Property Law Documents

Real Estate

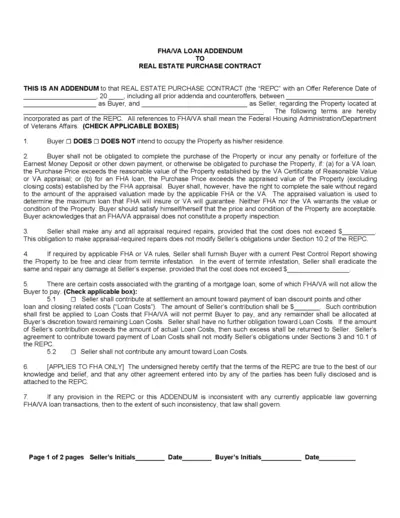

FHA/VA Loan Addendum Real Estate Purchase Contract Form

This document is an addendum to the real estate purchase contract for FHA/VA loans. It outlines terms and conditions specific to these types of loans, including buyer occupancy intention, appraisal requirements, repair obligations, and loan costs contributions. It also includes clauses for acceptance, counteroffers, and rejections.

Property Taxes

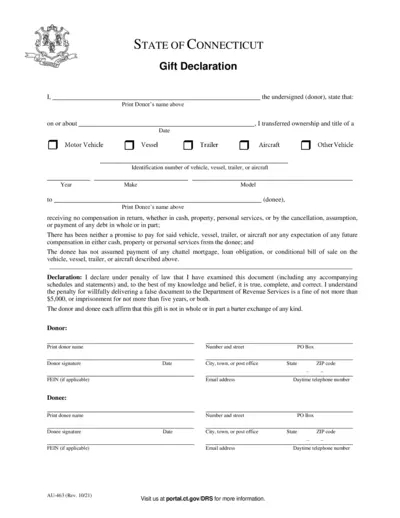

Connecticut Gift Declaration Form for Motor Vehicles

This form is used in Connecticut for declaring the gift of a motor vehicle, vessel, trailer, or aircraft. It requires signature and information from both the donor and donee. This form ensures there is no compensation expected from the gift.

Real Estate

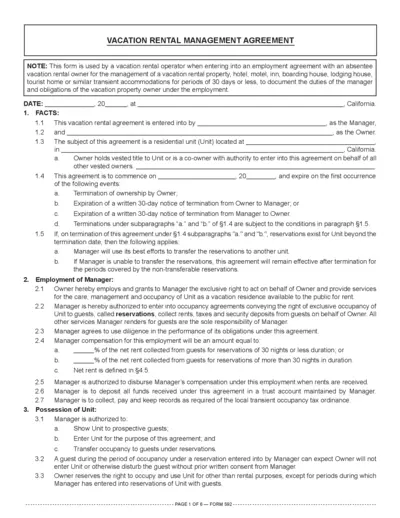

Vacation Rental Management Agreement

This file is a Vacation Rental Management Agreement used by vacation rental operators when entering into an employment agreement with property owners. It outlines the duties of the manager and the obligations of the property owner. The agreement includes details on employment, possession, rents, manager's services, and maintenance of the unit.

Property Taxes

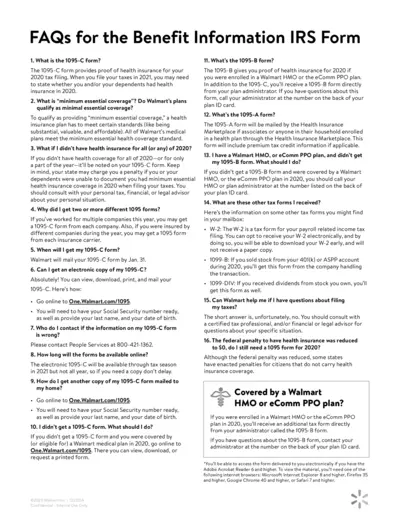

FAQs for the Benefit Information IRS Form 1095-C

The FAQs for the Benefit Information IRS Form 1095-C provides details and instructions about the 1095-C form, essential for tax filing for health insurance coverage in 2020. It includes information about minimum essential coverage, obtaining copies, and other related tax forms. Users can also find out how to get electronic and print versions of their 1095-C form.

Property Taxes

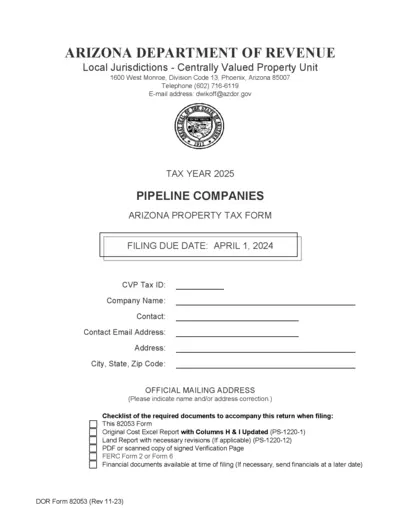

Arizona Property Tax Form for Pipeline Companies 2025

This file is an Arizona property tax form specifically for pipeline companies in the tax year 2025. It includes detailed instructions, tables of contents, and necessary forms for submission. Make sure to file by April 1, 2024, to ensure compliance.

Real Estate

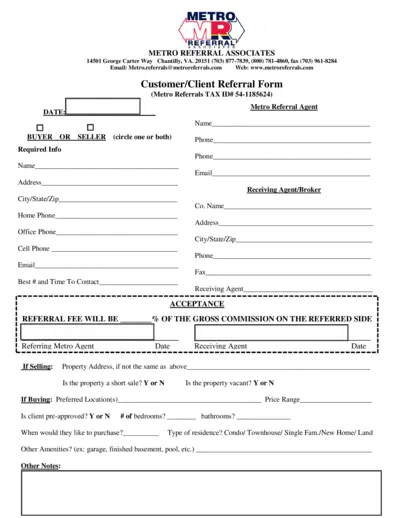

Metro Referral Associates Customer/Client Referral Form

This form is used by Metro Referral Associates to facilitate the referral of clients or customers between agents. It includes sections for detailed client information, property details, and acceptance conditions. Fill out the required fields to ensure proper processing and acceptance of referrals.

Property Taxes

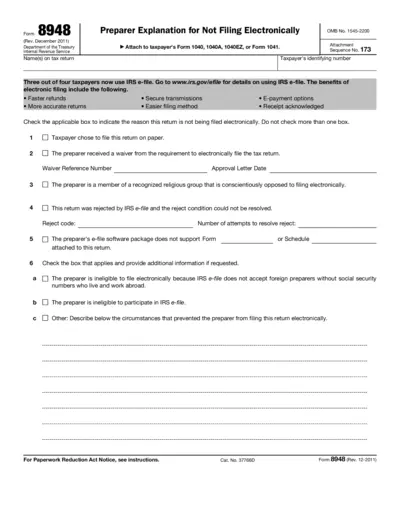

Form 8948: Preparer Explanation for Not Filing Electronically

Form 8948 is for tax preparers to explain why a tax return is being filed on paper instead of electronically. It includes details and options for different scenarios where e-filing is not possible. Attach this form to the relevant paper tax return.

Property Taxes

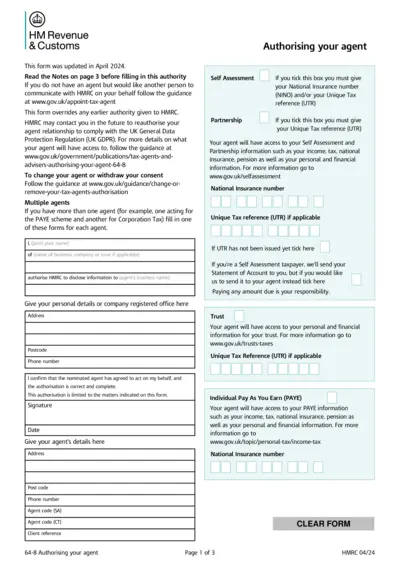

Agent Authorisation Form - April 2024 Update

This form is for authorizing an agent to handle your tax matters with HMRC. Complete the form to specify what information your agent can access. For more details, read the instructions provided with the form.

Property Taxes

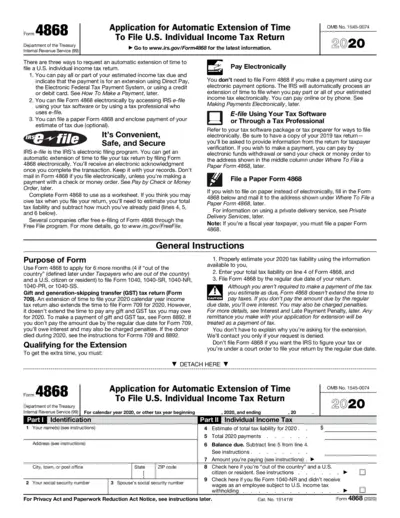

Form 4868: Application for Extension of Time to File U.S. Taxes

Form 4868 is used to apply for an extension of time to file your U.S. individual income tax return. It provides up to 6 additional months to complete the filing process. This form is essential for taxpayers needing more time to finalize their tax returns.

Property Taxes

Indian Income Tax Return Form for Individuals - AY 2019-20

This file is the Indian Income Tax Return Form intended for individual residents with total income up to Rs.50 lakh. It includes sections for various income sources and deductions, and provides detailed instructions for filling out the form accurately. This form is not for individuals who are directors in a company or have invested in unlisted equity shares.

Property Taxes

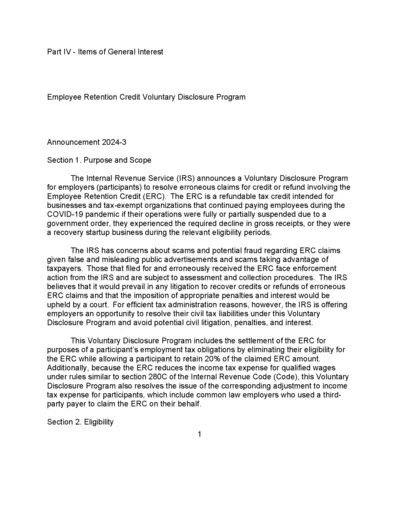

Employee Retention Credit Voluntary Disclosure Program

This file outlines the IRS Voluntary Disclosure Program for employers to resolve erroneous claims involving the Employee Retention Credit (ERC). It provides eligibility criteria, terms, application procedures, and more. Employers must apply before March 22, 2024.

Real Estate

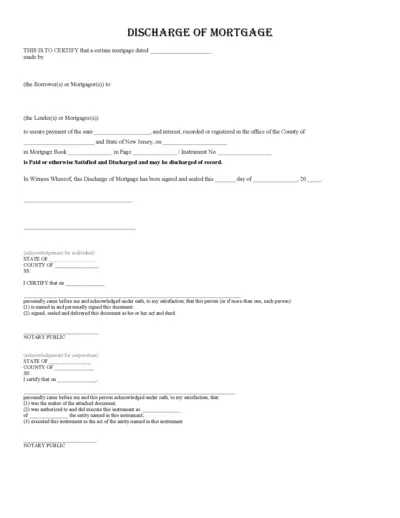

Mortgage Discharge Certification Form

This file is a Mortgage Discharge Certification form used to certify that a mortgage has been paid and discharged. It includes information about the borrower, lender, and details of the mortgage. The document needs to be notarized to be valid.