Property Law Documents

Real Estate

Keller Williams Realty Policies and Guidelines Manual

This manual provides comprehensive policies and guidelines for Keller Williams Realty employees in the United States and Canada. It covers topics such as the Keller Williams story and philosophy, belief system in action, and local, city, regional, and international ALCs. The manual is designed to help employees understand and implement company policies effectively.

Property Taxes

NY State 2018 Instructions for Form IT-214 Real Property Tax Credit

The document provides detailed instructions for filing New York State Form IT-214, which allows homeowners and renters to claim a real property tax credit. It includes eligibility criteria, filing guidelines, and specific steps for completing the form. It is essential for residents with household gross income of $18,000 or less.

Real Estate

Real Estate Open House Sign-In Sheet Template

This file is a template for a real estate open house sign-in sheet. It collects contact information of prospective buyers. It includes detailed instructions for owners, agents, and prospective buyers.

Property Taxes

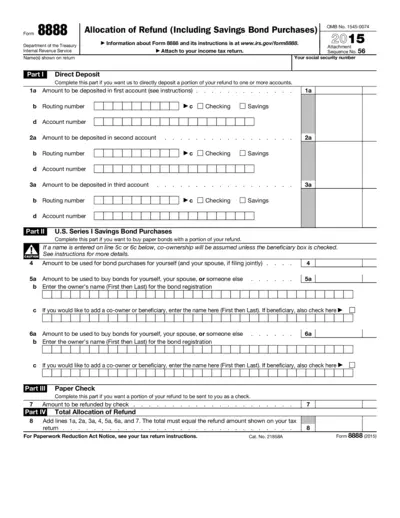

IRS Form 8888: Allocation of Refund and Savings Bond Purchases

Form 8888 allows taxpayers to allocate their federal tax refunds into multiple accounts and purchase U.S. Series I Savings Bonds. Attach this form to your income tax return to specify your allocations and purchases. Visit www.irs.gov/form8888 for detailed instructions.

Real Estate

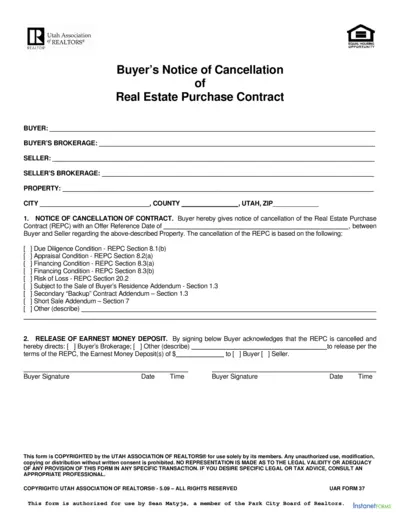

Utah Real Estate Purchase Contract Cancellation Form

This file is a Buyer's Notice of Cancellation form for a Real Estate Purchase Contract (REPC) in Utah. It allows the buyer to formally notify the seller of their intent to cancel the contract and specify the reason for cancellation. It also provides instructions for the release of the earnest money deposit.

Property Taxes

Missouri Form MO-1040 Individual Income Tax Instructions

This file contains instructions for the Missouri Form MO-1040, which is used for filing individual income tax returns. It includes guidelines on electronic filing, benefits of using the e-file system, and important filing requirements. Detailed instructions for filling out the form are provided.

Real Estate

Warranty Deed Document for Michigan Real Estate

This file is a Warranty Deed template for Michigan real estate transactions. It includes all necessary fields for property conveyance and warranty. Use this template to ensure compliance with Michigan recording statutes.

Real Estate

Texas REALTORS Special Flood Hazard Areas Information

This document provides essential information about Special Flood Hazard Areas as designated by FEMA. It includes details about flood insurance availability, ground floor requirements, compliance issues, and the importance of elevation certificates. Buyers and property owners can use this information to understand flood regulations and insurance requirements for properties located in flood-prone areas.

Property Taxes

IRS Publication 590-A - Contributions to Individual Retirement Arrangements (IRAs)

Publication 590-A provides detailed information on contributions to Individual Retirement Arrangements (IRAs). It includes rules, limits, and guidelines for traditional and Roth IRAs. This publication is useful for taxpayers preparing their 2021 tax returns.

Zoning Regulations

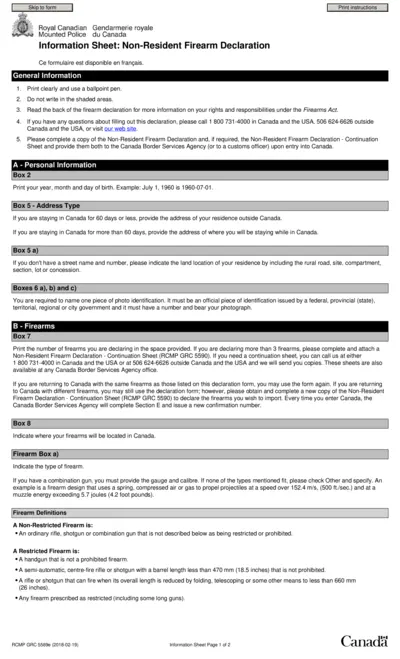

Non-Resident Firearm Declaration Instructions

The Non-Resident Firearm Declaration form provides detailed instructions for non-residents on how to declare firearms when entering Canada. It includes personal information, firearms details, and declaration sections. Additional confirmation numbers and payment methods are also discussed.

Real Estate

2023 Indiana Association of REALTORS® Residential Forms Changes

This file outlines the changes in residential forms introduced by the Indiana Association of REALTORS® for the year 2023. It includes important notices about line numbers, placement of signature blocks, and the new IAR logo. The forms are essential for real estate transactions in Indiana.

Property Taxes

RITA Individual Income Tax Return Form 37 for 2023

This file contains the RITA Individual Income Tax Return Form 37 for the year 2023. It provides instructions and fields for reporting income, calculating taxes, and claiming refunds for residents of RITA municipalities. The form includes sections for W-2 wages, self-employment income, and other taxable income.