Property Law Documents

Real Estate

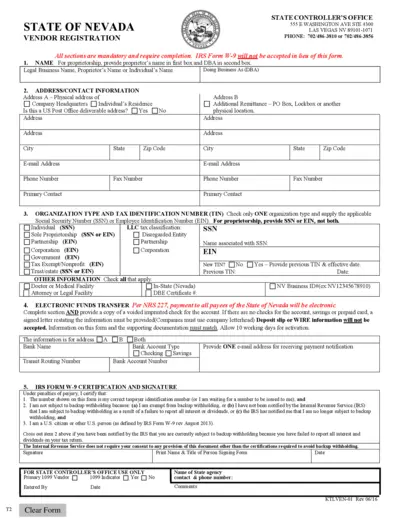

Nevada State Vendor Registration Form Instructions

This file contains instructions for registering as a vendor with the State of Nevada. It provides guidelines for completing the Nevada Vendor Registration Form. It includes sections on name, address, organization type, tax identification number, and electronic funds transfer.

Property Taxes

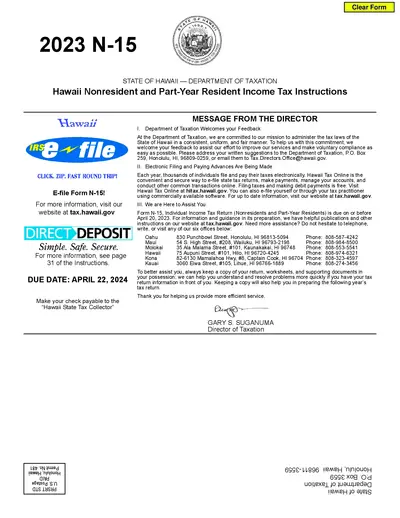

Hawaii Nonresident and Part-Year Resident Income Tax Instructions

This file provides comprehensive instructions for Hawaii nonresident and part-year resident income tax returns. It includes electronic filing information, important reminders, changes to note, and detailed form instructions. Essential for ensuring accurate and timely submission.

Property Taxes

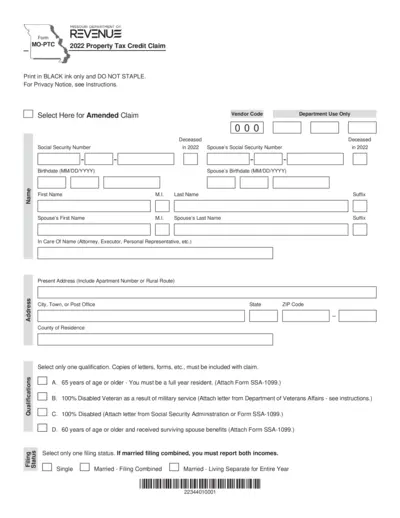

2022 Missouri Property Tax Credit Claim Form

The 2022 Missouri Property Tax Credit Claim form is used to claim a tax credit for property taxes or rent paid by eligible Missouri residents. This form requires detailed income and residency information. Attach necessary documentation as specified.

Property Taxes

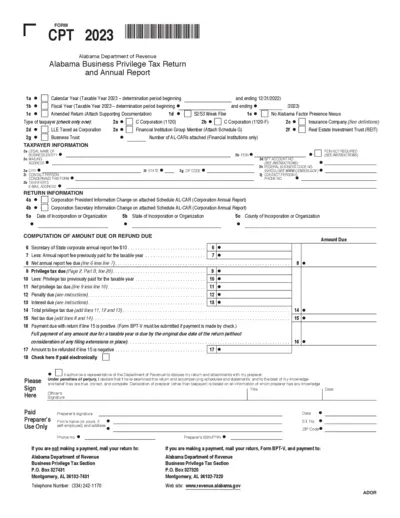

Alabama Business Privilege Tax Return and Annual Report 2023

This document is the Alabama Business Privilege Tax Return and Annual Report form for the fiscal year 2023. It includes sections for different types of taxpayers and instructions for computation of amounts due or refunds. Detailed instructions on how to fill out and submit the form are provided.

Property Taxes

2012 W-2/W-2C Reporting Instructions DC

This document provides the 2012 reporting instructions for W-2 and W-2C forms in the District of Columbia. It includes new updates, reminders, and instructions on electronic submission. Essential for employers handling employee wage records.

Property Taxes

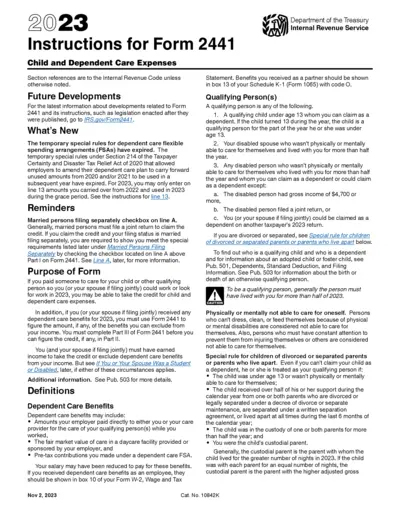

Instructions for Form 2441: Child and Dependent Care Expenses

This document provides detailed instructions for taxpayers on how to fill out Form 2441, which is used for claiming child and dependent care expenses. It includes information about who can claim the credit, how to report expenses, and who qualifies for the credit.

Real Estate

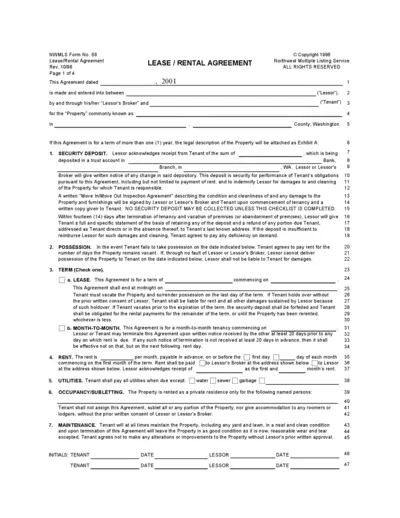

NWMLS Lease/Rental Agreement Form

This Lease/Rental Agreement Form is designed for Washington state landlords and tenants to formalize rental terms, property conditions, and compliance requirements. The standard form includes sections on security deposits, rent, maintenance, utilities, and other essential lease terms. Easily fill out, sign, and share the agreement.

Property Taxes

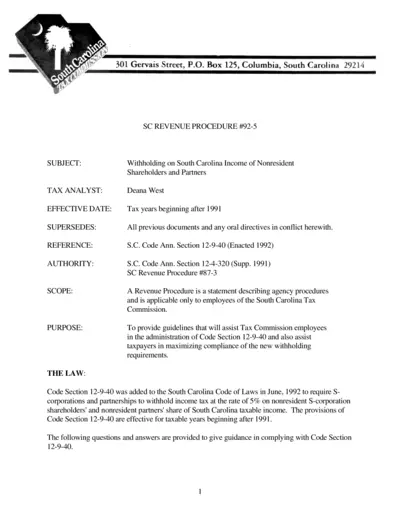

South Carolina Nonresident Income Tax Withholding Guidelines

This document provides detailed guidelines for withholding South Carolina Income Tax on nonresident shareholders and partners. It includes instructions on withholding rates, computation, remittance, and exceptions. South Carolina's tax compliance procedures are also covered.

Property Taxes

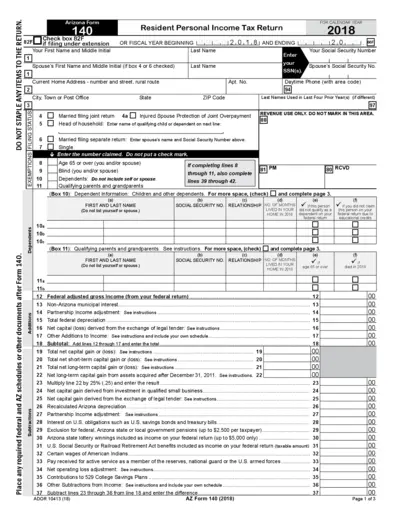

Arizona Form 140 - Resident Personal Income Tax Return 2018

The Arizona Form 140 is a document for residents to file their personal income tax return for the calendar year 2018. It includes information on exemptions, dependents, income adjustments, and instructions for submissions. Make sure to review the form to ensure accurate completion and submission.

Property Taxes

South Carolina 2022 Individual Income Tax Form and Instructions

This document contains the South Carolina Department of Revenue's 2022 SC1040 form and instructions for individual income tax filing. It includes filing guidelines, important dates, and payment options. This is essential for South Carolina residents to complete their state tax returns accurately and on time.

Property Taxes

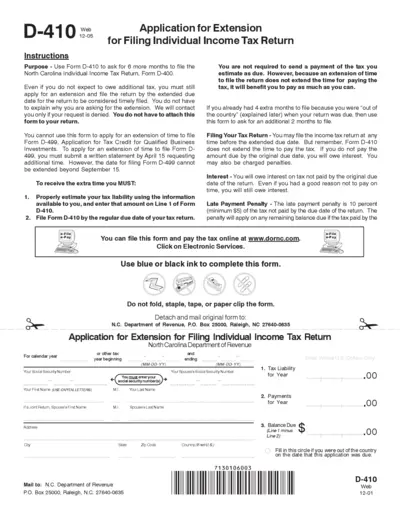

Application for Extension for Filing Individual Income Tax Return

This file is for individuals seeking an extension to file their North Carolina Individual Income Tax Return. It provides instructions on how to apply for a 6-month extension using Form D-410. The file outlines the eligibility criteria, penalties, and steps for submitting the form.

Real Estate

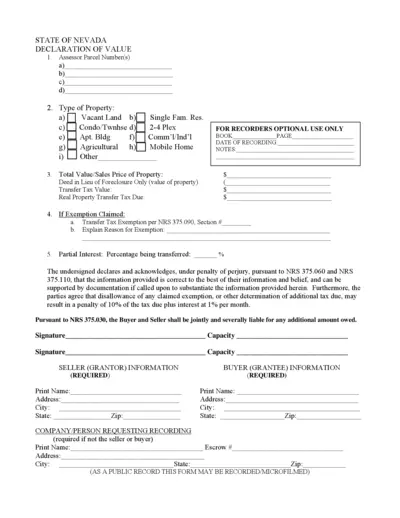

Nevada Declaration of Value Form

This form is used in the state of Nevada for declaring the value of real property. It's required for assessing transfer taxes and exemptions. Proper completion ensures compliance with Nevada Revised Statutes.