leach-Bliley Act and offers sample templates to assist professionals in safeguarding customer data. The document is designed to help tax professionals comply with legal requirements and protect sensitive information.

Property Taxes

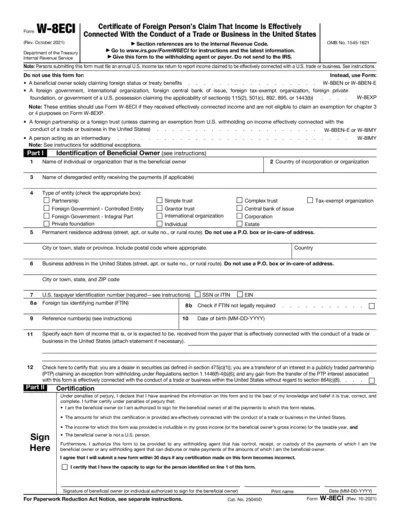

Certificate of Foreign Person's Claim That Income Is Effectively Connected

Form W-8ECI is used by foreign persons to certify that income is effectively connected with the conduct of a trade or business in the United States. It is submitted to the withholding agent or payer. An annual U.S. income tax return must be filed to report the income.

Real Estate

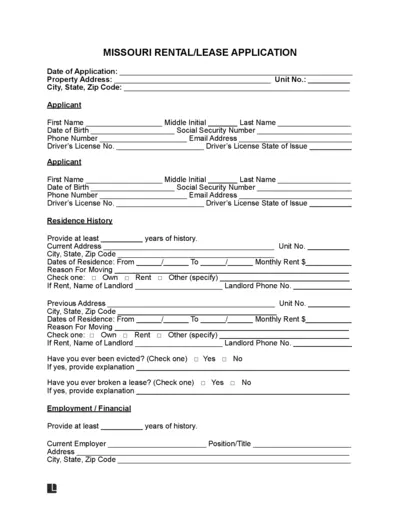

Missouri Rental/Lease Application Form

The Missouri Rental/Lease Application form helps landlords gather necessary information about potential tenants. This form includes details about the applicant, residence history, employment history, financial accounts, and other personal information. It ensures a comprehensive background check to make informed rental decisions.

Property Taxes

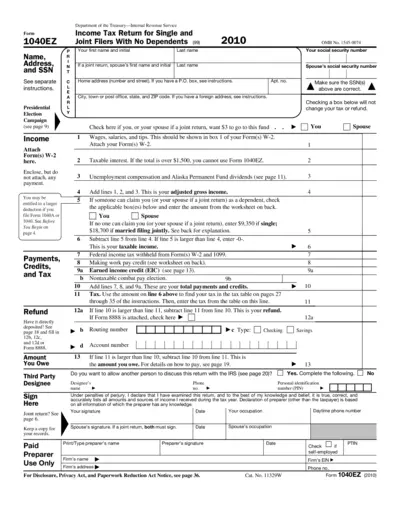

1040EZ Income Tax Return Form for 2010

The 1040EZ form is designed for single and joint filers with no dependents. It allows you to report your income easily. This form is for the tax year 2010.

Property Taxes

PA Department of Revenue Form 1099-G and INT FAQs

This document provides answers to frequently asked questions about Pennsylvania Department of Revenue Forms 1099-G and 1099-INT. It explains what these forms are, why you might receive them, and how they affect your tax returns. It also offers guidance on what to do if you have questions or need corrections.

Property Taxes

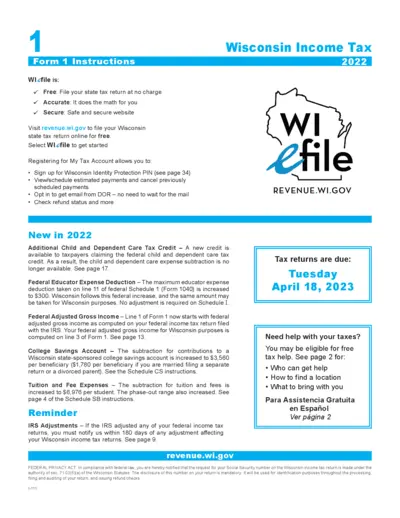

Wisconsin Income Tax Form 1 Instructions 2022

This file contains instructions for filing Wisconsin Income Tax Form 1 for the year 2022. It includes information on who must file, important updates, and general instructions for completing the form. Use this document to ensure accurate and timely submission of your tax return.

Property Taxes

IRS Publication 915: Social Security and Equivalent Railroad Retirement Benefits for 2023

This document provides federal income tax guidelines for social security and equivalent tier 1 railroad retirement benefits, including taxable benefits and deductions. It's updated with the latest rules and filing statuses. Beneficiaries will find explanatory notes for special cases and resources for further assistance.